When it comes to leverage there appears to be two camps: no leverage and a ton of leverage. This is simplifying things, but if you talk to rich people they typically talk about leverage positively or they got wealthy without leverage buying lots of assets with cash (significant business cash flow). Another interesting item here is we’ve noticed that people with a large sales background – constantly talking a big game since it’s their career – use more leverage. On the other side. Those with a technology background or another industry with high cash flow lean towards a de-leveraged approach. Naturally, there is a middle ground here between zero leverage (decreasing your long-term net worth) and over leveraged (buying tons of cars on credit)

The Problem With No Debt: While you can still get rich without debt, the major issue is that you’re decreasing your long-term net-worth. If you receive a million dollars with a low interest rate of 2-3% and cannot figure out a way to generate value… You’re simply not trying hard enough. Realistically, to receive the extremely low interest rate in the first place, you would need a high income (allowing you to obtain preferential treatment). While there is some truth to avoiding “the top of the market”, at extremely low interest rates, you should be able to weather any storm over a 20-30 year time frame.

If you want a rule of thumb we’d recommend calculating the “spread” and multiplying this over a 15 year time frame. For example, if you were able to get a 2.5% interest rate and your long-term annualized return was closer to 6% this would be a 3.5% spread. While you can certainly deduct the interest from your taxes (mortgage situation for example), this rough math means you’re growing your net worth by an additional 3.5% per year (on the amount you borrowed). If we play this out over time on our $1 million dollar example, it would result in an incremental $35,000 per year. ($60K-$25K = $35K)

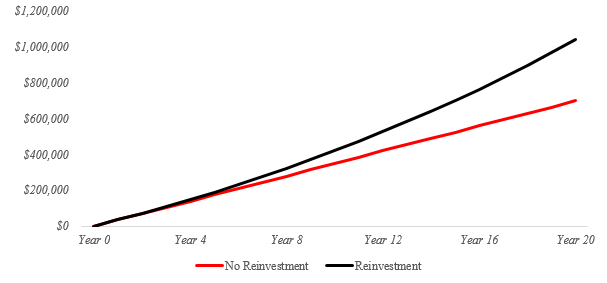

In year 1 and year 2 not much of this is a big deal. An extra ~$3,000 a month won’t sound like much. But. If we reinvest that same amount of incremental money then you’re looking at a significant change in cash flow. While $35,000 per year times 20 years would be $700,000… the return is actually much much higher. To keep the numbers “less risky” we assume you can earn 4% on the $35,000 per year.

So after 20 years what does this mean? It means you’ve generated $1,042,000 not $700,000 over a 20 year span. This is how people get rich using other people’s money. If you want a good rule of thumb, every twenty years assume that you’re going to recoup the entire loan amount. This is an extremely simplistic way to think about the number but also helps explain why zero debt does not make sense for a long-term investor. If your return versus the interest rate is 3.5% or higher… you’re essentially losing out on that money (notice we didn’t say risk free as everything has risk even treasuries).

The Problem With too Much Debt: On the other side of the equation is where you run into payment issues. If this is ever the case and you’re “concerned” about making a monthly payment or quarterly payment… it’s time to de-lever. Or more importantly. It is best to avoid getting into this situation in the first place. Unlike the other section, this situation is dire as you could be forced to sell assets to make payments (see people in credit card debt). In fact, this is similar to buying a car on credit as you’re levering up into a guaranteed loss.

Using the same $1 million dollar loan example, this is only a good idea if you’re 100% certain that you’ll be able to make the $25,000 a year monthly payments. This is not a large amount of money relative to the loan size (assumes you’re a high income earning individual). But. You better not rely on a single source of income when you decide to lever up with a large sum of money. If you’re missing any of the payments the game is no longer fun. Why? Well if you’re forced to sell items to pay the interest it probably means your cash flow statement blew up. That’s the downside of debt. When it goes in the other direction there is significant pain and suffering.

The Minimum Leverage: The above is pretty basic knowledge, so the more interesting question is a minimum leverage amount. Notice we said leverage amount and not “leverage ratio” since this is more of a personal finance item than it is a company specific item. If your business could blow up any second, leverage is likely not in the playbook (while recurring revenue businesses can take on more risk). So. From a personal finance perspective? We’d look at your passive income as the best determinant for your debt load.

Facing the facts here, unless you’re levering up to flip houses and it’s part of your actual business, you’re really just trying to juice your returns over a 20 year time frame. This means you’re looking for extremely low interest rates and for a medium risk asset that will unlikely decline over a long period (stocks after a recession, housing after a recession, so on and so forth). To make sure you’re always able to hit the interest rate payment, simply match your passive income.

Continuing with the same example from above, if you have an interest payment of $25,000 per year, this would require passive income of around $25,000 per year. While this sounds like quite a bit of money, we’ll leave it up to the reader to decide what classifies as passive income as there are multiple forms (passive and semi-passive). If you’re bright enough to have found this blog and make good money, you’re likely sitting on two streams of income where you could easily classify stream two as “passive income” since you could start up a third one if one of them didn’t work anymore.

Currently, you can get near-risk free returns of around 3%, this would mean that with $1M in investable assets you should actually have $1M in debt. Why? Well with $1M generating $30,000 a year… it’s highly unlikely that you’ll miss those interest payments of $25,000 per year. If you’re unable to pay for your own food, water and shelter by yourself in a worst case scenario… we doubt the person would make it to a million bucks in the first place. This is less of a jab at regular people and more of a confidence booster for the future rich people!

Does This Always Work? Of course not. Sometimes you’ll be forced to make tough decisions on leverage. Looking at markets in general, you want to have some broad views of when you’re rejiggering your exposure. We’ve already made our opinions clear from 2012 till the end of 2018 there was nothing to do but buy stocks as we were still working out of a recession. At current time frames, we’re just not as interested and are not *adding*. This is a significant change since you’re not dumping stocks and “unloading all of your exposure” instead you’re de-risking by tossing more money into cash. Why? Well if you toss more money into cash and have more accessible money, the interest rate you will get typically improves (everyone wants to know how much liquid money you have M1)

The other important concept here is that there is no way to time the bottom at all. While we’re sure a few people will hit the exact bottom and a few people liquidated all of their stocks in the first week of October of 2018… No one needs to be a hero to get rich. What is more important is getting the broad trendline correct. We know that most bull markets last about a decade and up to around 12-13 years. We know that real estate and stocks should go up mid-single digits over a 20-year frame, so on and so forth.

Putting these two broad items together what you want to do is have enough cash on the books to *allow* you to buy the bottom. When de-leveraging occurs and people unwind their positions the last thing that people have is *cash*. So you’ll be in a fortunate position to do just that. Borrow money near the bottom. As a final rule of thumb when you hear that we’re officially in a recession, we suggest looking at your debt load and increasing it. Then you just need to play the waiting game.

Side Note and Important Announcement: First, we’ve officially decided to write a final product to complete the trilogy… it will be on effective spending. Being brutally honest, it has not been easy as 1) there are no real books on this topic as they are all typically about frugality and 2) we want to cover everything as maximizing your “status” over time is an important art. Second, we’ll go back to posting regularly here (likely more frequently for the next month or two) to make up for the pause over the past couple weeks. Third, we’ll drop the introduction/outline well ahead of the launch of the book. This is because it will likely take a good amount of time to do it properly and will need some feedback. It will expand from not just “when you’re rich” but when you’re lower on the economic totem pole all the way up to $20K/month or so… After that it becomes too personal (for many reasons to be explained). Fourth, to cap it all off. One frustrating part about doing all of the work is that many people don’t bother to read important sections. So there will be a surprise section in the book to reward people that actually take the time to read it.