Some of our posts are too technical and some of them are watered down. The goal here is to explain what is currently going on in markets from a high level and why you’re seeing so much debate on Twitter. Some people believe that everything is going to crash and other people believe we’re going to see hyperinflation. As usual, the S&P going down 70% or seeing hyper inflation of 30%+ per day are both unlikely. They could happen in theory but hopefully we can agree it is unlikely. So lets go ahead and talk about why you have to look at fund flows. Fund flows is fancy wording for where people want to put their money.

Fund Flows: Finance has a lot of jargon that can be simplified. “Equities” is just a stock. “Cap Tables” = list of who owns how much of the company. “Liquidation preferences” = who gets paid first and last if the Company goes bankrupt and must sell all of its assets. “Fund flows” is another one = where the money is going.

The first step/concept is a bit confusing… Money isn’t really “lost”. Meaning? If you see the price of bonds fall down… It means that someone sold that bond and collected cash. That cash is now sitting in his account. If you own 1,000 bottles of coca-cola and sold them for $1 each or $0.70 each you’d have $1,000 or $700. No matter how you slice it, the person who sold now has cash.

The second part is “where does this money go”. IE. The fancy world of finance = Fund Flows. So if you just got $1,000 or $700… What are you doing with this money? You are going to have choices. Here are a few and we will definitely miss a lot: 1) leave in cash, 2) use it to buy goods/service, 3) use it to buy/invest in real estate, 4) use it to buy gold/crypto, 5) use it to buy bonds, 6) use it to buy stocks, 7) use it to fund a new business, 8) use it to buy inventory, 9) use it to pay bills… so on and so forth.

The third part is the piece where most retail investors lose their footing. If you are a billionaire and sold $1B worth of government bonds, are you really going to be able to use $1B to just pay for food? Of course not. You have to invest in something. This is important since most individuals deal with small amounts of money. If you are dealing with large amounts of money, say a billion dollars, it isn’t responsible to leave 100% of it in cash under your mansion. So? What are your options. You can simplify it and say: 1) cash, 2) stocks, 3) bonds, 4) crypto/gold/silver and 5) real estate.

Now the fourth part, the decision making. Look at those five options. Over the past few months, interest rates were taken to zero. So your options in terms of returns are as follows: 1) cash at 0%, 2) stocks at ???, 3) bonds at 0%, 4) crypto/gold/silver – inflation hedge and 5) real estate at ???. Notice. Bonds typically offer a return since you’re taking on risk (the bond you bought is tied to a particular company staying alive). And? If that bond now generates a 0% return (or near 0) why would you take the unnecessary risk of owning a bond vs. having it in a bank account earning interest?

Now we purposely used question marks since you have to make a judgement call on if the market is under or overvalued (we know long term returns in stocks is around 7%). That said, the point should be clear, by taking interest rates to zero you’ve force people to take on more risk. If you get no return from cash and no return from bonds… It means you have to be sure the market is going down. That’s the only reason to remain in cash/0% yielding bonds.

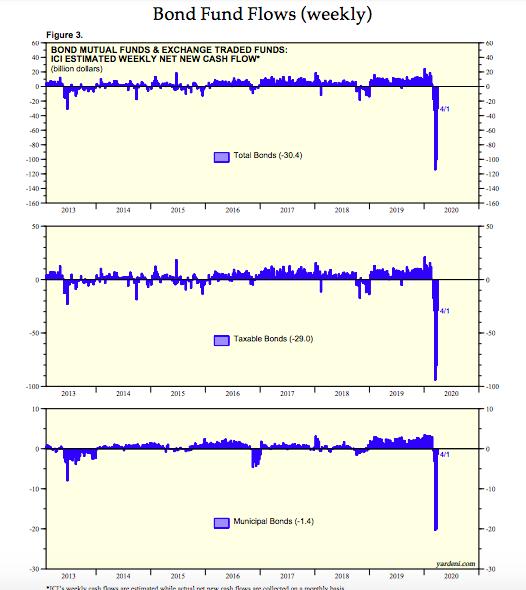

Now the fifth and final conclusion point to explain what happened the last month. You saw a massive net bond outflow. So if we know that tens of billions of dollars have left the bond market we would return to point 2… this money has to go somewhere. It can go into cash at 0% or go back into bonds (unlikely since you just sold). So. You’re left with very few options. Which one of those options offer a positive long-term return? You guessed it stocks. Many fund managers can’t even buy some of the other stuff (crypto, real estate for example – topic for another day) so you’re stock with stocks.

Does this mean that the stock market is going to continue to go up? Not necessarily, but if you watch the movement of money you can see why we had this rapid rally from 2,200 back to 2,780. We’d argue that we’re back to overvalued again (have said this since 2,640 or so) but the recent rise makes sense off the bottom if you were watching fund flows. Remember, the movement of money is way more important than any economic indicator or retail investor because we really doubt anyone reading this is able to buy and sell $100+ billion worth of bonds. You can access this information for free by following this link: https://www.yardeni.com/

Moving onto Financial Incentives: With the fund flow part explained we can move onto incentives and bailouts. When companies go bankrupt, the employees are hit less than the CEOs (generally). Why? Well if a company goes under, it usually gets bought out by another group of people. The concept of bailouts creates a lot of bad incentives. If you were the CEO of Boeing and knew that you would never have risk of going under… Then you just take out a bunch of debt and remain levered up at all times. In fact, you’d be a fool to not lever up if you knew the government would hand you a check in the end at the interest of national security.

This is a slippery slope. You certainly don’t want foreign companies purchasing your airlines (anything related to national security) but why would we allow poorly run companies to be run by the same people? It doesn’t make any sense. If Boeing is taken over by a better management team, the USA wins over the long term as do the employees. Instead of focusing on poorly run companies that should be fixed, we should have been focused on sending money to the workers. Having the value of the stock decline doesn’t hurt the vast majority of the workers since management teams & executives are the only ones who really own any stock (just look at who owns the company – the fancy Cap Table).

The excuse making has already begun and you’ll see more of it. “The airlines didn’t do anything wrong”. “No one could have predicted this”. These arguments are poor and are typically made to rationalize decisions. Said another way, if you bought a house and got fired because the Company you work for got bought out last week, does that mean you should get a bailout too? No one could have known the Company was being sold! It doesn’t make any sense. If you are a well run company or financially responsible individual, you have savings for a rainy day. The amount of cash flow run-way you have is dependent on how much risk you took.

A smarter solution? If the government is forcing you to go out of business (shutting down your restaurants, hair salons, etc.) then they should cover the payroll with direct payments. No this isn’t a great solution but that is who is impacted by this. You’re forcing people to live without income, so you have to replace that income. Why would you spend the vast majority of the money on servicing a company that is levered up 5-10x? Doesn’t make sense. The manager of the Company should have started a rainy day fund for unforeseen events. The worker is being forced out of a job… This is simply not the same.

This applies to AirBnB super hosts as well. If they bought 10 homes on leverage and didn’t have any money in the bank to pay for a month of no income… They have to go under. This is how risk and reward operates. If you levered up and borrowed a bunch of money with no way to deal with a few bad months, you’re simply out. The people who should be rewarded are the super hosts who were able to survive the storm. Some super hosts likely have cash to survive a year or more. If that’s the case, they survive the downturn and are one of the rare survivors. When the dust settles they also get to buy more assets since they survived and were responsible hosts.

To summarize this, since the government is the one who forced businesses to close, they should look to help the people who are out of work. They should not bailout massive companies that shouldn’t have been levered to the gills in the first place. We’re as capitalist as it gets and yet it makes way more sense to send everyone money and simply tax it back based on their 2020 income. This way the money goes to people who needed it the most and you don’t have to worry about massive defaults down the line. You don’t restructure the debt of a poorly run company and let their employees struggle to pay rent and pay for food.

Fund Flows and Incentives: One comment we get on here is we’re too blunt and cynical. This is for a reason. This website is written for people who are entering the work force and cut throat business environments. In that particular situation you should be much more cynical and focus on incentives. Why? Well people are going to work to make money, not hug each other and have fun at the clubs. To explain this further, this is also why we’ve recommended ordering catering and tipping people who work at grocery stores right now. The are getting unfairly treated relative to their value (in our opinion). If we wanted to be entirely heartless we’d recommend against that. It’s important to take the situation into account.

If you want a cheat sheet for fund flows and incentives first ask what the environment is. If it’s anything related to making money, veer on the side of incentives and people optimizing for that incentive. If you give your employees a reason to cheat you they will and if you give your customers a reason to look elsewhere they will. So be a bit more “cynical” and calculated. If it comes to your friends you should be more centric as you’re not going to lose a friend over a $20 meal difference at dinner (unless the guy does it 100x in a row and shows he’s trying to game the system). Finally, with anyone in your immediate family being more of a communist makes sense as you don’t want any of them to feel “lower”. As a reminder this website tailors to making money and succeeding in a cut throat environment so we veer to profiteering type ideals. (Hat Tip, yes we agree with Taleb who said something along the lines of capitalist with strangers, socialist with friends and communist with family).

Just like investing, fund flows and incentives apply to any online venture you start (or brick and mortar). You will avoid screwing your customers long term at any cost (example selling them something and price gouging later on something that wasn’t included). You will also incentivize your workers to stay longer even if it means you’re paying a high than market wage salary. As always it’s a gradient. If you apply this gradient of colors to fund flows the answers will become more clear over time.