We provided an overview of the “Future of Wall Street” where we continue to de-emphasize cash equities, research and sales & trading. Overall, investment banking is not going away any time soon and unlikely going away in our lifetimes. Knowing that, it is still a relatively safe career that will allow you to develop an foundation of skills for your future (starting a business, going into a sales position, etc.). Given our recommendation of entering investment banking (if one is interested in Wall Street) we realized that not all segments are equal. With that said here are the trends as of 2017.

Verticals & Industries

If you decide to go into a specific vertical, say healthcare, technology, consumer etc. You’ll likely develop a wide range of skills within that broad vertical. More importantly, as you go up the chain (where the real money is) you end up specializing. We realize that many people take the Career route to becoming multi-millionaires and this will help you decide “where the puck is going”. Instead of doing a detailed overview we’ll give broad strokes of how to think about each sub-market.

Healthcare: This is a sexy sector. Why? The companies absolutely need to raise money and can be sold quickly since a single product success leads to material amounts of sales. Go into Bio-technology if possible. In a rare case going into the Equity Capital Markets segment in a bank that does a ton of biotechnology deals actually makes sense. If your bank is constantly on every single bio-technology IPO you’re going to make a lot of money even if you’re on the ECM side and not the vertical banker.

The other segments such as medical devices are much more stable and less “fast money” so to speak. In addition, one hurdle for Bio-Technology in particular is industry expertise. If you’re unfamiliar with the sector it makes it much more difficult to obtain a position. Someone with a degree in finance and a degree in a science related field will have a much better shot. For an overview of Healthcare click here.

Technology: This is a good sector if you’re in Internet or Software. That is essentially it and the rest of the sectors are going to see meaningless deal activity relative to these two. As money is produced online and we move to an age of automation/robotics the two biggest growth engines in technology will be Internet/Software. In addition, the fund raising within this sector is quite high so you could benefit by working within Equity Capital Markets if the bank you’re working for has stellar bankers in either sub-sector. For more details on Technology we have two overviews (Part 1, Part 2)

Financial: This is *now* becoming an interesting sector. With interest rates set to go up (according to Janet Yellen Comments) financial companies should see the most benefits. Banks make money by taking deposits paying a low interest rate and issue loans at a higher interest rate (therefore this segment should do well – Banks/Bank holding Companies). Beyond this segment, the other two interesting items near-term will be financial technology and Broker-Dealers. Smoother exchanges and decreasing middle man costs (financial technology) have been and continue to be growing trends. The insurance side and specialty finance will likely be more stable/steady. In short, this segment is one of the largest generators of revenue so it won’t be going away any time soon creating a more stable long-term career for you. For an overview of FIG Click Here.

Consumer: The movement is towards e-commerce (pro-tip Shopify has a ton of great data to start an e-commerce company/website). This is technically within the Internet sector for many firms, however the trend continues to lean towards e-commerce and some banks allow their consumer banker to pitch this sector. No surprise, this comes at a cost to classic brick and mortar sales for both hard-line and soft-line retail sales.

Now the interesting piece is that the large consumer companies will likely purchase the up-start e-commerce companies in the future. This means if you decide to go into the Consumer sector you’re probably best positioned to find a bank that does a lot of buy-side advisory. This means you’re going to find the bank most responsible for advising large cap companies on their purchase of small cap consumer companies.

The other sectors (Grocery Stores, Automotive parts, Quick Service) are more stable. This means you’ll find some consistent deal flow and unlikely see banner years of income. The money is in e-commerce if you can build a niche investment banking career there. For an overview of the consumer sector click here.

Oil And Gas: What a wild ride it has been in Oil. Consistently at around $100 a barrel all the way down to $30 and now we’re back to around $50. If you’re of the belief that this is going to sustain long-term you’re likely better off in the Refinery sub-segment of oil and Gas and if you believe we’ll see $100 oil soon, then you should jump into E&P. Overall, this is a cyclical business (historically), so you’re going to gain a lot when oil goes up and you’re going to lose a lot when it goes down (laid off/fired). For an overview of Oil and Gas click here.

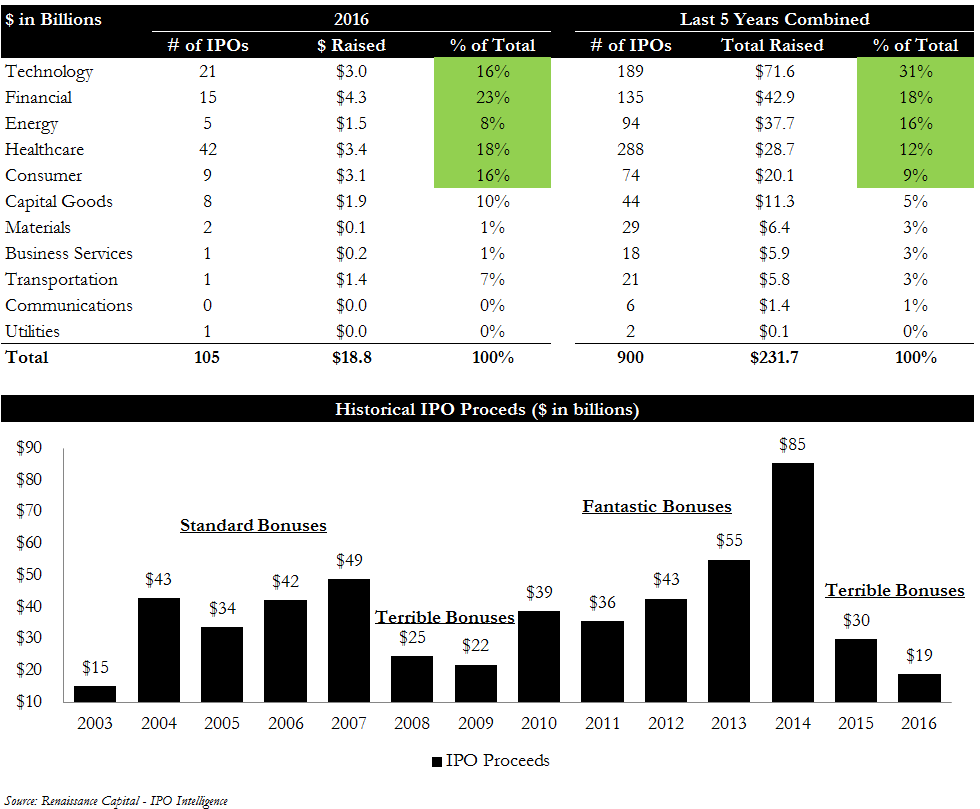

Other: The reason we’ve outlined it as such is due to the categories outlined by Renaissance Capital when they track overall IPO proceeds. This gives you an idea of where the activity is and can help you understand which sectors will make more or less money. At the end of the day your investment banking career is dependent on generating money those large bonuses and all in compensation numbers are not going to be paid out to a utilities banker who got on a grand total of one IPO worth $100K to the Bank. It is going to be paid out to the guy who brought in $10M worth of revenue which will more likely be in Technology/Healthcare/Consumer/Energy and financials now that things have changed. (Click to Enlarge)

Here is a table and chart showing IPO activity. The key points are: 1) entering the green sectors is smart given that is where the activity is going, 2) items can be cyclical given that Technology has represented 31% of total IPOs over the last 5 years but just 16% in 2016 (50% cut!), 3) Financials have remained relatively steady over the past five years and 4) your income is also volatile given the deal activity explaining why bonuses were down in 2016.

Vertical / Industry Summary: Given the overviews provided above and the historical fund raising activity you can gather the following: 1) if you want to do healthcare you’ll focus on more on Bio-tech if interested in fund raising, 2) Technology focus on internet/software, 3) Energy is quite cyclical so expect ups and downs and 4) consumer and financials are relatively stable. From a “risk” standpoint, this means you want to choose biotechnology/internet if trying to maximize near-term income (get on the good deals get a top tier bonus with extremely high competition) and if you’re looking for stability you can go into consumer/banks/standard medical device type sub-sectors.

Groups

There are really four standard groups, that’s fund raising, M&A, leveraged finance and restructuring. These are typically the main four items in terms of groups. If the bank separates them out it means you’ll work on all vertical sectors (listed above) but only on deals related to fund raising, M&A, leveraged finance or restructuring.

Fund Raising ECM/DCM: Quite simple, if you’re looking for a long-term career we can’t recommend it unless you are certain the bank you’re joining will always be a leader in fund raising. That would leave it up to high quality bulge brackets (Goldman/Morgan). This is because your skillset is not as developed as someone in M&A. That said, you can make a large amount of money if the deal flow is consistent and you’re well liked politically moving up the chain every 3 years. If you go down this route be sure to build tangible skills on the side in case you get burned out of the career.

Leveraged Finance: Unlike the market activity position in ECM/DCM, leveraged finance does offer some more modeling skills for you. It also gives you more skills given that you’re constantly learning about structuring and capital structures. This is a good building block to transfer into other sectors, just not as robust as something like M&A.

Mergers and Acquisitions: No complications here. When a real estate agent sells a house he collects a fee. When an investment banker sells a company he collects a fee. This is the best product group to be in because you obtain 1) transferable skills, 2) access to private information to see how companies really run, 3) steady deal flow as M&A deals are constantly done and 4) difficulty in being automated given the level of privacy and interpersonal skills needed. Now you can explain to anyone why bankers make a lot of money. If you sell a Company for $1.1B and original negotiations were for a price for say $1.0B…. You just added $100M in value and you take a $10M fee. Good luck explaining why that guy is overpaid because he isn’t.

Restructuring: This is the “everything is collapsing” group. Essentially, when companies are in trouble, they are likely going to work with the restructuring division of the bank to reorganize the Company. This segment does extremely well during recessions given that bad market conditions usually require more restructuring (when your stock price is down 40% and you can’t raise funds…. Well you can fill in the rest). The skillset is solid overall and we’d say it’s a good place to work, just not as attractive as M&A.

The main points here? If you’re just trying to do something for a few years (go into banking not as a career but as a way to get money temporarily) just enter ECM/DCM and raise either equity/debt in a bull market and put your money away. If you’re looking for a long-term career go into M&A, deals will always be done and they are difficult to automate. And. Both leveraged finance and restructuring are great, if you have a special edge that will make you better at either always choose what you’re good at because getting promotions is where the real money is (not a lot of money in being a junior banker).

Concluding Remarks: As usual the game of investment banking is to get to the revenue generating role. This does not mean any of the groups are “bad”. If for some reason you can get to a revenue generating role in any of them faster (even as a materials banker for example) you should do it. The above is simply a quick glance at how to think about the groups/verticals you’re joining when unsure. Now… when someone says M&A bankers are overpaid you can explain the basics to them since they do not know how the industry works!