If you’re young and broke, you’ve got a better chance of reaching $100M+ when compared to someone in his 40s with a million or two to his name. This is because the older person has much more to lose (likely has high expenses, Career to give up and many other ongoing costs). Oddly enough, we’ve noticed that many people don’t get to even $1 million largely because they spend at the wrong times, ramping up their expenses when the ROI doesn’t even show up. So we’ll go ahead and highlight some milestones on when to do a lifestyle upgrade.

Basics: Someone in their early 20s shouldn’t have high expenses. The expectations of you are low. You don’t need to go to the club and drop $10K on bottle service. You don’t even need to spend a lot of money for entertainment purposes. Using the classic example of a “date” you can easily get away with going to the beach and drinking wine/beers. This is entirely acceptable since no one expects a 21-24 year old to have a lot of money.

Another interesting psychological note that we think goes unchecked. Even if you do make good money, there is no point in showing it. Generally speaking, people do not like it when you have “more money than you should”. If you want to experience this first hand, it is quite common to get “bad looks” on your first couple of business class flights. They look at your face and assume that you have money from “mom and dad”. Instead of being annoyed by this social taboo, use it to your advantage and simply upgrade when you realize you can upgrade your entire lifestyle.

The underlined section is critical. If someone decides to upgrade their lifestyle in sections, something always appears off. If they buy Gucci shoes, but don’t own their own apartment… this doesn’t make sense. If they do buy an apartment but can’t afford to go out to a decent dinner ($100 a person), this also doesn’t add up. From what we’ve seen the people who end up with a lower net worth despite having high incomes try and upgrade in “bits and pieces” versus overhauls every 3-4 years or so.

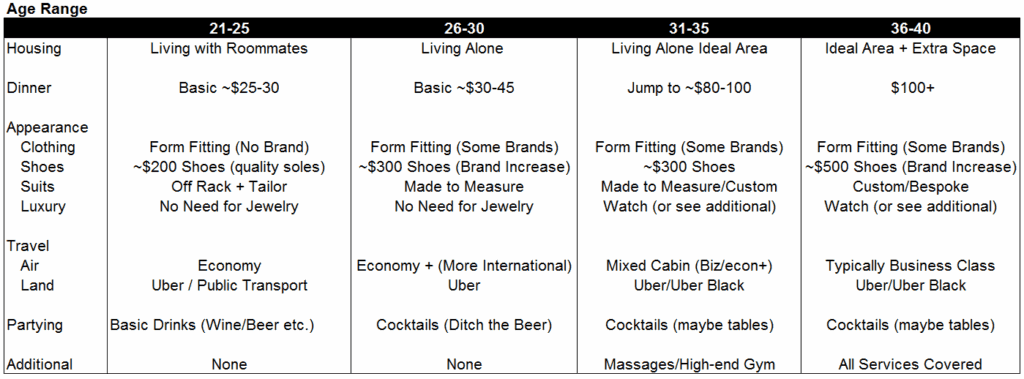

For the sake of starting a debate here, this is a rough outline on how to increase spending and what we would consider the bare minimum (major city).

Age 21-25: Our blog targets people in the 21-35 range for a reason, it’s the easiest time to get rich. Most people will overspend because they are making a few bucks (~$100K/year) and think they are now “rich”. This is when a smart person will realize that spending at such a young age is largely a waste of resources. If you’re going to spend all of it then you’re going to negatively impact your social life. It sounds counter intuitive. But. If you’re trying to show how successful you are when you’re young, all it does it damage your relationships with older successful people.

There are always exceptions to the rule but a good rule to follow is “No one wants to see someone younger than them (or the same age) succeed”. If you follow that basic rule you’ll realize why people are so competitive. They truly believe if you’re the same age as them you are somehow “equal” especially if you meet for the first time in a neutral setting.

This was a long introduction to say that “you should spend like you’re a young graduate”. This means you shouldn’t even bother upgrading your life through your early 20s. Even if you hit it big (and many of you will) by age 23 or so… There is no reason to spend a bunch. Why? The ROI is just too low. For what it’s worth we’ve found that age 27 or so is the inflection point and by 35 you can essentially do whatever you like.

With this backdrop we’d say a good framework is to live with roommates your first 3 years or so, 21 to 24 years of age. You can eat at basic healthy places and avoid going the bottle service route (bunch of college people chipping in to sit around a cheap bottle of vodka doesn’t have a high return profile). Find some basic brands that fit your frame and spend more of your time building revenue streams.

Treat the first 3-5 years after graduation (if you went to college), as a very difficult video game. You want to live as cheap as possible because it’s socially acceptable (take advantage of it!) and you won’t have much time to do anything else besides build revenue streams and go out a couple times a week. Finally, no girl you’re interested in will care if you live with roommates under the age of 24/25. If she does care… not a good catch anyway.

The Financials: Roughly speaking, in an expensive city, you’re looking at rent of around $1,500-2,000. Your food costs and drink costs should run around $1,000. Then you’re left with another $1,000 for transportation, a vacation/trip and miscellaneous costs. This will get you to around $70-90K in gross annual income being spent. If you’re a banker you’re essentially saving your bonus. Unless. You’re a smart banker who created a second form of income adding a few thousand dollars a month and growing.

Age 26-30: To reiterate, the chart is just a guideline. Some people may end up living alone a tad earlier but our point is that around this age bracket it starts to damage your social life. If you live alone at age 26-30 this is going to help your social life the most. You don’t need to buy anything or upgrade to a massive high-end apartment, all you need to do is live in a good area of town alone. If you’ve taken your early 20s seriously, you should have two solid forms of cash flow (at least). You should also have a good amount of money invested which means the income you make from investing (stocks/real estate) should add another “0.25x”.

Pausing here, a solid form of cash flow is something that covers all of your *necessary* expenses. This should be 1) rent, 2) food/drinks and 3) utilities (internet included). If you’re in this situation it means that you’re able to invest at least ~50% of your income into new ideas, stocks/bonds/real estate etc. Also. Our 0.25x assumes that you’ve already done this. You should have some investment income coming in that results in about 25% of your total living expenses being paid for. Ideally it is higher (closer to 50%) but 25% is a good minimum goal to hit by this age bracket.

From a social perspective, you can still get away with a relatively basic lifestyle. Instead of trying to “flex” on everyone at this age, go ahead and fly under the radar again. The reality is if you try and push hard into the spending category you’ll run into big competition (guys in their 30s) with 2-3x the spending power. It just isn’t a fun game to play. We’d recommend taking this time for a lot more traveling and simply upgrading the venues a tad.

If you travel in this age bracket you’ll know what countries are enjoyable. You’ll have a better feel for your own personality and you will get a lot more life experience. Some of them will be good (learning a language) some will be terrible like getting robbed or tricked the by locals in some form.

The Financials: At this point, you should be putting significant distance between yourself and your peers. The chances your peer group took the time to build a second stream of income is under 1%. Seriously. Under 1%. Your lifestyle is going to upgrade at the same rate as everyone else. While they got income bumps of 20-30% like you did (Career), they will spend it all to upgrade to this next tier of living. You on the other hand, had a 100%+ bump since you created a second form of income.

The monthly spend goes up a bit but nothing crazy, the two biggest benefits to your social life will be 1) living alone and 2) the change in suits from basic off the rack clothing to made to measure (at minimum). Each month you’ll spend about $2,000-3,000 on rent, $1,500 going out, $500 on traveling and $1,000 on the rest. This gets you into a range of about $5,000-6,000 a month or low six figures in spending per year (gross income basis).

Age 31-35: This is where the “money hose” turns on. Compounding is an amazing mathematical phenomenon. If you’ve gone through and followed the rough 9-10 year guideline you should be set. You should be worth well over a million dollars and more importantly your cash flow is now over 3x what you can spend in a year. If you were spending about $5,000 a month, you’re likely making $15,000 a month net at this point (again could be much higher depending on how hard you worked).

The best part about this age range? It becomes acceptable for you to be “well off”. If you check into your business class flight, you no longer get a strange look from the passengers. No one believes you were a spoiled kid who inherited money and you can drive a nice car/wear a nice watch without any social repercussions. The only downside of this age bracket? You’ll get a lot of questions about how you were able to “make it”. Just deflect them and say it was luck since there is no point in having these conversations with people your own age (“No one wants to see someone younger than them (or the same age) succeed”.

Now the fun part begins, since you can cover 3x your old living expenses you can easily decrease your multiple to ~1.5-2x. This means you can increase your spending to at least $8,000-12,000 or so per month. We don’t know about other people, but if you’ve got $10,000 a month to spend and you’re a single person… you’re doing well practically everywhere. This is 100x more true if you’re location independent. Even if you decided to work a Career, major cities are quite easy to live on with five figures in monthly spending (~$200K gross a year).

Depending on how you want to change your life, essentially you move to the “ideal” part of the city for you. If you were there already? There is no reason to move. The next two biggest upgrades will be your flights (moving to business class at all times possible) and the change to services (freeing up hundreds of hours per year, cleaning/cooking/stretching etc.).

The Financials: Each month you’ll spend about $4,000 on rent, $2,000 going out, $1,000 on traveling and $2,000 on the rest. “The rest” is quite variable here. We don’t know if the person decides to buy a home. They could rent and live a location independent life. They could also give up traveling because they love the city they are in. We just don’t know. What we do know is that the flexibility is there and the gap between you and your original peers will become so wide it becomes uncomfortable. The good news is that the other people who made the correct life decisions will stand out like Ferraris parked in front of a 7-11 (obviously out of place!). These individuals will end up being your new normal contacts.

Age 36-40+: We’re only putting this section in here as a bit of a warning sign. When you start getting closer to 40 or so the “assumption” is that you did make it. This is the exact opposite of the beginning of the article! When you’re young people assume you’re broke and give you a pass. At 40? People assume you’re rich and don’t give you a pass for anything.

If you want to continue going out frequently it’s much more likely that there is a “group” environment associated with it. While there are always exceptions to the rule, it’s more likely that a rich guy will show up with a group of people versus solo. The times you’ll see him going into a club alone are next to zero. You’ll find these individuals go into cocktail bars, hotel bars and other nice venues alone but the clubs are now reserved for pre-planned events since the days of going out hard all night are slowing down.

The Financials: Ideally there shouldn’t be any checking of any spending at all. If you want something you get it and move on.

Key Conclusions: There are a few interesting conclusions here. First: Spending a lot of money can actually hurt your social life. Not only does it make it harder to get rich, it doesn’t make your social life much better. Second: If you make it financially it is smarter to build out that passive income flow from real estate and stocks before turning on the “money hose”. You’re going to be well off buy still relatively young so you can be a bit more cautious. Third: All of the age brackets are certainly guidelines. If for some reason you make it to $10 million by age 30 for example… you can just jump the spending to the 40+ level since it’s irrelevant. There is something odd about turning ~30 years old, where spending is no longer seen as taboo. Fourth: your social life will change. This is not something that is preventable in our opinion. If you’re not changing social groups over time it usually means poor decisions were made. Attrition alone will take your original group of colleagues and dwindle it down to 1-2 of them. The good news is the other people who made it will stand out. Fifth: money is just a tool. Unless you make it to huge numbers of $20M+ it’s hard to tell the difference between someone spending $15,000 a month and $20,000 a month. This is why your preferences will change quite a bit (working less) unless a large opportunity presents itself.