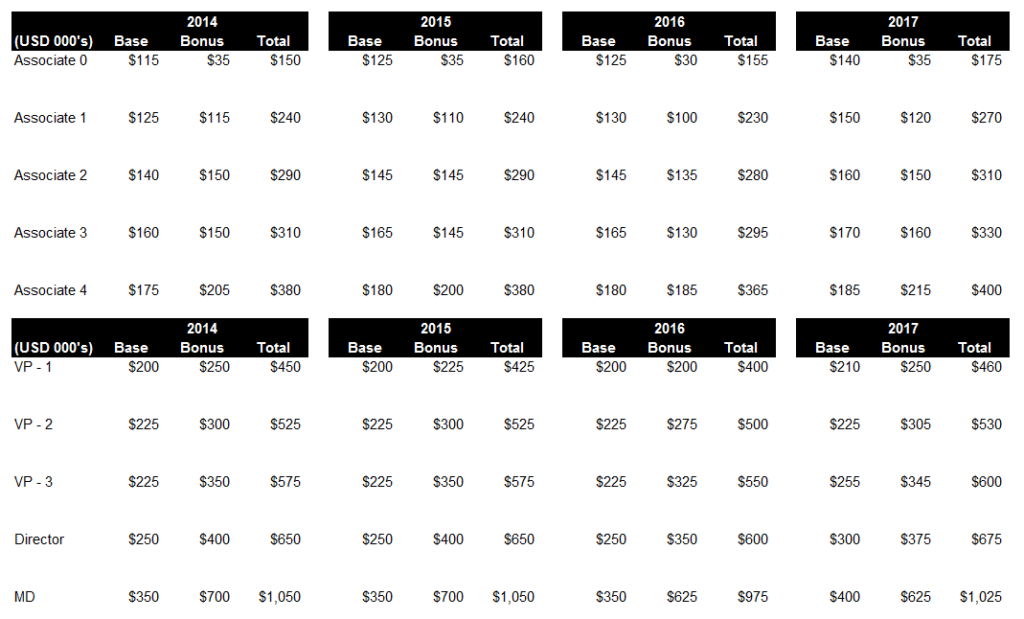

We are updating the total Investment Banking compensation numbers for 2017. Excluded from this overview is investment banking analysts as the variability has not moved much. Simply put an investment banking analyst should make $155, $180K, and $205K in years one, two and three (plus or minus $5-10K depending on how good or bad the bank did). The reason we have excluded the exact break out of base and bonus is two-fold: 1) analyst base salaries are a bit less standardized now with $85K being the rough mid-point, 2) the bonus is being adjusted to match the all in compensation numbers of ~$155K, ~$180K, ~$205K. We made similar points last year, the only adjustment really is that most banks have moved to about 85 Base/ 70 bonus for the good analysts for a first year payout (as usual 100% of base as bonus is reserved for the top-tier performers). Perhaps add an extra $5K to be safe this year given that results were up slightly.

Budget Setting and Bonuses: As always, bonuses are set in Q4, despite being paid out around February-April, so it is relatively easy to get the Street range, this year bonuses will be up ~6-12%. This is better than expected with results actually going up relative to poorer results last year.

Not much has changed in terms of base salaries (we’re adding a small amount to gross up the average) and bonuses were up decently this year. This year the industry should be up ~6-12% on the bonus line, we’ll take a slightly bullish stance and unless you’re at a struggling bank we assume up 10% would be more than reasonable.

Overview: Generally, the lower level (excluding new hires who have only been around for 6 months), will see less volatility. Banks view junior employees (anything below Vice President) as fixed costs so they typically don’t see much volatility. As a reminder we’re attempting to build a picture across the Street which includes everything from bulge brackets, elite boutiques and middle market firms (excluding the tiny shops that have limited deal flow).

If you look at the numbers, you’ll see that the real money is made when you’re generating revenue (Vice President, Director, Managing Director). This is because Wall Street is no different than playing in the World Series of Poker. We’ve said this before but it needs repeating.

No one is going to get rich working as an associate and you’re only making money at the revenue generating role and more specifically once you close a few deals (Directors typically have brought in some money). In addition, once you reach Director level or even Vice President you’ll quickly realize starting your own company will make you more money than working for someone else (hint, hint, hint, never put all your eggs into Wall Street).

If ~$300K seems like a lot of money, look at the real math. If you live in a major city like NYC, then you can roughly assume you get ~$65K per $100K gross made. This means you’re getting $16.25K per month. Rent alone is going to run around $5K if you’re living in a good part of town and the rest of your living expenses will usually approach $4K a month or $9K in spending per month… Saving $80-100K a year isn’t going to get you anywhere soon. Once you hit $500K or so, then you’ll see an inflection as a single person because you can put away $200K+ and not see much of an impact to your life style.

Before the Outrage Hits: We realize the numbers here seem high for those that are not used to Wall Street. We have a few important points: 1) the stress is significantly higher as you’re on call 24/7, 2) while the hours are higher… no you don’t work 80 hours a week as a revenue generator… not even close, 3) the fund raising market will see significant pressure due to crypto currencies and ICOs in the future and 4) always remember that cost of living matters quite a bit when looking at these income figures.

How Do You Calculate Your Bonus as a Revenue Generator? You will get around 10-15% of what you kill. This is the rough math and makes all those occupy Wall Street people scoff and get on their knees. To generate a $1M bonus you’d need to bring in $10M to the top-line at the firm, roughly speaking. This is certainly not an easy task and most people will get stuck in the $300-400K bonus range where they get some small deals, sign up some retainers, some poison pills, some fairness opinions etc… but never really get the big money.

Nothing has Really Changed… The number of slots available has continued to shrink on a relative basis. The roles remain unchanged. Analysts and Associates stick to supporting the senior staff and the Associates with sales skills are shoulder tapped to become Vice Presidents if they have the intangible skills necessary to generate revenue. The Directors are usually stable and keep angling for ways to become Managing Directors without getting fired for trying to steal clients from the current MDs… the MDs continue to chase the biggest deals possible and angle for becoming the head of investment banking. Oh and we are going to reiterate. Remember to follow the rules in Efficiency if you’re going into banking. If you go into the wrong group you won’t make much money and will be unemployed sooner than later.

The Buyside is Still Seeing Pressure: For another year, passive investing has outperformed active managers impacting the number of roles on the buyside at hedge funds & mutual funds. Private Equity has seen low rates help their investments (this may change if rates continue to go up) as cheap money has improved the ROIs on investments particularly if the debt is set at a fixed rate. Interestingly, just now the Fed increased the interest rates making the math harder to make sense.

Key Way to Avoid Confusion: If you’re looking for one line, just assume you’ll be up 10% at least on a “like for like basis”. Given all the base salary changes we adjusted them throughout all levels to reflect the evolving environment. This means some of the totals look better than the other ones depending on *when* the base salary was moved up for the group. Also, remember that getting a promotion usually leads to bigger jumps and if you were simply going from associate 1 to associate 2, not much happens and that would be reflective of a “10% like for like” jump (IE: an A1 to A2 associate last year made about 10% less than this year).