In short, we’re screwed. While we can fight off the virus and potentially stave off mass casualties, the economic damage is the real issue. Back in 2008-2009 there was a *centralized* issue. The issue was that many mortgages were collapsing. So the solution was drastic and simple, lower rates and inject cash to the major banks to avoid a cascade of defaults. In this situation we have a distributed attack on the system. How do you bail out restaurants, airlines, hotels, malls, casinos, cruises and real estate all at once? The second issue is that the distributed default is not easy to contain, if someone runs a small business with $1M in revenue and $100K in profit, it means his monthly expenses are $75,000! This is a big issue. Even if it’s a single month at 0% interest… It would take the person 9 months to recover. Now scale this up and spread it across the united states. That is the current situation today.

Explanation: The more sophisticated readers can skip this part. In simple terms many companies operate with leverage. This means they have more debt than cash. So imagine you have $1M in debt and $200K in the bank to run your small business. Well.. if the business makes $1M per year, you’re probably okay. If the business has slim margins (restaurants, airlines, casinos, etc all have slim margins), then you’re in trouble if your annual income was low.

What happens? We can use a simple real estate example. Forget the “regular upper middle class consumer household” they are actually okay if they have a single mortgage. Go to the bigger picture. You have a 1,000 unit apartment complex in a major city like Las Vegas Nevada. Suddenly the entire casino industry shuts down for 2 months. This means people cannot pay rent. If they cannot pay rent that entire apartment complex now defaults. So you’re not looking at a regular mortgage default, you’re looking at a corporate debt default (even bigger).

What happens to “fund managers”: This gets even uglier. This week major hedge funds have fired Portfolio Managers. If you think all hedge funds are “hedged”… Well many are simply wrong. Even Citadel and Millennium have fired PMs this week and those are some of the better performing funds in a market neutral book (market neutral for newbies means they have to be long $100 of Stock A and short $100 of Stock B). In theory, by being long and short the same amount, you should be “flat” if the market goes down. As you can imagine with huge volatility this doesn’t work. Why? Well the books are levered up 5x!

Lets review in basic terms. If you want to own say Google, you have to be short something else in internet say Amazon (again this is not correct exactly but explains it well to regular readers). So you have $1M to invest. Well in order to generate returns you lever up the book. You have $5M to invest into this position. So lets say you short Amazon and go Long Google. $2.5M is short Amazon and $2.5M is long Google. Great. Assuming no wild swings, you will outperform if internet stocks go up and google does better than amazon. If internet stocks go down and Amazon goes down more than google, you’re set!

Seems fool proof. Until? 20% swings. Look at stocks in the S&P 500 and you will unlikely ever see this ever again (we hope) over the next 20 years. It could get worse as we don’t think we’re anywhere near the bottom. That said, a 20% move would force you to LIQUIDATE that google position. That is absolutely crazy. Since you’re 5x leveraged if you don’t have money to support the margin call, they force cell the asset… You’d think it ends there? No. It gets worse.

Now imagine while this is happening, you have had 5 years of record performance (Citadel and a few other funds are up substantially the last 5 years using this long=short construct). Now you get people calling “i need to pull out $5M since my business is getting crushed” from wealthy clients. So not only do you have to deal with the margin calls, you now have to begin selling assets to cover the $5M redemption (redemption is finance speak for customer asking for money back).

Welcome to what we’re seeing today. We won’t even go through the Oil fiasco as that’s too painful to even write. Texas is going to suffer if numbers stay as low as they are (oil prices) and we’ll leave it at that.

Fed Policy Out of Bullets: Since interest rates have been low for so long, the interest payments were easy to hit. If you take $1M loan at 2%… That’s only $20K a year! Incredibly easy to find a way to generate profits of just 2% on $1M of capital (so everyone said…). Then you have a strange event like this, a complete out of the blue viral severe pneumonia. Suddenly those business that were making profits due to cheap debt, borrow at 2% and get 4% returns… are borrowing at 2% and seeing – 50% “returns”. Leverage cuts both ways.

If you believe -50% is not feasible we suggest you look at real estate or casinos as good examples. You have a sudden revenue drop to zero for at least a quarter (we doubt it’s that short), and you’re looking at $0 revenues and hundreds of millions in losses. Unless you fire people of course… which is why layoffs are occurring immediately. Remember the small business example set above, if you have zero revenue, you have to borrow to cover that month of expenses. Now imagine that monthly payment is $50-100M not $50K… Now you see how hard it is to “get that money back” with future earnings.

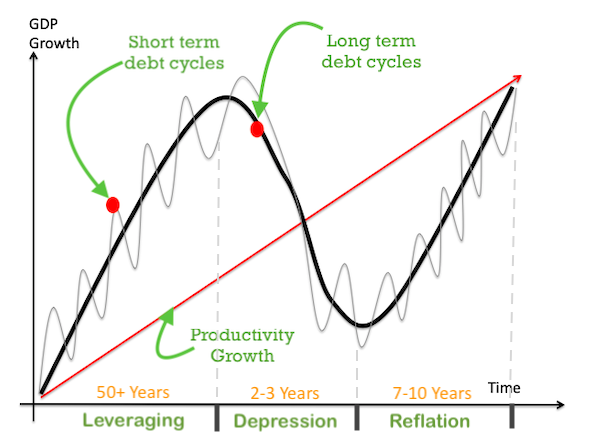

Since we live in unprecedented times, the Fed is attempting to help create “liquidity”. This means all of those margin calls are being funded with 0% interest rate money. Also. The government intends on giving individuals money straight to their bank accounts (sending them checks!). While this is fine for now, it doesn’t solve the long term problem. If trillions of dollars of revenue goes to zero… expenses were paid with 0% debt… How long does it take to repay the debt? We don’t know. But. We’ll say it is likely a very very very long time. If you want us to guess, unless there is a miracle, you could see 3-5 years before real growth and pay down is seen. This is simply a guess based on the environment continuing through Q3. If the virus does come back in Q4… all bets are off as thousands of business depend entirely on holiday season earnings (not to mention skiing in the winter).

The Fed had two choices: 1) take rates to zero – Check and 2) start printing money – check. This is a bandaid but we’re now building a massive debt burden even if it as 0% interest. Also. It assumes that everyone returns to “normal” when we get through this mess (doubtful, again an opinion). So you have a cascading debt load, consumers can’t pay bills, those companies are levered up, they can’t pay the debt, they get 0% debt, they have to pay all that debt back with future cash flows. You can see the issue.

“Just print money”? This definitely will help. We’ll actually go on a limb and say that’s better than the debt idea for now. We know the crypto community will hate that comment but it sure beats seeing people unable to pay for food. You’re better off with the second option which leads to? Hyperinflation or even Stagflation. If you print too much money, prices keep going up and people are still unemployed creating a massive issue – stagflation.

So there you have it. Two choices: 1) push out the pain again with 0% debt and pray the business environment goes back to normal quickly or 2) give people money to prevent default and risk asset price inflation. By the way, we mean “give people money” literally. As in sending checks in the mail.

What Do You Do: First of all, thank you for all the emails the past two weeks from the people who actually took our advice. We’re thrilled you’re financially better off and mean that seriously as we don’t even care about being right anymore, better to see people avoid a massive blow up (having a month of food is huge in a lockdown). What you should do is much of the same. We’re in markets that are likely going lower (opinion) and if we’re wrong and there is massive printing leading to inflation, you still hold some stocks from way back in 2012-2016 so the cost basis is 50-60% lower. So you’re good to go.

Instead any more you get you have to keep it simple. 1) retain 12 months of cash on the books at all times, 2) all income you get you want to buy “store of value” this is gold, crypto etc. While people believe the store of value narrative is gone.. it isn’t. Re-read the section on margin. If people had billions of dollars levered up 10x or more, it means a 10% price drop would liquidate all crypto investors immediately. That is what you saw. Same with gold. While gold investors are less levered up. Investors have to sell gold to fund their losing positions. Any time leverage continues and margin calls ramp up… this means everything goes down temporarily and volatility spikes.

Since we have to give a recommendation now, the easiest one is the same as a month ago. Keep cash balance up to 12 months of your expenses. Just focus on that and take your costs to zero (impossible but you get the picture). If you are already there and have 12 months or more, go ahead and buy store of asset products like crypto and gold.

In terms of your work there isn’t much you can do. If you’re in the Ad space, the vast majority of you should probably take spending to zero. Yes zero. Unless you’re in an industry where benefits are being seen today, just take your spending to zero if you’re already losing money. On the Career side of things, this is not the time to be “lazy” catch up on the news when you’re done and spend your time being helpful to your employer. Thank your lucky stars you’re still employed at this point.

Predictions of the Future: We *hope* for the best but prepare for the worst. Our “standard case” not worst case or best case is that this virus lasts for over 3 months. In addition, we think it comes back stronger in Nov-Feb time frame. We’re not being pessimistic, we’re simply looking at facts from prior corona virus cases. The last 6 of them never resulted in a vaccine so we don’t know why this one will suddenly be solved. The answer? We recommend you personally stay safe and if you’ve been acting paranoid keep that up for another 9 months or so. You will be laughed at today and it’s worth it. Better to be laughed at and take the risks to near zero.

In terms of industries we have some bad news: large gatherings (casinos, concerts, cruises etc.) are going to see long-term issues for at least a year after resolution. Why? There is just no mathematical way this is solved in a couple of weeks. To the low IQ people who said “this is just the flu”, “store of value is done for crypto and gold” and “will be back to normal quickly” it’s best to go ahead and delete all of those comments. They are incredibly uninformed. Even if the numbers get “better” in two weeks, you don’t want to have people come back together because it will just spread… AGAIN. This virus is asymptomatic which means you can catch it and have no symptoms. We lost control of where the virus is and by quickly going back to crowds you’re just going to spread it again.

Think Through Risks: It was fascinating to see how people understand “big risks”. Tail risks and things like that sound fancier but we prefer simple english. a “Big risk” is a systematic uncontrollable risk. In plain english: 1) you die or 2) you lose everything. This is why we went full paranoid with this virus, one of those two risks were clearly present. If there is a chance of losing everything you have or dying, you just don’t take the risk. We don’t care how strong, healthy or intelligent a person is. They do not have the capability to avoid a airborne microbe that can infect you with a debilitating lung infection.

On the positive side of the ledger, this is also why things like crypto and gold exist. In a world of absolute chaos, what can be used as money besides “paper”. If we enter hyper inflation like Germany in the early 1900s… those dollars are going to be worth nothing. To be clear. We really really doubt it gets to that but the point is the same. Always have a 5-10% hedge (if you can afford it) or a 1-2% hedge (everyone can afford this) against a catastrophe. If it’s asymmetric to the upside you *must* own the asset. If it is to the downside, you must AVOID it at all costs. COVID-19 is the downside.