As you know we’re positive on long-term dollar cost averaging in general since you’ll essentially mirror market returns of 7-10% over a lifetime. The problem? The next downturn will be severe because people are emotional. The one item that practically nobody talks about is the lack of emotional stability during the next decline.

Understanding Passive and Active

Move To Passive: The move to passive has been enormous, approximately $200 billion has moved into passive ETFs while actively managed funds lost $150B in net fund flows (just last year!). What does this mean? It means that there are now billions upon billions of dollars sitting in accounts where money can be pulled out with a few short clicks.

We anticipate the next decline to be an absolute bloodbath. This won’t change the long-term horizon of 7-10% returns in indexes, but it will likely lead to many people losing millions of dollars due to lack of emotional control.

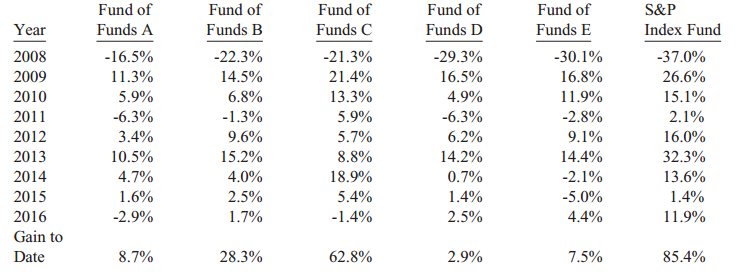

Review of the Warren Buffet Bet: In 2009, Warren Buffet made a $500,000 wager that no investment professional could select a set of five hedge funds to match the performance of an un-managed S&P 500 index. It seems simple enough until we look at what happened.

“For Protégé Partners’ side of our ten-year bet, Ted picked five funds-of-funds whose results were to be averaged and compared against my Vanguard S&P index fund. The five he selected had invested their money in more than 100 hedge funds, which meant that the overall performance of the funds-of-funds would not be distorted by the good or poor results of a single manager.”

We cannot emphasize the bold and italics enough because it will prove our point even more.

Fund of Funds are Scams: We have absolutely no defense for “fund of fund” hedge funds. They are essentially scams. You’re paying fees upon other management fees just to underperform over the long-term. As an example: If you buy a “fund of fund” (double fees), you’re paying the manager of the fund picking a fee of about 1% and you still have to pay another 1-2% fee levied by each hedge fund so your total cost is about 2-3% out the gate! In short, point one is that fund of funds are not intelligent investment vehicles. Period.

Blanket Hedge Funds Can’t Be Compared to the S&P 500: We have no idea why people compare the performance of a hedge fund to an S&P 500 index. They are not related at all. In fact, many hedge funds are set up to underperform the S&P otherwise the fund is not doing its job. We don’t think this is well understood so we’ll provide an example.

A large percentage of hedge fund money is run in what is called “market neutral” books. This means your dollars short are equal to your dollars long. To make that comment even simpler, it means that if you invest $100 into stock X you must short sell $100 in stock Y in the same sector.

We have simplified this concept to make it easier to understand but the point is clear. A market neutral book is set up to provide stock price appreciation with no exposure to the S&P 500. If you’re doing 5% returns on an annual basis you’re running a pretty solid book because you should in theory not have any exposure to the S&P 500 (which is appreciating by 7-10%).

If you don’t believe this then take a look at the same chart provided in Warren Buffet’s letter to investors (page 22).

Look carefully. Notice that every single fund outperformed the S&P 500 during the last recession (2008)?

Despite having excessive fees (again Fund of Funds are poor investment vehicles), every single one of the fund of funds declined less than the S&P even with a negative 3% headwind. Why is that the case? Well now you know. Large sums of hedge fund money are not set up to beat the market. The only way to make this bet fair? Compare the returns of the S&P 500 to hedge funds with a Beta of 1.

The point of this section is three fold. 1) we think the next decline will be severe. When more money is in passive it means individual investors are able to click sell (emotional) allowing for a flooding of the gates creating a massive buying opportunity on the dip, 2) comparing the S&P 500 to a basket of hedge funds is beyond foolish as it does not take into account the beta exposure of the fund and 3) we do agree that dollar cost averaging over the long-term will yield a ~7-10% return, however, if you’re already worth a lot of money we’re getting closer and closer to suggesting a basket of bonds!

Valuation Has Surpassed the Average

If you’re in it for the long-haul (40+ years) you can certainly ignore this section. Most are not at this point given our demographics have continued to change (most readers are in their 30s). If we look at all of the valuation metrics there is practically no item where we can cleanly say we’re below average

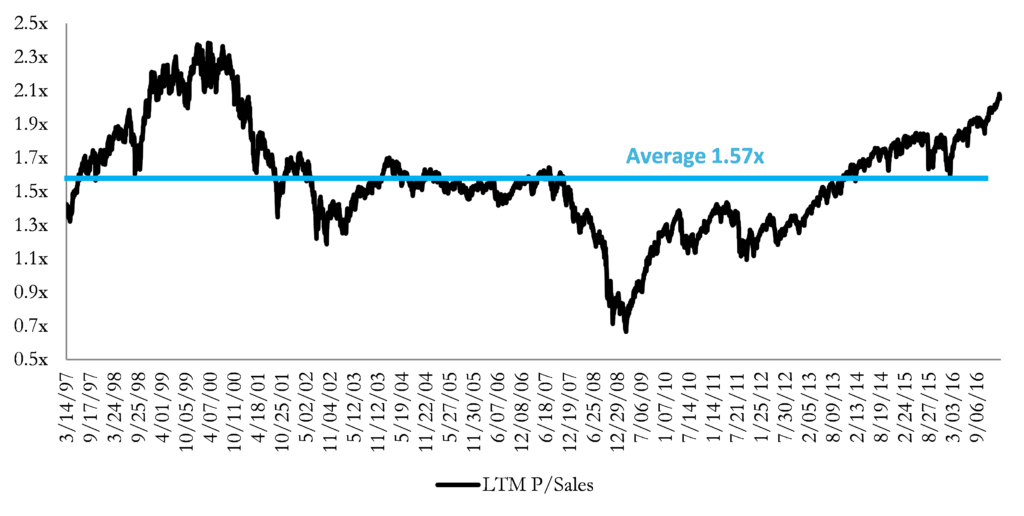

S&P 500 – Price to Sales (Last Twelve Months): Price to sales ratios are typically attractive somewhere below 1.5x. At this point were at approximately 2x and moving upward as the S&P continues to appreciate. While the companies are certainly more profitable, the sales multiples are not very attractive anymore. While we don’t think we’re at the top yet, there isn’t much room to run and if it ever hits a 2.3x it’s probably best to exit all together.

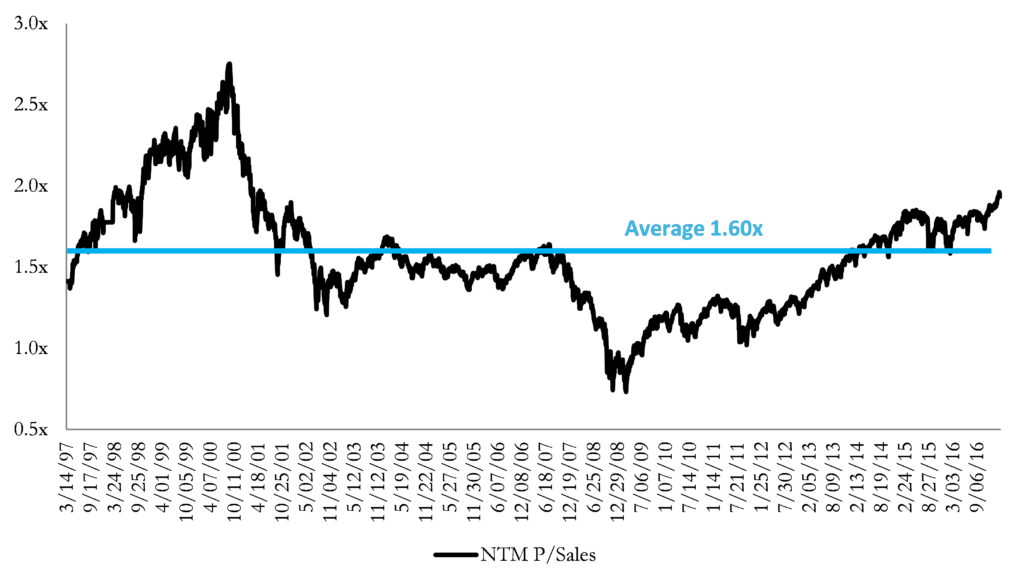

S&P 500 – Price to Sales (Next Twelve Months): Largely speaking you’re looking for a similar entry point at around 1.5x or lower on an NTM basis. If you’re extremely bullish then investing at 1.5-1.7x is also fine because it implies that numbers should be higher than current forecasts. That said, we’re creeping up towards that same 2x marker making it tougher to justify throwing in large sums of money.

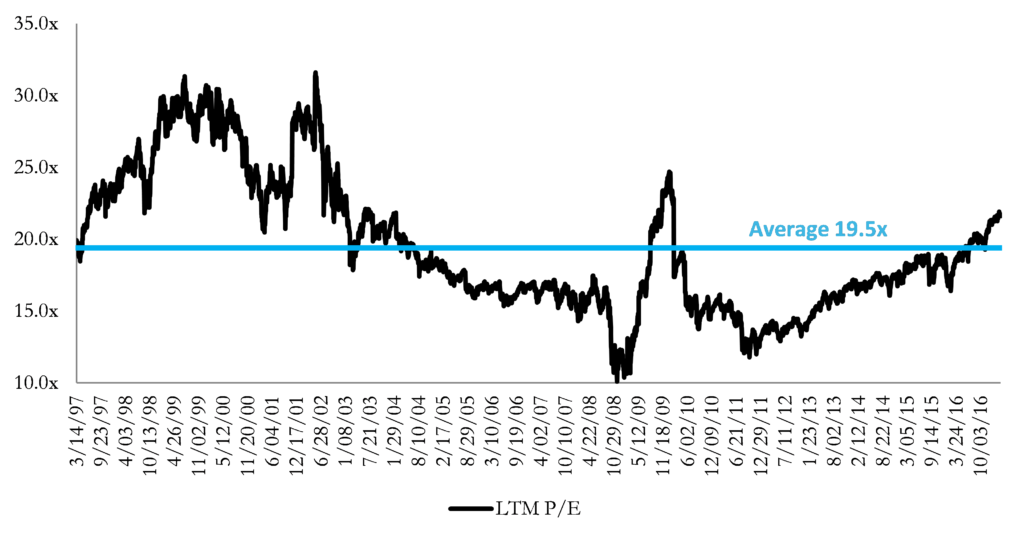

S&P 500 – Price to Earnings (Last Twelve Months): A sign of life. Companies today are significantly more profitable due to advancements in technology (internet, software, automation). This means that the P/E is actually relatively reasonable in the low 20s on an LTM basis. That said, this is still above the average where you want to be seeing numbers closer to 19x.

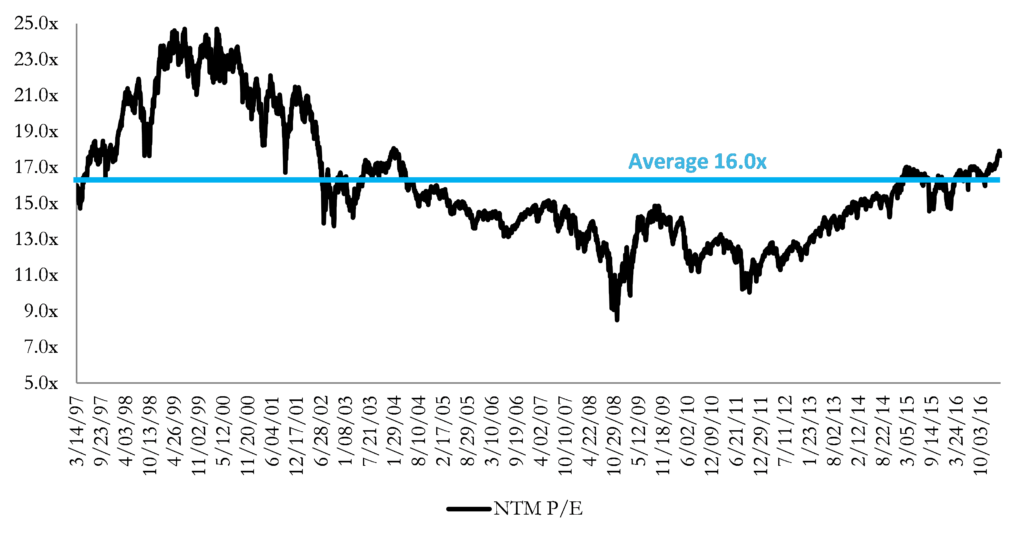

Price to Earnings (Next Twelve Months): Finally, we come to our last metric, the forward P/E. This is the last reason why we’re still okay dollar cost averaging some money for now. Despite the run-up and despite the valuation on a price to sales basis, the earnings per share on a forward looking basis remains reasonable in the high teens. It is certainly above average but we’re not in excess of 20x and we do believe that there is more room to cut costs and achieve the earnings numbers.

What Does This All Mean? The stock market is above average on every single metric including the forward FTM multiple. It does not mean there will be a decline near-term (in fact we think nothing will happen this year and it will be fine). The problem is that bonds will become significantly more attractive once rates go up a couple of more times and there will be a better *risk to reward* buying opportunity. This is good news for everyone who has built up their financial independence fund.

What to Do

Now that it is becoming clear that we’re at least beyond *average* valuation, what we’re saying is that we should all look to new investment vehicles beyond just S&P dollar cost averaging. We are not saying that you should throw your money into a hedge fund (many require millions just to get in by the way!), instead we think you should operate like a hedge fund at this point.

This means, if you are over the age of 30 and you are financially independent, it is time to brush up on your risk profile. If you’ve been averaging into the S&P for the last decade you’ve made a ton of money and there is no reason to risk your principal.

– We recommend starting a business ASAP. Make no mistake, if you’ve had a good run career wise and things start to get softer, that stream of cash flow is going to be under pressure. Start learning online sales or at least consulting on the side. Getting comfortable now is what everyone else is doing and that is exactly what you *shouldn’t* be doing.

– Take your market exposure from 1 to sub 1 by year end 2017. If nothing is learned from this post we suggest explicitly reducing your market exposure to under 1. For newbies this means if your entire portfolio was just the S&P 500 (that would be market exposure of 1), then we would reduce that to at least 0.7 or so (70% stocks, 30% bonds) somewhere around the end of the year when rates have gone up a couple of times.

– Do Not Risk Principal. Under no circumstances do you risk your actual principal wealth. This is the money that is stashed away to cover your cost of living forever. It is not worth it to have high exposure to the stock market with above average valuations across every single metric. If you’re already rich lets keep it that way.

– Watch Tax Rates and the Muni Market: If rates do increase and the tax rate declines there will be an enormous buying opportunity for tax free returns! Everyone has been praying for “5% risk free” for a long-time and we may get *close* to there if rates do go up quite a bit and the tax rate comes down! We can always pray! But at minimum, it should be tracked diligently for the remainder of 2017.

– Don’t Be Fooled by Indexes: Yes it works. As we stated in the past if you dollar cost over 50+ years it’s going to work. The problem is listening to the media and allowing them to drive people into indexes (notice everyone talks about indexes now). Don’t be fooled means… Don’t expect this upward trend to go forever. When the declines come there will be a stampede out (people have no emotional control and never will) so expect a bigger buying opportunity. If your plan is to stomach the downturn just remember this post and it will likely be uglier than most people think!

For fun, notice that even Warren Buffet is willing to pay high fees for solid Investment Bankers (M&A), not related to equities.

“And, finally, let me offer an olive branch to Wall Streeters, many of them good friends of mine. Berkshire loves to pay fees – even outrageous fees – to investment bankers who bring us acquisitions. Moreover, we have paid substantial sums for over-performance to our two in-house investment managers – and we hope to make even larger payments to them in the future.”