The Q&A section will be held right here on this post (IT IS NOW CLOSED). As usual it will work as follows: 1) leave your transaction ID *in* the comment we will manually delete it before approving, 2) you are allowed one question on any topic excluding personal finance which will be covered on January 1, 2018, 3) since we will be done with selling a business and the book… Q&As will be available every single month during 2018 for all purchasers (only need to purchase one book either Efficiency or Triangle Investing to participate) and 4) the Q&A will only be open for 48 hours closing at midnight Sunday the 26th. This should be good news for everyone reading this blog since we can now answer all the primary questions with two products and respond frequently to personal questions on a monthly basis. Everyone wins and we get to avoid taking a loss on the blog for 2 years in a row (thank god!). Now lets jump into the topic of the day, re-balancing a portfolio… or what we call, reinvesting in each asset class.

Portfolio “Re-balancing”

We made a comment about “never reducing dollar exposure” and got immediate criticism. This was music to our ears since the opinion flew right in the face of *conventional* advice of portfolio re-balancing on an annual basis. Since our blog caters to more ambitious individuals, with enough knowledge of differentiated investment vehicles you can certainly increase exposure to almost all of your assets on an annual basis. Triangle Investing focuses on the three major categories in 2018: Stocks, Real Estate and Crypto Currencies. These are the three areas to focus on based on our current demographics (20-40 range). That said we’ll also touch on cash and bonds at the end.

Crypto Currencies: This is an uncorrelated asset class with high risk and high reward. The most valuable piece of this asset class is that the vast majority of people don’t understand it. When a new security is mis-understood it means that price discovery has not taken place and the asset is not priced correctly. If you want proof of this you can simply buy a couple of the recent books on the topic… They are not very good! Suggesting that the value is only in sending money overseas or “digital gold” misses the point by a wide margin. Again. This is an opportunity for you as it acts as a high beta play. We find it odd that people who tout high risk at a young age tell people to avoid a high risk high reward assets that can be understood by reading a few thousand pages of white papers.

Since crypto currencies are here to stay (we’ll explain in detail in our book) the value proposition is going to create a wide range of opportunities and risks. Look no further than the scam ICOs (90%+) that are being launched on a daily basis and the mis-pricing of legitimate software code (blockchains being used correctly).

Now… how do you make sure your exposure on a dollar basis continues to go up if an asset can correct by 50% overnight? The answer is in cash flow and allocation. For example, if you’re a younger investor with $500K in assets, you can likely create an income stream of $40K or so per year (8% returns are doable for someone with niche knowledge). Since we know an asset such as crypto currencies can decline by 50% this means your exposure should be around $20-30K. Why? Well if it corrects and you’re certain in the value of the crypto currencies you’ve purchased you can dollar cost average into the dip. This still leaves you with $25K+ in excess returns that can be reinvested into stocks/real estate or bonds.

Real Estate: This asset is used for your monthly cash flow. With that sentence alone we’ve probably given away the type of real estate we would recommend buying. Essentially, if you can take on some leverage (Use Other People’s Money) and generate monthly cash flow by collecting rent checks, you’re able to dollar cost average into a multitude of projects. You can either save up for the next real estate property or you can invest in stocks, bonds or crypto currencies. The crypto currency exposure is not the same because it does *not* print money for you. The real estate asset does. Cash flow then allows you to re-balance aggressively.

Lets say a young investor has done well and now has real estate exposure generating $2,000 a month. This number may not grow much, but the stable returns allows him to either 1) build equity in the home, 2) invest in a new asset with leverage and 3) take the money and “re-balance” by buying other assets. By doing this with your real estate returns you never have to sell any of your assets. Selling and re-balancing just triggers more and more fees which can range from 1-3% depending on what you’re selling and re-buying.

Stocks: No doubt in our minds that prices are elevated today. That said, having exposure to stocks is a near necessity to remain balanced and several boring ETFs offer good dividend yields such as Vanguard’s High Dividend yield ETF (VYM). If you’ve got niche knowledge you can also invest in the trends that you believe are long-term in nature (artificial intelligence, move to social media from mainstream media, robotics, virtual reality and more). By investing in the companies that should grow over the next 10 years combined with a stable dividend portfolio… the long-term rate returns should be in the high single digits.

Cash and Bonds: The last group we’re putting together. As a person gets older they become more and more risk averse since they worked for many years to amass a large net worth. If you’re truly in a category where your annual income (active money) cannot offset declines in your investments, then you’re looking at a bigger and bigger cash/bond position. The problem today? The returns are simply horrifying. Making 4% and only seeing 3% or so on a post-tax basis is barely keeping up with inflation. Until you’re unable to offset big corrections in the market we’d simply build a small balance that increases by a month of living expenses per year. As an example a person who has been working for 10 years should have 10 months of living expenses or so.

The Obvious Catch! Why do we believe that you can increase exposure to all asset classes consistently? We assume you’ll be making more and more money from ages 21-40 or so! Call us optimistic but it is definitely possible. Once you run the math you’ll be surprised to see that it is possible to increase your exposure to all items assuming that your income is growing and you’re diversified. Lets take a look at the math.

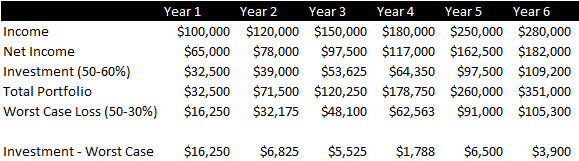

The first part is earning more money, we have you increasing your income from 100K to $280K over 6 years. This is not easy for your standard person but we’re talking to YOU a person who is going to go into a high paying career and start an online business as soon as possible. Not only that, but if you take the numbers down lower it doesn’t change anything since its about diversification and the amount of money you can re-invest every year.

The second part is the Net income after tax (self explanatory and we keep it at 35%) and the more important idea is that you’re saving about 50% of what you make. Every two years you’re going to try to increase the savings rate by about 5% (you’ll still be spending more money, but your savings rate goes up). This makes it possible for you to live a better life every two years (upgrade) while saving more money on a percentage basis. Your cost of living increases go up slower than your income.

The next part shows your total portfolio amount each year (assumes zero gains, making the income part of the equation much more achievable). The last and final part is the “worst case scenario” where you make an assumption on how badly the portfolio could decline. Since we assume zero gains, we think it is achievable to take your worst case scenario from a 50% loss (high risk when you start) down to a 30% total loss by year 6. Below you can see how there is always a positive “difference” number when you compare the Re-investment to the Worst Case (calculated by taking Investment minus Worst Case)

To put this all together, you already know what we’re going to say… Earning more money is significantly better than trying to save more. You will save more naturally since you won’t have time to burn the money and you will be able to *continuously* build your net worth. Now if you get to $20M+ we have no doubt it will be next to impossible to offset a 50% reduction in investments… Unfortunately we are not there yet! For fun, we’d say it is possible to get to ~$700K in annual income for anyone reading this blog (if they are serious). Using a 20% correction as a “worst case scenario reduction” for a diversified group of investments this means you can amass a portfolio of at least $1.5 million or so before you’re even worried about big stock market corrections. If you want to get more conservative you can add to the bond/cash exposure and suddenly you can go up to $2M knowing that you’ll increase exposure across the board! We have no doubt lots of people will hate this post but that’s fine, we’d say it’s better to focus on making more money than poking around doomsday scenarios where everything is down 75%+. And… With that we’ll leave you with a favorite quote of ours “The more money you make, the more risk you can take”. That is why the rich get richer!