No return is risk free. We know that many will say treasuries, are risk free but we’d argue that even those instruments have risk (government reliance, just ask Venezuela). Secondly, we don’t view any instrument including treasury bills as risk free because who knows what will happen to the *long-term* tax rate. If someone reaches financial independence with nothing but government bonds at an income of $5,000 a month net of tax … But. The tax rate on government bonds doubles, he’s done. For illustrative purposes, we’ll stick with $5,000 a month net of tax as the hurdle.

Diversification: Before any negative comments come in that state “1% risk free returns make it impossible to be financially independent”… We’ll highlight diversification. Specifically, a diversified portfolio is likely *less* risky than a portfolio entirely tied to one instrument! Why? The answer is the type of risk you’re exposed to. We would rather have 15 forms of passive income generating a combined $5,000 net of tax figure than have one form of passive income that hits the $5,000 a month marker. By keeping a truly diversified portfolio we would argue that your risk actually comes *down* versus loading up entirely on one product even if it is touted as “risk free”.

Conventional Ideas of Risk: You’re unlikely reading this website for conventional advice (none of it works!). Since we’re talking about something that is “well understood” we’ll go ahead and outline the conventional idea of how each instrument is viewed from a risk profile perspective to prevent spam in the comments section: Cash, CDs/Treasuries, Money Market/Checking/Savings Accounts, Government Bonds, Investment Grade Bonds, ETFs/Large Cap Equities, Mid Cap Equities, Real Estate, Small Cap Equities, Derivatives. That is the conventional idea of “risk” and we’re taking the side that each one has a different type of risk. If for example, all of your money is in savings accounts (even at $10M) you’re at risk to hyper inflation, meaning you should never have all your money in one asset. A person with $5M in a savings account and $5M in 15 other asset classes is actually safer.

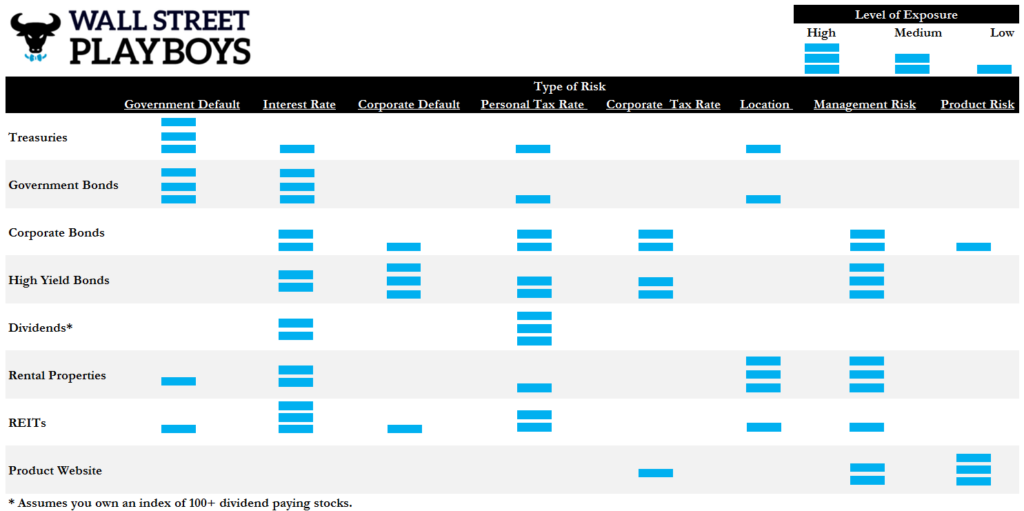

Types of Risk and Instruments: Here’s an example of a table showing *some* of the different types of risk you’re exposed to by instrument. Now there are a million different ways to earn semi-passive or fully passive income, but understanding the type of risk you’re taking is critical. While it sounds crazy we would caution everyone on putting all their passive income into one bucket even if it’s “risk free” treasuries. Note: we are sure we missed several types of risk in this example, it is for illustrative purposes and feel free to provide other ideas in the comments section. (Click to Enlarge)

Treasuries: Now don’t get it mixed up, they are largely risk free assets. We’ve read all those corporate finance books in the past and know all of the theory behind it. The trick here is that there is still government risk. The risk is small but it *does* exist. Knowing that your return could be impacted by the US government is certainly a type of risk. In addition, you’re also exposed to interest rate fluctuations (small amount due to assumed short time period of treasury), tax rates (who knows what the government does) and of course Location since it’s all in the USA.

Government Bonds: We’ll go ahead and take the cookie cutter finance approach and say this is higher risk than treasuries. It is essentially the same instrument but with more risk because you’re exposed to longer time periods (lets say a 30-year bond, where interest rates could go up in that time frame). Essentially a government bond gives you the same exposure to all of the risks associated to a treasury bond with the added risk of time.

Corporate Bonds: Here we look at it differently than textbook personal finance advice. We don’t think there is as much exposure to the government. That is correct. We discount that risk because… drumroll… tax inversions. Think about what has happened the last 5 years and you’ll find that tons of corporations that are “in” the USA pay practically *nothing* in taxes. Look at technology companies and look at other large multi-national companies. While these companies all started in the USA they are not really 100% exposed to the US government. If things really hit the fan they can always move. Now this doesn’t mean you buy nothing but corporate bonds. Why? You’re now exposed to different types of risk. You’re exposed to the standard interest rate risk, you’re now exposed to that company failing (we’ll assume large multi-national), corporate tax rates can change and of course you’re exposed to mis-management of the Company and product risk. Finally, we also remove location risk since businesses are actually quite nimble and are not exposed to one geography.

High Yield Bonds: This is essentially the same as a corporate bond with more added risk on the default side, the management side and the product risk side. One of those three are likely under pressure for the company to be in the “high yield” or “junk bond” territory. The benefit is that companies are still pretty nimble (meaning they are less exposed to one government or one location). This one is quite simple because it is a higher risk corporate bond. Your investment edge in this case would be knowledge associated with the Company issuing a junk bond.

Dividends: Since we’ve covered the broad stroke corporate side of the equation we’re adding a small section to highlight dividends. The reason? Well the tax rate is significantly lower! We find it humorous that all of the “early retirement” calculators don’t even account for taxes… as if they can avoid the government. A 15% tax rate versus a standard 30%+ tax rate is a huge difference because passive income of $10,000 is really $8,500 for a dividend compared to $7,000 or so for a bond… a 20%+ difference. Finally, dividends do give you equity exposure which is an added risk (in bankruptcy the bond holders are paid before equity holders) but we have no doubt everyone reading this already knows that.

Rental Properties: This is another interesting one, the type of risk is again different. You’re certainly exposed to some government risk since the house can’t be moved easily to another country (if the government decides to seize assets like China, you’re outta luck!). To keep it simple we’ll assume the rental properties are paid off so you’re really just exposed to interest rate risk, tax rate risks, location risk and management risk. The “product” risk is essentially off the table unless someone is excruciatingly bearish and believes a home could be worth $0 in the future (highly unlikely). This is likely why the phrase “location, location, location” came from the real estate crowd. The phrase highlights that *location* is one of the most (if not the most) risky part of the asset. Finally, management risk is always there even if you believe your property manager is a genius.

REITs: We’ve covered REITs in the past and you can classify this type of income as a different type of Real Estate risk. Management risk is a bit lower and you’re reducing your location risk due to the large number of investment properties around the United States. That said, returns are typically lower since you don’t have to deal with repair calls, tenants, mortgages etc.

A Product Website: We are biased. This is where you can see a lot of risk… just a different type of risk. If you sell products online it means that you are detached from governments in general. In an extreme scenario where the USA becomes a third world country, you could always pull an Eduardo Saverin (Facebook CFO) and renounce citizenship. Make no mistake, there is a lot of risk in running your own online campaign it is just *different*. The upside is that you’re not tied to anyone except your ability to sell a product (if that vertical goes extinct you’re also in a lot of trouble).

Bonus Item “Cash”: How safe is the government really? Not to get all tin-foil hat crazy… But. There is a reason that BitCoin has appreciated so much. There is always risk even with currency. We’re not in the camp that believes cash is going to go away in our life time, but we’re not going to take that type of risk either. Holding different types of currency (gold, bitcoins, silver, etc.) makes a ton of sense. We may talk more about crypto currencies in the future.

Risk Adjusted Financial Independence Calculation

Here is where the fun begins. If you put all your eggs into a single form of passive or semi-passive income then you should reduce the income stream to account for the *type* of risk you’re taking. Taking it to the extreme, if you have 1% exposure to 100 assets generating a total of ~$5,000, you’re likely set. On the other end, if you have 100% exposure to one asset class… That is likely not worth $5,000 it is worth less than $5,000 due to the heavy exposure to one or two types of risk (tax rate on that item could change or the type of risk taken has a one time “black swan” event that wipes it out).

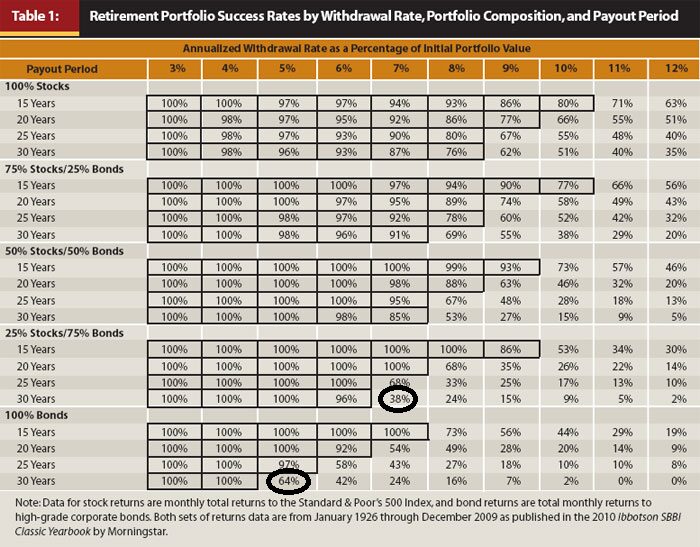

Now we know what’s going to happen, hard core finance guys are going to look at this post and say that it doesn’t make any sense because bonds are paid out before equity holders. They will say that your risk is by definition lower if your passive income is 100% bonds versus 100% equities. So on and so forth. So lets go ahead and see what happens based on factual data from a Trinity study.

Kaboom. Take a look at the black circles. If someone loaded up on 100% bonds in retirement because they are “less risky” and maintained a 5% draw down rate… over 33% of them failed. And. At 7% the portfolio only had a 24% success rate! We’re simply pointing out that any asset class could have a material correction during any 30-year time frame. If we were posting back in 2006 our comments would likely be flooded with “low risk mortgage backed securities” being the answer to our problems. No one knows which major asset class will see the next major downtick… during that time frame, equities were actually better (they may not be now).

Before we move on, the second key point from the chart is that your ideal “financial independence” number should be a 0% principal drawdown number. If you have ~$5,000 in net of tax income coming in monthly, then you’re in good shape (assuming that is equal to your base line living costs). We have never understood why the calculation for financial independence has been on a gross income basis. There are certainly many ways to structure your personal finances to reduce taxes, however, there is going to be a tax rate associated with the vast majority of investment vehicles (no avoiding those capital gains taxes unless you live on practically nothing – Taxable income of ~$37K).

Putting it all together, knowing that you do not want to be exposed to one single asset and knowing that you do not want to touch principal… we’ve come up with a quick calculation to figure out where your financial independence stands on a risk adjusted basis. If you’re already a multi-millionaire it is unlikely that this applies (we’d wager you’re still working) but here it is:

Risk Adjusted Financial Independence = Post Tax Annual Living Expenses – (Passive Income * (Income Streams/8))… Overall, when you get to your targeted net worth to trigger the financial independence cliff, you’re going to diversify those cash flow streams.

Examples of Financial Independence

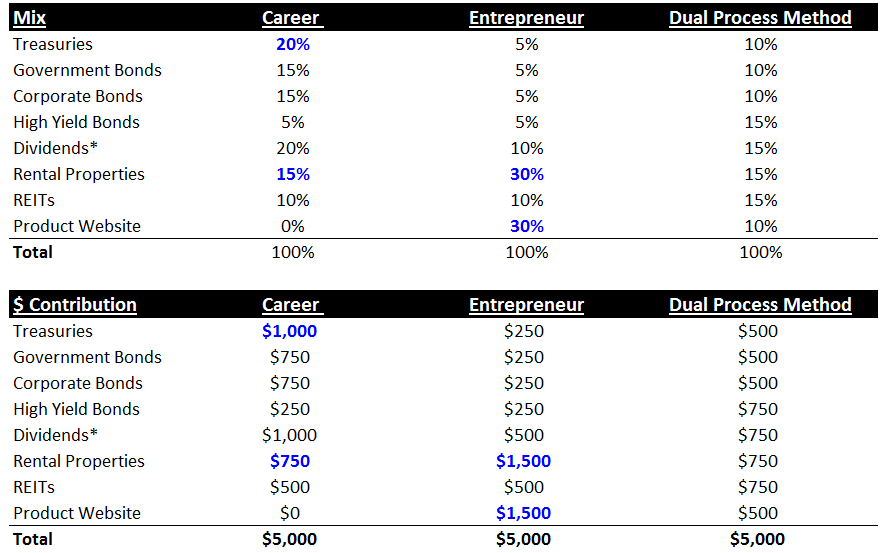

Now building off prior posts, we’ve found that there are really three types of people who become financially independent. The Career builder, the Entrepreneur and the Dual process method. For one reason or another they seem to have different cash flow set ups. None of these are “right” or “wrong” since all three don’t have to work for the rest of their lives. But. We’ve noticed they do seem to look a bit different

Career: It is highly unlikely that someone manages their finances exactly in this fashion. That said, from what we’ve seen those that have made their money from Careers tend to put more money into real estate and cash. Those two items really stand out and you can see it in their everyday conversations. Most will talk about owning some small rental properties and they’ll frequently reference emergency funds & the value of a cash balance. Finally, when they do pull the trigger (stop working) they tend to talk a lot about the “dividend aristocrats” or companies that give out increasingly larger dividend payments.

Entrepreneur: This individual is on the opposite side of the spectrum. You’ll see them talking more about creating passive income from “internet property” which is just another phrase for ‘”niche site that sells a small amount of volume”. Since most entrepreneurs on the Internet have skills to increase income in various niches, they prefer using this to generate income. The one “shocking” thing is that they tend to buy their own place pretty quickly (only one apartment or house) increasing their real estate exposure quite a bit up front. Finally, the last interesting thing about this category is how they try to monetize different avenues. Just because someone is good at product sales of say diet products does not mean they would operate a profitable content site (blog/news etc). For one reason or another they continue to try new avenues once they are already financially set.

Dual Process: There are not many of these but they exist. Typically dual process individuals take the shot gun approach to success trying practically everything and working long-hours to get there (reminder long hours are a key to any type of success). This results in a lot of various small skills that add up to chunks of money coming from many different angles. You’ll see dual process individuals flipping a lot of items and “hustling” which means flipping internet assets, flipping homes, flipping anything for quick money!

Concluding Remarks: Overall, your risk profile is going to be different however, we would encourage everyone to think about risk differently when compared to what the masses do. Risk isn’t just a text book item. It is related to concentration to a type of risk as well (as we saw in the bond example above). From an actions stand-point: 1) diversify aggressively if you get a windfall of cash, 2) write down all of the types of risk you’re exposed to *yes we believe you can even reduce government risk!*, 3) decide where your next passive income stream will come from, 4) remember to keep cash on hand at all times to avoid personal financial collapse and 5) for those that are serious about de-risking their portfolios we strongly recommend Personal Capital for tracking your cash flow, avoiding excessive fees and seeing your net worth grow (the product is notably better than Mint).

PS/Side Note

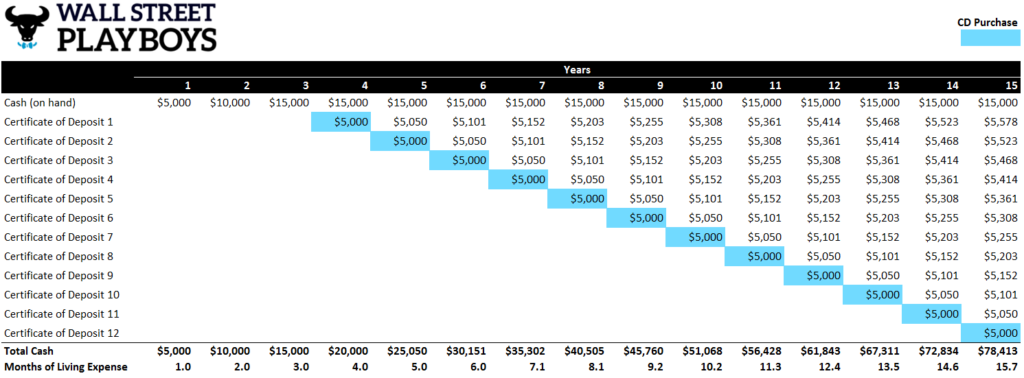

As a side note, we did not do a good job of explaining cash balances and Certificate of Deposit staggering in a prior post. With that, a comment came in and asked about it. We’ve provided an example below and note the following assumptions: 1) we assume you will get a 1% return over the course of a year to keep the math simple and your monthly cost of living is $5K, 2) we assume you *first* put away a few thousand dollars in case a one time life event occurs – injury or “something just happened”, 3) you will eventually hit an inflection around year 15 where it practically grows by itself making you *nearly* 100% resistant to a recession (most recessions do not last longer than 2 years or so). Here is an example of how the cash flow will look and please note that you will likely use differing time frames – not just 1 year CDs. (click to enlarge)