The best way to avoid personal financial failure is by having as many income streams as possible. From our own experience you want to try and develop two streams of income at the same time. We’ve seen that people who attempt to develop 4-5 streams of income at the same time are usually left with nothing. All of their ideas are only 20-30% good and that’s just not enough to develop a meaningful income stream (we’ll draw the line at ~$2,000 a month to represent a meaningful stream). Once you develop two streams of income the move is to develop a third stream. Trying to squeeze the last 0.005 ounces of toothpaste from the tube does not make sense when compared with your other option (getting a new tube).

The Three Back Up Plans First

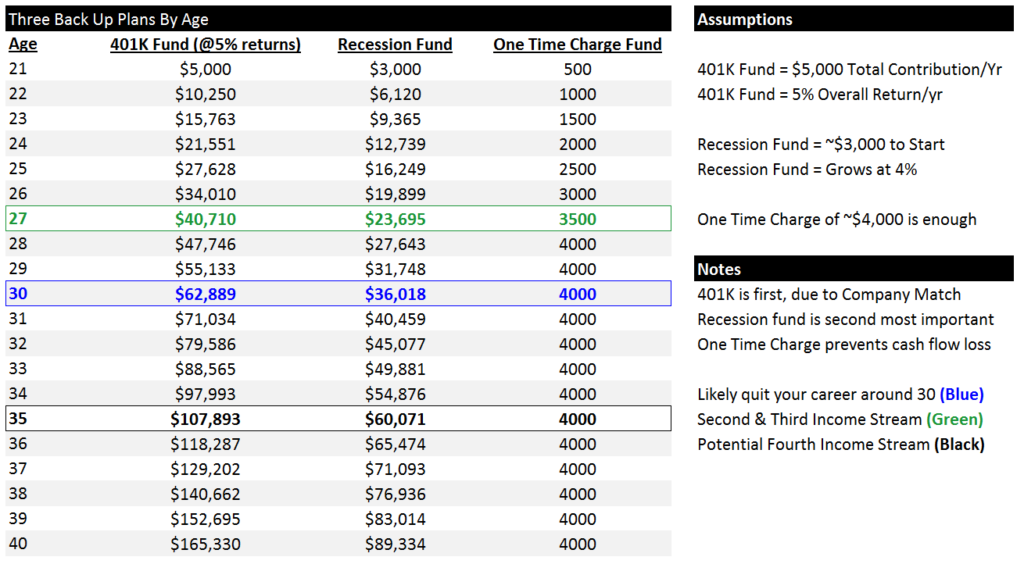

Backup #1 – 401K/Retirement Funds: For those of you that are working a career to start, you’re going to put all of your retirement money into the S&P 500 or a fund that mirrors the S&P 500 with low expense ratios (at least under 0.20%). Why? Well you can’t touch the money for some 40 years. This is such a long period of time that timing the market is meaningless. The best strategy is to go through the potential investment vehicles available to you and find the lowest expense ratio fund that largely mirrors the S&P 500. Sit back and throw money into it up to your employers maximum match at minimum. Eventually, you’ll stop contributing when you quit your career outright (free long term S&P market exposure!).

Backup #2 – Cash Fund: Knowing that your backup plan is already in place we have a simple calculation for how much money should be in your liquid cash account 1 month per year worked. As you accumulate more and more money, you’re not going to want to risk seeing it go away. This is why we can recommend S&P 500 indexing over the long-term but feel completely fine owning some bonds/cash as well. If you’ve been working and building a business for the last 12 years and something happens (market crash or business crash) you absolutely do not want to touch any principal. Besides you’re in your 30s at that point and the best years of a man’s life is in the 25-50 range, having to adjust your lifestyle would be horrible (1 year would get you through practically any recession).

Backup #3 – Staggering CDs: Finally, the last backup plan is a basic staggered CD. Every 3 months you should receive a small chunk of money, that money is then reinvested into a CD another 3 months out. You’re not doing this to get rich (it won’t work), you’re doing this to have a “one time charge” fund. Lets say everything is fine and then one day you break your collar bone in a skiing accident (we may or may not know someone who did this recently). Well that would be a one time charge of a few thousand dollars. You’ll have this money accounted for at all times. You use the lump sum to pay for it and spend the next year rebuilding that part of the staggered CD. Charge it to the game but you were prepared! The below table should give an idea of how it works:

Multiple Revenue Streams

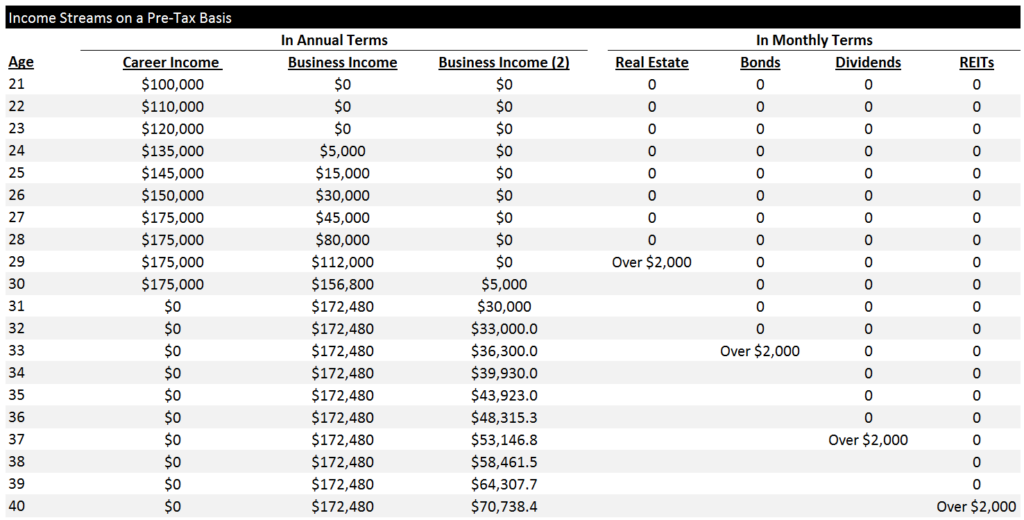

Now the numbers above look daunting if you’re just starting out. The reality is that the first 5-6 years are horrible. You feel like you’re going no where. You’ve got one income stream (typically a career) and your arms are flailing around trying to get a second one up and running. This is normal. The good news is that your second and third income stream will likely hit around the same time. Why? Well check out the framework.

First Income Stream – Typically Career: You’ve made all the right moves and found a good career, the problem is that you’re smart and realize that it could go away tomorrow. The issue with a career is that the risk of being structurally unemployed increases over time. If you lose your career in year one or two, there are thousands of positions that will take you in. You’re not making a ton of money so it’s not hard to replenish. When you start making multiple six-figures… the Company is going to *search* for ways to replace this type of cost in their P&L (remember they are running a business). If this larger income stream goes away it becomes significantly harder to replace since there are not as many positions that pay in this range.

Second Income Stream – the Hardest: Forget the saying that “the first million is the hardest” the second income stream is the hardest! That is all the saying really means. If you’re able to get a second income stream up you’ll learn so much during the process that the third income stream will be easier to make. Once you’re able to replicate what you have learned to a few different sectors you’re all set because the cash flow model turns exponential.

Third Income Stream: The interesting part about the third income stream is that it typically comes at the same time as the second stream of income (~5-6 years of building a second stream). During this time you’re making money in your career (pocketing a large chunk of it every year) so your bank account will open up the door for that third income stream already. The most common third income streams we have seen utilized are Real Estate, Bonds, Dividend ETFs and REITs.

Worst Case Scenario Planning

No one is going to take the exact same path as laid out in the above chart (in fact we took a mix of two plans from this older post). Given that set up, we should think about where the “primary risks are”. Meaning, what items in here would make it difficult to become financially well off?

Primary Risk is Active Income: The primary risk to personal financial collapse is your ability to earn an active income. This is why we don’t really believe in “retirement” where you sit around on the beach drinking Mai Tai’s all day long. Since you’ll build a ton of skills over the next 20 years it will be hard to walk away from thousands of dollars in income. In addition, by avoiding active income your pulse on the industry will decline. With the framework set up above, you’ll dedicate at minimum 20 hours per week to active income even if you’re financially set (we also assume you’re under 50 if you’re reading this).

Second Risk is a Recession: This is why you’ll keep a large chunk of money in a checking account. If the economy goes into a recession and all the items to the right side of the chart (Real Estate, Bonds, Dividends, Reits) all get cut in half… Well you won’t have to sell any of it! By preventing a draw down on any real passive income stream (where you invest ~5 hours a year monitoring), you’ll never have to worry about cash flow again.

Worst Case Scenario Math: Lets say you’ve largely taken the path outlined in the chart. A recession hits at age 31. Conveniently right when you left your career! Well you can still take a lot of punches and survive: 1) assume your biggest active income stream goes away – extreme & unlikely scenario and 2) assume your passive income gets cut in half. Your cash flow now is $30K a year + 1,000 a month or ~$42,000 a year. Importantly, you don’t need to spend any of this for a year because you’ve saved enough to survive this scenario. You’ll build up a second income stream (again) over the next year and we know that recessions generally don’t last longer than ~12 months. By the time you’re through the worst part of it? You’re back to ~$60,000 a year + $24,000 in passive income or a 100% improvement in the worst possible situation.

What Are the Two Biggest Conclusions from This?

First Conclusion: Your biggest risks actually have nothing to do with your current form of income. You can earn money with a career for now, a business or (God forbid) a job and be perfectly fine. Adaptive income is the key to success. Back when humans had no real “economy” we survived due to adaptation “adapt or die”. In today’s economy “adapt or die” refers to skills learned to generate active income.

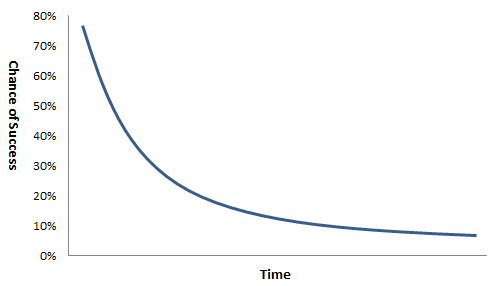

The Second Conclusion: We don’t have time. There is no argument against working hard when you have the chance (18-30 year old time frame, unless you hit it big early). We have heard it all and it never adds up. The only thing you’re left with if you don’t work hard when you’ve got the chance is a lifetime of regret. Life is just a game of probabilities and there is no amount of money that will allow you to get your time back.

As you get older your body will slow down. We don’t care if someone is on every drug known to mankind. There is no way to maintain peak performance from ages 30-60 as the body continues to atrophy. If it were possible, professional athletes would have much longer careers. Knowing that your “life energy” is going to decline over time (starting around late 20s), there is no physical way for you to invest your peak energy into earning money. The chart below summarizes it well: note there is no age where it’s “impossible” hence we deleted the x-axis, the point is that there is a finite number of years to live so by definition the number of chances at success declines.

Finally, the probability of failure is not a good excuse. If you don’t try… your chances are exactly 0. In addition, what do you lose by giving up your early years? Nothing. You lose absolutely nothing by failing for ~12 years straight. Here is what you lose in summary: 1) you lose the chance to obtain permanent liver damage, 2) you lose the chance to hang out with people who will unquestionably drag you down and 3) you lose both money and women because the women are *largely* uninterested in some young dude out “seeing the world”. Sure, you’ll end up with a few cool stories. But. You’ll wake up with the realization that you’ll be working for the rest of your life (making someone else rich or barely scraping by!)

Summary Points: 1) you will not have more energy than you have today so use it wisely, 2) create both recurring income streams and a worst case scenario cash fund, 3) work on at maximum two ideas at once, 4) if you go down the “career” route, realize the risk of it going to zero *increases* over time and 5) make the assumption that your primary income stream will go away one day and see how the worst case scenario looks.