You’d think that all of these items have little to do with one another but they do! They all follow the same pattern. Heavy emotions with strong conviction on both sides. This means you will be laughed at and ridiculed immensely for a strong opinion on any side of the market. This is great for you as it allows you to manage risk and ideally see significant outperformance over many years. While we realize many are upset about the election as it *looks* like Biden will win, the reality is that there are hundreds of opportunities even *if* he does. Notice we put emphasis on the word looks and if because people really get upset over politics (which we took 3:1 odds on over 3 years ago and are sleeping easily with the outcome even if he loses – ie. Good risk management and not debatable unless looking at it with 20:20 hindsight vision). Before we begin, there is still a 2-3% shot Trump comes back and we realize this but we’re going to go ahead and continue under the assumption he has lost.

Political Stuff: The only real thing we learned from this election is that there are a lot of swing trades during the election. If we decide to make a bet on the next one, we will *not* try to make an early bet. The reason is that neither candidate is strong. Why do we know this? Well Biden will be over 80 years old and the chances that he’s the same guy running for re-election in 2024 is slim. We took trump in 2017 at 3:1 ($100 wins $300) because we knew he would be the person running for president. We had no idea we’d see the worst pandemic in history, but that is life.

Polls are useless. This shouldn’t be debatable as no one can really believe this was a landslide by any means. Polls are astrology for men at this point. The quality of the information is more important than the information… “garbage in, garbage out”. Therefore, we know going forward that the spreads will make *no* sense in future elections. The spreads went +/- 400 during the election! So emotions are flying extremely high.

What is the conclusion here? After this election, we’ve concluded that it actually makes sense to trade the lines based on which states are reporting. There was a time when people were worried Trump would lose Texas which was one of the craziest theories we had heard. This digression aside, instead of thinking “people are crazy” the real answer is “massive opportunity here”. In conclusion, the main thing we learned from the election is the spreads are actually wider during the vote counting vs. needing to wait three years to get the 3:1 payout (or zero since it is likely he loses). It would have been wiser to close the bet when trump was at -400 during the “trading” of the election. Lesson learned!

Bitcoin/Crypto: Absolutely hilarious. When the election was getting close in October we received many many many emails saying how dumb we were and that Trump was going to lose and on top of that Bitcoin was going to zero. You’d think that the groups would be unrelated… But here we are.

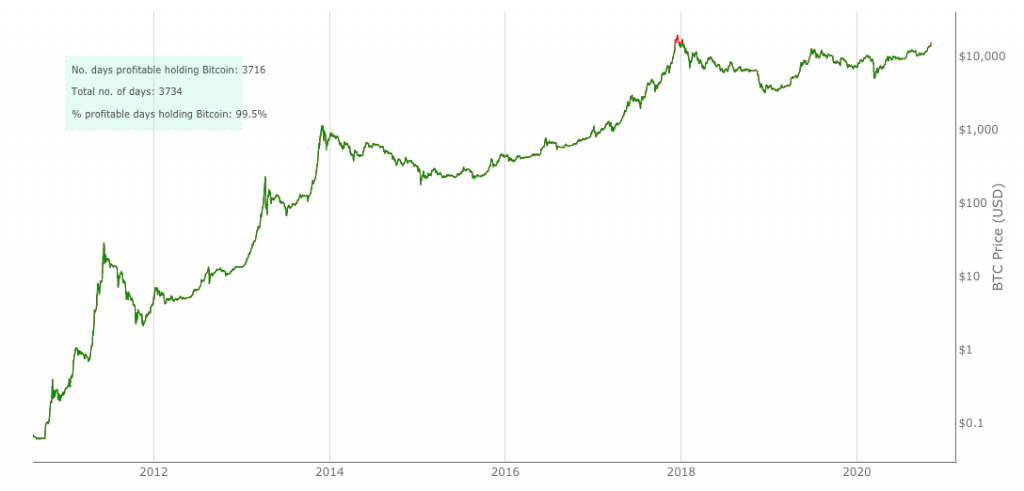

As you can see from the chart below, there are <20 days in the entire history of Bitcoin where you could have lost money. If you are actually down today, we recommend seeing a psychologist (joke) or simply dollar cost averaging. Dollar cost averaging is probably the best bet. If you simply bought a few bucks worth every single month, you’re up massive no matter when you started.

The other interesting thing you should notice is how the “negative” people believe that they were right. Not sure how this is possible but what they are really saying is an asset/stock/price *must* be at an all time high for anyone to be right. The same people believe that Tesla is a terrible investment because it is at $429 instead of $442 (yes seriously, the ones who were short since $40 split adjusted still believe they are right since the stock was down in 2019).

With the explanation out of the way, we can zoom out to our standard recommendation for Bitcoin only. We cover investing in our book but for fun we’ll leave the simple math here again. If you believe in Bitcoin (you don’t need to), then you can run the math on the necessary amount to hold. Starting with the total number millionaires. There are about 47 millionaires in the world. Of these 47 million, about 10% of them are considered ultra high net worth, this would represent 4.7 million people. Take the total number of BTC available at 21 million divide by 4.7 and you get 4.47 bitcoins.

There you have it, currently if you own about 4.47 bitcoins there is no way for you to own less than the top 10% richest people individuals in the world. Yes, we know this math isn’t perfect as we suggested 4.2 before (number of millionaires has skyrocketed over the past year). If you’re extremely worried, then you can move to 5 coins and you’re guaranteeing that you’re well into the top top top of the richest people in the world. As a final note, we also realize that institutions are now buying it and that is not an issue. If 100 coins represents “institutional level ownership” then your position will be enormous as you’re 5% of an entire institution just sitting at home reading this on your computer screen.

For fun, while this article is extreme the numbers give you an idea of just how much money institutions have. They have a lot. Before you click the link, we are not saying we agree with him. The author states “When, not if”. Like any good writer you have to make a bold stance and type in an aggressive way otherwise no one will read it.

We also recommend checking out this website for interesting charts.

Basketball: As many of you know we’ve made tons of bets over the years, trump twice (one win, looks like one loss), 10+ boxing bets, 2 failed MMA bets and 5-8 basketball bets (Toronto, MVP bets were some highlights). In good news, sports are coming back and while we realize many of you have no interest, sports are similar to crypto and politics. Everyone has an opinion, another massive spread created every year.

What we’ve noticed over the past couple of years is that the boxing industry is seeing shrinking spreads while the basketball industry is seeing widening spreads in terms of the “correct” outcome. IE. since boxing is losing steam relative to basketball (this year an exception due to COVID-19 related ratings drops), it means you should probably shift your interest a bit to the mainstream sports. Why? The more mainstream something is… the more that average joe bets. If average joe bets you know he’s a net loser 60-65% of the time and you will be a winner 60%+ of the time if you simply use stats and math instead of emotions. As these new online betting platforms ramp up and gambling grows significantly as an industry (as we suspect it will), we’d steer an emotionless/intelligent person to look at the major events for spreads.

Stocks! The final item here is stocks. You never want to tell someone you dislike their stock (or like a stock they are short). As Voltaire has said “it is dangerous to be right in an area where established men are wrong”. Since the stock market is primarily driven by institutional investors and accredited HNW individuals, if you tell them the opposite opinion they will attempt to rip your jugular out.

This has been a fun one as the tech trade has gone parabolic over the past few days. With contentious elections and all of the noise, it is becoming clear that nothing is getting done over the next four-years (is anyone really surprised? Life hasn’t changed much the last four years outside of the forced pandemic/quarantine).

As we move forward, people have entirely forgotten about COVID-19 as the election has created a massive veil/distraction. Meanwhile, those who have no emotions tied to the election have made good money (tech, healthcare, crypto have gone straight up for clear reasons). The other thing we can conclude is that stimulus is practically guaranteed at this point. If Biden wins (as it looks likely) he may lock us down again and that just means more bills. In the *extremely* rare case that Trump wins, he has to send out checks and try to help the lower middle class again with direct stimulus. Tough to see how that won’t be the case. Dollars will be printed.

Concluding Remarks: It has been a great week (even if it doesn’t feel like it for many Trump supporters). Looking across the spectrum of emotional topics, we can clearly see that there are many asymmetric bets/investments to make over the next 5-10 years. We’re still quite bullish on the future even if we have to change physical locations (seriously we are). In the end, life is about winning and you deal with the circumstances you’re given. As a final note, we will hold a Q&A once the elections are over. No one is going to be interested in the Q&A until that point anyway because… emotions are high! Good luck and have fun out there. Keep looking for asymmetric ideas/bets.