Overview:

We have written about basic ways to hack your 401K for additional liquidity but one question that does not seem to be addressed is this:

“When have I over saved in my 401K?”

The truth is it depends. If you intend on living in the USA forever and have no interest in leaving the country for more international exposure (wink, wink) then you are likely going to contribute the max for life. However… for those of you that are interested in going international, there is certainly a limit we should all be aware of.

When you’re fresh out of college the answer is simple. Always obtain the Company match and if possible max out the entire $17,500 limit. For additional details review our post on investing priorities.

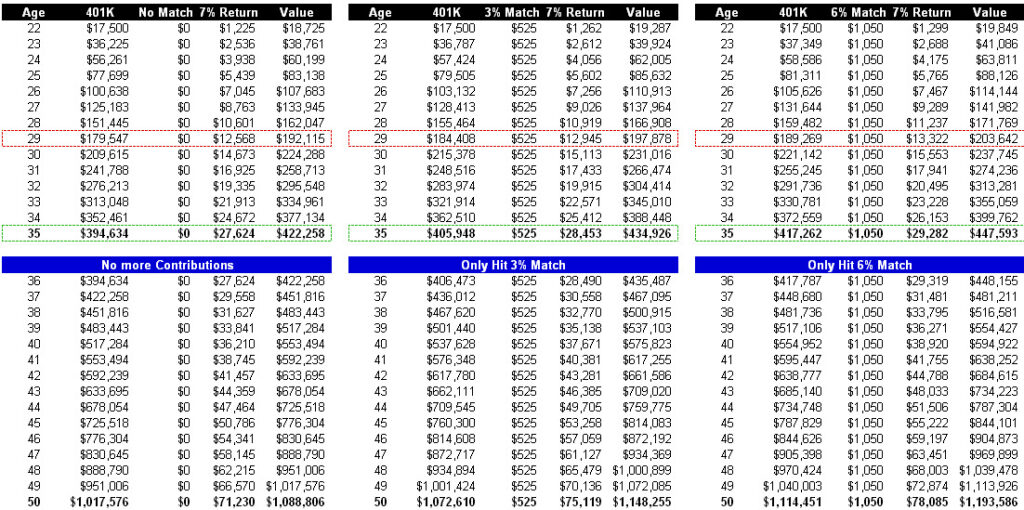

With the background out of the way lets jump into a detailed chart and highlight the important markers.

Chart Summary:

1) Dashed red line: This is where we believe financial independence is in clear sight solely from your silly 401K. A great investment vehicle for building a small amount of wealth. You’re making about $1,000 a month. This is not a lot but it is constantly being reinvested into the same portfolio. Momentum achieved.

2) Dashed green lines: This is where we believe it becomes less useful to contribute. Why? Your retirement at this point is practically set in our opinion. If you can bring in ~$25K per year in income during your 60s you can certainly live off of this amount in multiple countries around the world. Assuming the same 7% returns you are going to be even richer by the time retirement age rolls around.

3) Match vs. Non-Match: As you can see, the difference between the matched and un-matched portfolio is greatest in the beginning years and becomes less important over time (compounding is extremely powerful). Ideally your income continues to go up but we safely assumed that it was a fraction of your $17,500 max contribution.

4) Million Dollars (Bold): Long story short? By the time you make it to 50 years old, if you have maxed out your 401K for ~13 years… You’re going to be in the million dollar club by retirement. If you can’t live off of $1M outside the USA you’re certainly doing something wrong!

Tax Avoidance:

Yes we know what you’re saying “but that million dollars is going to be taxed!” Well we all hate taxes. That is one thing the rich and the poor can agree on. No one enjoys paying a lot of taxes. So what can be done? Well it is time to utilize the progressive tax system in our favor and leverage the international laws as well.

1) Up to $97,600 earned outside of the USA is tax free if you legally live outside the USA

2) If you pull income out of your 401K it is treated as regular income .. meaning? Do not go past the 15% level at $36,900

What this implies is your best bet is as follows: When you intend to pack your bags and leave to Thailand, you can earn some income abroad (tax free) and live with the much lower tax rate as you slowly bring money out of your 401K. Finally, if you retire early, you can use the same 401K roll over rule we have talked about in the past. You slowly roll over pieces of the 401K one year at a time into a Roth IRA and take the money out in 4 years and 1 day.

Review Time: Stop and ask. Do I want to live in the USA forever? If yes then continue contributing the max and saving even more than that to live a great lifestyle. If no? Then it may be time to run the math. If you’re in your mid 30s with close to $500K in your 401K account, you’re probably good to go since the rule of 72 states that your money will roughly double every 10 years at a 7% compounding rate.

Below are the bullets for those that plan on living abroad:

1) Match your 401K at minimum

2) Max out your 401K at $17,500 as soon as possible and do this for 13 years

3) Reconsider your strategy when you are at the ~$400-500K 401K value range

4) Set up your tax structure by finding income abroad, no one wants to sit on a beach all day

5) Practice the native language and have a blast

If you’re looking to relocate, be sure to run the numbers.

If not? Well keep stacking that cash.