There are a million posts on the difference between being young and old it really boils down to a shift in recovery time along with pain tolerance. When you’re young, you have the ability to recover quickly (just look at physical injuries) however your pain tolerance is lower (not enough repetition). As time goes by, after multiple painful repetitions (physical with weights/sports, mental with stress/emotional events) you’re going to become desensitized to most forms of pain. Tolerance builds over time making the answer clear… put the pain/stress on as early as possible to become desensitized.

Big Gains

Put Physical Pain Up Front: If you look at someone who is overweight and in their 30s, the upward battle to get in shape is enormous. Muscle memory is real. If you haven’t developed a solid physique in your 20s or at the latest early 30s maintaining a high level of fitness will become incredibly difficult. The reverse is also true. If you can take the physical pain up front, you’re going to be in the best shape of your life and offsetting the inevitable declines will be significantly easier. Even if someone tries to take performance enhancing drugs to give themselves an edge, it just won’t compare (otherwise pro-athletes would continue to perform well into their 40s). Remember, when referring to fitness we mean both looking good and feeling healthy as well. There is a tremendous difference between being physically muscular and being coordinated with cardiovascular health as well. Since health is #1 (more important than both time and money) anyone foolish enough to let their bodies go down the drain in their 20s will pay for that decision for the next fifty years.

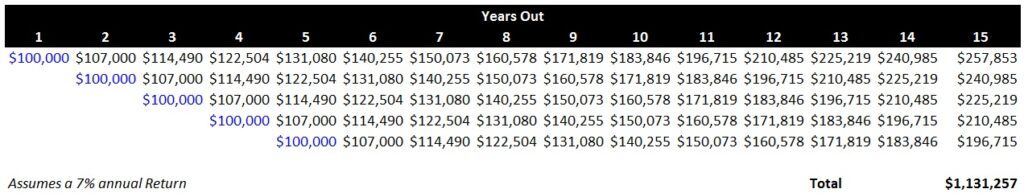

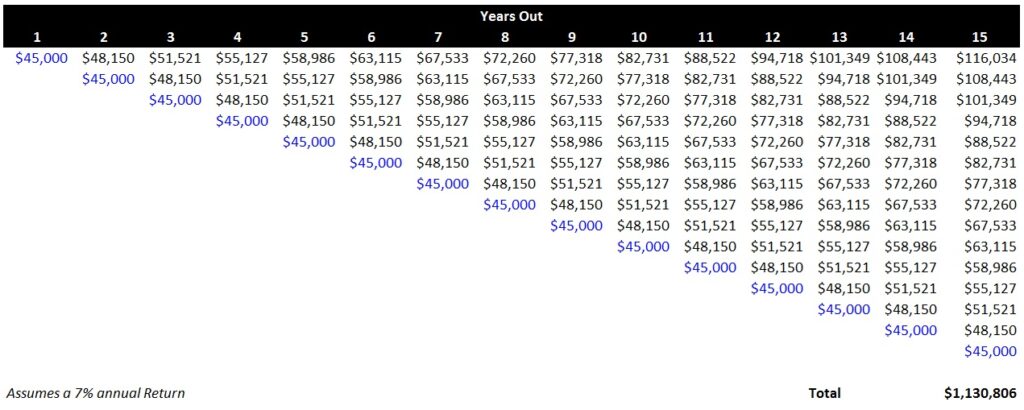

Put All Financial Gains Upfront: Instead of trying to get ahead by slowly putting away money (10% is always thrown around as the norm), it makes much more strategic sense to try and put away a large amount of money early and “let it ride”. This allows you to let time work in your favor and you can even slip up a few times. Your slips won’t matter because if the principal investment is untouched you’ll be set without lifting a finger. Once the math “clicks” you’ll see its much more meaningful to work extremely hard when you’re young to lock in the compounded gains. The table below should be an eye opener. As a simple example, if someone decides to wait for 5 years before really putting money away (think doctor/lawyer) that means you’ll need over $600K+ in post tax income to catch up to someone who put away low six figures just a few years earlier. This is a daunting task when you consider that the young hungry business person will unlikely see a zero income year.

Decide to Play Catch Up? If someone decided to “take it easy” because investing smaller amounts over time is easier, you’ll see a huge disadvantage appear. Even if they were to put away 45% (almost half) of the amount for 15 years (3x more time) they won’t catch up to the big investments made by the first example! To put it into clearer terms, the last five years of investing (years 11-15) is roughly equivalent to the single $100K investment made in year 1 by the first example ($257.8K vs. $285.8K). This means five full years of effort in “out years” is equivalent to a single painful event year 10 years ago. This bears repeating. Even if someone saves approximately half as much over the course of 3x more time, they will be worth less than the person who put the large capital investments up front. If you want to play the game from a psychological perspective, think about tripling the number. Take any amount you have today and ask if you’d rather have triple the amount in 15 years .

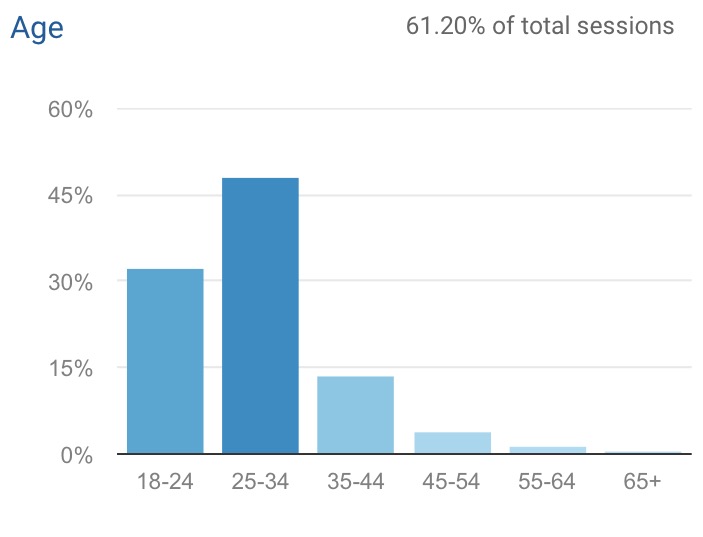

Take Advantage of Being Young: Approximately 32% of the readership is just joining the workforce while the remaining consists largely of working professionals with 6-figure incomes (or better). With that in mind we would challenge any young reader to learn the art of “playing dumb” as early as possible. This means using your youth as an excuse to avoid large scale items. No one cares if a 22 year old lives with a roommate. No one cares if he can’t afford a $40,000 watch. No one cares if he goes to Thailand to party instead of Monaco. No one cares if he only has two suits. No one cares if he eats a sandwich to go vs. a sit down seafood restaurant for lunch. In short, take advantage of lying down about any amount of income you’re making and you won’t see a material impact to your social life. When you’re 30 it won’t be impressive to “scrape by” and you surely won’t be interested in drinking 12 shots over the course of 48 hours to party all weekend. In short, if the *perception* is that you’re young, penniless and naive… You know what to do… Take advantage of the situation.

In Your 30s Not There Yet? No problem, the strategy we would deploy is the see-saw approach. One year you’ll bite the bullet and focus a ton of time on generating event driven income (anything that’ll allow you to potentially sock away 6 figures in a year, we’ll draw the line there). Instead of trying to become frugal (see boring) you’ll oscillate between putting away a large amount of income and relaxing the following year. The reason why we would suggest this route over the constant grind is that you’ll avoid personality deterioration. If you’ve ever hung out with someone who saves 70-80% of their income for 10+ years… you’ll know exactly what we’re talking about. Years 25-45 or so are the prime years of your life so if you’re already in your 30s it probably makes sense to switch to an oscillation framework. In addition, this guarantees you’ll outperform the steady saver from the examples provided above, one year of pain is worth more than two mediocre years. So you can live it up, buckle down and oscillate to avoid burning out and remind yourself of the joys that money can bring.

Forget About the Investments: This is probably the most difficult part. In order to see the value of putting big gains up front you have to forget about the investments and avoid using the gains. This means you’re doing yourself a disservice by constantly checking a personal trading account or your net worth on a daily basis. This will either 1) make you feel rich or 2) make you feel uncomfortable during a market down-tick. In addition, to avoid using the gains you’ll have to *trust the process* by taking any material financial windfall and throw it all into equity + debt instruments and close the brokerage account screen.

Small Gains

While the most important section is about the value of large gains, we’d say small gains should be used as a “revolver”. For those unfamiliar with finance terms, a revolving credit facility is essentially quick access cash at a low interest rate. Instead of being charged an interest rate, all small gains should be used to create a revolving cash facility for one-time charges.

Website Income: You will fail. Or you’ll get lucky and hit your first idea out of the park. More likely your first 10 ideas will fail. This is a great thing because failing early in life sets you up for a great future and the small failure can actually help you. What you’ll do is set up 2-3 basic checking accounts with income from all of your failed ideas. Lets say you started a niche website on the best yoga equipment for stretching (talk about a terrible idea) but… that website generates a couple hundred dollars a month. Now lets repeat this with 5 more websites and that’s $1,000 a month. You can take all of the money and throw it into an “emergency” checking account. This will offset all of your one-time charges for at least 5-10 years. In five years you’ll have $60,000 to either keep as a safe haven or use to fund a small idea: as noted $50K is the approximate amount we use for selling a new product: 1) $10K website design/sales page – any specialized work you need to make your website look better; 2) $5K demand check – quick demand check before you even get started with your idea (if there are zero orders you don’t proceed); 3) $35K product manufacturing and design -find a place to produce your product and design.

Small Gain High Risk: Another advantage of small gain items, you can take a huge amount of risk with it. If you have a similar situation to the items outlined above you can also throw it all into risky investments: small/micro-caps, high volatility crypto-currencies, high volatility leveraged equity products, options etc. This is a great way to get a meaningful return off of a small gain. If you’ve walked backward into an extra $10,000 for some reason (large gift, fortunate one time sales day etc.) you can go ahead and put an aggressive move onto the table. If you end up picking up a 5-10 bagger (500-1,000% return) that’s going to make the small gain a meaningful one. Besides who want’s to live their life buying nothing but boring indexes and bonds!

Hitting Singles With a Rental: The third way to make small gains is to own a couple of middle class rental properties on leverage. This means your primary goal is to get the cash flow to “show a zero”. Subtracting out fees and depreciation, on a tax basis you can show 0 income on a couple of properties while benefiting from cash flow positive numbers in the mid-hundred dollar range on a monthly basis (this even includes property management if real estate isn’t you’re way of earning your money). While we’ve focused primarily on “electronic real estate” (cash flow positive websites). Diversifying into cash flow positive rentals can also be used as a small gain for high risk rewards or emergency cash accounts.

Putting it All Together

While we’ve put up a lot of numbers here the key is really decisiveness. We’d say the biggest mistake we see people make when trying to accumulate money is being indecisive. Once you choose your path to earning *event* or large one time gain income… You can’t falter. Instead of trying to go down 3 paths at once choose one to be your primary income producer. The biggest and most lucrative ones are of course: Business, Real Estate and Career income. Once you’ve set down on one path to be the primary income stream do not deviate. You’re allowed to go down two paths at maximum. Since you’ll be developing two income streams one will naturally dwarf the other but your skill-set will be diversified. The rest of the money will all go to “small gain” set it and forget it type environments. If real estate is not your path to earning income, you’ll need a property manager. If internet based income is not your path, then you shouldn’t bother with purchasing “internet real estate” on flippa. If you’ve gone into sales, it does not make sense to spend your weekend doing a technology bootcamp. Decide on a path (making sure it is lucrative first).