Growing up, cars were known as a cool luxury item. We all want that Lambo, Ferrari… maybe even a Hummer. This is a trap. While we do advise that the average male learn how to fix cars as it is a profitable business if you can bring a car from not running to running and slang it on Craigslist, overall ownership is a dismal financial choice to say the least. Lets run the numskies.

A Honda Civic.

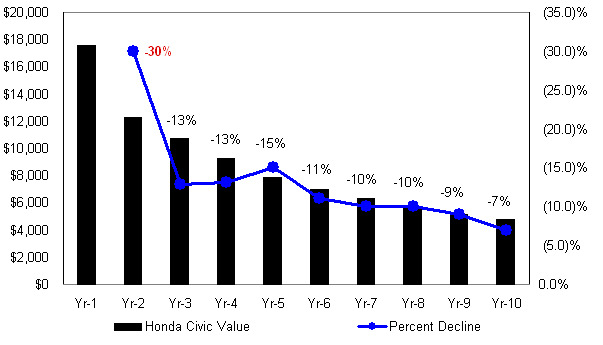

This is arguably one of the best items to use as your average daily use car. It gets you from A to B and is a relatively cheap investment, lets look at the below diagram depicting the depreciating value.

Notes: Years 1-6 are pulled from Kelly Blue Book and year one represents a new car.

Wow. Year two may as well represent what happens when a dime piece passes thirty.

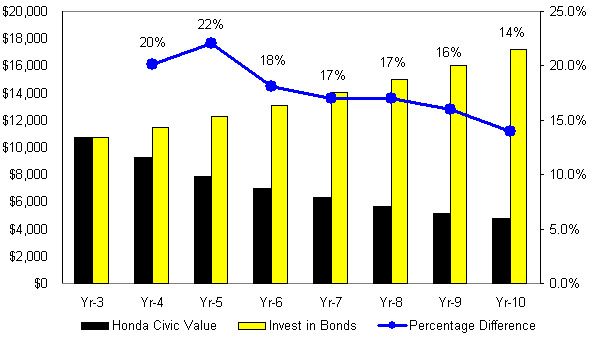

Return Profile: Lets ask a simple hypothetical question, assuming you’re a bright guy and do not buy a new car what happens to that $10,702 (Yr-3) if you simply put the income into 7% yielding bonds and got rid of the car instead? Lets take a look.

Notes: Honda Civic value is run off Chart 1 numbers. Investing in bonds grows at 7% and starts at $10.7K. The percentage difference takes the 7% return in bonds less the negative decline in car value.

Above Market Rate Returns: As you can see, by avoiding a car you’re effectively creating above market rate returns. As the old saying goes a dollar saved is a dollar earned. In this case you’re getting 1.5-2.0x long-term market rate returns. If we showed you the black chart alone in any sort of investor meeting the books would be closed before the meeting began. If someone were to simply invest in 7% bonds for 7 years he would have $17.2K in the bank, interestingly enough roughly equal to the cost of a brand new car.

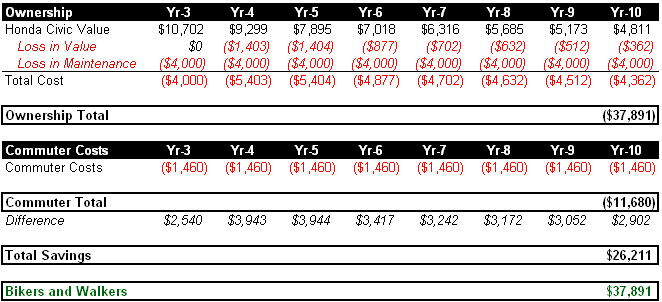

We’re Not Done Yet: Beyond the above mentioned loss you’re seeing the average person drive ~1,000 miles a month (conservative estimate) at $0.25 per mile in total cost we can assume you’re losing out on an additional $3,000 a year. Add to this another ~$1,000 annually for insurance, tire changes and other wear and tear items and $4,000 is your additional cost. This is a low ball estimate. With $4000 a year you can easily afford public transportation or even walk/bike to work. In reality, for men out there public transportation may act as a large value add to your life. Instead of suffering from road rage and traffic you can bring your tablet/kindle/library book and simply read on the way to work (this way you’re being productive during your commute).

The Comparison: To end this grim financial picture lets compare car ownership over 7 years to a commuter who we’ll peg at ~$120 per month. The below diagram shows the cash flows over the next 7 years.

Conclusion: After living in a large metropolis it becomes difficult to justify the costs of long commutes. In this post we haven’t even touched on the cost of commuting in a car, with an hour extra a day you could be hitting the gym, learning a language, reading about a new business opportunity or at minimum reading something inspirational. With that said, if someone is flush with cash and has F-you money, by all means go ahead and buy that dream car.