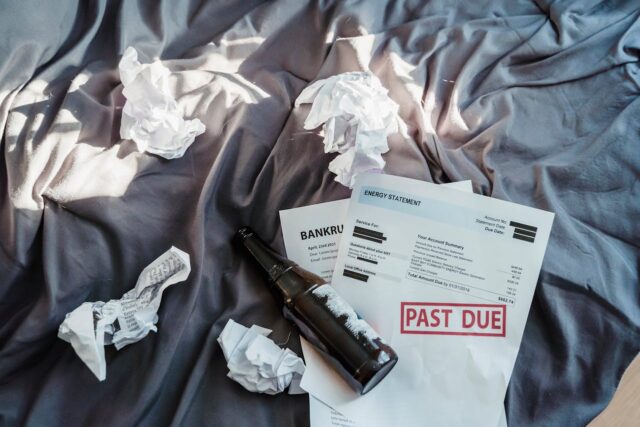

At this point, we have high conviction that we’ll see a wave of defaults/bankruptcies in early 2021. While we realize a lot of bankruptcies have been announced thus far, this does not account for the numerous people & entities that were not allowed to evict tenants. For example, if you had your occupancy rate drop from 90% to 55% in a single year, it is unlikely that you’re in great shape. In addition, you’re in even worse shape if the occupancy rate is “at 90%” but half of these tenants are not paying rent. You are still on the hook for the loan against the apartment complex (don’t even get us started on the leases for businesses).

Step One, the Defaults: As we’ve described in prior posts, allowing businesses such as restaurants and bars to operate at “25% capacity” results in more losses when compared to closing up shop and waiting until full capacity is allowed. The math is extremely simple as the establishment needs to run at 70-80% capacity at minimum to generate profits. Fixed costs are not going to change and the margins on food will remain suppressed due to competitive markets.

Therefore, as companies are allowed to evict tenants who are not paying rent, the debt burden will continue to rise. Why? Well the loans that were given to these businesses have to be paid back. Even if it is a 0% loan, there is a real chance that interest rates go negative (yes we’re serious). In that situation, they would be in even worse fiscal shape.

Lets go ahead and assume that interest rates stay low (slightly above zero) and you’re still stuck with a bill that needs to be paid back over the next 3-5 years. And. Run some simple math. If the interest free loan of 0% was used to cover 9 months (about the length of the pandemic) and you lost money the entire time, it means that you have to make up for 9+ months worth of losses. Who knows how much this is. What we do know is that there is a bare minimum number which is zero.

Take the zero scenario (remember it is much worse than this since they are losing money). If you didn’t make any money for 9 months it means that you have to pay back 3/4 a year worth of profits. If you open on January 1, 2021 with the exact same profit and loss profile, you will be in the red until October of 2021. This is because you have to pay back the entire loan amount! This is simply insane for most businesses as you didn’t lose 9 months… you really lost 18 months. If you were generating losses the entire year (extremely likely), then you really lost 24 months or 36 months at minimum. This means? Probably better to default.

If the above is too wordy, a simple rule of thumb would be “take the number of months the business could not run at full capacity, multiply by 2.0-3.0 and you get the total number of months they need to pay back the loan”. For example, if a business was locked down for 10 months, this means 20-30 months to recover from the pandemic *assuming* the business returns to normal immediately.

Step Two Solutions: As many of you are well aware, we have no interest in politics since they detract from the main concept of this blog: “You are responsible for your own success/failures”. As long as we don’t end up electing a benevolent dictator and turn into a socialist country like Cuba, we were going to be just fine regardless of who wins. In fact, if you understand the above you’ll realize that both the democrats and the republicans will be forced to make the same decision no matter what. What is that decision? Print more money/UBI/Helicopter money.

Why? Well there is no other solution in sight. If you want to try and kick start the economy again, you need to give people money to spend and these business that went under need to be “bailed out”. The problem here is that unlike the financial crisis in 2008 where it was primarily driven by one sector (housing) we have a crisis that is impacting 50%+ of the GDP (Technology, Healthcare, Grocery stores and a few other various businesses are the only ones that flourished).

Your other two options are not going to sit well: raise taxes and a wealth redistribution. If you want our long-term view, we think a wealth redistribution of some sort is inevitable (or a wealth distribution through UBI to the large numbers of structurally unemployed people). The fun part is that people do not think long-term. Even though we should be preparing for artificial intelligence and job losses, we’re not going to accept the long-term reality. This means what? It means they will choose the path of least resistance which is printing money.

As a fun note, notice that we don’t mention a vaccine. We don’t mention who is going to win (our public wager has been out there for three years already – Trump) and we don’t even mention our expectations for a “recovery”. All we care about is what we know. We know that there is no *silver bullet* or magic pill that is going to solve 9 straight months of losses due to a pandemic. The only solution that will sit well with the masses? Printing vast amounts of money. In the end, we know that businesses lost ungodly amounts of money, are levered up and have to repay these debts (or default).

Similar to the end of section one, if the above is too wordy… the government has to print money. Doesn’t matter if it’s a democrat, republican or some hybrid version of the two. If they don’t help the businesses that they recently stomped on, the uproar would be unbearable. You don’t want to see riots from the people who wanted to be left alone.

Step Three – Being Prepared: Take a big picture view. Is there a scenario in which retail out grows online sales now that we’ve taught a huge portion of the economy how to use Amazon, Netflix, Shopify etc.? Probably not. Is there a scenario where people spend less money on health care given our aging population and new interest in virus research? Probably not. Is there a scenario where people riot on the streets due to job loss, political turmoil and socio-economic unrest? Probably. If there a scenario where kids learn more online than they do during their old K-12 habits? Probably.

As usual, you’re free to disagree with any of the questions we posed above. Instead of listening to a blog, it is always best to think for yourself. If you can’t think for yourself you’re already being swayed my media and celebrity personalities.

Now that we’ve got that out of the way, there are some easy near-term solutions for you. The first one is that you should re-stock up on any basics. With businesses boarding up heading into an election it is likely intelligent to stock up on all your basic needs again. We think it is unlikely that the chaos is uncontained, however, why should you expose yourself to this risk? Buy all the food, drinks and toiletries you need to survive at least a couple of weeks. This won’t “cost” you any money as you need the items anyway. If your city has civil unrest you can stay inside and watch the show on TV.

The next near-term solution is to have assets in your hand that have some value. We’ve already explained the importance of crypto currency, gold, collectables and physical cash. We’re not going to lecture anyone on the perfect allocation. That said, a good number to have in your head is “6 months of living expenses”. This should be on the go. If you’re a gold bug, maybe you have a 50/50 split of physical gold and physical cash. If you’re a bitcoin HODLer, you may have 75% bitcoin and 25% cash. We don’t know. You might even be a rare sports card collector with a stash worth $100,000+. Either way, you need to have some wealth stored in a way that makes it difficult (if not impossible) to confiscate.

The third near-term planning item is to write down an “exit plan” to lower your cost of living. We’re serious on this one. The world is going to go through a lot of pain over the coming years so you need a way to reduce your costs if necessary. If you are bored during the holidays, we recommend looking at all your expenses and *income line items* and saying “what can i do in a worst case scenario”. A worst case scenario can include: 1) moving to a low cost city or even country, 2) cancelling certain “wants” vs. needs and 3) changing the ways you make money. The third one is going to be painful for many people. If you are unfortunate enough to be laid off, you may have to trade your time for money for a period of time. The recovery phase is going to be quite difficult and when you do your worst case scenario planning, you have to keep income generation in mind. “Always prepare for the worst and hope for the best”

The fourth planning item is for people who have “made it”. The risk profile in the market has changed dramatically. Valuations are back up (massively), interest rates are going to be at zero for three years and wealthy people got wealthier (internet, technology and anyone who can work from home while generating revenue has made a killing). This means a large amount of money is floating out there. This money needs to find a home and that home is likely “alternative assets”. That’s fancy for high risk items: starts ups, crypto, SPACs (all the rage) and anything else not called a stock/bond on day one (yes we realize SPACs are technically stocks, no need to point this out as the point is still the same). We may have to do an entire post on alternative assets (something we’ve been researching all year at this point) since it’s the only asymmetric bet left at this juncture. If we can agree that there is a large amount of money floating around due to wealth disparity, that money needs to find a home and some of these alternative assets will likely catch a bid (meaning they increase in value 5x or 10x in a short period of time – 5 years or so).

The fifth and final item really ties this together. Chamath said it best when describing his investment philosophy (paraphrasing), “The biggest debate is if interest rates are -5% or +5% in the future… Knowing that, you want to be exposed to growth so it won’t matter which one prevails”. This is something we agree with and lines up with our view of alternative asset investing. There are very few areas of growth that *don’t* have huge valuations (technology is high and you do need some exposure there). A company that appears “cheap” is cheap because it is on the decline which is exactly what you’re trying to avoid.

If the above was too much, the tweet version is as follows: 1) stock up now ahead of election to reduce risk, 2) have “in-hand” net worth that is in excess of 6 months spending, 3) write down a serious plan B if things go south for your income streams, 4) look at alternative assets and 5) you need to optimize for growth… some argue this is a barbell strategy where you buy high-risk and extremely low risk only.

Step Four, the WSPs Prediction Part: This wouldn’t be any fun without some real predictions that are over the next 6-12 months. We gave two up front that we can’t see changing (printing and more defaults). This is an arithmetic thing and if someone has found a work-around we’d love to hear it.

The first prediction is that private equity firms are going to go down the work remote framework to juice returns. Pretty simple. Find a software company or any tech company that has a huge foot print. Go in there, buy it and then get rid of all the overhead. The business doesn’t need to be amazing it needs to simply “chug along” at 0-2% growth. Why? Well look at the P&L. Most companies have at least 5-10% of total costs tied to fixed assets (this is actually low). So then you simply borrow money at 0-2% and collect the return by cutting cost. While it is true that many tech firms are asset light, headquarters, travel and other such items hit the P&L in a big way. Good night to retail companies with huge real estate footprints when valuations decline.

The second prediction is even more crypto noise. Square, PayPal, Microstrategy, DBS bank and Fidelity are all drops in the bucket. They are drops in the bucket because the rails are not made. Once the rails are made, it unlocks all of those users at once. It is one thing to announce that 350M users can now purchase crypto assets. It’s a completely different animal when they can begin purchasing them. This won’t occur until 2021 or so at scale. The beta edition for PayPal is “cute” but it doesn’t really make a dent until the flows begin. Once the flows begin all bets are off.

The third prediction is a significant increase in both gambling and religion. We’ve talked about this in the past but it needs to be mentioned again. This isn’t going to be a fun time for the vast majority of people. Therefore, they will likely turn to religion and gambling. They are related in the sense that they both offer hope. Gambling gives you a temporary high/jolt and religion is a back stop for people who need a community to lean on. We have nothing negative to say about either to make sure nothing gets mis-understood. We are making this statement as a prediction.

The fourth prediction is bigger household headcount. The easiest way to reduce costs is to reduce overhead. The easiest way to reduce overhead is to live with more people. It will be interesting to watch as independent individuals (men who can afford to live alone) will command a premium. This impacts the dating market (seriously it likely will) and will impact the maturity rate of many people in their 20s. If you never live alone, it reduces your ability to mature. Again. We have nothing against the strategy as tough times call for tough decisions. That said, consequences remain.

The fifth prediction we have is an increase in financial literacy. We can’t believe we wrote that one out. While we don’t expect the increase to be explosive, the recent decisions made by the government cannot be glossed over. People are starting to ask questions about taxes, why there is unlimited money printing and modern monetary theory. In times when unemployment is at 2-3% people are more interested in hooking up with their tinder date or going to the strip club (okay they are still more interested in that, just slightly less so).

The final part is more obvious: 1) more remote work, 2) people moving to lower tax locations, 3) less conferences more zoom meetings, 4) reduction in air travel relative to the past, 5) reduction in cruise travel relative to the past, 6) massive increase in video games, at home entertainment, 7) increase in home remodeling, 8) decrease in commercial real estate prices due to reduction in footprint for major companies, 9) increased interest in healthcare investment and 10) another shift forward for technology companies.

Some Concluding Thoughts: A good way to think about the future is to simply bet on innovation. Trying to bet on people, companies or processes that worked in the past is not a recipie for success. You want to look for things that will make life cheaper, more effective, more efficient and easy to use. Things do not need to be “easy to understand” as data centers, internet connections, and other technologies we use everyday are quite complex. They need to be easy to use. Follow this line of thinking and we’re guessing you’ll fall upon the same conclusions we have. If not, we’re looking forward to the rebuttals in the comments section! Enjoy the weekend.