Around the age of 21-23 most people find out that the work place is not as easy as they thought. For those that end up starting a company they also find out that ownership is 100x harder than working for a Company. Either way, when you’re exhausted all of the time you begin to think in terms of time. “I would rather find a position that pays the most for the least amount of hours”. While great in concept (no one wants to work long hours for low pay), tying income to any sort of ticking time clock is not a good way to get rich. Imagine walking up to someone and saying they have to pay $1,000 per hour for your time (~$2 million a year). Everyone would laugh unless you were already a famous/wealthy person who could add that much value in an hour. Now if you said you expect to make $1,000/hour for every $3,000/hour you made them… the proposition would turn from laughter to “Where do I sign up”.

What Not to Do – Tie Yourself to Hours

Don’t work for an hourly wage or salary. This might not be possible if you’re looking for anything to keep the lights on. That said, you want to get out of an hourly/salary income since it will inhibit your income growth. This is an attempt to leverage your time (which is limited to 24 hours regardless of where you are in the world) and an hourly wage won’t give you an ability to scale.

Take a look at high paying salaried/hourly professions and it’s rare to see anything north of a few hundred dollars. Even $100 per hour is $200,000 per year (rough math is to multiply the hourly wage by 2,000). Even if you were able to generate this income and we assume a $200/hour position ($400,000/year) we have to remember that this is not something you can sell. For every hour you work you’re not building any future income. If you decide you want to quit tomorrow, that income stream is gone and no one pays you to leave your position (unless you received a severance package).

Now that we’ve bashed this form of income, if you’re forced to do something like this we would recommend anything where you’re sitting at a desk. This allows you to at least “double dip” on your time. For example, the chances that someone is reading this at work is quite high (we know this from web traffic data). So if someone has time to sit around and watch Netflix or Sports replays… They certainly have time to learn basic copy writing. For people who are really desperate for money, you can also buy and re-sell products at a premium (luxury hand bags, video game consoles etc.). The point here is that having access to a computer and internet while at work is a huge advantage as you can move the needle on your earnings without impacting your job performance.

The main ideas here are as follows: 1) you cannot sell any position that is deemed a job/career. Even if you were to start an amazing career, when it comes time to leave you can’t sell it for money. 2) anything white collar is significantly better than blue collar. There is absolutely nothing wrong with high paying blue collar positions if that is where you must start. But. If you can’t sit in front of a computer you have less access to future revenue streams. 3) putting yourself in a position where you’re tied to time spent versus results limits the amount of money you can make. Even if you were to work 16 hour days, that’s going to be the official cap with no upside from there.

First Step in the Right Direction – Results Oriented Pay

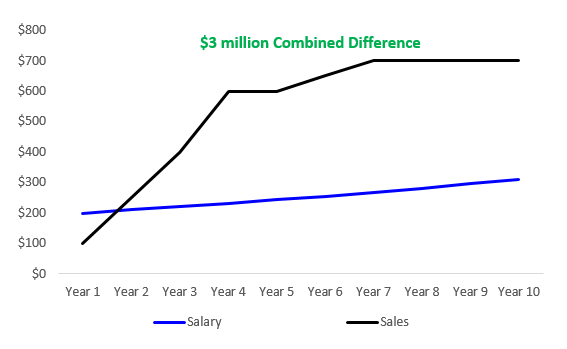

While we’ve touched on the importance of results oriented pay, it’s important to look at the math on why the numbers add up so quickly. There are really two types of payment mechanisms: 1) recurring and 2) high ticket priced items. We’re ignoring B2C (business to consumer) since the commission there is going mirror an hourly wage as there is a limited amount of revenue associated with each sale. While this concept is not new, we’ve finally figured out a way to explain it in terms of time. Essentially by tying yourself to units sold you’re able to condense the sales cycle. This is a common phrase used in a lot of businesses “sales cycle” all it really means is the time to obtain a sale. If you’re in a high ticket priced item business the sales cycle is typically long (investment banking is notorious for incredibly long sales cycles – classic Company Man lifestyle). In a new standard here we have a graph to depict the difference so it is visible.

If you are earning say $200,000 per year and this is the income you can generate without a results oriented position, you might be ahead of the sales position in the near-term. This is because the sales person needs to learn to *shorten* his sales cycle. By way of example if we assume the sales person is a real estate agent and we give him a 2% commission (usually around 6% combined seller + buyer so we’re conservative), he would need to sell about 5 houses worth $1,000,000 each. This is certainly an achievable number as you’re looking at 1 sale every 2.4 months. In fact that number looks awfully low and is likely tied to someone who is just getting started!

There are now multiple ways the sales person can catch up: 1) sell more homes at lower costs, say 20 homes at $500,000 to increase inventory, 2) sell a single luxury home worth $5,000,000 or 3) *shorten his sales cycle*. The last one is incredibly important. The last one is probably the most under-rated. Your average person believes that you have to “screw people over” to get rich, when in reality we can see that by shortening your sales cycle you’ll actually generate a lot more money. If you do a fantastic job selling a property, it is quite likely that the seller will then refer you to sell another property. As a rule of thumb it takes about three years to significantly shorten your sales cycle and it is certainly possible to sell two homes a month which would increase your number of sales by almost 5 times. Since you were making $100,000 a year with your low sales number, if you can increase your ability to sell that takes you to nearly $500,000 a year. In addition, all you would need to do is increase the average selling price slightly over the next 3 years and suddenly you’re hovering around $600,000 a year. Not a bad position to be in.

The difference is quite large here, while the salaried professional sees a steady increase to his income working to $300,000 over a 10 year span, the stair-step movement for the sales professional is quite impressive. Instead of seeing a stable line up and to the right (not going to work if you want to get rich), you see a big step function movement up. This causes three significant changes for the sales person: 1) typically the sales person has a lower cost of living since he doesn’t know if his transactions would close, 2) the payments are one time in nature and up-front versus spread out across a longer time period and 3) instead of having a question mark around his/her return, he knows the exact amount that will be wired to his account on closing day.

When we put this together you’re looking at a pretty huge spread between a salary employee and a solid sales person. The number we get to is around $3,000,000 in additional income over a 10 year time frame. This does not include any sort of “kicker” or benefit from selling higher priced items (higher margin) as is typical in enterprise sales outside of real estate. Also. We assumed that all of your sales are one-time in nature. If you’re lucky enough to land a position where you’re in charge of simply “renewing” contracts every year or two you’re in even *better* shape. This is because a high quality product has high retention and makes the follow up sale easier.

Now before we move to the value of equity it’s important to understand the psychological reason why sales is avoided. The answer is quite simple: responsibility. It’s not natural for humans to enjoy being told “no” over and over again. So most people are unwilling to go through the process of hearing negative feedback over and over until they figure it out. Also. It causes the individual to see significant *responsibility*. Responsibility is just a fancy way of saying “being forced to take care of yourself”.

Getting Rich with Ownership and Leverage

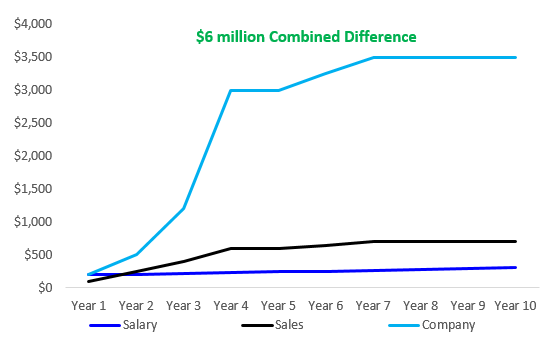

If the sales person seemed attractive to you we have to remember that he works for a Company. That company must make money otherwise they wouldn’t hire the sales person. If the sales person makes $100,000 a year or $5,000,000 a year… the company by definition needs to make more than this to justify his employment. So while it’s exciting to see the numbers from a performance based perspective, if we look at an ownership model we’ll see a bigger spread. In fact the spread doubles (at minimum) if someone can earn the exact same amount of money as the sales person.

Equity is everything. As you can see there is a substantial difference between the sales person and the Company even though they earn exactly the same amount of money. Even if the sales person is generating $700,000 per year, he’s not worth as much as a company generating $700,000 per year. Why? You can click sell. If you click sell we assume you’re going to make around 5x (maybe the is aggressive. But. The point stands). Even if the sale button was only 3x, you’re looking at a $2.1 million dollar difference in value. Now it’s certainly difficult to build a $1 million dollar business, the math says you’re better off earning an extra $50,000 from a business than an extra ~$200,000 from any job. This is because of the “exit” multiple or equity value.

Now lets turn to leverage and ownership. A common move once you know a specific market well is to purchase businesses that can be turned around. If you have a business that you bought for say $400,000 net income and it generates $100,000 net income per year… You only need to increase the net income by approximately $40,000 in two years to see a 100% return. Why? Well if you generate $100,000 and then $140,000 you’re at $240,000… Then you have to add $560,000 ($140,00*4) the new value of the Company and you’re at $800,000… versus the original $400,000 paid out. There is certainly a discount here since money next year isn’t worth as much as money today, however, the leverage is clear as day. If you’re getting a 4x value for every dollar you bring in, this means each dollar for your company is worth 4x as much as a dollar made working for someone else.

But it gets even better. No one said you needed to use your own money to purchase the asset. If you’re borrowing money you can actually see even greater returns. This is exactly why real estate investors are commonly self-made millionaires. Since you’re able to force appreciate the asset, you can get well north of 100% returns in a short period of time by simply making repairs or bargaining at the right time. So we can take a look at that quick calculation as well.

If you purchase an asset for say 20% of the value (using homes as that’s a common one to think of) and it’s worth $100,000 that’s $20,000. Now once we make repairs/forced appreciation we can say the cost of that was $20,000. If the total investment is now $40,000 and the Home is now worth $180,000 and you sell… that is $80,000 in profit off of a $40,000 investment. While this may feel far-fetched, returns like these are actually common when you have niche knowledge. There are quite a few people who own homes, take out money from the equity of the home to purchase a business they know well and do exactly this. Before, these types of arrangements were most commonly tied to Real Estate and Real Estate only. We’re happy to say that is no longer the case (hint)!

Conclusion: In a time when there are few good investment choices (set it and forget it options) there is always an opportunity for forced appreciation. You’re not supposed to say “always”. But. We truly believe it. Markets are not perfectly efficient so if you look for the right property, business, or any asset that can be fixed, you can probably find it within the next month. This is essentially the plan we’re going with in 2019 since the rest of our money is going into more boring stable investments (around 3% returns). If you can fix it, the returns are likely higher and we would argue that it is less risky as well. So that’s our “2019 Resolution” a shift to forced appreciation purchases.