The title is harsh. We’ve been taught that as soon as we get that good job, get that career on track and have a nest egg that we should… spend it to nest in a home. Much like other mainstream advice, this comes at a high cost if done incorrectly. This article is written for average Joe, not for a top-end real estate whiz who already knows the business and can flip homes faster than pancakes on a skillet. I digress.

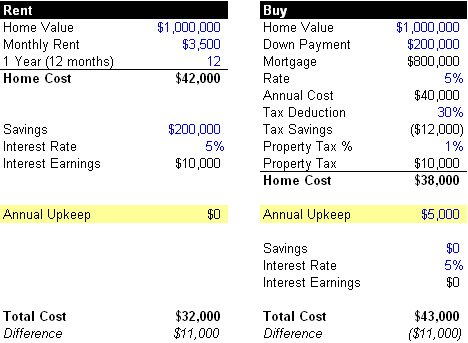

Here is a quick excel spread sheet that outlines exactly how we lose money by buying versus renting. An Apples to Apples comparison: interest costs vs. rent costs.

Lets jump to the assumptions

- Rent costs and interest costs are the same. Money goes into nothing.

- Tax deductions of 30% are baked into the model ($12K in this case)

- Down payment of 20% allows for lower rates, and is also no longer earning interest

- Property tax remains at roughly 1% and we assume annual upkeep costs of $5K

You’re losing $10,000+ a year by buying a home. To be honest, the overall assumptions made here are light, $5K in upkeep cost a year on a million dollar home is tiny. Every 5 or so years there are significant changes that need to be made (redo bathroom tiles, kitchen counter tops, the yard, the roof, the sprinkler system) all of this is cash flow out of your pocket to maintain the net worth of the home.

A Few Questions/Comments (Post comments below and they will be addressed):

1. “What about house price appreciation?”

Buying a home is both a call and a put option. While a house can appreciate, it can also depreciate (eg. Japan, USA in 2008). The best answer to this question is another question “what else can I do with my money?” People generally buy a home as it is a “safe” investment. Fair enough. We can still get exposure to homes by buying REITs in Bond/equity form which include companies such as NLY, AGNC, REM or bond funds such as DBLTX. Net net? Your risk to return profile is roughly the same for a non-real estate expert.

2. “Your Rates are off”

Addressing this before it even comes up, a similar return to investment as your total interest cost. Why? It’s roughly equal to the risk profile you’re taking. When you buy a home, you’re exposed to a single asset, in a single location. You’re effectively buying a single stock in a portfolio.

In addition, if we compare returns on a mortgage REIT and include the dividend payments, they suffered similar corrections to a single home.

3. “What are the Risks?”

This is the biggest misunderstood concept when it comes to home ownership. Illiquidity. Unlike a bad trade on a stock you’re leveraged in a home, you’re locked up like buying a triple leveraged index on the short side. Instead of 3 clicks and you’re out? It’s anguish when you’re wrong.

Conclusion: This flies in the face of a lot of what we are “told to do” so the biggest caveat that should be added is cash. The simple analysis above is primarily driven by the leverage you are taking on (4x ratio) and are paying interest, if this goes away and you know your stuff on the area the risk reward improves dramatically. Cash as always means options.