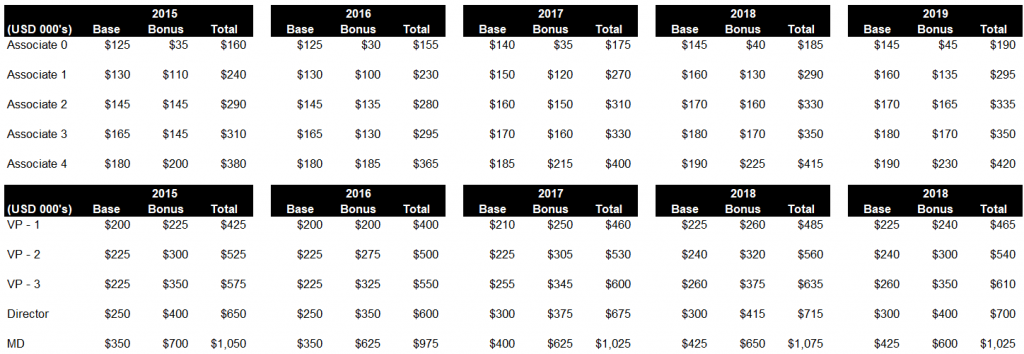

We are updating the total Investment Banking compensation numbers for 2019. Excluded from this overview is investment banking analysts as the variability has not moved much. Simply put an investment banking analyst should make $165, $190K, and $215K in years one, two and three (plus or minus $5K depending on how good or bad the bank did). The reason we have excluded the exact break out of base and bonus is two-fold: 1) analyst base salaries are a bit less standardized now with $85-90K being the rough mid-point, 2) the bonus is being adjusted and despite a weaker market (explained later) the non-revenue generators won’t take a large hit in mediocre markets. We made similar points last year, the only adjustment really is that most banks have moved to about 85-90 Base/ ~75 bonus for the good analysts for a first year payout (as usual 100% of base as bonus is reserved for the top-tier performers, we focus on the top 25% or so). Note if the bank did poorly, you’re going to see even more volatility and the total could very well be below last year.

Budget Setting and Bonuses: As always, bonuses are set in Q4, despite being paid out around February-April, so it is relatively easy to get the Street range, this year bonuses will be down for revenue generators and likely a tad up due to talent retention of junior employees. This is better than expected if you are a junior banker and bad news if you’re a VP or above.

Why? This is an important concept since it is the first time we’ve had a clean down year for revenue generators in quite some time. Investment banking is a “long sales cycle” business, meaning lots of nothing followed by a large deal due to a great relationship. If we look at this year as a whole deal flow is certainly softer in aggregate. This means less fees so by definition the revenue generators had a smaller pie to work with since the entire market was down slightly.

Now you’d think that the “bottom always gets burned” but investment banking is a bit different. They don’t want to burn the “cogs” of the organization because it doesn’t make a lot of economic sense. Even if you take the entire investment banking analyst class and pay them down… This is still peanuts compared to paying the under performing MDs down 20-40%.

The long story short is that you don’t want the entire junior class to leave. Technology companies are certainly on par with investment banking (corp dev at a top company for example) when you look at dollars per hour. So you want to make sure you don’t have to deal with more turnover than usual.

So Who Takes the Hit? All under performing revenue generators and even senior management (extremely heavy hitters who can clear $10M in a year, head global investment banking to take an extreme example). The extremely high paid individuals will move their number down to keep the high performers happy as a lot of their money is tied up in Company stock. Hopefully we’ve done a good enough job of explaining this and it makes logical sense from a business model that has a long sales cycle measured in years.

The Punchline: Numbers will be down about 5-9% if you include everyone (associates to senior management) at all the major/relevant firms. Some will be down a lot though. The under performing MDs will be down 20-40%, the top performing MDs will certainly be up if they were on the major deals and the senior managers at banks that struggled will be down more than double digits (oh and if you get a classic “zero” they are telling you to leave as usual). In general, assume numbers are down and depending on how the market ends it could be down double digits but we’re somewhat optimistic since the market was really the issue (not a lot of deal flow).

What is a Top Person: A top person is someone that is either generating a large amount of revenue or someone the firm is promoting. The first one is obvious and people who are working on the larger deals are typically the ones being promoted anyway (funny how that works!). Essentially, a top person is someone who is already generating a ton of money or someone who works for a guy generating a lot of money. If you’re a good junior banker the top person will want you on his squad, simple as that.

Overview: Generally, the lower level (excluding new hires who have only been around for 6 months),will see less volatility. Banks view junior employees (anything below Vice President) as fixed costs so they typically don’t see much volatility. As are minder we’re attempting to build a picture across the Street which includes everything from bulge brackets, elite boutiques and middle market firms(excluding the tiny shops that have limited deal flow). If you look at the numbers, you’ll see that the real money is made when you’re generating revenue(Vice President, Director, Managing Director). This is because Wall Street is no different than playing in the World Series of Poker. We’ve said this before but it needs repeating.

No one is going to get rich working as an associate and you’re only making money at the revenue generating role and more specifically once you close a few deals (Directors typically have brought in quite a bit of money). In addition, once you reach Director level or even Vice President you’ll quickly realize starting your own company will make you more money than working for someone else (hint, hint, hint, never put all your eggs into Wall Street).

If ~$300K seems like a lot of money, look at the real math. If you live in a major city like NYC, then you can assume that you’ll see about 64% of what you make (figure is around ~$192K). This means you’re getting around~$16K per month. Rent alone is going to run around $5K if you’re living in a good part of town and the rest of your living expenses will usually approach $4K a month or $9K in spending per month… Saving around $80-100K a year isn’t going to get you anywhere soon. Once you hit $500K or so, then you’ll see an inflection as a single person because you can put away ~$200K and not see much of an impact to your life style.

Before the Debate Begins: The “average” or “median” is becoming extremely difficult to calculate. Why? Well more and more of the top people are paid more and the bottom tier people are being asked to leave via a terrible bonus. The strategy of making sure you’re barely in the top quartile is material. You absolutely do not want to risk being in the middle anymore as it swings your pay down by a wide amount. To give an example, while the “average” Vice President makes around $500K, you could easily make 50% more if you’re at the top (yes that’s a quarter million dollar difference or more!). This difference only gets bigger and bigger as you move up the chain. Also. If you are the same Vice President but you’re awful at your job, you’ll receive a fast and swift “F You” bonus that could cause you to make less money than you made as a top tier associate(okay easily could). The “conference room” will be the next call.

To add to this volatility here are some incredible numbers that have occurred over the past 3 years and anyone in the industry would know the right banks (hint major M&A shops). A top VP in an extreme year has cleared a million, a top Director has gone to $2-3M if a major deal was made. That’s an enormous spread. Enormous. Remember… these are so rare so you should go ahead and assume more normal numbers, around $500K at VP level around $800K at Director level and over $1 million as an MD

How Do You Calculate Your Bonus as a Revenue Generator? You will get around 10-15% of what you kill. This is the rough math and makes all those occupy Wall Street people scoff and get on their knees. To generate a $1M bonus you’d need to bring in $10M to the top-line at the firm, roughly speaking. This is certainly not an easy task and most people will get stuck in the $300-400K bonus range where they get some small deals, sign up some retainers, some poison pills, some fairness opinions etc… but never really get the big money.

Things Have Actually Changed! You’re seeing a bigger and bigger change between banks. When looking at the chart we have to emphasize that there is a big difference between being at Joe’s Investment Bank and a top tier Boutique. This will cause a lot of people to look at the chart and say “that’s way too high” (bad bank or group) and the top banks to say “wow that’s terrible I am never leaving here”. We can’t decide if this is a good thing or a bad thing but one item we will say… We’ll make a bet that numbers actually pull back again (we made this comment in 2018 as well and were actually correct! Get a lot of things wrong but this one was right as 2019 looks like it will be slightly down) .

The Buyside Story is Still Seeing Pressure: For another year, passive investing has outperformed active managers impacting the number of roles on the buyside at hedge funds& mutual funds. Private Equity has seen low rates help their investments (this may change if rates continue to go up) as cheap money has improved the ROIs on investments particularly if the debt is set at a fixed rate. We think you’re going to see headcount reductions at hedge funds and long only funds in the near future. You have already heard of several if you follow financial news.

Key Way to Avoid Confusion: If you’re looking for one line, just assume you’ll be down as a revenue generator on a “like for like basis” and similar to maybe even up a tad as a junior banker (Banks avoiding additional attrition). Given all the base salary changes we adjusted them throughout all levels to reflect the evolving environment. This means some of the totals look better than the other ones depending on *when* the base salary was moved up for the group. Also, remember that getting a promotion usually leads to bigger jumps and if you were simply going from associate 1 to associate 2, not much happens and that would be reflective of a “10% like for like” jump. We’ve said it before and we’ll say it again, do not switch banks if you can get promoted since it’s just too much money to leave on the table (yes we are sure there are rare exceptions, but highly unlikely it ever makes sense)