We are updating compensation numbers for 2015. Excluded from this overview is investment banking analysts as the variability has decreased. Simply put an investment banking analyst should make $150, $175K, and $200K in years one, two and three. The reason we have excluded the exact break out of base and bonus is two-fold: 1) analyst base salaries are a bit less standardized now with some as low as 70K and the new norm for top tier banks being $85K, 2) the bonus is being adjusted to match the all in compensation numbers of ~$150, ~$175, ~$200K. This means the *mix* of income for analysts has changed but the *total* number is roughly the same. So we’re not going to squabble in comments over which bank is at $85/$65 versus $75/$75 for example. If you work in the industry you already know which banks pay what salaries… so lets move on.

Budget Setting: If you’re in a revenue generating role, you know that the budgets for the year are set roughly one month before the year ends (IE: late November early December). So even though numbers are not announced those in the “know” are already aware of where the “pool” is. We’ll cut to the chase:

“Bonuses will be down ~5-10% and your total compensation will be roughly flat”

Finally, before we delve into the data remember we are talking about two things: 1) investment banking division at an investment bank (not hedge funds, not sales and trading etc.), 2) we are including middle market to elite boutique banks, IE: everything from Baird to Lazard.

Changes in 2014: Last year most banks changed their base salaries, increasing them across the board. This is why you’re seeing more discrepancy with some banks paying senior associates $160K base salaries versus $175K versus $150K for example. The numbers are simply moving around a bit depending on which bank you work for. Again… however… total numbers are roughly comparable so we are taking the *median* across all banks. This is probably the best way to gauge numbers across the street as the outliers (an associate being promoted to VP) will drag the comp pool up, while the underperformers who get a “F*** you bonus” of $20K will drag the pool down.

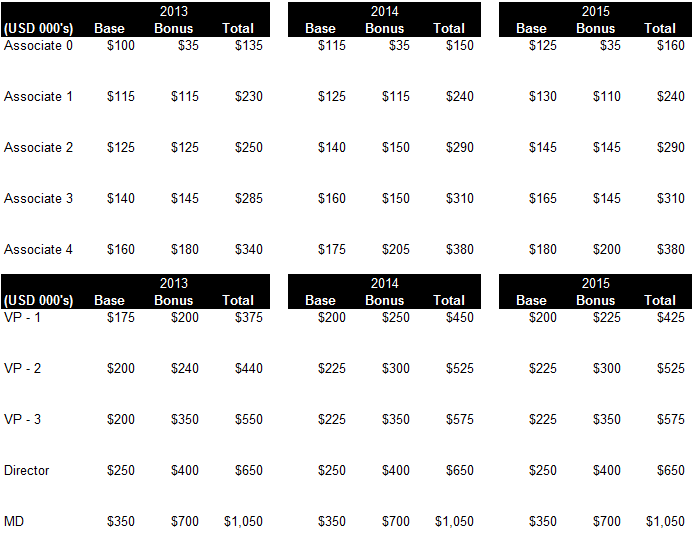

Below is the Data:

The Numbers

Associate 0 (stub bonus for MBAs): Your base out of MBA is probably in the $125K range today and you should get a $30-45K bonus, however, $35K is roughly standard.

Associate 1: First full year, the base salary is around $125-130K and you’re looking at making roughly $240K all-in at the *median*. We are going to emphasize certain points as a top tier banking employee will generally get 100% base as bonus for their first year. But. Again. We are talking about the median employee.

Associate 2: You’re making about $140-150K base and your all-in will be knocking on $300K total. We’re guessing it’s closer to $275K as many people under-perform and are kicked out of the bank. Therefore the skew is actually up as the money is shifted over to the people they like so we’re at $290K.

Associate 3: You’re performing well and you’re likely at least being considered for a VP promotion. You didn’t get fired and you never saw the writing on the wall to leave (IE: a terrible bonus). $160K and just over $300K all-in is about right for the median employee. ~$310K.

Associate 4: You either made it or you didn’t. You did extremely well and already made VP last year or you made it this year and you’re looking at $160-175K base and *more importantly* you’re total pay is about $400K. Once you make the jump you should be knocking on $400K.

Vice President: We’re lumping all years into one in this case because it is easier. If you’re sourcing deals and brought in some money for the firm you’re going to blow these numbers away. One thing we do know is that your base salary is likely $200K. This is industry standard at this point and you can anticipate a bonus of about $225-250K or $425-450K in total. More importantly… you eat what you kill going forward. If you can bring in money, then forget about the range above and you’re going to be promoted very quickly to director where…

Director: At this level your base is $250-275K. Since we’re including mid-tier banks we played it safe and said $250K. Your goal is to essentially generate 1.5x your base salary as a bonus bringing total pay into the $550-650K. Again… If you’re bringing in money none of these ranges matter at all.

Managing Director: Base salaries are generally $350K. Your typical number is about 2x base salary so just over $1M in total pay. To emphasize that this is bank by bank specific, a bulge bracket bank recently *reduced* its base salaries paid to Managing Directors (this was a 2015 phenomenon), anyone in the industry knows which bank this is.

A Couple of Admissions

We’re going to let you guys in on a couple secrets. This is probably obvious to our long-term readers but here it goes.

First: We won’t bother listening to nit-pickers on where the numbers are because we already received the data and sent it to two people: Mike and Sam (previous GS employee) who can both confirm the data is legitimate. Not going to waste our time.

Second: We actually strongly dislike Wall Street employees. This is not a contradiction. Most Wall Street employees will do whatever it takes to stab you in the back and screw you for a few thousand dollars. They will even do it for $10-20K (no joke). Your co-workers are *NOT* your friends.

The reason it is not a contradiction? Quite simple. We are smart enough to realize that it’s one of the best ways in the world to get rich. How many people make $300K at the age of 26? Not many.

In addition… how many people are able to play the game correctly and realize you make more in one year as a VP than two years as an associate? Again.. Not many.

If you can sell a Company, you’re going to be able to sell anything. No doubt about it.

Summary Points

– Not much changed year over year, while bonuses may be down about 10% the base salaries were raised so you’re really flattish

– Similarly, the rough way to think about each tier is a doubling of income. $150K as an analyst, goes to $300K as an Associate, which goes to $600K for a good VP which then scales to $1M+

– We stick with investment banking as the proxy for Wall Street compensation because it is the easiest to access (if you work in the industry) and it is pretty standardized across the Street

– We are not going to spend a lot of time on the buyside as we’ve already explained how volatile it is, ~$250K as an entry level hedge fund associate makes sense. But. After this… You could receive a $0 bonus or a 4-10x bonus depending on if you’re an associate, analyst or portfolio manager

…. Oh… by the way…. We hope you don’t work at Deutsche Bank

***

As usual, we won’t be answering questions. But. We *will* respond to interesting/valuable comments.

At least everyone knows why we don’t talk much about Wall Street numbers anymore, simplistically because it does not matter much. Get to a revenue generation role and keep your foot on the gas.