Many people get stuck in a specific stage in life and never seem to make it out. The problem is typically due to cash flow issues or major life mistakes. In rare cases, the situation is uncontrollable (we’d wager below 1% of the cases). Since the goal is to get rich we’ll go ahead and walk through the stages of income. We’d also be interested to hear where most of the readership is in terms of the life stages. We have no doubt that several of you are already in stage five reaping the benefits of a long and fun journey to the top.

Stage 1: Time for Money Exchange

The first stage in earning income is trading your time for money. In this stage, people are searching for a way to maximize their hourly wage. Almost everyone will work an hourly wage job at some point in their lives, especially the smart ones who work minimum wage jobs in high school to learn the value of money. It is important to note that the value in working for an hourly wage is not in the income produced. The income is meaningless if you’re only earning $10 an hour doing a repetitive task. The real value comes from the *light bulb* that goes off in your mind. You find yourself doing the math and realizing that even if you were to work for 20 years it would be extremely difficult to save anything: $20K a year * 20 years is just $400K (pre-tax assuming 2,000 hours of work per year).

Who works in these positions? It is typically one of three people: 1) people living paycheck-to-paycheck, 2) older individuals who got bored (don’t want to retire) and 3) young men and women. Of these groups the worst group to be in is group number one. This group should immediately run to obtain niche skills to increase their income and avoid living paycheck to paycheck. We are placing people who live paycheck to paycheck in the same group as those who earn minimum wage. The reason? They are running on a treadmill going nowhere and it’s a difficult downward spiral to get out of.

The second and third group are in good shape (ideally). The second group realizes that retirement is a sham and no one enjoys doing absolutely nothing all day. The third group has the immense value of time. They can take the small amount of money they have put away by working a remedial job and invest it into themselves to exponentially improve their earnings. One group gets to keep their mental health and the second group gets to learn about the value of time for money exchanges at an early age. Both win.

Stage 2: Performance Based Income

The second stage of earning money comes in the form of performance based income. For the vast majority of people this means sales. For others it will be Wall Street and Silicon Valley where your performance is ruthlessly compared to those around you (if you perform poorly your income *will* drop). While the pressure is certainly higher you are obtaining leverage for the first time in your life. The ticking clock does not determine your income. Your own value, will, determination (enter any motivational mumbo jumbo word) is what determines your income and overall success rate.

In this stage, most are beginning to see a meaningful savings rate. Instead of investing it, most will throw it into a checking or savings account since they are too stressed out learning how to succeed with their performance based career. There is nothing wrong with this for the first year, since the stress of being “on” all of the time will be a large shift for most people. The good news is that the first year or two of income will be significantly more than they were making in the past and they see the “light at the end of the tunnel” to growing their net worth.

The second stage also offers another revelation, the Company is profiting handsomely off of your revenue generation. The rough math is that you’ll get paid for approximately 10% of what you bring in (this is the Wall Street side and numbers may vary). Even if you were to get paid a higher commission rate, at the end of the day there is a large gap between what you see in income and what the Company sees in profit. If the Company did not make anything, then they would be out of business very soon.

The final realization while working for a performance based position is the value of the platform you are on. A company like Facebook is a great example of this. If someone were to turn on a single banner ad onto all WhatsApp messaging interactions, the revenue line would go up $100M+. Turning on the banner ad is not hard and the person who decides to do this should not be paid $10M for it. Instead the value is in owning the actual messaging platform with millions upon millions of users. This final realization prevents you from demanding pay hikes incessantly. You’ll have to build your own walking business and create an *ownership* structure for yourself.

Stage 3: Income Streams Without Leverage

The performance stage lasts anywhere from 2-8 years on average (this is pure guesswork/estimation). After a couple of years of work you’re likely investing in assets, those can range from stocks to bonds to CDs. The type of investment is not of importance, the new income stream is. When each income stream comes in, the mind begins to see how each income stream can cover a specific “cost”. For example, if one were to put away $100,000 into an index fund with a 5% dividend, they would say the $5,000 a year covers a month of rent for the rest of their lives.

Generally speaking, the first investment is typically not a leveraged position. Instead it’s a lower risk investment that gives off a small return. Within a year or two, they realize that returns of 4% are not going to help them get rich. Especially when they have another 30 years to become a multi-millionaire, taking a risk-off position does not make a lot of sense. Instead of continuing down the boring path they look for positions of leverage.

All of this said, the vast majority of people get stuck in this third region. It is possible to become financially independent with no leverage and no change in career by cutting costs to the absolute bare bones. Knowing that they can cut down to practically nothing and avoid taking additional risk (burn out from constantly grinding to get to this point) they usually settle into a routine. This routine results in cost cutting (more cost cutting) and did we mention cost cutting? Since the majority of career employees take this path we now know why frugality is a popular topic at this time. While it’s certainly great to go down this route for many people, if you view life as short then risk needs to come on since you have 30+ years to make it.

Stage 4: Three Common Income Streams With Leverage

After stage three a fork typically occurs: the three people who make it either: 1) go into leveraged positions (mortgage/debt positions in real estate are a good example), 2) go into building another income stream by hand or 3) take more concentrated skill risk – think technology. These three paths have very different skill sets. People who take position number two will rarely interact with people in position 1 (except for of the comments section of this blog!). People in position 1 will also rarely interact with heavier risk exposed people in position three, think of technology positions interacting with home builders… rarely happens except when the technology person is buying an asset.

As you’re all well aware, we chose step two which is why we’re massively biased. And… Many of you have already realized we obtain all the Wall Street information from prior contacts at this point. That said there is no “right way” we’re just outlining three high probability avenues that have worked consistently.

Real Estate Route: This one is easy to understand, you’re taking on leverage in the form of bank loans or other types of debt to purchase properties that generate an income stream for you. The key is actually keeping your leverage higher since that’s where the returns are. If you’re generating $24,000 a year on a $240,000 property your return is 10%… If that position is leveraged (it should be if this is your path) then your cash return is closer to 20-30% ($48K invested while the take home pay $9,600 a year after taxes, interest payments, etc.).

Spending Route: This is probably a confusing route for those uninvolved with marketing or online product sales… and an obvious one for those in it! In this route, you’re building an income stream based on paid traffic. This is separate from what we do here on this fun blog since it’s all organic and yields a zero return (content is not a good business model). Positively, this is probably the route that most will take that read this website as they are likely reading this post from their work computers where they could be building online income streams from wherever they are sitting at this moment in time.

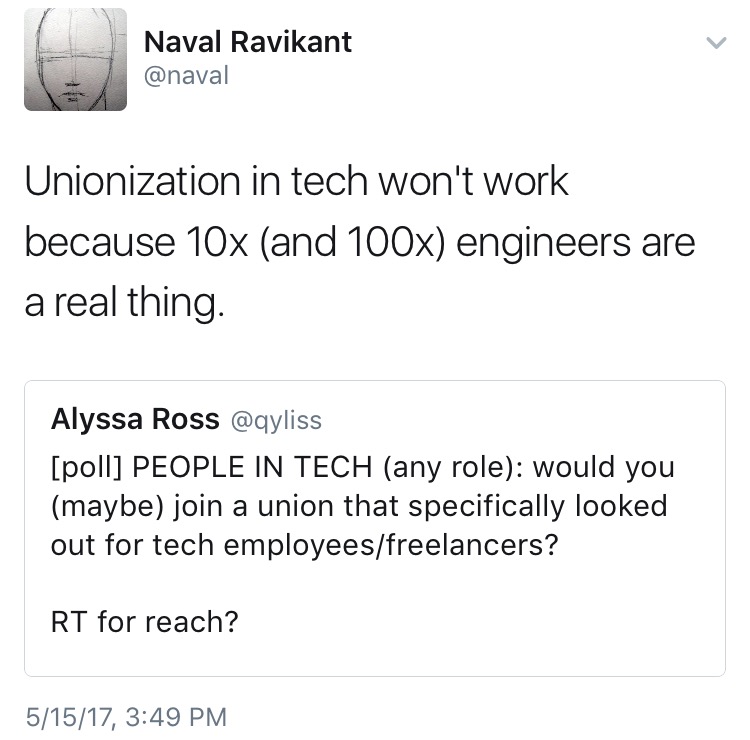

Concentrated Skill Risk: This is where the biggest pot of money is today. There is a reason why technology pays so much and it is because a good employee in technology can outperform 10, 20, 50 or even 100 mediocre ones.

Technology has reached a point where it is comparable to sports, the money can flow aggressively into a few hands (“the elite amongst the elite”). We have not gone down this route given that we’re no where near that field. The value of creating high quality recurring software revenue is incredible at this time (90% margins!).

The main reason these three streams of income have leverage? The first one is clear with financial leverage being debt. The second one is clear with a machine that sends the *right* type of traffic at all times into the same sales funnel and you’re continuing to do so until the target market is tapped out. The third option is unbelievable scale since it’s a set and forget recurring income stream so long as the product produces results. Leverage is typically confused with *only* being financial instruments when it can be applied to time as well.

Stage 5: Mastery of Spending or Scale

The ones who make it this far will now reach the last stage which is mastery of financial leverage, spending or scale (recurring income). Yes there are a few other ways to get rich, however these are the most common if interested in doing research on how millionaires made their money. The vast majority are 1) business owners, 2) real estate or 3) a scalable skill/position (heavy skew to business owners). Naturally, the last two typically translate to item number one over time.

It’s tough to say when someone has mastered the skill of spending or scale. We’d say the skill has been mastered once you’re excited to do your work and any “set back” is seen as fun. Lets say a project didn’t work. Instead of getting emotionally rattled a new lesson is learned and you’re *excited* about learning the new lesson. If you’ve made it to a high net worth already, this is a rare occurrence. It is a rare occurrence since most of the big mistakes were learned a long time ago. You’ll take the lesson in stride and happily go onto the next project with slightly more skill than you had before.

Concluding Thoughts: It is no wonder that frugality is popular nowadays. There is a huge difference in pay scale in America. Many people are living paycheck to paycheck while those with skills have moved into Career type positions and are working hard to move into stages 4 and 5…. Or they’re hanging out on frugality blogs in stage 3. Frugality has gained popularity as those with Careers likely interact quite a bit with those on the paycheck-to-paycheck system and they see the upside if they were able to correctly obtain the right skills.

All of that said if you’re interested in learning more about making money, staying in shape and doing so without choking off your personality… You’ll probably like our upcoming book Efficiency. The benefits include: 1) How to get into the top 10% physically with 1 hour a day of exercise; 2) How to eat correctly to be in the top 10%; 3) How to figure out what type of intelligence you have; 4) How to use this type of intelligence to choose a career and the *right* company: Wall Street, Technology or Sales; 5) How to start an online business (the basics); 6) Clear outline of how to create and start an online product business with correct copywriting; 7) How to go into affiliate marketing if someone wants to take a stab at the competitive space; 8) Overview of how affiliate marketing operates and how to do it, 9) How to do all of this and maintain a normal social life (avoid choking off your personality). Efficiency will be available in July, subscribe to receive discounts or follow us on Twitter for the launch. Remember we can give the tools, but no one can execute on the plan but you.