The early retirement crowd is about penny pinching and living like a monk. The masses lack discipline, causing them to spend every pay check that comes in. Both are wrong.

If the end goal is not about Net Worth… Then what is it about?

Adjusted Lifetime Spend (ALS): Is that an actual personal finance acronym. Nope, just made it up. Lets go ahead and define ALS.

ALS = Total dollars spent during your peak years on an an inflation adjusted basis.

Lets define each letter clearly and move onto the conclusions at the end, starting with “A”

Adjusted – Utility Definition: In Econ 101 you learn about the marginal utility of an item. This is a key aspect to our ALS formula and the concept needs to be understood quickly. In simple terms, every dollar you spend is not equal. Example, if you are starving… a single slice of pizza is well worth the $3 you spend to obtain it… however… you would not spend $300 on 100 slices of pizza to eat at that moment in time.

With the most rudimentary example out of the way, lets apply the concept to your financial future.

We have explained over and over again that ~7% returns are obtainable over the long-term. In addition to that, if we factor in a 2% inflation rate it means the real buying power of each dollar invested increases by 5% per year. If you invest early (emphasis on early) you will increase your buying power. Meaning that $100 invested at age 22 (on business education or investments) will likely grow over the next 20 or so years, leaving you with more money to spend on entertainment. When you start approaching the age of 40-50 you should likely take you foot off the gas (we will get to that later). Now with this in mind we do not want you to become a stingy early retirement evangelist. Run your life like a well oiled business.

An intelligent business man knows two things. He knows that you need to spend money to make money and all investments compound. This is key. Knowing that you need to spend money to make money, you are not going to burn all of your money in your 20s.

To be crystal clear here, burn is defined as money that will not return *additional* money in the future (entertainment spend).

– A shot of alcohol by yourself at the bar nets you $0 in the future.

– A nice suit that will help you interview will likely net you positive $ in the future.

– An expensive watch will likely add $0 in the future.

– Spending $10,000 on advertising in a day may or may not add income in the future (if it does KEEP SPENDING!).

So on and So forth…. The crux of the issue is that there are two buckets for money.

Bucket 1 – Spending/Using money for more money – marketing, investments, building clients, business expenses

Bucket 2 – Spending for Entertainment/Utility – partying, concerts, sporting events (all of your non-income generating hobbies)

The end goal over the course of your life is to maximize the dollars spent on bucket number two. Just realize that bucket number one helps you obtain more of bucket number two in the future.

Clear? Clear. Now lets see how you maximize the peak years.

Lifetime – Peak Years: Assuming you do not spend to impress other people (a futile path to happiness as you’re allowing others to choose what you enjoy), the goal is to maximize spending in your peak years. No matter how many drugs come out to elongate your life, you’re going to have a grand total of 40 peak years. Lets call it 20 to 60 years old. At 60, no matter what you’ve done, it’s going to be quite difficult for you to live it up partying, traveling, playing sports etc. If drugs were really the answer, then athletes would never be forced to retire.

Once you accept this fact, you’re likely leaning towards the masses: You Only Live Once (YOLO!)… the mating call of the middle class. What most do not realize is that your youngest years is where you can grow your income the most. You have an enormous amount of energy to build income streams (recurring cash flow), lock down intelligent friends and go out to learn the rules of the game without blowing a grip of cash.

To summarize your decades simply look at your peers and apply the follow rule “What is everyone else doing? Do the opposite”

20s – Masses: Blow large sums of money on night game “having places on lock with $10-20 tips – LOL”. Get blacked out and grab bottles to go to the same club as Lil Wayne – LOL again. Work a dead end job and become an alcoholic. Naturally these guys know all the “best places to go out at night”, as you can imagine… They don’t.

You: Be smart and do the opposite, day game like a champ. Spend that money on slick clothes and a place with great logistics (does not need to be high end, emphasis on logistics). Put every other cent away into smart investment vehicles. The girl will give you a pass for not being a millionaire, you’re young, handsome and energetic. Besides, how many people wake up drunk every Saturday and Sunday earning Zero dollars over 3 days. Yep. Everyone.

By focusing on day game, you improve your sales. By living logistically close to your career and the epicenter of the city? You have no commute and save precious time. You are giving yourself the tools to succeed.

30s – Masses: Follow the masses again to find the truth. Your typical 30 year old is just now realizing he made some serious financial mistakes. He has “some” interest in starting a business but didn’t build any necessary skills to do so. He is intent on making money though. He starts reading personal finance blogs, he cuts his cellphone bill from $80.55 to $65.66 to save $14.89. He doesn’t realize that these “retirement experts” are actually running a business. No worries, at this point he is going to start dolling out financial advice to anyone who listens and will cut back drinking a tad because he can’t afford it… gotta save to “retire!”

You: Ah you did the opposite. You have more than enough money in the bank. You have control of your emotions and don’t worry about 10, 20, even 30% corrections in the stock market! It doesn’t matter because your net worth moves by 6 figures every month anyway (sometimes even in a week!). Get ready to ratchet up the spending. Your competition is gone! You go out and realize your only competition is high energy young guys who cannot keep up with your lifestyle game. They are pitching drinks at the bar, you’re going to the World Series next week. Who wins that battle? In short, you’re spending more because you can.

40s – Masses: The masses are now scattered. Some are out of the game due to divorce, unable to catch up financially. Others are still trying to save money but can’t seem to get leverage from their salary or hourly jobs (job not career). The common thread? They can’t make a mindset jump. They need to stop trading their time for money… But they just can’t. They are usually disturbingly risk averse at this time.

You: You’ve paid your dues for a good 20 years (roughly). If you did really well you already transitioned to the 40 year old lifestyle at 34-35. You simply put your business/career/side hustles/equity/bond cash flow items into cruise control. This does not mean you allow yourself to degrade, you simply have enough success to choose your pressure points. When you see an opportunity to make a significant amount of money you jump in. You work hard. When no opportunity is around, go back to your hobbies (sports, partying, dancing, etc.). The main ideas is that you no longer have your foot on the gas jumping into new situations at all times. Instead you’re waiting intelligently like a lion in the grass for the next smart move.

50s and 60s – Masses: Ahh yes the final frontier of the peak years. If you have experience in healthcare you realize that this is where serious issues begin to show their ugly heads. It can be as small as injuries that require surgeries to full blown strokes/heart attacks. Not pleasant. This is another item you wish to avoid.

You: Even if you played your hand perfectly, your body is slowing down. Yes you will be significantly more energetic than the masses but you won’t be perfect by any means. Maybe you have a kid, maybe you don’t, but at the end of the day you should be spending even more aggressively. Likely in line to slightly above your late 30s and 40s. This is not a material change from your 40s, you just become more and more particular about opportunities that are worth your time. If you’re real smart, in your 30s and 40s, you already know some bright old heads to bounce ideas off of (real successful men in their 50s and 60s).

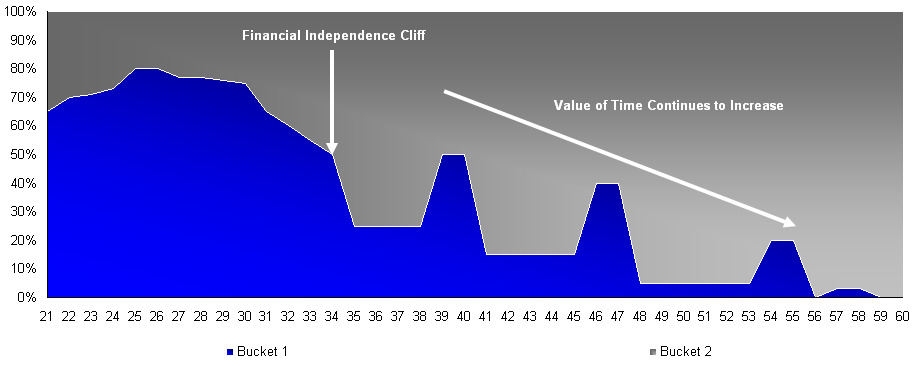

Summary Chart: With the important issues of this post squared away lets take a look at a general framework for your Adjusted Lifetime Spend (ALS). In the chart below we look at how your spending will change (does not include the masses). Yes there are jumps and gaps in the chart because this is how a lot of income production will change (energy levels also change rapidly).

Chart: Net Income Spent by Bucket – Click to Enlarge

1) Notice that bucket one spending is extremely high in your 20s. You don’t know much so you learn by doing and failing over and over again. You make many mistakes but your money is being used to generate more income later on. You spend a bit on entertainment but you leverage your youth to stick to cheaper venues.

2) Notice there are jumps, by decade, in income production. If you are learning new things every day, you are going to start scaling your skills and will break out of the $100-150K barrier sooner than later.

3) Through your late 30s and 40s, bucket one spending becomes quite variable. Some years you spend 0-10% on bucket one (already financially independent anyway) and 100% of your income on bucket 2. Other years you spend upwards of 50% on bucket 1.

4) As you approach the end of your peak years, you maximize bucket 2 even more. While you could have done this earlier, you still see good business opportunities arise. Each year you become increasingly picky, hence the increase in bucket 2 spending.

Spend – Dollars Out the Door: The final word in the ALS equation. Spend. Spend is simply bucket two of the summary chart. Money dropped solely on entertainment/hobbies that will unlikely yield a positive cash flow return. While this does not seem like it deserves a section on its own lets go ahead and look at the ways you can spend.

– Alcohol/Drugs: Decrease in lifespan, one time increase in happiness

– Sports/Lifting: Long term increase in lifespan, long term increase in happiness

– Art collections/Car collections: No material change in lifespan, long-term increase in happiness

– Traveling: No material change in lifespan, long-term increase in happiness

– Game/Girls: No material change in lifespan, long-term increase in happiness

– Mentoring People (Kids for those that want kids): No material change in lifespan, long-term increase in happiness

– Pure Entertainment: No material change in lifespan, short-term increase in happiness

– Charity: No material change in lifespan, long-term increase in happiness

What is the point of the list? The point is that you can spend your money to build an extremely interesting lifestyle the earlier you begin. The only real vice that needs to be taken in at moderation is alcohol/drugs. We’re not saints over here so you can certainly partake from time to time, just realize it is likely smarter to do these activities when you are young and to do them intelligently. Drinking and doing drugs on a weekly basis usually means you’re an alcoholic. If drinking or drugs cause you to lose income, you ARE an alcoholic. Doing these things when you succeed at a task? Not so much.

The real point in the spend part of the equation is that you are going to die. You don’t want to die with $10M in net worth having spent only $5M over the course of your life. Assuming you have no kids, if you made $20M in your life… You should spend $20M by the time you are dead (over $20M for the debt loving financially savvy types as they ready to kick the can – wink wink).

We’re not going to fault people for their interests so long as they do not deteriorate their personal well being or the well being of others. If you are obsessed with traveling, feel free to sky through 50+ countries. If you are a car person, get a new whip every year or collect them and fix them. If you are an art collector… build those walls! Just don’t become a weird guy who no one wants to hang out with because he penny pinches with a several million dollars in the bank.

Now lets conclude with an example, the dreaded 401K will help frame the point of this long winded article.

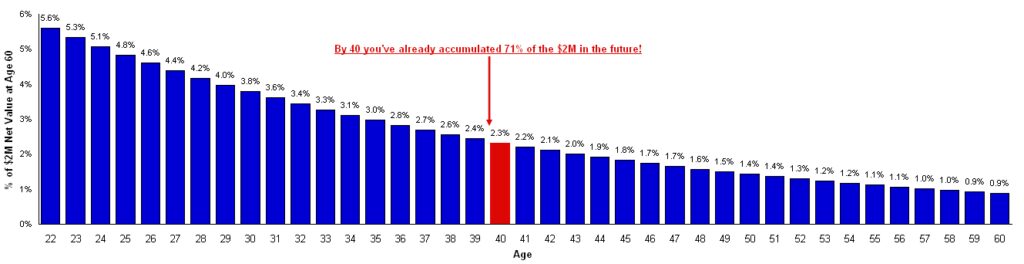

The Dreaded 401K: As we have said hundreds of times. Absolutely no one gets rich with a 401K and no one ever will. Even if you hit 7% returns (5% real rate of return) you only end up with about $2M in inflation adjusted dollars (real buying power). With that said, we can use this to explain our ALS formula in much greater detail.

Here is the Framework:

1) Imagine you put away $18K a year (the new 401K maximum) every single year and obtain a 5% return

2) Now we assume you max out your first contribution at age 22 giving you 38 years of returns

3) This results in a total of $2M (this is real buying power)

Now for the kicker, how much of the $2M was attributed to money you put away early versus later? Lets take a look.

Chart: Percentage Contribution to Your Future $2M Retirement – Click to Enlarge

1) A whopping 5.6% of the $2M comes from your first $18K investment

2) Less than 1% of the total is earned in your latest years (if you continue contributing)

3) By 40, you’re more than set to cover living expenses in “retirement”

As you can see, the laws of mathematics work for you if you run your life intelligently and work drastically against you if you do not. You cannot fight compounding returns. You can however, accept the numbers and take advantage of the increases to live an amazing life over your peak years (~20-60).

—–

There you have it. “You only live once” so lets make the most of it. You want to maximize your Adjusted Lifetime Spend. Don’t forget it.

1) Money helps you make money.

2) You are going to get older. You are going to die.

Balance. Maximized spending.

With that said, for the young guys out there…

Lets Get It. Lets Get it. Lets Get It.