As our readers know, we don’t tailor our writing to regular people and instead focus on ambitious individuals interested in living an exciting life. Everyone has a different lifestyle they are looking to maintain and we’ll go ahead and provide a framework for how we think each year should stack up at minimum. We give up at 35 years old since no one should be giving life advice to someone in that age bracket (they’ve already made their decisions).

Assumptions

1) The first assumption we make is that you’re going to generate at least $100K a year out of the gate. If you’re working on Wall Street, within Enterprise Sales or in Silicon Valley, this is absolutely attainable. This is what we have recommended for a long-time in terms of a starting career.

2) Next, we assume that your net worth is calculated on POST tax money. We think it is a fraud to include $1 million in a 401K as $1 million to your net worth (it’s likely closer to $700K if we assume a 30% tax rate). To keep this estimate conservative, we assume all money in your 401K is worth 60% of the face value (40% tax rate).

2) We also assume that you will get a 5% 401K match. This is a rough estimate and we assume you’re not going to invest in excess of the match because you have better things to do with the money (primarily starting a business)

3) We use basic tax brackets since we don’t know where you live. Specifically we’ll assume everything up to $200,000 is taxed at 28%, everything between $200,001-$400,000 is taxed at 33% and everything above $400K is taxed at 40%. As an example if you made $400K exactly, we assume your tax bill is $122K (this is $200K times 28% and the other $200K times 33%). Again, this does not perfectly match the tax brackets to avoid perfect calculation and keep it simple.

4) We assume that your living costs increase at a rate of 5% per year and you’re going to live with roommates when you graduate in the first place. There is no reason to be a big spender when you’re young since we live by the saying “learn in your 20s, earn in your 30s, burn in your 40s”.

5) We assume your after tax investment returns will be 5%. This means the money you have on the sidelines will create 5% in annualized returns every single year. If you’re dollar cost averaging into the S&P 500 you should be able to generate around 7-10% over the long-run so our 5% assumption is quite conservative.

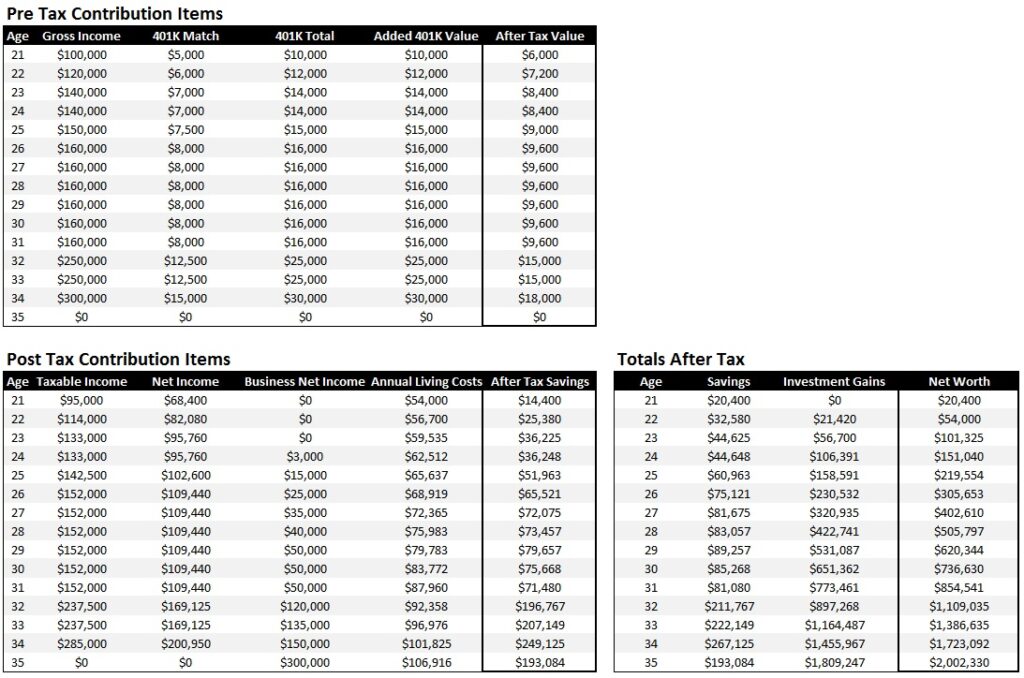

Example 1: Mixed Income Stream (Most Common)

From what we’ve seen, the most common path is this one. You start a high paying career, get burned one year on compensation, start a side hustle and… voila! Well over $2 million dollars by 35. Below is how it typically works out.

Age 21: To keep the math simple we’re going to assume you begin working at 21 years old. This means you’re likely graduating from college (despite costs rocketing higher!). In addition, we’re going to assume you have $0 in total net worth. If you’re reading this and are on track to rack up $100-200K in student loan debt, we suggest quitting entirely and reassessing why you’re going down the path of shackles. Since you’re going down an ambitious path we assume you’ll start with a Base Salary of at least $100K. This is going to be conservative given the compensation numbers for high earning careers on Wall Street, Silicon Valley and Enterprise Sales.

This is going to be a terrible year. You’ll realize that the cost of living alone is likely around $54,000 at minimum even when you live cheaply. Your after tax savings will likely be a smidge higher than 20%.

Age 22: To keep you motivated most companies offer a pretty nice income hike from year 1 to year 2. This is not because the company likes you. This is because they likely lost money on your participation in the labor force (training costs etc.) and if you leave after year one, they have to write it off as a loss or a bad hire! Ever wonder why employers care so much about time at a firm? Well now you know. They really earn money off of you once you’re up and running, not when you’re green.

We assume you get a 20% hike and because of this you’re still motivated to work. You put away just over 25% of your gross income a big step up when you look at the year-over-year change in total after tax savings (59% increase!).

Age 23: At this point most companies give a similar pay raise on a dollar basis. This is enough to keep employees motivated and they are now in the green on their investment in human capital (you!). Since you’re still seeing some career progression and you’ve got another wage hike you’re feeling pretty safe in your position making it easy to continue slogging along. The one thing you do notice is that the people who have been there for about 5 years seem to be more bitter than the younger employees.

Since the dollar amount increase was the same, your total compensation is up 16.67%. You end up putting away ~31% of your total gross income and your net worth should clear $100K. Unfortunately, around this time year 3 to year 5 time frame, you’re going to get hit by “the system”.

Age 24: You get one of the following excuses: 1) we had a bad year as a firm or group, 2) you’ve been getting solid raises so you should take one for the team or 3) we don’t know if you’re ready for the next change in role. It does not matter what the excuse is. Your compensation is going to be flat. It could be up (barely) but the point is the same, you realize that you’re a COG in a system that doesn’t care about you at all.

Hopefully this terrible conversation happens earlier rather than later in your career. This is because you’ll have the energy and motivation to do something on your own. You’ll strike out and do something small (typically free lance consulting) and make a few bucks with minimal effort. Total savings is still in the low 30% range.

Age 25: You get a small hike, but the move is not great, you’re realizing that you’re solidly in the center of the “triangle” within the firm where it is hardest to move up. Everyone wants you to quit or fail because it will lead to less competition for them over the long-term. You stick it out anyway and realize that it will be a while before your next “step function” upward in compensation. The silver lining is you can continue to freelance.

Your time is spent either freelance consulting or you’ve figured out that you can start a full business selling products! The result is largely the same, you focus more on your business and generate well over $1,000 a month. Not bad! Total net worth goes to $200K!

Age 26: You’re solidly stuck in the middle of the Company/organization. You look around and everyone in this bracket between 26 and 32 or so years old makes the same. It’s depressing to see and you realize if you jump firms… well it’s going to be the same story! May as well remain in the same Company if you’re plugged in from a political perspective. Besides, working on your business makes the most sense given the returns you’ve seen over the last two years.

You begin shirking a tad at work, cutting corners when needed and grow your small side business to $25K in total profit. It’s now generating a *near* living wage! You don’t have time to burn your cash since you had to work hard to get here. Net worth $300K

Age 27-31: This is probably the most painful bracket. You’re going to be doing the same mundane work for the vast majority of the time. The guys you want to replace won’t quit and there is no slot for you to fill. Your only upside is from your company. It’s tough to stay focused because the business you’re running cannot be scaled easily due to your current necessary career schedule! You’re going to feel like you’re chewing through a concrete wall.

The good news is that you’ll be able to chew through the walls without killing yourself. You’ll grow the business to an official near living cost profit pool of $50K by the time you’re 31. Lucky for you, since you have a career still it’s pure profit! Net worth $850K+

Age 32: For some reason this happens. When you’re about to quit because you see the light at the end of the tunnel you’re given some change in role. Think about it like this… If you were smart enough to realize you’re being underpaid… and were smart enough to start something… you’re probably a better worker than those guys slogging in long hours with nothing else going on! You’re hard working or you’re smart. You can’t be both.

For fun, we’ll assume you get promoted to a new role and your business takes off at the same time. This creates a tough situation for you because you’re not about to walk away from that high income boost and you can cover your living costs off of your business! You typically stick around “just one more year… just one more year…”.

Age 33-35: Your business cannot move anymore. It’s growing at a minimal rate of just 10%. Your income from your career is still the majority of your earnings. The problem is that working for someone else is becoming a hassle. You can’t stand taking any orders. Everything at work makes you annoyed and you’re going to take your foot off the gas more and more. They typically try to motivate you with more money but at the end of the day, you get blown out once they realize you’re not tied to them.

Reminder. Under no circumstances does anyone know what you’re doing. You simply get blown out around 34. The best part? Your business ends up benefitting because you never really focused on it. Typical net worth? Multi-millionaire at $2M bucks (Click to Enlarge Image)

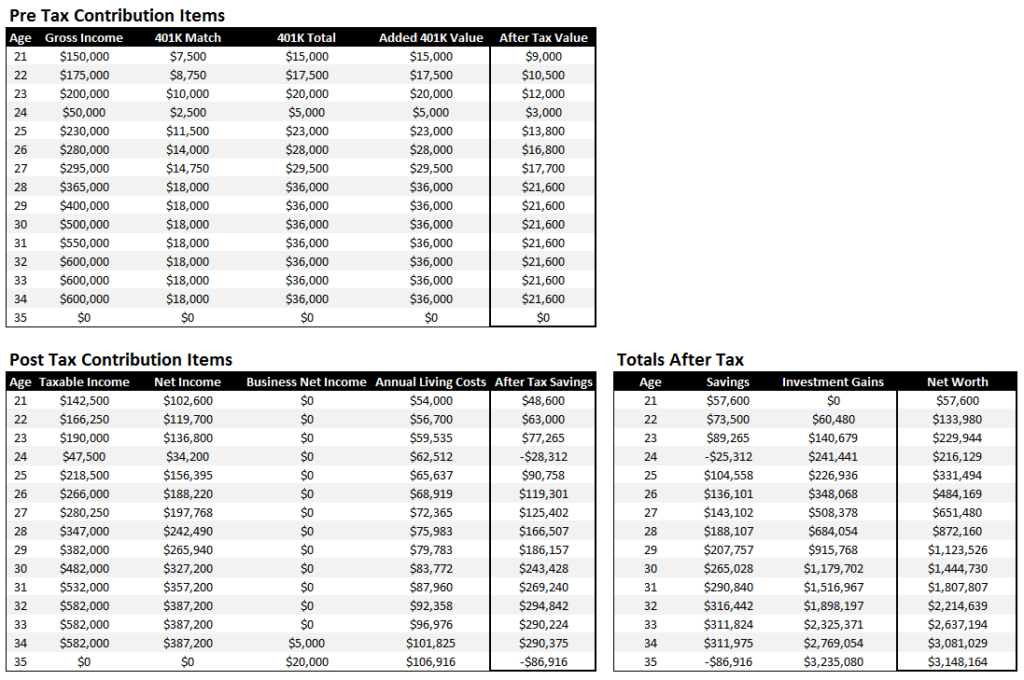

Example 2: The Career Man

Some people just never see a reason to start their own Company. The reason why? Their careers never see a bump or hiccup. Specifically, a lot of luck goes their way and they have the skills to fill in each leg up of responsibility. We’ll use our Investment Banker as the best example since we know a few people who have pulled this off.

Age 21: Top –tier investment banking analyst. You’re the best in the class in the right group/sector and you’re going to get paid at the top. Roughly speaking this is around $150K for a first year and you’re going to have the same living costs as everyone else ($54,000 out the gate). You are able to save your entire bonus so your savings rate is pretty solid at $57,600 in post-tax money in year-one.

Your savings rate is already over 33% when compared to your gross income and you had to work hard to get the top-bucket. No vacation for you, just deal related activity and a smile on your face even when getting crushed.

Age 22: It is rare to fall from top-tier in year-one to year-two. You end up being in the right “circle” from a political perspective and people in Wall Street rarely change their minds. You continue to get all of the right deal related projects and since you’re still focused, it is easy to get into the top-bucket again. Overall, you clear $175K in your second year without skipping a beat

It has only been 2 years and you’ve cleared $133K in net worth! Pretty impressive. While everyone else is wasting money getting drunk at the club you’ve built a strong baseline for a career that could lead to an associate promotion!

Age 23: After a somewhat easier year 2 you decide to begin training all the first year analysts. You also attempt to participate in more drafting sessions (proactively) dropping hints to the higher ups that you do have what it takes to be in an associate role. You’re able to manage the younger analysts and you have ideas for updating slide decks and S-1’s without any push to do so.

It has now been three years and you get the head nod for the promotion. Your net worth is nearly $250K (not quite) and it has only been three short years..

Age 24: We are throwing in a low number as a transition year. Why? Typically, you’ll either get a meaningless stub bonus or you will not get paid the exact top tier bonus from Analyst 1 through Analyst 3. This is a precautionary measure to make sure the math still adds up. In addition, many analysts typically upgrade their housing when they are moved to an associate role.

Overall, we take a small step back to keep all estimates conservative.

Age 25: Your first year as an associate requires more proactive work from you, you’re updating projects before you’re being told to do so. This means you know what your MDs and Directors want to see and simply save everyone time by putting all the items in there before it is requested. In addition, you’re consistently training the junior staff. Nothing special in this year but you’re clearing $230K (at least!).

Age 26-27: These two years are quite similar to age 25, the difference is that you’re continuing to show leadership in the form of training and initiative with pitch books and live deals. In addition, you spend some time at industry conferences to build a small set rolodex of contacts in your industry. More importantly, they give you the role of “staffer” right at the end of your third year as an Associate. This is typically given to VPs (most firms) so the writing is clear. If you can manage the team well, you are in-line for a VP promotion.

Age 28-29: Around this frame they give you a promotion to Vice President. You did the necessary work and luckily you built a small contact list within your sector. You get a material “step-function” up in your total compensation to $400K with a green light to $500K the next year. By the time you’re solidly in a VP role you’re also solidly in the 7 figure net worth range.

Age 30-34: It gets extremely difficult to predict in this range. However the general set-up is as follows: 1) you execute several deals – didn’t source them, 2) you sign up a few small mandates, 3) you eventually win a couple of extra small M&A deals or lead an IPO sourced by an MD, 4) you sign up more retainers for other ideas such as registered direct transactions, poison pills etc (small stuff), 5) you eventually close a couple of nice M&A deals or get lucky and are the banker for a specific IPO. The long-story short is you generate enough revenue to warrant a director promotion but not quite good enough to get to MD! You clear $500-600K each year. By the time you’re all set and ready to quit, you’ve got $3M in the bank and you start a hobby to make some side income. (Click to Enlarge Image)

Finally, most people don’t quit. If you were this good you’re likely a career banker.

*Note: for the 401K contributions below, we assume you are never able to contribute more than $18K which is the current max, hence the $36K cap at age 28 and beyond*

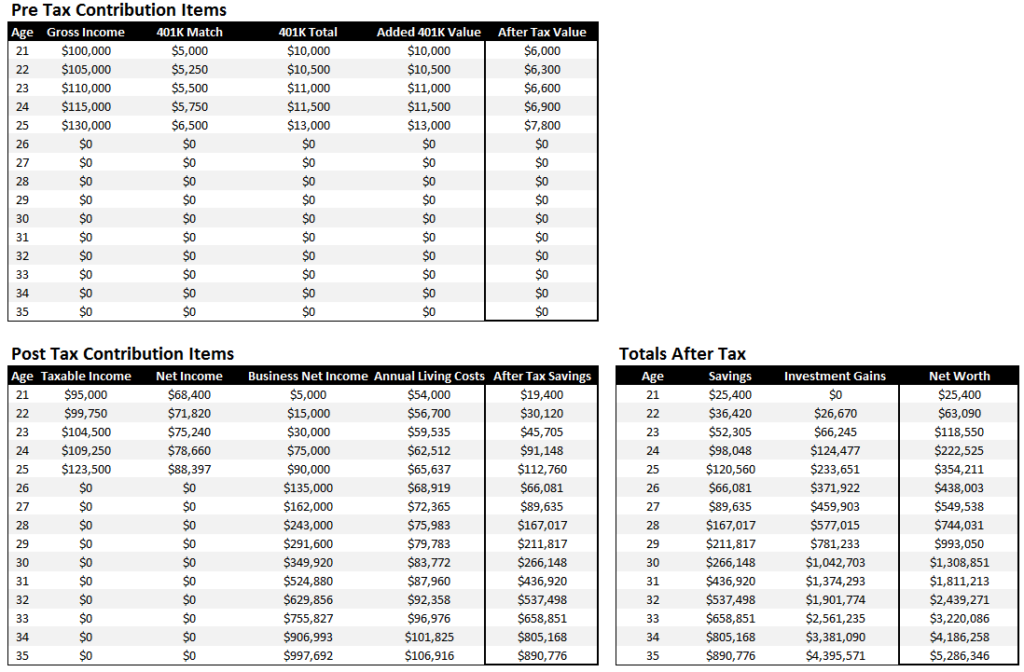

Example 3: The Entrepreneur

This is where the real money is, we’ve seen several people quit their careers rapidly once their companies begin to gain traction. It is tough to work for someone else when your business is making more money than your career!

Age 21: You start your career and begin acting like an entrepreneur out the gate. Instead of wasting time with politics (big career mistake!) you simply get your work done and go home immediately. This does not look good to the higher ups but you don’t care as you’re already working on something on the side. You save a decent chunk (just over$25K).

Age 22: You get an “okay” pay raise that is in-line with everyone else at about 5%. You realize pretty quickly that there is more than performance that matters at work. There is something called political capital where you have to be liked by the “right” people in order to get the better payouts. Fortunately, for you you’re still seeing 200% growth from your business so it remains as a focus point for you and you triple it to $15K net of tax.

Age 23: You’re solidly a “median” employee. There is no hiding from this fact. You can’t really get laid off or fired because your work is solid and good, you just don’t play any of the political games within the firm. Luckily your business doubles again, because this is why you don’t have time to play the politics in the first place!

Age 24: The step function occurs! No not for the career you hate but for your business. You clear $75K in post tax money which is roughly equivalent to what you made at your career. You’re thinking about quitting immediately but the firm has no reason to cut you. You’re a top tier performer from a work perspective but you take no initiative because there is no reason to anymore and on top of that there is no incentive either! Funny situation around this age as you’re not willing to give up all that money and you’re not willing to go all in on your business either.

Age 25: Your business now starts making more money than your career and you hear of a Reduction in Force (RIF) that is occurring over the next year or so. You raise your hand for the RIF since you don’t care about the career anymore. Once you raise your hand, they add your name to the chopping block (so you think!) and your business is doing great almost at $100K!

Age 26: They don’t let you go! Unfortunately, when it comes to cutting people its actually harder to get rid of the top-work performers even if they are not motivated! You end up getting a long-winded pep talk about working harder and are handed a ton of work that will double your hours at the firm. You quit. Forget about it you say and you walk away. Your business ends up generating $135K that year.

Age 27-35: For those skilled enough to build a 6 figure income while at a career, they usually end up scaling to around $1M in net profit. For some reason this is around where it all shakes out. You can certainly exceed this number or watch the number flat line. Overall, getting to a million dollar business is possible and this is where we assume it all shakes out. You’re growing your business in non-linear fashion and end up getting to a $5M net worth at age 35! (Click to Enlarge Image)

Concluding Remarks

We’d like to take the time to highlight a few key psychological factors for people looking to become multi-millionaires.

First, you will get screwed at least one or two times. There is no escaping it unless you’ve go the luck of the Irish. You’re going to get burned pay wise or work wise somewhere (typically 1-2x) over a decade time frame.

Second, once

your business income exceeds your work income your motivation falls off a cliff. You don’t care about doing anything beyond the minimum and quickly fall out of the “circle” politically.

Third, If you’re spending your time building income streams you can get to multiple millions of dollars by age 35 and the numbers clearly prove this out (even with 5% cost of living increases!)

Fourth, if you don’t focus in on building yourself up early, there is practically no way to catch up.

Fifth, we don’t have much time. There is a 20 year time frame at maximum to really make money. No one wants to be killing themselves working around the clock at age 40+.