If you forced us to decide we would choose the highest cash flow at this point in our lives. Trying to maximize net worth is becoming less and less important since the money doesn’t go with you when you die. That said, everyone has different opinions on what is most important to them. Maybe they have families (where the future requires setting up trusts and declaring “bankruptcy” to hand over assets) and maybe making money is just a game to them where they’re pushing the number up to change their lives as fast as possible.

Cash Flow Maximization

We’re starting with cash flow because we’re biased. Once you’re financially independent… what is the point in growing your net worth aggressively if you can’t even use it? There is practically no point at all. While you don’t want to go negative we would strongly prefer to have tens of thousands of dollars coming in per month than have $5-10M locked away in an investment that can’t be pulled out for 5-10 years.

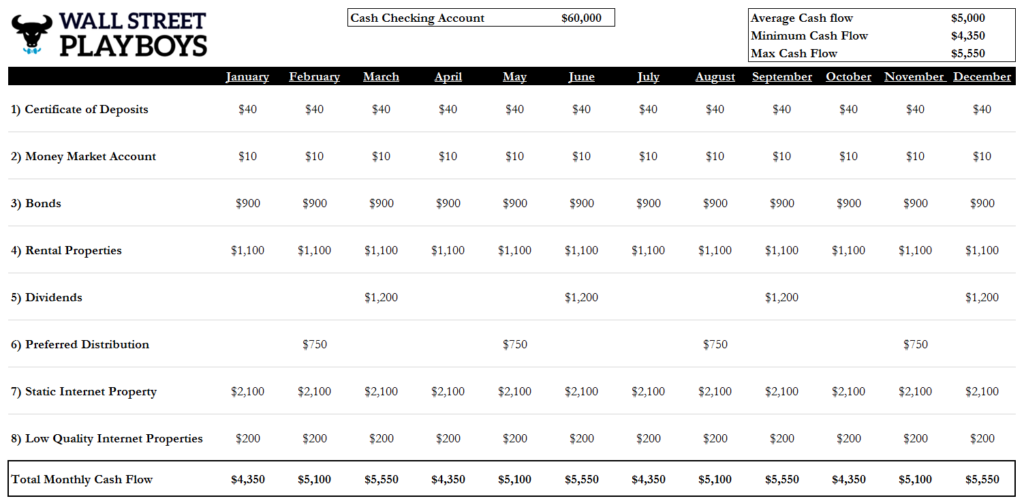

Untouched Cash Flow Setup: The first step is creating a cash flow machine that allows you to sleep at night. This is a framework that you can use when deciding how to allocate money to your streams of semi-passive and fully passive income. You’ll have at least 8 different streams of income flowing into your P&L and more importantly, you’re likely still working since no one really quits. We set it up with the same assumptions as a prior post ($5K a month) to keep the math simple. (Click to Enlarge)

Application for Various Assets: In this example, you have everything you need. It isn’t perfect but it’s pretty solid asset allocation to protect against many different types of “risk”. The first three items are at risk to inflation. Why? If inflation suddenly goes to 5% and you’re earning 1-4% in CDs/bonds… that value is being diluted over time. This is why you’re going to have assets that have the potential to go up if inflation increases. These assets typically include rental properties, dividends and preferred distribution assets (preferred dividend instruments). Finally, you’ve got a set of static Internet properties that generate good monthly income off of sales (not content based income since that eats up valuable time). These internet properties are more important than any of the above items because you can always build more of these boring small sites if you need more income without material updates in the future.

Variance in Cash Flow: In the top right corner is an important point. The primary reason this is “good cash flow”? There is minimal difference between your minimum cash flow and your maximum cash flow on a month to month basis. The spread is $1,200. Since you have $60,000 in a checking account for either 1) starting another Internet based business or 2) cash flow issues for your living expenses… you’ll never have to worry about eating into the principal.

In your worst case scenario, you pull out $50,000 and you have to do so in April when your cash flow is lowest. This gets you down to $8,500 in cash balance that will be replenished pretty rapidly. In addition, this incentivizes you to pursue cash flow rich businesses in the future (fast payback on your $50,000 investment).

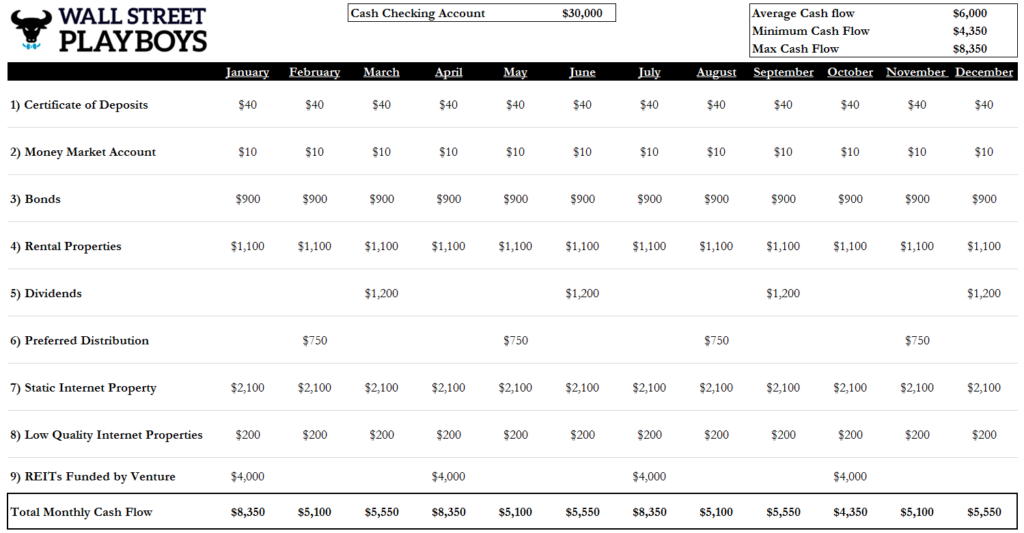

Psychological Bank Accounts: The last thing we recommend is placing all of the cash flows from these items into one bank account. All of your future ventures will be funded from a different bank account(s). This is a way to prevent you from eating into the principal. Lets say you took out $50,000 to fund a new venture… well all of that money must replenish your “safe account”. Then, take a chunk of profits and throw it into a new cash flowing item. After a year or so your new account will look something like this (Click to Enlarge).

What are the Other Bank Accounts for? The other accounts you open should be for your active income. By the time you’re a millionaire, you’re likely working for yourself so the cash flows will not be stable. The entire point of creating a “passive income” bank account is to prevent you from ever going overboard on debt load and risky ventures. If you’re levering up a *single* business that goes bust, you can always recover. Levering up all of your assets once you’re above the age of 30 is probably not worth it (as you know we anticipate most of you will be millionaires within 10 years). Once you’re set up with multiple accounts you’ll want to manage and monitor all of your cash flow using tools such as those provided by Personal Capital.

Total Cash Flow Maximization

With the basics out of the way lets move on to the good stuff: Maximizing cash flow. This way you can spend *more* every single year without worrying about going broke. Given the nature of financial investments it will be difficult to maximize both net worth and cash flows so here are three simple strategies to maximize cash flow:

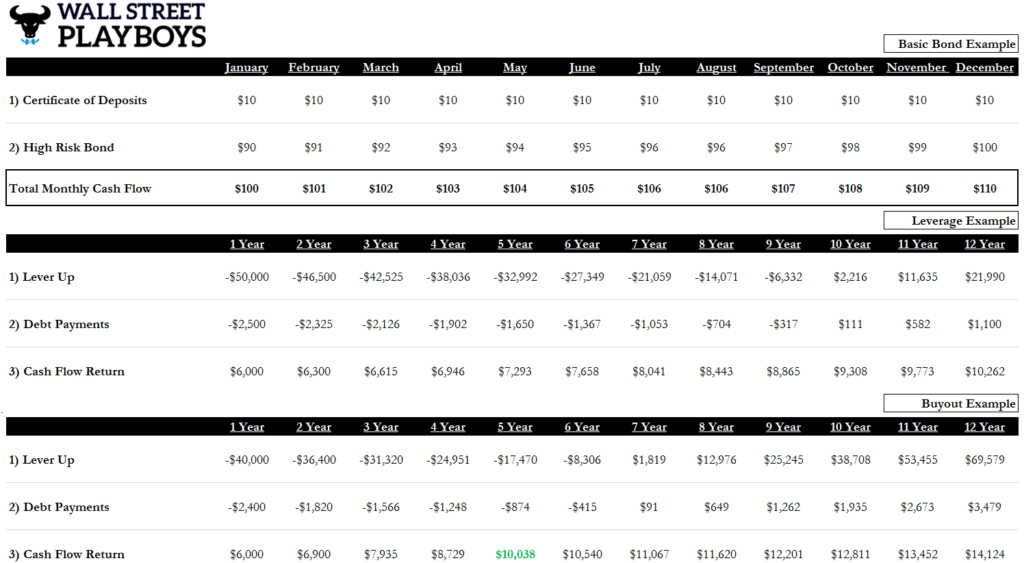

Bar-Bell Cash Flows: Take your income and split it up into two different types of instruments. Say, Junk bonds and CDs. Your income will now be split between an aggressive high yield bond portfolio (90% of excess income generated from active earnings) and 10% into boring dull instruments like CDs and money market accounts.

Lever Up: Take all of the leverage you possibly can out on one business and buy income producing assets (keep the spread). If you’re willing to lose that business then the “get cash or die trying model” can absolutely work. You can make millions with other people’s money.

Mini Leveraged Buyout: We’ve been messing with this idea lately. You lever up and buy assets you can fix on a small scale (not classic private equity, but a mini private equity). You can do this with homes, internet properties, small businesses etc. Since a lot of our readers are interested in internet businesses you can use Flippa which sells tons of websites (“we may or may not” have done several of these with other people paying them to set everything up including the bank accounts). You’ll do one of the three: 1) buy it straight and fix it knowing there is an issue with the site or 2) you can see a new business model and apply it to a different niche you know well or 3) you can rebrand it.

Which to Choose? As always success is up to you. No matter what. Anyone who finds this website/article will be the master of their own future and they deserve all the credit in the world for their successful ventures. That aside, we can say option #1 is for risk averse people, #2 is slightly riskier and #3 is the riskiest. Option 1) The barbell strategy is straight forward. You just want to spend more money next year because you’re trying to upgrade your life a bit. Maybe you just want to pay for golf 1x a month for the rest of your life. Option 2) the lever up model is usually used in real estate and is more stable/predictable relative to most leverage models and Option 3) it is tough to get leverage to buy a random internet business so rates are higher, in addition there is usually an “inflection” point in most sites where the demand is tapped out. So you have to be certain of your venture and you also want to sell right around the green area (year 5 in this example). Why? The buyer will think there is more growth potential even though it begins to flat-line at 5% a year versus the 15% it was growing at previously “blue sky” still appears to be on the table if you sell in year 5. Note: Yes all of this is rudimentary math, there are deductions, depreciation, appreciation potential, valuation of websites and other items that are not included. Time frames can also be moved in if you do good work (returns in less than a year or two). (Click to Enlarge)

Net Worth Maximization

This is a different way to prioritize your future. Many people who intend to have families (or those that already have families) want to build a large net worth so it can be passed on to their children. In addition, there are many people who don’t care too much about spending more and prefer accumulating assets as a game (making money is just a fun game after all). If you’re in this camp you’re likely going to focus more on higher risk/growth type assets that will be locked up for longer periods of time.

Private Equity: This is one of the ways to lock up your assets with a high return profile. We laugh nowadays with people saying “it’s all about fees and you should never pay a PE firm even 2%”. These individuals don’t understand risk and returns. There is a trend to simply throw your money into index funds forever and that will outperform “every” private equity firm and VCs etc. (Wall Street knowledgeable readers will not believe this but it is true, most don’t understand private equity). If this type of thinking were true… all of those firms would have a difficult time staying in business (last time we checked KKR isn’t a small company). We digress. If you’re looking to optimize for net worth Private Equity can be used as a vehicle to accelerate investment returns assuming you’re willing to leave it untouched for several years. In addition, do not go in blind and simply hand over money to any firm, you must research and be 100% comfortable with the investment vehicle you choose.

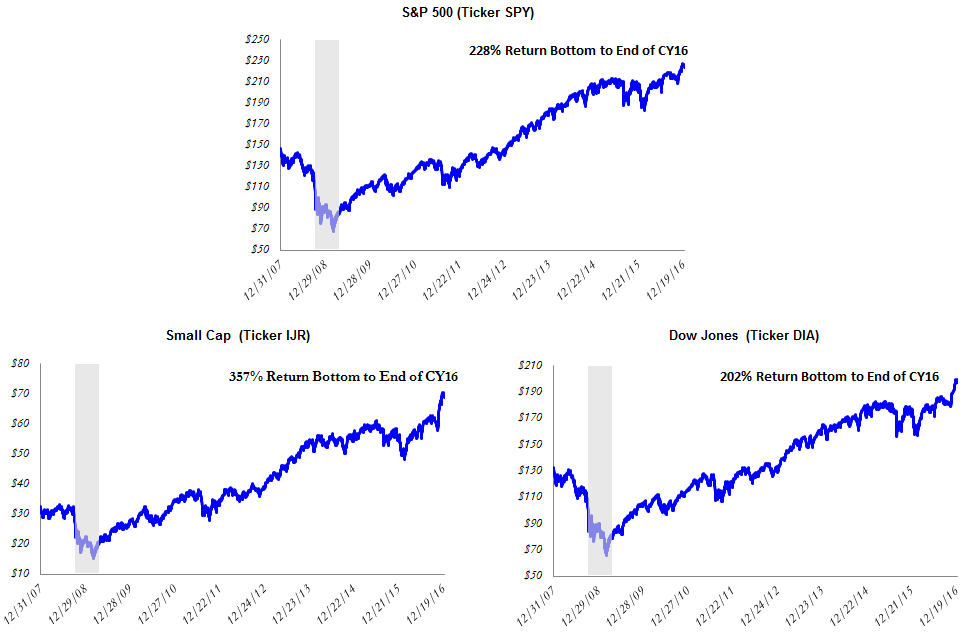

Small Cap Overweight: You can also get aggressive during downturns with small cap indexes assuming you’ve built a cash portfolio. This means you’re unwilling to lock your money away and you believe you have extreme emotional control. This is the most critical part of buying baskets of small caps. You have to buy them when everyone is selling. We don’t mean you “time the market” on a yearly basis, instead you’re going to buy as soon as we’re officially in a recession (build massive cash position and acquire small caps like no other). Once the economy is *factually* in a recession and the market in general has puked you unload all of your excess cash into small cap investments. Aggressive? Yes. Is that the point? Yes.

Below is a clear example of this strategy. We used three simple tickers to show it (SPY which is the S&P 500, DIA which is a Dow Jones Tracker and IJR which is a S&P 600 small cap tracker). We entered into a recession in the 2008-2009 time frame (roughly), if you started buying when things started to go negative (grey bars) you’d make a ton of money. To emphasize this, if you bought small caps you’d make *more* money. Since small caps take a bigger beating during recessions that’s the group you buy. In short, the small cap index went up about 357% vs. the S&P at 228% vs. the Dow Jones at 202%. Those are big differences. (Click to Enlarge)

Angel/VC Type Investing: This is yet another high risk strategy. You’re going to invest in early stage companies after they have tapped out every single source of funds they could find using their personal networks (you should be an accredited investors). Some people attempt an aggressive “bar bell” strategy here where they are taking their excess income and putting 10% into CDs and then 90% into high risk Angel/VC type project where a few outsized returns make them rich. This is not for the faint of heart and requires quite a bit of knowledge.

Concluding Remarks: The one thing to takeaway is that we did not mention a “dual process” approach. This means we would recommend choosing *one* path. You’re going to either maximize your cash flow in the future or you’re going to try and maximize your net worth. Many will disagree and that is fine. From what we’ve seen most people decide on one path (either cash flow or net worth) and develop extreme expertise in a few of the ideas listed above. There are very few people doing heavily levered real estate transactions while angel investing and buying small cap stocks. The reason? Specialized knowledge. If you can crack any of the above strategies you’ll see strong out-sized returns relative to what everyone else is doing. All that said… If you have a great strategy that doesn’t give it all away feel free to leave it in the comments.