For many people, getting a million or two is enough. In that case, it may not be the least risky option to get “rich” if that is all an individual needs. Once we start putting more parameters or restrictions around what qualifies as rich, you’ll start to get to some startling conclusions. Specifically, we’ll draw the line at 38 years old (to make the math easy and assume 18 years of effort). That is when you should be rich (approximately 20 full years after entering college… if you choose to go to college).

Two Surprising Paths We Don’t Recommend

Doctor or Lawyer Path: We’ve said it several times, however it needs to be said again. Becoming a Doctor or a Lawyer is not a good way to become rich. You’ll live a well off life and if you truly believe a couple of million is enough, then this path is for you. Lets go ahead and look at the numbers.

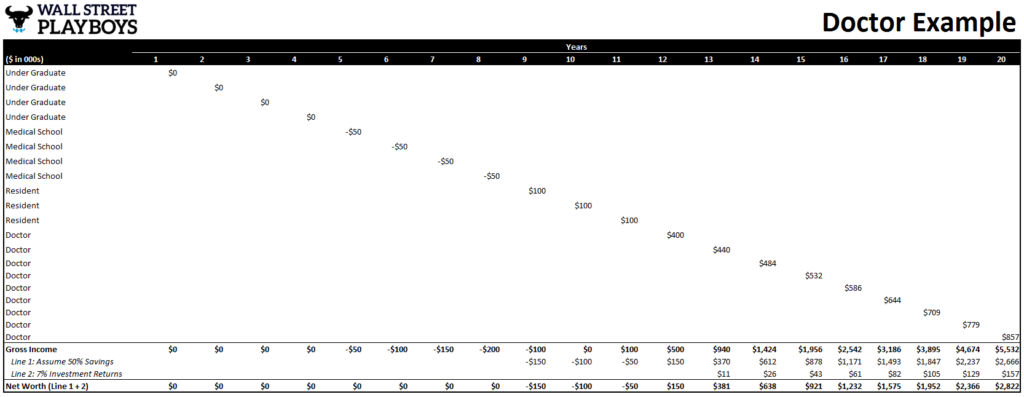

Doctor: In this case you’re going to spend approximately 4 years in an undergraduate program. Then you’ll spend four more years in medical school (assume $50K cost per year for tuition/room/board) combined with residency for 3 years. All in you’re going to be in school or doing residency for a total of ~11 years. The good news is that we’ll assume you will receive $100,000 per year during residency and we will create an enormous savings rate for the doctor at 50% of total gross income (note this is extremely high as it assumes you’ll pay practically no taxes at all). Once work begins, the Doctor will start out earning $400,000 a year and see 10% wage increases up to $857,000 (close to a million). To cap it all off, we will assume that all of the savings will be reinvested at a 7% annual rate of return. What does this get you to? $2.82 million at the age of 38 (Click to Enlarge).

To put the nail in the coffin check out a comment from a dentist (Dentaljax) who chimed in on an earlier post: “Wish I could do it over, but I’m a dentist making 500k, however just started making good salary in my mid 30’s and have 250k student loans still. Younger guys…do not go into healthcare! I’m over a decade behind bankers… even saving only 100k a year, they’d already be near a million, if their savings went up over those years…2 mm easily. You can live off that. Instead, my financial nut is less than 100k, my 500k salary is only half after taxes, take away another 36k a year for my student loans, and you can see I’m forced to work my ass off to rapidly build up investments or I won’t have enough principal to live off down the road. Worse yet, there is no stealth wealth, everyone assumes you’re rich because of the degree and you feel the resentment. I have the lowest net worth of practically anyone I know! Sure I can live comfortably (now closer to 40 than 30), but I AM FORCED TO WORK FULL TIME, and will have to for decades. Since I’m really clueless about the whole internet space, I’m going to have my second income stream be real estate, but living in an expensive coastal town even this will take many years of rent inflation to pay any dividends. Moral of the story…when you’re young, work hard to make money. I worked hard to get into more school where I had to keep working hard and taking on more debt, and did not make any money for a decade. You’ve been warned!”

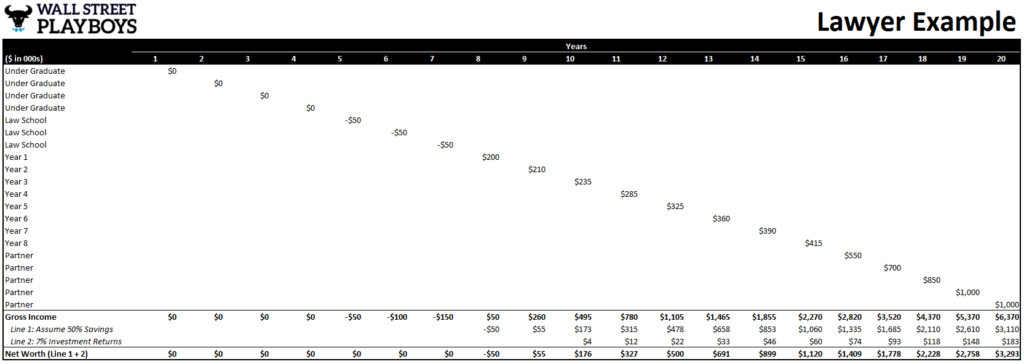

Lawyer Path: Ahh… So the masses were wrong (as usual) about being a doctor being a good way to get rich. So instead they go down the law path, surely that’s the way to build wealth! Not so fast. While you’ll be out of school faster, the numbers are typically a tad lower making the path similar. You’ll obtain an undergraduate degree, follow with three years of Law school followed by a $180K base salary job (smart readers will notice we call law a job not a career). Why? You’re trading time for money. So now lets look at the quick math. $180K for year one (base) and a $15K bonus. After that you’ll increase as follows with base followed by bonus in brackets: 1st year $180,000 ($20,000); 2nd year $190,000 ($20,000); 3rd year $210,000 ($25,000); 4th year $235,000 ($50,000); 5th year $260,000 ($65,000); 6th year $280,000 ($80,000); 7th year $300,000 ($90,000); 8th year $315,000 ($100,000). In addition we assume you’ll be promoted to a Partner role where you’ll go from making $550K up to a cool million by 39 years old. Note: none of our writers have worked in law and we were directed to a large blog that covers numbers in that sector (high end firms) you can find the numbers here.

To keep things fair, we’ll assume the same aggressive savings rates. 50% of gross income and 7% returns. Again. We do not believe these are achievable numbers, however it allows us to create an “ideal situation” so there is limited room to make the assumptions seem low. Life is rarely “smooth sailing” from start to finish, so the fact that someone will be earning a smooth increase every year for 13 years straight is astonishing in its own right. The result? $3.29 million at the age of 38 (Click to Enlarge).

This wouldn’t be complete with yet another reader comment this time from a Lawyer (Nathan): “Lawyer here. Law is worse. Even the areas of law that are performance-based (personal injury, class actions…anything contingency-fee based) take too long to get really rolling to make law worthwhile. Any other practice areas you’re straight up trading time for (not great) money.

Law is a “copper handcuff” job: The money starting out is not that great and the work required makes it a Yuuuuge time suck and difficult (but by no means impossible) to build biz on the side. If you could get a job as a lawyer (emphasis on “job” and not “career”), means that you: (i) are reasonably intelligent; (ii) have solid work endurance; and (iii) are not socially retarded. = you could be successful and far better off financially doing something else (sales, engineering, etc)

Law is still prestigious, yes… …but as WSPs say: F*ck prestige. Get money.”

Three Paths We Do Recommend

Wall Street, Silicon Valley, Sales: These three paths are the cleanest if you’re interested in building a Career and believe it is less risky (you’ll see later that risk is essentially the same). No matter, all three offer the potential to get to around ~$4-5M by the time you’re 38 or so. This is a pretty big step above the two examples above… Why? Remember we assumed no interest rate payments on school debt and made excruciatingly conservative assumptions on all the costs the Doctor and Lawyer will undertake.

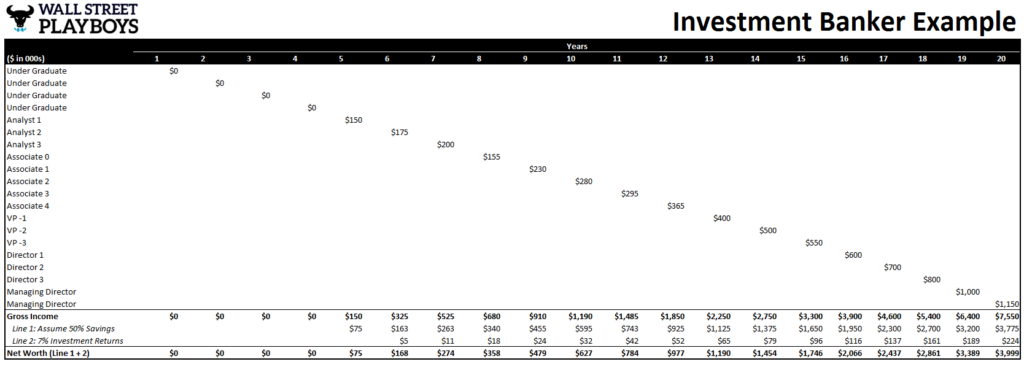

Wall Street: Since we’ve already given out investment banking compensation numbers several times in the past you’ll see the numbers work pretty quickly here. If we make the same assumptions about savings rates and investment returns you get to approximately $4 million dollars ($3.999 million to be exact!). To get to $5 million you’ll need to survive another two years and you’ll be there at age 40 (Click to Enlarge).

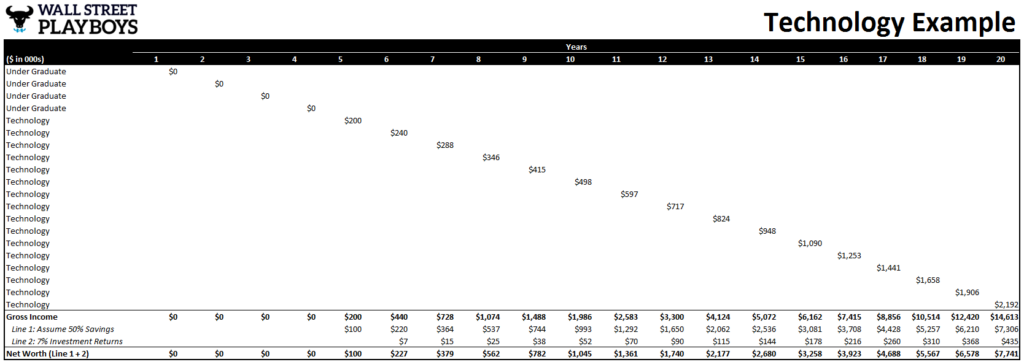

Silicon Valley: The real downside to Silicon Valley is that you’re in a bit of a higher risk situation depending on the Company you work for. This means you have to either accumulate ownership of the company (stock) or join a high end company with solid base pay and bonuses with minimal stock upside. Either way… The numbers go up well if you’re savvy and can make the jump from being a pure technology person to being a manager as well. Since we’ve made solid rosy scenario assumptions for everyone else we’ll keep the same for this example as well. The result? $7.7 million at age 38 (Click to Enlarge)

Wow what happened here? Well if we assume you’re going to add more value over time and can make the transition into management roles, the income does not slow down. The top firms also offer outrageously attractive benefits such as food, laundry and other miscellaneous goodies making the numbers slightly more achievable.

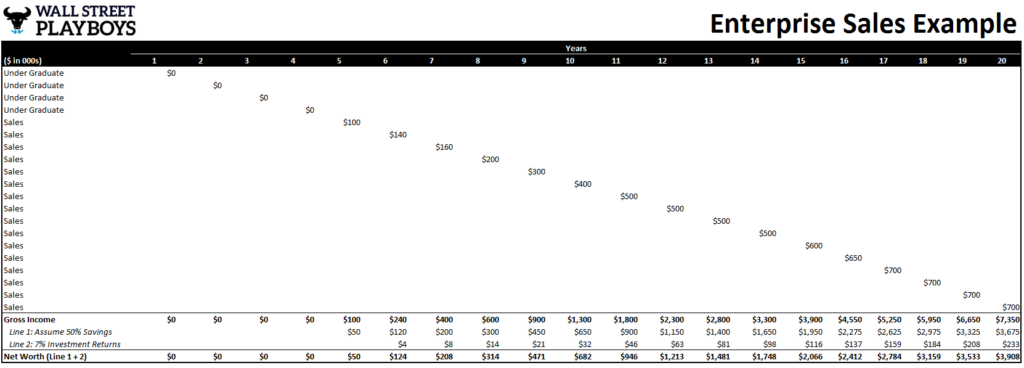

Sales: Ah yes. The “terrible career” everyone says not to go into. Why? Talking to people is uncomfortable. Sales is uncomfortable. Trying to show value is uncomfortable. Being 100% tied to “eating what you kill” is uncomfortable. Then they all wonder why the salesman lives a comfortable life… Because he’s willing to take on uncomfortable situations. They never see the light. Good for you though because once you build your book of business it becomes smooth sailing. The one “strange benefit that will shock you” is that you typically go up the learning curve quickly then stabilize into a niche. The result? Close to $4 million as well at $3.91M (Click to Enlarge).

Since we’ve covered Wall Street and Technology enough on here, here is an enterprise sales quote from a commenter with the unsurprising name of “TechSales”: “Get good at sales. I am selling software and there are so many jobs that will take you if you are good at sales. Heaven forbid you are unemployed you can find a job within the week if you have proven numbers. Month at the latest. (meanwhile you walked down to the BMW lot and showed a picture of your W2 last year at 300k and get hired to sell high-end cars until you’re re-employed at a tech company).

If you did everything right you should have a rolodex of sales managers and VPs of sales that you can get back onto with 1 call.

Start as an sdr and grind. That’s all there really is. You don’t have to have a degree but it helps get in. Competitive to get in but nothing compared to banking. I got in after applying to a fair amount of jobs online cold and working with sales recruiters. Eventually, I got a job within a few days off an online reply.

I had slightly less than 1 yr b2b when I got my job and I believe that helped. It’s not rocket science. I have a LOT of smart friends (sons of oil execs, son of a Harvard doctor, physics engineering etc), but they are all too chicken to deal with rejection all day and being hung up on.

If you can get over getting rejected, hustle like a mad-man, and are semi-socially coherent you should do well.”

The Reality. Ownership & Equity Value.

“Better to be laying the first brick of your own pyramid… than being paid to lay the last one for someone else” – @WallStPlayboys… While it sounds like a cool comment really think about the numbers behind it. It was said for a reason. That last brick being laid is essentially the 1% of all positions (Careers). How many people will be an elite investment banker? How many an elite coder? How many an elite sales person? Well the numbers don’t lie… 1% or less. So how is that relative to your option of building ownership and creating your own company with *equity value*? Pretty similar.

Notice. We’re not saying any of the recommended paths are easy. They are not easy. Luck, skill, effort and emotions made of Kevlar are all necessary for any path… This is the same for starting a Company. The question is… where do you want to draw your line at being rich? The doctor? He’ll benefit by starting his own practice. The Lawyer? The same. The Banker? If a real killer… the same… So on and so forth. No matter what without the amazing power of ownership (equity) you’ll unlikely go north of ~$5 million. If you do? Well that means you likely got there due to added time – such as company management positions.

Building Equity Value: The misunderstanding is that we’ve all been taught to think about money in annual income. That is not smart. When you’re building annual income you can never sell it. Let that sink in. If you’re a managing director at an investment bank you cannot “sell” your career to a director and collect 5x earnings or $5M on the sale (there is no sale!). This is 100% false for an actual company. In fact as it grows the multiple typically expands! Why? It means it’s more likely stable and less likely to fall off a cliff depending on the sector.

As an example, if Joe decides to start a company in college he likely earns less than he would as an employee at any of the three careers. Long-term? He can win by a large margin. If he were to start earning just $50K in year one but end year 18 with a business that generates $5-10M a year? Forget about it… He won even if he saved $0 the previous 17 years. The reason? He can sell that Company for a multiple and immediately become a deca-millionaire.

That Thing Called Risk: Time and Time again we get the same twitter rant. “Other people have different risk profiles” and we can’t help but laugh. We would like to see how many people enter any of the above careers that actually make it to $4-5 million (you’ll see that number fall off a cliff, otherwise the number of High Net Worth Individuals would be better than 1%!). Do the quick calculation.

Step 1) The number of people earning $465K+ is 1%… remember this includes people above the age of 38

Step 2) The number of people who save 50% is going to be significantly lower than this (less than ½ of the people earning $500K will save 50% of gross income)

Step 3) The number of people who have a smooth sailing path as outlined above is less than 10% of those entering the high paying positions… likely closer to 5%.

Step 4) The number of people with a chance at even following the career map is therefore 0.025%

Wait a Second… So even if we make more aggressive assumptions… Less than 5% of the people in the top 1% of net worth work in careers? That is correct. Take another look at the math and you’ll see that is how it works. Take all the numbers and re-calculate them. Take all the assumptions and make them more aggressive (quite difficult) and you’ll see at bare minimum… 90% of people who really make it (top 1% net worth) did so through good old fashioned ownership (equity value)

What is more risky now?