One of the consistent things we’ve noticed in our Q&As is that people are much more focused on trying to squeeze an extra 5-10% raise instead of trying to generate 5-10% by themselves in some sort of small business. We used to wonder why this was the case but now have an answer. People are afraid to start in the first place. In the work force you’re forced to listen to what someone else says to do. Therefore, their brains are wired to take orders and they don’t know how to “start” from zero and hence… they never do. Here we outline some basic math to explain why this doesn’t make any logical sense.

Business Income is Not the Same: We assume you’re pretty successful already, making around $200,000 a year in your current position (role is not important). The reality is that you’re likely living in a high tax state to generate this type of money and we estimate your tax rate to be around 33% (keeping it simple) so you’re really generating $133,333 or so after taxes.

Why is this important? Well if you do spend your entire year finding a way to get 10% more from a company switch, that’s going to be $20,000 gross which is $13,333 after taxes (likely a bit more due to escalating taxes). This is not going to be as much money as you thought. You’re making just over a thousand dollars a month in additional income.

Instead we assume you start a new basic business (consulting for example where you’re doing time for money exchanges) and you make $20,000. Well… There is a big change here. You can now deduct business expenses as having 100% operating margin is unlikely. You will be able to deduct expenses for your work related activity and this can include basic items such as your cell phone, your laptop etc. Showing a 50% operating margin is actually entirely fine and doesn’t raise any red flags. So you’re generating $20,000 in income, deducing $10,000 (likely items you would buy anyway) and now you’re paying tax of just $3,333. This means your net income was $16,666.

Now you may look at that number and say it is small. While true it is still 25% higher than your other option (finding a new career). That is a big difference over the course of 10 years. Assuming you can add say $100,000 in business income or $100,000 in your career the answer is beyond clear. Also. Would you rather have your livelihood tied to one income stream of $300,000 or one income stream of $200,000 and the other at $100,000. Your risk drops dramatically with the second set up. It isn’t even close.

For fun if we assume that’s the case: one guy earns $100,000 from a new business and the other person earns $100,000 from his career, the difference is $16,666 after taxes (understated as taxes for the career would go up). In 10-years assuming a basic 7% compound interest rate, you’re looking at a difference of $230,000… About a quarter million dollars by simply starting a basic side income. This is a huge amount of money for the vast majority of people and could purchase a basic home in many parts of the United States. Oh… And don’t forget… This is after tax gains. So at most you can have a 15% tax rate at the end (long-term capital gains).

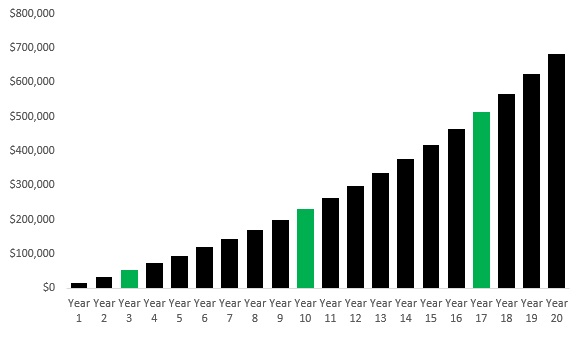

From the chart above within just 3 years the difference is a luxury car about $50,000, in 10 years the difference is a normal house and in 17 years it is two homes or one home in a nice area.

How to “Start”: Despite giving out a clear zero excuse way to start, we might have to start from the absolute bottom. Meaning? You’re unwilling to even get up and try something. The good news is that you can start by the time you’re done reading this post it is really this simple.

Step 1: go to a university near you

Step 2: print out and hang up flyers offering the service you can offer

Step 3: wait

You’d think that this would be an easy task, and yet most people don’t even bother. If you have any sort of high quality career, we can promise you that people will pay for your advice/attention/time. This works for the vast majority of our readers since they are largely in high-earning careers (at least that is what analytics tell us).

If you want an even easier version of this replace university with “any place with your target audience”. This means you simply need to know what you can offer and where the people will be. This is incredibly easy. In fact, ticket scalpers make money with this strategy and they are definitely not the most competitive or smartest people in the world (but they make money doing it!) A long time ago it was actually quite easy to just go to Costco and buy a case of beers/water and sell them near the stadiums during games. This does work and it’s always fun to hear how hard “business is” when all you have to do is take a high demand product to the customer.

With the small tangent aside, everyone reading this just needs to ask two questions: 1) what am I good at and 2) where is the demand for that service/product. If you cannot answer that question then ask yourself why you’re employed in the first place. If you’re really being paid to do nothing you’re in deep trouble since you’re first to be cut. After you can answer this question, you then take that skill and monetize it during your free time.

Start Small: Even if you’re not thrilled with the first year of performance and only make $10,000 or so, this is the only way to learn. Instead of wasting time looking for the “best opportunity” you should spend your time making a million mistakes and figuring it out as you go along. This surely beats doing nothing. If you make a ton of mistakes and learn the following: 1) correct pricing, 2) correct marketing, 3) scaling, 4) website design and 5) traffic… You’re pretty much set for life.

You’re set for life because you have the tools necessary to generate income regardless of what happens with your career. Relying on yourself instead of another person is significantly better than golden handcuffs. The longer you stay with the golden handcuffs… the worse it gets. You end up losing your freedom as you’re on call more (the income is next to impossible to replace). Similar to the slow boiling frog analogy. By the time you realize what has happened… it’s too late.

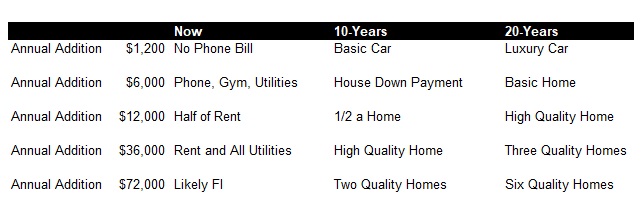

Take a look at the below table as a good example of how quickly things scale. We have an annual addition table based on the following markers: 1) $100 a month, 2) $500 a month, 3) $1,000 a month, 4) $3,000 a month and 5) $6,000 a month. “Likely FI” refers to being able to pay all your living expenses at this point.

It is hard to mentally picture compounding but the above chart is a pretty good example. If you’re making $200,000 a year, finding a way to add $1,000 a month does not seem like a high hurdle. That said, in just 10 years you’re either able to buy a house outright (your own money plus the side income). That’s a substantial change to your life particularly if you’re only 21 years old. Imagine being 31 years old and having your cost of living actually *decline* because you made a single smart decision 10 years ago. Oh wait… That’s exactly how it works! In the more likely scenario (you find a way to generate $3,000 or so which is the lowest number we’ve received from readers of this blog), that means you’ll have three quality homes in 20 years. That should almost be a saying, 3 thousand for 3 homes (about $1.5M dollars).