What a crazy time to be alive, we’re seeing interest rates go down, unemployment levels drop dramatically and the top 10% of earners are actually seeing wage *compression*. That last part is quite shocking as it implies a bigger shift to “two economies” predicted quite a while ago on this blog. Either way we’re sticking with the same old 2021 likely a down turn unless something drastic happens. In case people attempt to “troll us” in the comments we’ve done exactly what we said we’d do. Dollar cost average into index funds since 2011… Bought Real Estate… Bought Crypto… and ended with some fun individual bets on stocks. For the entirety of 2019 we’ve only put money into two things: 1) crypto and 2) cash. That’s it. So to emphasize, no we did not “sell” as there is no point to selling unless we see a significant down day. If we sell stocks we’ll let everyone know. This means our stock positive as a “dollar basis” is higher, but as a percent of net worth is much lower as all money earned this year went into cash/crypto. Now onto the post.

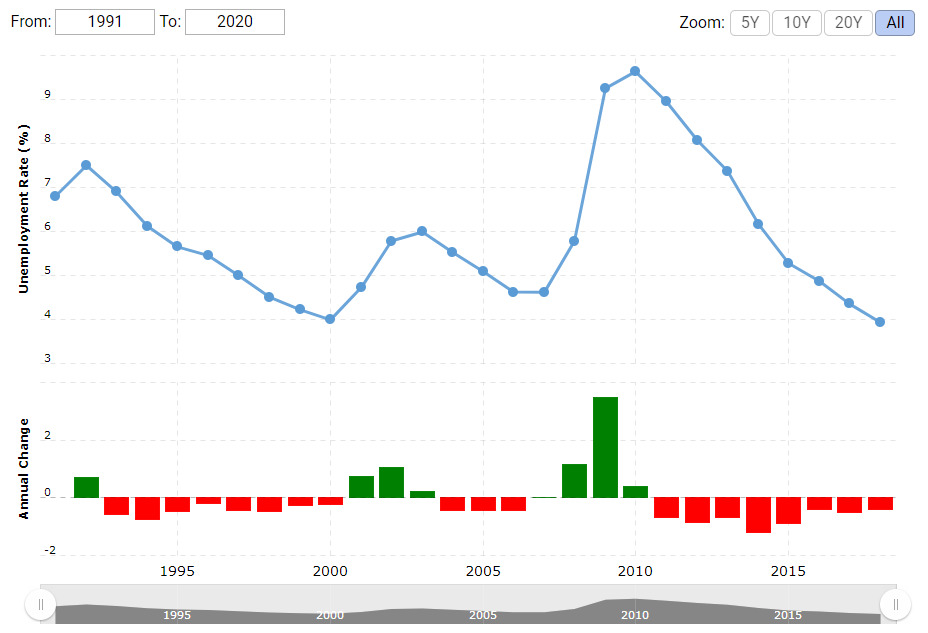

When Breaking Records Isn’t Good: When everyone is bullish you should be bearish and when everyone is bearish you should be bullish. This is the same old theory thrown out by Warren Buffet who suggests buying when there is “blood in the streets”. A good indicator of overly bullish scenarios is the unemployment rate. This rate is currently set at just ~3.7%. That’s an insane number from any perspective. In the year 2000 it was just under 4%…. (followed by dot-com bust)…. In the year 2007 it was around 4.6% (followed by the real estate bust) and now it is 3.7%…. lower than both of those previous lows.

Seems like an obvious sell? Not quite, you have to also look at the rate of decline of the unemployment rate which is still severe. When it flattens out, that’s the time to get out. If we look at the numbers when the rate of declines slows it means that unemployment can’t really move much lower. Then the bottom falls out and we go into unemployment hiking territory. Don’t get us wrong, recessions are awful and ideally we never see one. That said, the chances of “never seeing one” is basically zero especially if it has been over a decade since a downturn.

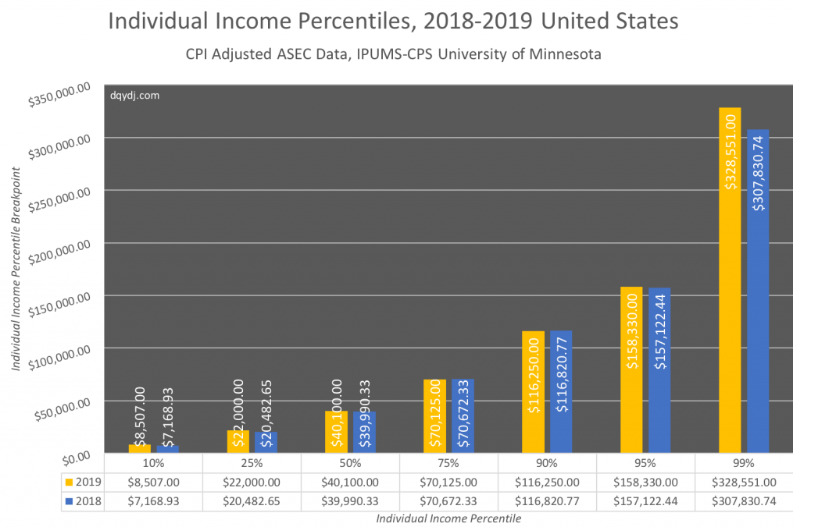

Wage Compression: This is an unbelievable trend that we thought would not occur for some time period. To be in the top 10% you have to earn *less* than you did a year ago. Which is absolutely insane to think about. It means that we’re seeing wage compression for high earning white collar jobs in addition to regular pressure across the middle class. We have no problem saying we got this totally wrong. We thought for sure the top 10% would at least be fine, but it appears that you need to be in the top 5% to really make it! This is such an interesting stat we’re still having a hard time thinking through the long-term consequences. The one clear one is that people will become extremely class aware going forward. When people are seeing buying power go down they wear it physically on their faces and body language while those who are not will have a hard time “hiding “.

Taking a look at the chart above, we see that buying power went down for every single segment excluding the top 1%. Now sure we can argue that $20.5K to $22.0K was a big jump… But it’s more likely a rounding error similar to the move in the bottom 10% (the bottom brackets always move around more due to the gig economy, minimum wage changes etc.) When we look at the 50% to 95% range… Nothing really changed from 2018 to 2019. That’s quite an interesting trend as the cost of goods is certainly going up over time. Sure. People can come into the comments and say there is “no inflation” but simply ask yourself “Am I paying the same price for everything from 5-years ago?” We all know the answer is that things got more expensive. Meanwhile the top 1% saw a notable increase of ~7% to $328K.

Before moving on, we realize these are national numbers. If you live in high cost of living areas such as New York, Los Angeles and San Francisco, the Top 1% number moves up to $500,000+ and the median moves up closer to $70,000-90,000 or so. That said, the trend is actually similar in high cost of living areas. After an initial increase in income (5-7 years after entering work force) the numbers flatten out and you either make it big or you’re stuck in the center. This is why you see a lot of people in the $150,000 – $200,000 range with a huge age band of 25 – 40 years of age.

Declining Rates: Unsurprisingly the fed has started to cut interest rates by a pretty large amount. People will look at the numbers and say “1.875% is not that much different from 2.40%”… But. It is a huge change. The reason why it looks small? The average person looks at it from a small numbers perspective. If you’ve got a $100,000 loan and it has interest payments of $2,400 a year versus $1,875 a year, this unlikely breaks the bank for most people.

So why is it a big deal? It’s a big deal when you look at the percent change and use large numbers. If you’ve gone from 2.4% to 1.875% that is a rough 22% decline in the interest rate. Now… run these numbers on a very large sum of money. Say $10 trillion dollars? This means the total interest payment would be $240 billion versus $187.5 billion dollars or a whopping $52.5 billion.

Yes we have simplified the concept quite a bit, that said, if a 25% decrease doesn’t sound like much just look at all of the prior recessions. Generally speaking, the Fed has attempted to begin cutting rates in advance of an official recession. This occurred before the dot com bust and before the global housing crisis. Some historical facts, in the late 2000s the rate was at 6.5% or so and went down to around 5.4% before we entered an official recession (-17% decline in the rate). In July of 2007, the rate was around 5.25% and declined to about 4.0% before we were officially in a recession (-24%).

Now onto the more important item, since we know the fed is attempting to cut before recessions it’s a good idea to time this out. Between the first rate cut and official recession in 2001 was about 15 months. Between the first rate cut and official recession in 2008, it was about 6-7 months. For fun we can look at the early 90s as well where it was around 14-15 months. With this rough math it implies we’ve got around 8-16 months from October of 2019… This puts us into June of 2020 to February of 2021. (Now you know why we expect a downturn by 2021 or so). Funny enough, this is more anecdotal, however this blog now gets more page views on the posts about spending money (clothing etc.) vs. earning money at this point. A significant shift from just 3 years ago (generally not a good sign as it means people think their wages now are “normal” versus significantly inflated when compared to mid-economic cycle wages).

The Positive News: As always, crisis is just another word for opportunity. We’ve said that for years and are excited for the next downturn (if it comes) since it’s the easiest time to make it into the top 1% or top 5%. Think about it like this, if everything is crashing down, it means assets are not priced correctly. Look at stocks and real estate for the most ludicrous mispricing back in 2008-2009.

The bigger positive news? If you’re worried about making money, this is your time to strike. It is undeniably the easiest time to secure funding and to find a niche market. We’re not saying that the market will last. But. If there is an obscure niche market like the fidget spinner craze, you can make out like a bandit in a single good year. No one really does the math and all you really need is one or two good years for your life to change. If you were to save $500,000 after taxes (one event income) due to a clean strike when the iron is hot, it would lead to $2 million dollars in value in around 14-years assuming you simply earn money to pay the bills during that time frame.

The other important item is that “talent goes on sale”. Since large companies are littered with politics and other riff raff, when a downturn takes place it is quite easy to find talented people at a reasonable cost. In raging bull markets (like the one we’re in), you have many people overearning or quite literally doing nothing as headcount ballooned and management lost sight of the department.

This Money Making Game Shouldn’t End: Another fun math exercise we ran through is how quickly people can fall out of the 1%. This is an important thing to recognize. If you take your foot off the gas you will fall behind QUICKLY. Not slowly. QUICKLY. So lets take a look at these rough numbers. We include home value in all calculations of net worth to keep it simple.

In the Age 30-34 band, to be in the top 1% you need a net worth of $925,000

In the Age 35-39 band, to be in the top 1% you need a net worth of $2,307,000

In the Age 40-44 band, to be in the top 1% you need a net worth of $2,865,000

In the Age 45-49 band, to be in the top 1% you need a net worth of $9,666,000

In the Age 50-54 band, to be in the top 1% you need a net worth of $14,745,000

Take a look at those numbers. The only time the numbers seem to decelerate is around the late thirties to early 40s band as the cost of having a family likely weighs in on results. That said, the numbers are extremely clear. Even if you’re in the top 1% at age 30, there is no guarantee you’ll be even close by age 45-49. Assuming that money doubles every 7 years, if you had a million by the time you were in the 45-49 band… it means that you only really have $4,000,000 so you have to come up with a $6,000,000 spread. If this doesn’t prove the point that winners continue to work after becoming rich… we don’t know what will.