We are going to take an extremely complicated subject and attempt to make it understandable to anyone. We will fail miserably at this given that it’s our first attempt at describing the idea. In this case we’re using the readership as our Guinea Pig so thank you for reading! Essentially, we are going to walk through from start to finish and explain how markets are not efficient along with how they are becoming more inefficient through the use of ETFs.

The Beginning

Efficient Market Hypothesis: In basic terms, the efficient market hypothesis states that it is not possible to outperform the stock market because “all share prices reflect all information”. This means as we sit here today, every single stock perfectly reflects the value of the underlying Company. Now if someone is an efficient market hypothesis believer we can look at both historical examples and current examples today to prove this is not the case.

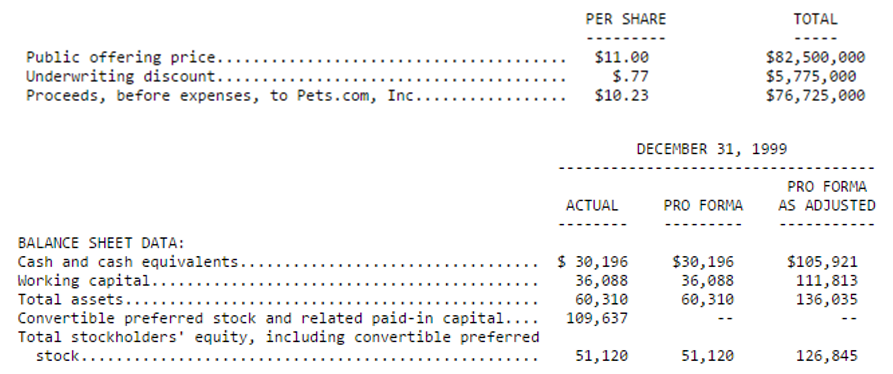

Historical Example Internet Bust: We’ll start by looking into the past. During the Internet bust there was a Company called “Pets.com”, it is now infamous for being one of the biggest disasters in Internet IPO history. To keep it simple, the Company generated $619,000 in revenue (that is thousands of dollars not millions) yet the Company raised a total of $300 million dollars (yes million not thousands). More importantly, while the Company earned $619,000 per year in total sales it was also spending millions of dollars leading to a total cash flow burn in the millions. Please take a look at the photo below from the Pets.com IPO.

To avoid deeper explanations, here are the basics… The line that says “Proceeds, before expenses, to Pets.com” is essentially how much money would be added to a checking account: $76 million dollars. Not only that… but the checking account already had $30 million dollars in the bank (see Balance Sheet Cash and Cash equivalents). Now the checking account has $106 million dollars which is shown in the Pro Forma as Adjusted column. This sounds great because if the Company is going to see that checking account go up in the future, the total value of the Company is well above $106 million. The problem? It’s losing millions of dollars… quickly.

Fast forward a little bit (a little bit over a year to be exact) and after losing tons of money there is practically no money left in the checking account. No problem… they will just go and ask for more money to put more cash into that checking account. Unfortunately? No one wants to put money into that checking account because they believe it will never actually go up in the future. Therefore, the Company goes under.

We’re not saying that you should never invest in a company that is losing money today. Far from it. We’re saying that the “Efficient Market” was unable to correctly value the future cash flows of Pets.com. On a small scale, if you created a website that lost $50 in the first month, it does not mean your website/idea is going to fail. The same applies to any large company that is currently losing money. If it can get to positive cash flows in a timely manner or raise funds easily, it will be around for a long time.

The Efficient Market hypothesis defenders will say “Hindsight is 20/20 it would be impossible to predict the failure of Pets.com if you were an investor at that time”. Well, that is what was said about the real estate pop… and a few geniuses *did* figure it out and made hundreds of millions of dollars in approximately one year. To emphasize this point, they did not “guess” they went directly to the source of information and found the underlying issue with the real estate market and made millions. While it is true that 99.99% of people could not figure out the underlying issue, saying that the top 0.01% could not is factually incorrect based on the data. While we will unlikely predict the next major crash or boom (would never claim such a thing) saying that 100% of people cannot do this? We’ll take the other side of the bet!

Fast Forward to Today

Assuming we’ve convinced you that markets are not 100% efficient, we’ll begin to tie this to the market today. If you’re still convinced that markets are 100% efficient we have no problems with it, we’ll simply agree to disagree. This will prevent the comments section from turning into a large scale debate. We’re being extremely careful with our wording using the phrase 100% which means every single stock and bond is currently priced correctly today to reflect all information. Not 99.99% but 100%.

Enter Index Funds and ETFs: We have long suggested that people dollar cost average into index funds. That is because over the long-term, we think the American Economy will continue to do better. This is not a new concept given that Warren Buffet himself has recommended this strategy. So if a recession happens and someone loses their money from an index fund… please send hate mail to Warren Buffet instead of a bunch of crazy people on a blog called “Wall Street Playboys”.

Back to the point. What exactly is an index fund or an ETF? An index fund/ETF is a vehicle that tracks the overall performance of a group of stocks. Using the S&P 500 as an example, if you invest into an ETF that tracks the S&P 500 you’re getting exposure to 500 different stocks. Remember, investing in the S&P 500 is not an investment in “America” it is specifically an investment in 500 of the largest stocks in the United States. If you wanted to invest in all American equities you’d have to buy somewhere around 4,000 different stocks and buy one share of each.

Now lets think about why this matters. If everyone decides to invest in nothing but index funds (take the case of 99%) it means that the market is inefficient. Why? Well if everyone buys the exact same stocks over and over again… no one is helping “correct” the market except for the 1%. Lets look at two basic examples using a smaller index fund.

In this index fund we’ll have four Companies (Pets.com, B, C, D). Since 99% of people have decided to become “cult like” passive investors all we are going to do is buy the exact same four companies forever. The people in the 1% sit and wait as more and more bids to buy keep coming in and eventually they capitulate and sell at an enormous valuation. The strategy is to simply click buy and forget about it so the passive investors don’t look at the performance of the companies. In short, there are millions of people hoping to buy 1 share of all four companies and eventually someone managing their own money decides to go ahead and sell it to them.

Pets.com suddenly loses a ton of money. And. The market did not recognize a change. Why? Since there are 99 buys coming in for every one sell, there is always a new person who is willing to buy this dying company (remember people are blindly throwing money into this fund). Put this together and you’ll see that while the stock price may function for a while… Does the current price reflect the true value of Pets.com? The answer of course is no. While Companies B, C and D may be solid companies, Pets.com is essentially obtaining money for free by issuing new shares to sell back to the market. As they burn more and more money, they just issue shares to the market to keep the balance sheet full of cash and go back to losing money hand over fist.

Now… lets move to a more applicable example since the one above is not realistic at all. There are approximately 2,000 ETFs in the market today (probably more). Lets call this index fund the “Candy Fund”. In this fund people get to invest in every single publicly traded company that makes candy (chocolate, taffy, gummy bears etc.).

Everything is going well in the candy fund until chocolate company #1 goes bankrupt due to accounting fraud unrelated to the consumption of chocolate. Now the ETF is valued at $45 since Chocolate Company 1 no longer holds any value. But wait… Should chocolate Company #2 be worth $5? Lets assume there were only two places in the world to buy chocolate… In that case chocolate company 2 is probably worth $10.

The problem? It’s still sitting there at $5 and when you buy an index fund you’re equally buying each candy company.

Now that everyone is thoroughly confused (we’re having a hard time putting this new concept into practice ourselves) lets think about what this all means in a few simple ways: 1) As more and more people invest in baskets of stocks, the underlying assets are receiving bids equally even if they deserve two bids instead of one. In the candy example, a smart person would happily pay $5 for the second chocolate Company. 2) In addition, as more people move to passive it also means that many companies are receiving bids that don’t deserve them. Pets.com is an example where there is a bid for an asset that shouldn’t be worth a cent and 3) Flipping this around, if someone panic sells the “candy fund” with billions of dollars, it will bring down the price of all candy companies even if one of them (say the company that makes mints) sees an increase in cash flow of 100%

Fast Forward to the Future (All Real World Items)

Currently, more and more money is flowing into passive investments (indexing). With our confusing examples listed above (hopefully it wasn’t that confusing) we can see that this will create market inefficiency. During the next downturn there should be a watershed of opportunities. As companies go bankrupt and other companies go public, there will be a large change in the securities held by each index fund.

We’ll go ahead and repeat that. Since there are around 2,000 ETFs today, many of these ETFs will hold the *incorrect* weight of stocks.

The second thing that will happen? We will see a lot of people become extremely rich. Why? Well… if more and more people are ignoring the entire stock market and believe they can never identify an opportunity… That by definition means there is more opportunity for YOU. If you are an expert in say real estate you’ll want to study every single publicly traded real estate ETF and Company. If you’re an expert in oil and gas you should spend a good amount of time studying oil and gas ETFs and the companies held by each ETF as well. As we move forward, if any particular ETF continues to go up in value that just means more and more opportunity for you during the next recession.