You want to get rich. Everyone does. It’s just taboo to say so. No one wakes up and says “Hey I want to be as average as possible”. On this side of the web wanting to get rich and admitting so is encouraged (maybe you’re rich already)! Now that we have people visiting from all over the USA, we think it’s time to predict exactly when you’ll wake up and say “Well. Looks like I’m officially Rich!” from a purely financial perspective.

Feeling Temporarily Rich

One Time Windfalls: Almost everyone will feel temporarily rich several times in their lives, we think this is primarily due to one-time windfalls of income. Maybe you got your very first investment banking analyst bonus check, maybe you just closed your first $1M+ property sale and maybe you were gambling for fun at Vegas and won $10,000. Either way… you’re going to feel rich temporarily. From what we have seen, most people will feel temporarily rich when they receive a one-time windfall that pays for approximately one month worth of living expenses.

Large Currency Exchange Gain: If you spend some time traveling at some point in your life you’re going to visit a specific location that you enjoy. It could be Russia for the nightlife or it could be Brazil for the beaches and happy go lucky people. Either way, if you enjoy your first visit imagine what happens if you return to find that your currency has appreciated by some 20-100%! We’re using a wide range but the numbers are not out of the realm of possibilities. Going back to a place you enjoyed and seeing the cost plummet will make you feel temporarily rich for the month or so you spend in that location. For those in the United States, the recent currency moves over the past 2-3 years should have everyone feeling a lot richer.

Feeling Rich Based on Income and Passive Income

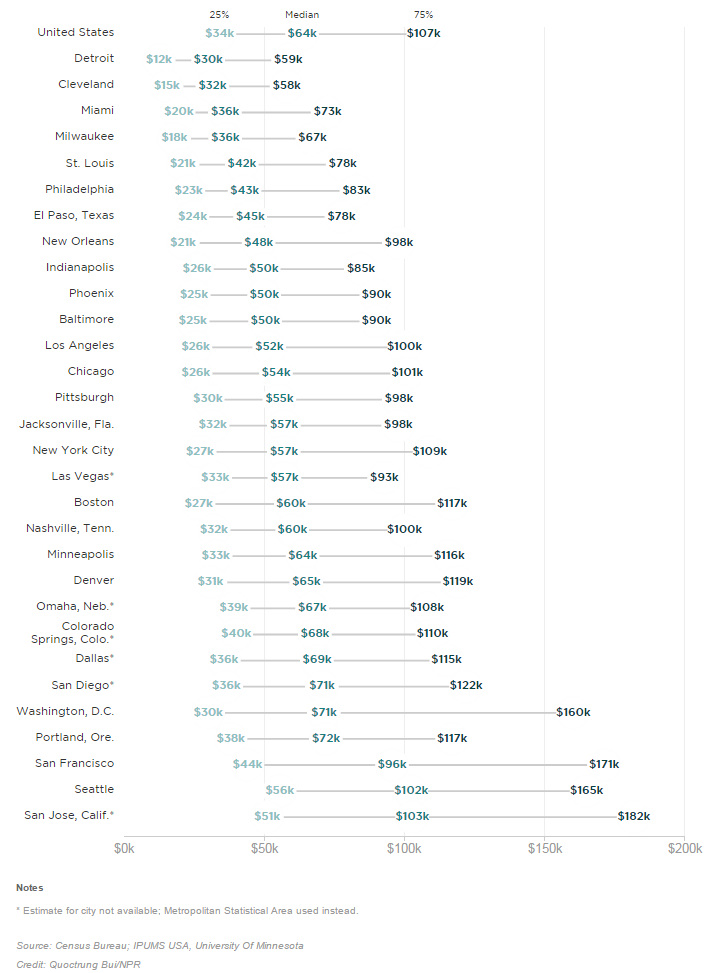

Basic Calculation – Relative Wealth: At this point in time. If you’re making $50K a year you’re in the top 1% worldwide (top 0.31% to be exact according to the global rich list). So congratulations on being in the 1% already. The problem is that you won’t feel rich because your environment is not Subsaharan Africa or Thailand, you’re living in the greatest country on earth: the United States. Here? $50K is approximately equal to the median household income so you’re smack dab in the middle. You’re unlikely going to feel rich due to your environment… take a look at the chart below for more details (2013 data).

As you can see, the median income and average income varies across the country. This will be a major determinant in feeling “rich” or not. Importantly, we also raise the bar a bit more and say that you must look at the Average income. The reasoning is pretty clear, the median is going to be lower than the average. There is a floor to earning ($0) and there is no cap (if Warren Buffet walks into a room of 50 people, the average net worth is significantly higher than the median). In that scenario, the average should be to the right of the median on the bell curve. The basic calculation to feel rich from what we have seen? ~2-3x Average Income

Location Scenario – Relative Location: It gets more complicated. Lets say you’re living in a major city and absolutely loathe it. Well even if you make 3x the average income… you’re not going to feel rich! There are a lot of unhappy people making a ton of money living in a place they absolutely hate. This is a big problem because it says that being rich could require more income if you’re forced to live in a city you don’t like at all. This is a bigger balancing act and from what we’ve seen it takes another full multiple to feel rich (locked into a city you don’t like). The calculation to feel rich in a place you dislike? ~4x Average Income

Now the plus side is that you may be able to reduce the necessary income to feel rich if you absolutely love the city you’re in! Generally speaking, if you spent the last two years traveling the world and found a place you love, you’ll need less money to feel rich. Psychologically it is quite difficult to give up money (any money addict will agree) so the multiple isn’t quite a full turn but somewhere around half a turn. If you find a city you love you’ll feel rich with ~1.5-2.5x average income.

Feeling Rich Forever – Passive Income: The main premise in feeling rich forever is that it is relative to your passive income (not semi-passive income). A well run business or a high paying career could go away tomorrow. Sure this is less likely with a business. But. The potential for it to go to zero is still there. This is why “feeling rich forever” is relative to your inactive income. If you receive $10M tomorrow, you’ll feel rich forever due to the passive income generated by the money. The simple calculation = 1.5x your annual spending in passive income.

Feeling Broke Forever

The calculations to feel rich are pretty straight forward. The problem is that life is complex and there are many “curveballs” that will prevent you from ever feeling rich. Most of these curveballs are psychological where people become addicted to status items or beating everyone else in the race to the “highest net worth” game.

The Constant Comparison Game: No matter what, you’re not going to be the richest person in the world. Constantly changing the people you “compare yourself with” will lead to nothing but unhappiness. If you live in a major city it is practically impossible to become the richest man there and if you do succeed in that… you’re going to become famous which involves another whole host of problems. Importantly, getting relatively rich is the name of the game over here. Trying to become the richest man in the world usually leads to a life of constant work and stress. Figure out how much money you’ll need to live a life you enjoy, multiply this number by ~30 and put the blinders on. Trying to beat the guy who owns 1,000 income producing real estate assets is not going to make your life any easier!

Ignoring the Full Picture: The second easiest way to feel broke forever is to ignore the fact that life is a mosaic. Would you take an extra $1M in order to be overweight for the rest of your life? Would you trade $1M for a personality that leans to pure risk aversion (See no fun life experiences). Would you hand someone half of your net worth to be five inches taller and more muscular (we sure hope not). In short, ignoring the full picture makes most people envious. They see one piece of a person’s life and ignore the rest that they wouldn’t touch with a 10 foot pole. Instead, recognize that a person can be successful in one category while unsuccessful in many other categories… ask for advice on the piece that they are good at (ignore the others).

Earning Income You Hate: When you start with nothing, there is absolutely no way you’re going to enjoy everything you do. You’ll be forced to do dirty work to succeed even if you think it is “below you”. There is no choice. However, once you have a large war chest of cash, you can become much more selective in your income streams. Working in a position you loathe just to earn more money does not make sense if you don’t need the additional income. If your passive income already covers all of your living costs with a large buffer as well, doing things you hate will ensure that you’ll never feel rich.

Giving Up Your Freedom: This is a very common mistake. Once someone feels rich they load up on items that cause recurring costs. Huge recurring costs include stretch mortgages, car payments and addictions to status goods. Feel free to buy a few high end items just avoid that ones that kill your cash flow. Cash flow is significantly more valuable that one-time charges because the one-time costs can be avoided in year two but a recurring payment can last up to 30 years.

Not Valuing Your Time: This one catches a lot of people by surprise, if you’re already well off financially does it make sense to put off things that *can’t* be done when your older? It really does not make sense. Spending late nights working on a project you enjoy makes a lot of sense. Spending late nights working on a project you loathe when you could be attending a once in a decade event does not. If you have the means to do as you please, don’t wake up in 3-5 years and say “I wish a did XYZ”. There are no second chances when it comes to time (money can be made and lost rapidly).

Concluding Remarks: Everyone will feel temporarily rich at least a few times in their lives, in order to feel rich we estimate the following 1) you’ll need 2-3x the average income in your city, 2) 4x if you’re in a city you dislike, 3) 1.5-2.5x if you love the city you live in and 4) if your 100% passive income gets to 1.5x your annual expenses you’ll feel rich *forever*. Now if you’re interested in feeling broke forever we can recommend: 1) comparing yourself to everyone, 2) only looking at one trait of every single person, 3) continuing to work in positions you loathe, 4) giving up your freedom with heavy debt load items or recurring payments and 5) choosing money over life experiences when you no longer need it! Hopefully everyone got a good laugh out of the last five items, however, if you walk around this week see how many people fall victim to these psychological facts (there are many especially in high paying professions!).