“How do you suggest I get into XYZ Wall Street job”

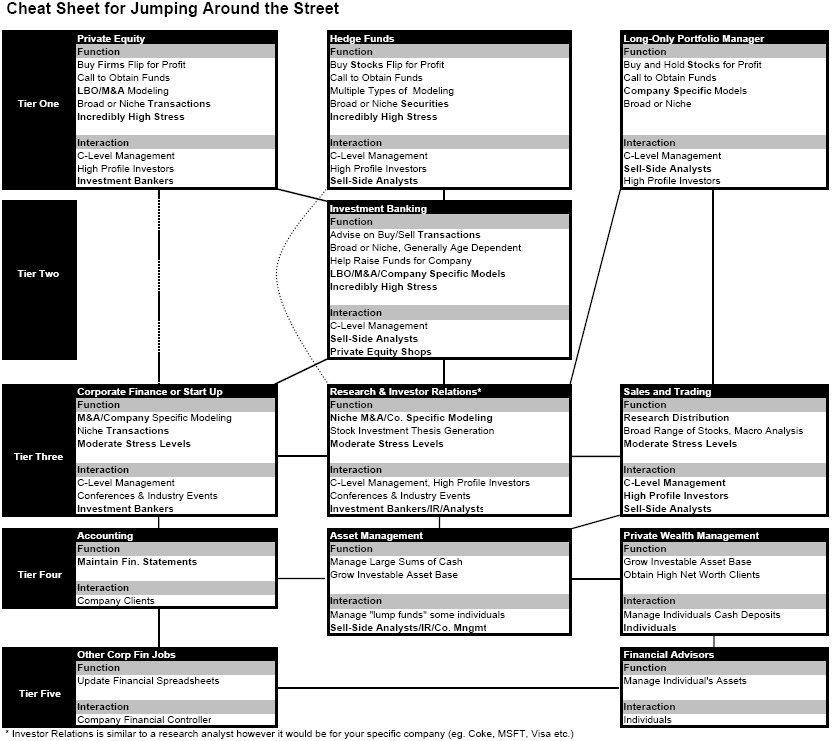

With that being the primary question, we have attached a Navigation Map.

Now if you look carefully at this chart, the lines “linking” to other boxes is the easiest way to transition. So an investment banker could go to PE with some hard work, but would be harder pressed to jump to a long-only shop. In addition, if he wanted to move down to a tier 3 job that would be tremendously easy. Moving up the prestige scale is significantly harder than moving down.

The next thing to note is once you drop below tier 3, you’re in no mans land. The hardest of all jumps is from tier 4 to tier 3. The reason why is at tier 3 and above you’re looking at high paying positions with significantly higher stress levels. In tier 3 it would be easier to jump down banks (Ex. from a bulge bracket research position to a mid market investment banking position). Same is true from tier 2 to tier 1.

Now if you look at the chart from left to right it moves from transactional positions to modeling positions to stock picking/portfolio positions. This explains why it is much more difficult to move from corporate M&A to sales and trading even though they have relatively equal pedigree. The jobs are simply not that transferable. In a corporate finance job you’re looking at acquisitions, not movements in stock prices and in a Sales and Trading position you’re monitoring many stocks and must be on top of significant moves in stock prices.

For a trained eye there are two glaring omissions. 1) People with PHD’s and 2) Venture Capital.

1) For the PHD position if you understand the niche versus broad concept it would be in your best interest to apply your niche knowledge to break into either a research position or a hedge fund position. At that point you’re in the game and you can move around after 1-2 years of experience with relative ease.

2) For Venture Capital, we hesitated on placing it into the private equity bucket since it is ***relatively*** similar, you are deploying capital into a small firm and hope to exit the position at a profit. The reason why it is excluded from Wall Street is the segment is niche and your job could be impressive to meaningless. The reason why is some Venture Capital firms simply make you call and try to obtain funding or cold call to source deals. This would actually be a better link to Sales and Trading. Alternatively, you could be a rock-star and have a large amount of cash to invest yourself… In which case you unlikely need any advice from this site. With all that said we already covered the basics of the topic.

Pay? Note anything below Tier three is a significant drop in pay (50% or more). When people speak of ”Front Office Wall Street” they are referring to Tier 3 and above jobs. As an example a person with 5 years of experience in Sales and Trading is making $150-200K at minimum. A person working in financial advisory services is making $75K or so as they are likely seeing 5% raises versus $10-20K+ raises which are the norm in front office roles.

There are exceptions (a person who started his own asset management firm as an example) but generally your goal is to jump into a Tier 3 or above job as soon as possible to learn the necessary skills to have a long career on the Street.

Conclusion: While there are always exceptions to the map laid out, it is best to start there. Print it out and ask yourself where you could slide in with the best “pitch”. In addition, remember that time is not on your side in any way. The longer you stay in any position, be it Banking, Research, Accounting or otherwise, the tougher it is to move. Give yourself 1-2 years max before jumping into one of the tier 3 or better jobs. There are times to be patient and when it comes to moving up or getting into Wall Street… this is not one of those times. Good luck out there.