In our overview on How to Invest as a Bachelor and Part two outlining how to obtain a high paying job we’re continuing down the journey to financial success and the message remains the same:

You must invest.

We already know that a savings account is yielding at best 1% this day and age. With that in mind how is that helping you obtain financial freedom? It is not. In fact you are going broke. This article could not have come at a better time as Janet Yellen recently took over the Fed and stated the following:

“Inflation remained low as the economy picked up strength, with both the headline and core personal consumption expenditures, or PCE, price indexes rising only about 1 percent last year, well below the FOMC’s 2 percent objective for inflation over the longer run. Some of the recent softness reflects factors that seem likely to prove transitory, including falling prices for crude oil and declines in non-oil import prices.” (link)

Take a quick pause for a moment and re-read the quote above.

Now that we understand the Fed intends to increase inflation since they believe it was 1 percent… this means you are going to become poorer if your money is invested at a paltry 1 percent. Instead of complaining about the changes and the printing of money the only solution is to take massive action by becoming an intelligent investor.

Backdrop: So we avoid all the Suzy Orman type comments, we are going to make the following extremely dangerous assumption: You are responsible and can control your emotions. If you check off both of these boxes you’re already in the top 10% of the USA in the first place. With that out of the way and the assumption that you have a high cash flow career we’ll take a walk through a high level personal capital allocation policy.

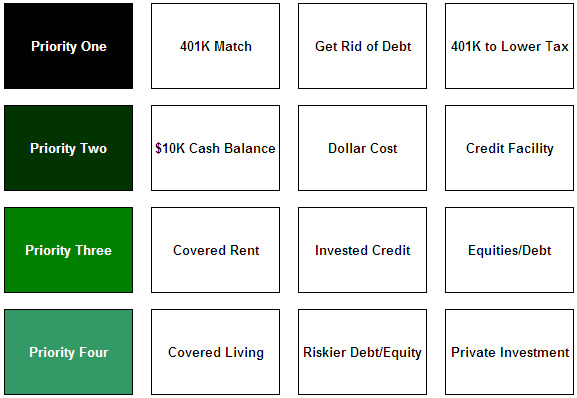

Priority One

We move from left to right in each priority. Assuming you have some debt (ideally not much due to intelligent decisions) your first order of business is to get the Company match, get rid of debt for psychological reasons and lower your tax rate with additional 401K investments.

Company Match: This is free money. Even if the rate on your debt is 10% there is no way you will ever find an investment opportunity that yields 100% returns upon investment. This means you have literally doubled your money on day one. While the Company match may be small at 3%, that is still $3,000 of free money on the table assuming you make $100,000 per year. It is much more financially irresponsible to forget the match than it is to have a small debt load.

Paying Down Debt: If you have a mountain of debt, you likely need to adjust your strategy by finding a debt specialist to pay it off in a one time sum or have a piece of it forgiven. With that said if the amount is relatively small, then pay it off quickly so you can have more mobility with your credit score. A high credit score means better access to credit. Credit scores are just as important as your GPA out of college.

401K for Lowering Taxes: Always pay the least in taxes, an obvious choice. When you’re close to 6 figures or when you eventually approach $200K+ in income, you want to make sure you defer those tax payments since your bracket increases. In addition, a savvy reader will realize we prefer 401K tax avoidance to $10K liquid from the get go. Why? If an emergency occurs you can always tap into your 401K in a real world disaster. In addition, the extra 401K contributions are unlikely going to break the bank since the goal is to simply lower yourself to the next bracket. Sticking with the $100K example, you want to get your bracket to $89,350 according to the 2014 single taxpayer bracket. If you are nearing $200K, well jump down to $186,350, so on and so forth.

Priority Two:

Priority one should be taken care of quickly. At this point you are in the lowest tax bracket according to 401K manipulation and you are ready to build a personal financial profile as well. In addition, you’re looking to build personal wealth that is untied to your Company. Finally, you should be looking at a possible credit facility in the future for low rates on debt for leverage.

$10,000: This is simply a number that we’ve derived from personal experience. As soon as you have $10,000 in the bank there is no reason to have any more in a savings or checking account. Lets run through the math quickly.

Assuming you can live on $3,000 a month this means the savings account already has you covered for 3 months and 1 week. In addition, you’re never going to quit a job. You either get laid off and get unemployment or you quit for a new job. Assuming unemployment benefits are roughly $1,800 a month, that is another $5,400 as you eat into savings. Quick math below:

($10,000 + (1,800*3))/3,000 = 5.133 months.

Assuming you’re a hard working person 5 months is more than enough time to find a new job.

Dollar Cost Averaging: We have already talked about this investment strategy but it bears repeating. In 30 years will companies be larger? Will things be more expensive? Will the Equity and Debt Markets be higher? In that case you know your money should be working for you instead of burning a hole in your pocket at 1% losses since the Fed intends to increase the rate of inflation. Finally, notice we try to avoid stock picking and fund advice because 1) we have no idea what will happen to the global economy on a day to day basis and 2) we have no interest in becoming financial advisors.

Credit Facility: Now we’re getting to the good stuff. Your portfolio is growing and you have momentum. At this point you should be receiving terrible financial advice from everyone pitching you to do X and Y with your money. This is when you know you have momentum. Instead of allowing them to steer your future you slowly build up an insanely high credit rating. You have churned a few cards and are now locked into a pair of good credit cards and one for your credit history. Start manipulating your credit rating to 800+.

Priority Three:

Now we’re starting to see the benefits of all the trees we’ve planted. You’re no longer fighting against price increases since you’re an asset owner with total assets well eclipsing your annual pay. You’re getting richer. You’ve got a credit score that would surprise every bank if you walked in and needed a loan. Time to diversify.

Cover Rent: While you’re manipulating your credit rating from the end of priority two you should have a system for tracking your passive income. If you’re banking on bond yields, dividends or rental income you should have a personal database that tracks each cash flow. When this number covers your rent you can now consider leverage if the rate is low and the opportunity is low risk and slightly higher yield.

Credit Facility: We are considering a live update of how to utilize debt but for now we’ll keep it high level. Run the debt load where you have a 3x debt to return ratio and you are generally in a safe position. As a simplistic example since we receive numerous emails on real estate if you are able to pick up a 15 year mortgage at 3% and the cap rate on your real estate investment is 9% (assuming you’re buying for rental income) then you should be in a good position. With a 30%+ down payment the 3% rate is achievable and your tenants should be paying your entire mortgage for you, perhaps even more.

Equities and Debt: At this point you have a relatively large and mixed portfolio. You’re invested across all asset classes but it is a good idea to take a look and consistently rebalance. If your career is firing on all cylinders and you have large amounts of cash flow you can continue with a heavy skew to equities. This is because a market correction of 25% would leave you unphased. On the flip side, if you’re unwilling to lose 25% in your equity portfolio it is time for a change.

Priority Four:

We’re at the final stages of your journey and you should be a mature investor. A market decline of 5% in a few weeks (what happened in January) should leave zero emotional toll on your mind and body. You simply don’t care about market movements with regards to the dollar cost averaging piece of your portfolio. Again, you are not phased one bit. In addition, if you’ve built a meaningful career, have read 100s of books and have strong relationships for liens of debt… You can consider a few bigger ticket items.

Cover Expenses: When most people talk about location independent income all they mean is they want to live a normal life in any city in the world. They simply want to see cash flow surpass expenses. That is it. By the time you have appropriately readjusted your portfolio and have access to cheap debt we are guessing you’re approaching this threshold. Instead of getting into high risk ventures keep your eye on the relaxation point (cash flow = expenses) and ignore higher risk items for now.

Higher Risk: At this point you should have a niche. You should know one area better than anyone your age and anyone 10 years your senior. That is the benchmark and there is no getting around it. If you’re not an expert… the entire high risk category should be thrown out of the window. High risk includes: Private Equity, Seed Funding, Mezzanine Funding, Bridge Loans, Angel Investing and individual equity or junk bonds.

Private Investments: While private equity is technically a private investment those that are familiar with high finance know the distinction, in this case we’re referring to silent investments. Unlike an actual Private Equity deal where you may have some say in the process in a silent or private investment you’re simply pooling assets with a group of investors and you are investing in a project.

Concluding Remarks: Every single person is going to have a slightly different journey. Many have different debt rates so they may kick the can down the road because the rate is incredibly low on a high debt amount (no reason to pay back early) and others may find priority four to be extremely high risk (not for them on an individual basis). All of that aside we will still cover some high risk investments. Finally, if you’ve receiving anything from this post at all remember this:

If you don’t learn how to invest, you are becoming poorer