After writing on this blog for years, the one concept that seems to separate the rich from the middle class is the concept of convexity. If you tell someone they can become a millionaire in 10-years they think this means you save $100,000 per year for 10 years straight. Anyone who has made it to a million dollars knows this is not the case at all. Just like a regular job (which you should leave ASAP), earnings do not stay flat and earnings do not go up in a linear fashion. Everything has a “curve” to it and this is why a person who gets to $1M will likely make it to $10M unless they make significant mistakes along the way.

Getting to $10M the Easy Way

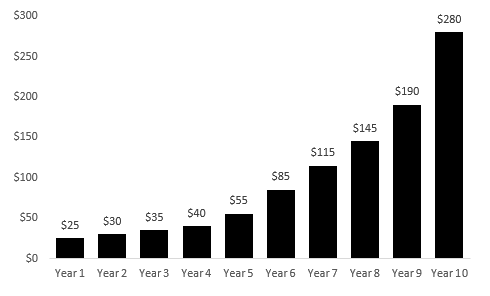

Getting to the First Million: No, compounding is not how you’re going to get to the other $10M. While it certainly helps a ton the last couple of years, the reason you’ll get there is because of increasing earnings or at minimum stable earnings. There is practically no chance that your 10th year of earnings will be lower than your second, third or fourth year. To make an illustrative example the below chart is a common way that people make it to their first million dollars.

As you can see here, you’re not going to get rich in your first 2-3 years. Unless you hit it big with crypto currencies, started and sold a Company extremely early in life or had some extreme one-time event occur, the gains are heavily towards the tail end. This is the same with practically everything in life. While you were only able to save around $55-60K in your first two years, if you become a millionaire, you will get this same amount by simply doing nothing (5.5-6.0% returns!).

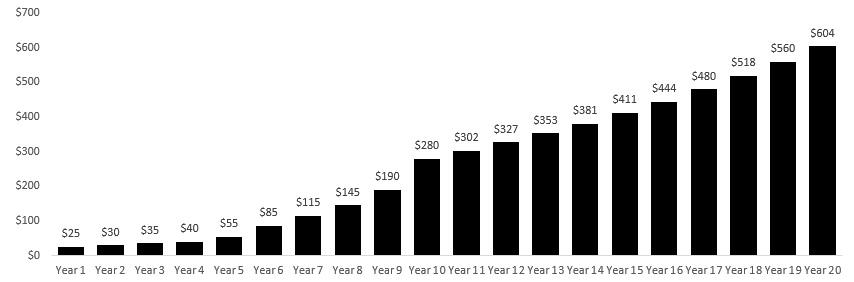

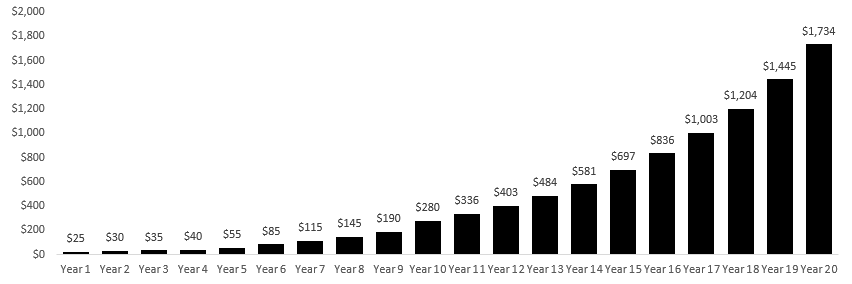

At this point we’ve already separated the future rich people from the forever middle class people. Middle class people think that earning is “linear” so they need to put away $100K every single year. If that was true it would mean that their 11th year of work would only see an increase of $100K. This makes no sense at all. Even if you work a regular salaried career with *no* commission payment… we can bet that you’re earning well over 50% more in year-10 compared to Year 1 (more likely you’ve doubled your income or more). To drive home this point, even if your earnings flat-line for the next decade (Unlikely unless you never earn more than year 10 for the rest of your entire life), you still end up being worth around ~$5.4M (age 40 assuming 8% returns).

In a more realistic scenario, you’re able to grow at about 20%. This seems like a large number since everyone takes the “5% guaranteed returns”. Instead we’re referring to your regular 5-7% returns from investing and then an additional 15-16% from your business + career. If you somehow got to a million dollars without a business, then see the prior paragraph and you’re probably on track to be worth $5M or so by 40. Someone who started an actual business is more likely to get to $10M (relative ease).

Avoiding the Negativity: For those that still “don’t believe” then how about the actual value of the asset you’re building. If you are making $200K after taxes as a worker or $200K after taxes as a business owner, who is worth more? The answer of course is the business owner. We don’t know of a single business that sells at less than 2-5x net income so the person who makes $200K after taxes through his own business is worth at least 2-5x times as much as the person who earns the exact same amount of money as the salaried worker. Now people may say that terrible websites sell at 18-24months net income… But those do not make $200K a year. If they did, please email them our way and we’ll buy them out.

This part is probably the second most common mistake between “middle class” thinking and “rich thinking”. If you’re middle class you just look at the cash flows and think that it’s the same value. It couldn’t be further from the truth. The people who follow the plan we outlined, end up being worth $2-3M very quickly. Why? No rich person values his business until he is interested in selling it. If you’re considering selling it… it means it was successful! Funny how the success cycle works. By way of example, once you clear your first $100K online or through another business venture you begin valuing the equity. You realize that you own 100% of an asset generating $100K a year. This is worth half a million dollars alone and does not include the money you saved as you built this from scratch.

Don’t Screw It Up: Since the math does not lie from the basic items we wrote above, the amazing part is how many people screw this up… Badly. From what we’ve seen the people who make it to around $2-3M in their early thirties typically screw it up through lifestyle inflation, a heart breaking divorce or a grip of leverage. These are all controllable mistakes. If you get to $2-3M in your early 30s and can avoid those three items we’ll say your chances of getting to $10M+ is 95%. The only exception here is if you inherited the money or you got “dumb luck” which is essentially equivalent to hitting the lottery or falling into money while *learning no skills*.

This is probably the most important part of the post. We’ve met a few people who executed on the plan and are around this range at this point (after all it has been about 6 years of blogging now!). The key things to be aware of are as follows:

Lifestyle Inflation: The funny thing about lifestyle inflation is that being a cheapskate actually costs you more money. We’re referring to items that depreciate in value: clothing in particular. If you’re actually serious about looking sharp, you’re going to buy high quality shoes (~$500-600 range minimum) and high quality suits (~$2K range minimum) and then offset this cost by buying basic cheap items for the gym. Wearing brand name tank tops for workouts is essentially a waste of time as you should be focused on the workout not looking sharp. The second item in lifestyle inflation is buying “too much home”. We covered this in a prior post which made people angry for no reason (because they are barely making their payments and are “house rich”). Don’t be house rich. Everyone tries to be house rich and we know what happens when you do what everyone else does.

Heart Breaking Divorce: Pretty simple here, don’t cave into your emotions. If you’re really going to have a family etc. always lock away the money you made pre-marriage. This guarantees you have at least a few million to your name growing at 5-7%. Ideally, you can avoid it altogether. That said there are always “situations” since we get the same question a lot. So. The absolute bare minimum is stated in here.

Tons of Leverage: This is probably the hardest one of the three to avoid. If you’ve made it this far and are not an emotionally attached person, it means you’re probably a higher risk individual (exact opposite of your typical investment banker). If you’re a higher risk loving individual it means that you’re constantly searching for a new high. Once you get to a couple of million, the typical move (that goes south) is over leverage into some business deal, asset or investment. For some reason, any time you give yourself a chance to lose it all… Life usually forces you to lose it all (part of the simulation). A good rule of thumb is to avoid levering up past your passive income (ultra conservative). And. We’re not against debt (it’s a good way to get rich), we’re against debt to the point of stress.

A Tangent Note on Risk Taking: One item you’ll notice in the prior paragraph is the comment about high finance and low risk. Despite what is written in the news, high finance people are usually *not* risk taking (with their own money of course!). Anyone who has worked in the industry knows this is a fact. The typical banker actually tries to “save money” by maxing out their dinner expenses and even tries to cheat on taxi receipts. They are penny pinchers. Almost none of them take on real risk which is why there is a running sarcastic joke that when anyone says they will start something the response is “Yeah because you’re a high risk taking entrepreneur”. Bankers are typically a lot more negative and if you ever announce you’re doing your own thing they’ll laugh at you… Since your success will verify that they made a bad decision. This is a small tangent but needed to be said since we’ve seen a lot of bad info in the comments about this over the past few months.

Getting to $100M, Time for Some Lady Luck

We already outlined a way to increase luck and here we’re going to talk about the different types of luck and why you’ll need some to get to the incredible 9 figure level. No we’re not there instead, we’ll explain why it requires some good fortune (mathematically). People may argue that some of this isn’t luck and that’s fine, we’ll go ahead and guess they aren’t actually worth 9 figures as the vast majority in this range will admit some luck was definitely part of it. Besides. If Warren Buffet was born before allocation of capital could make you rich… we don’t think he would do very well in other money making activities hundreds of years ago (physical hunting, gathering and farming etc.).

Low 7-Figures, No Real Luck: We’re a dangerously optimistic group of people. Based on pure optimism we think anyone in the United States who finds our blog can become a low 7-figure millionaire by simply following the most logic steps possible. No luck needed. The only requirement is 1) smart career choice, 2) effort in creating a second basic income stream and 3) a ton of effort in your early 20s. After that it’s difficult to fail. From the prior segment on why we think this person will be worth $10M, we assume they end up quitting their career. But. Even if your side income is only moderate, at least you’re still going to get to around $5M relatively quickly.

8-Figures, Some Luck: Essentially the luck needed is either gaining market share in a massive industry (cosmetics, skin care, diet, fitness etc.) or latching on to a fast growing space early (vapes, grey area drug market, a personal brand – the last requiring fame which is a personal decision we’d avoid). This type of luck is incredibly easy to obtain. The only real luck you need here is to catch the attention of a few influencers. This type of “luck” can be manufactured by essentially going to every single conference and meeting related to your field. If the product you’re selling is legitimate (I.E. it works for just one big name in the space) then you’re going to sell a lot of units out of the gate and create a new “base line” revenue level that pushes you into 8-figures relatively quickly. And. If it ends up being a one time wonder like figet spinners, well you’ll get to mid-7 figures extremely quickly and that’s not a bad place to be.

Bad Types of Luck: Before moving on you may get luck that appears “good” and just back fires on you. This is typically something that makes you a lot of money and then goes to zero. Lottery winners and large customer orders that end in returns are two big examples of this. Of the two winning the lottery is better since anyone reading this blog is likely more intense than the average person and wouldn’t squander it. The last one is more delicate, essentially if you win a big contract try your best to make sure there are clauses that allow you to remain profitable. Sometimes people get overly excited about a new win that ends up making no money at the end of the day. Discounts hurt margins so be careful is the message.

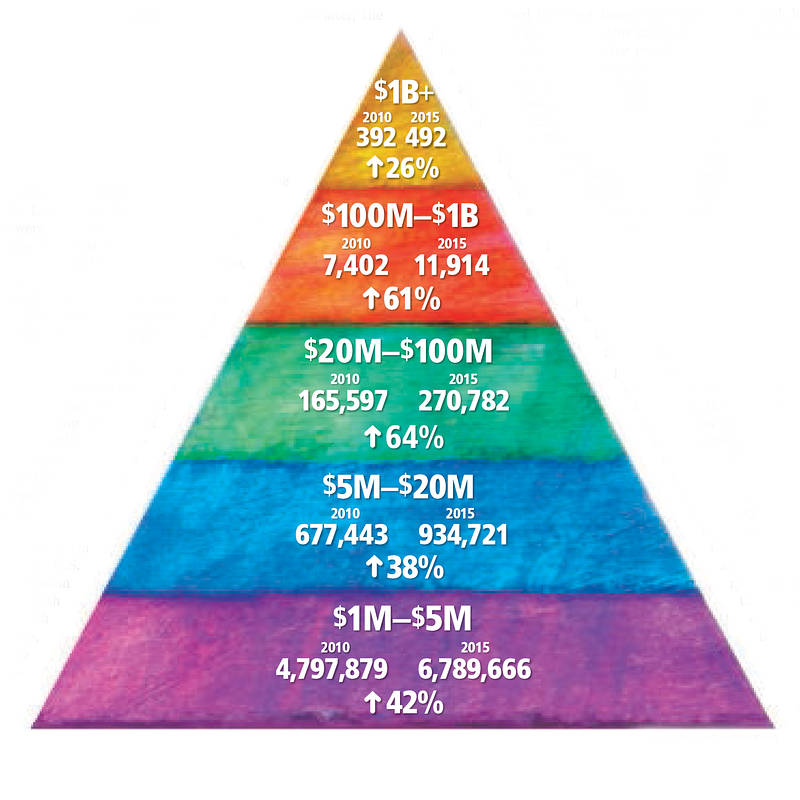

Ultra Rich Some Serious Good Luck: The was an article from Baron’s magazine some time ago that shows how concentrated the triangle gets as you move up the stack. We lost the link but here is the main useful picture.

Each wealth segment is harder and harder to break into. Doing the quick math you see about a million people worth $5-20M but only 270,000 worth $20-100M. Then it goes all the way down to 11,914.

Why is this? It’s because companies grow and die. Most ultra wealthy people claim that they simply worked hard but how many companies and products stick around for a long period of time? The typical household looks completely different and brands that were incredibly profitable and popular such as Toys R’ Us don’t even exist anymore. The type of luck we’re referring to here is *longevity*. Picking trends is not easy. Just 10 years ago investing in taxi medallions was a “good idea” since you got a high single digit yield and then Uber came through breaking every regulation known to man kind (killing them off).

So what is the point here? It means several forms of luck can be forced onto yourself: 1) learning the right skills like coding/sales is not impossible luck, 2) forcing yourself to meet people in a profitable industry is not impossible luck and 3) having differentiated skills relative to the competition is also not impossible luck. What is serious good luck? Being completely right on the sector and having a “mania” around it. If you can hit all of those once you’ll get to the 9 figure area since you’ll have a quasi monopoly on the product you’re selling for a special point in time. Take advantage of it by moving fast and you’ll be ultra rich. It’s low probability but hey at least by following the road to ~$10M you’ve got a chance for $100M. As Felix Dennis said… You won’t get rich working for your boss!