We’ve covered a lot of topics here on this blog and we’ll attempt to put two together in this post. Essentially this will help explain why some of the information appears to conflict. It is largely due to timing, since your financial stability, age and location determine what makes sense for you at a certain point in time. To make this come together, we’re going to make comparisons between what your regular person does and what a future successful person typically does. Reminder. Our view of success does not mean “money” since we would never trade places with a rich old, out of shape, overweight, boring guy with a miserable personal life (no friends either).

#1 Instant Gratification Trap: This is essentially the very first trap that regular people fall for. In a rare case, we have empathy here since people are targeted at ages when they are impressionable (14-20) or so. They are sold a dream that if they lever up with debt, they will go on and get a 4 year degree that grants them a good paying job/career. Fast forward to 2018 and we know with certainty that this is not true at all. Many people with college degrees are the same people working at Starbucks, Retail Stores and Restaurants. They don’t have a choice since their debt went towards a degree for a school that does not have high quality *exit opportunities*

Your typical successful person will see through this trap. They will go through the weeds and figure out the following: “Does this actually lead to higher income streams”. If it does not, then why would someone spend 4 years drinking low quality beer to obtain the degree? No logical person would. To emphasize, we realize this is quite a tough task for your typical teenager since they don’t have much life experience. And. This is why there is such a large separation at age ~20 or so between the haves and have nots. We don’t make the rules here we just adjust to them. Here is an older post that is still relevant on how to operate the college system.

We have used basic math formulas to decide if the education is worth it. Simplistically, we think it makes little sense to take on debt unless you’re positive that it can be paid off within ~1-2 years. If you’re already working, then you would also include the opportunity cost of your work. For fun, at this point in time, our recommendations haven’t changed from the older post. One thing that has changed is we would recommend coding boot camps now. The high quality programs that require significant commitment to both obtain acceptance and complete lead to high paying careers as of this writing.

#2 The Stress Trap: Assuming someone was able to avoid the first trap, the second big trap we see people fall into begins around age 22. They usually have the exact same friends they had in college/high school and are attached at the hip. This leads to similar group think where they seek out other people who have also known each other since high school/college. Similar to smart people thinking alike, regular people also congregate in the same areas. This is typically highlighted by the striped t-shirt un-tucked with jeans out at the bars.

Now what is the stress trap? It is essentially the endless cycle of drinking 4 days a week gaining weight slowly but surely as the savings rate stays at around 10%. Instead of focusing on the issue (which is time lost due to “social obligations”) they continue looking for ways to squeeze more income out of the Company they work for. They incessantly talk about trying to interview to a new place. They incessantly talk about trying to make an extra 5% working for someone else. This creates a lot of stress since the Company is never incentivized to overpay relative to market wages. Constantly worrying about how to squeeze more income out of the P&L usually leads to… you guessed it! More drinking and low quality socializing to “relax”. Our favorite comment of all time is the people who say “oh man it feels great to drink a beer after work”… every day… in front of a TV with other people who just barely made it through the week. In short, the signs of incorrect decision making surround *survival* if the person gives off this vibe you know it’s time to smile, nod, agree with their issues. And. Avoid them in the future.

Naturally, we have less empathy for this group because they are trading the highest amount of energy they will ever have for a few beers and low quality comrades. This is entirely controllable and should be recognizable. The smart person in the group looks at his situation and reassesses it. Sure you don’t want to give up your entire social life. But. You don’t want to tread water because of it. Instead of going our constantly, you find any source of secondary income over the next 3 years. People think this needs to be a massive number, but it doesn’t. It just needs to create a buffer room between you and your stress levels. One distinct inflection point was getting enough money to pay for the 8 nights a week of going out (Thursday/Saturday). Once your online revenue is paying for your social time, you feel less guilty, you drink a lot less and it doesn’t create any stress (was funded by income unrelated to your work).

#3 The Leverage Trap: Here is where the big change in net worth occurs from what we have seen. Your average guy is barely saving money and is worried about the *expense* line. Therefore? He looks directly at his cash outflows which will read: Food, Rent, Taxes. You sure can’t avoid Taxes and saving a few dollars on beer during the week won’t do much. So. He goes down the “buy a home” path. While this used to be a good idea back in the day, buying a home without an investment return in mind doesn’t make a lot of sense. Even professionals who work in real estate are not going to put 80% of their net worth into their primary residence (doesn’t make any sense, all eggs are now stuck in one basket). Funny enough, if the person really messed up, he won’t be able to afford the down payment in the first place and will only talk about the dream of buying! (which he shouldn’t do)

The successful guy has already tasted blood at this point. If he spent 2-3 years building another income stream we have no doubt he is clearing at least $1-2K a month. This is peanuts but it’s all he needs to see. Why? Well if this income stream is perpetual he just needs to repeat it a couple of times and suddenly he’s looking at $3-6K… $6-12K… etc. Instead of worrying about leverage and his “rental payment” he’s busy looking for ways to pay his rent without levering up (i.e scaling his small ideas). This leads to a big change in belief systems. The successful person believes in generating and creating to obtain more, while the regular person is focused on squeezing the expense line to create headroom. Unfortunately, the regular person doesn’t realize that debt payments cannot be missed and if his income ever goes down he’ll be under water quickly.

At this point we’ll do a short recap. Both people are around 25 years old. If the person is levered up with $100K+ in student debt he’s likely already in a big hole. If the person avoided this big initial trap, then he’s spending too much time hanging out at low quality bars meeting other mediocre people. After that he looks at the amount he saved and tries to “squeeze” more juice out of it by levering up, only to lock himself into one region with no way to exit the contract easily. Contrast this to the successful person who is debt free and is now generating some solid side income.

#4 Building on Sand: At this point you can see that the regular person is building on sand at this point. Since the structure is not stable (debt, one form of income) a single minor shake up and the whole building collapses. Naturally, this is when most people feel the strain of potentially starting a family (typically several years too early). From what we’ve seen the standard move is to get married at around 30. These are relatively smart guys with high quality careers but minimal other items going on (not rich, not dead broke either). The problem? The infrastructure hasn’t been built so they are essentially trying to put more items into the house that is built on sand.

At this point the successful person is rocking and rolling. His friends have changed quite a bit since he is able to go out whenever he wants. Monday night? Sure. Wednesday? Maybe, but Thursday is usually reserved for yoga class and XYZ sport in the morning. So on and so forth. The difference between these two people become quite enormous at around this age because of the income disparity (typically 2x income disparity). If someone is in a middle tier city they are clearing $200K while their old peer group is at $100K. In larger cities you could double both of these numbers as an example. With such a higher income disparity, buying that basic home/apartment now looks reasonable and the money isn’t needed to reinvest in any business at this time. (goes ahead and buys).

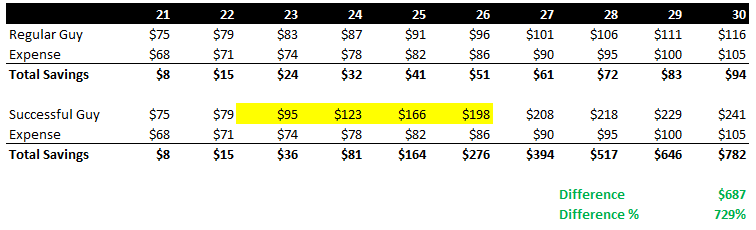

To illustrate this look at how the income difference adds up assuming this is essentially what happens.

Now look at that difference! It is insane really. With one good decision of finding a way to create another stream of income that equals his current career, he is now $687K richer than his peer making a difference of 729%. There is no other word to use besides insane. They spend the exact same amount of money each year and yet one guy is well on his way while the other person followed the “save 10% every year rule” and got nothing out of it! Note, we didn’t even include a 5% annual investment gain and if we did the numbers would be significantly worse.

#5 Scaling the Spending: At this point the lives of the two individuals couldn’t be any more different. One is looking to get by with an eventual family to start while the other person is just now looking at his savings and saying “buying a home would now net me return without investment gains”. This couldn’t be more different since the purchase for the successful person will have an immediate ROI positive impact and also improve his quality of life.

Now it gets really uncomfortable because the successful person has to avoid telling people how he lives his life. You don’t want people to know you’re spending half of your income (significantly more than you used to spend) partying, traveling and taking up new hobbies. Instead you’re going to have a natural “glow” that says you’re set and don’t have any worries. Funny enough, this is around the point when you believe in “women’s intuition” because they can sense it as well and recognize you’re better off than most. For the younger readers when you hit 30-35 let us know if you see the same thing happen.

Everyone has a different reaction to this new life but we wrote a pretty solid post on this topic called “End of the Road”. These are the common threads to be cognizant of. You end up having much *less* to talk about because there is nothing to complain about. Generally speaking 90%+ of conversations is just some guy complaining about something to you. You won’t be able to relate so you’ll avoid these people. In addition, your spending becomes very inconsistent. Sometimes you feel like partying hard and drop a lot of money on alcohol. Other months you don’t feel like going out at all and spend your time in the gym and going for hikes/running on a beach/traveling to a new city. We really don’t know what you’ll do but we do know that it sure won’t be “normal”. As a dead giveaway, if a guy is over 30 and randomly decides to take a “quick trip” internationally, he is probably rich. The only people who do these things are people with money and a lot of free time.

#6 Health Trap: Now we’re moving onto more serious issues. Many people will be filtered out by this point. They are already in the regular person camp. The bad news? The game isn’t over! Some people do everything correctly and still fail in this category. When you’re 20, your body can take a beating so you invest that energy into work/secondary income streams etc. If you try to do this at 30-39 you’ll look horrible. We still get a good laugh out of people who think “all people who work 80 hours a week in their 20s will look terrible”…. Then why do rich people live longer? It just doesn’t make sense and is a horrible argument to justify being lazy and broke.

Moving on here, at age 30-35 or so (rough range for making it), health becomes the #1 factor. Your hormone levels decline, your body needs more rest to recover from minor injuries etc. Many people let it fall apart here and pay for it with future hospital bills and doctor visits. They essentially missed the point. The point of getting rich was to 1) live a fun and healthy life and 2) use it as a tool to get anything you dreamed of. If you’re simply getting rich to get rich, all you will have is a bunch of digits sitting in an account that don’t add any utility to your life.

We’ve given away the health answer here many times but for completeness the answer is the following: 1) extensive flexibility training, 2) high quality vegetable and fruits, 3) low carbohydrates, no sugars except on special occasions, 4) decreased daily alcohol intake – besides, who would respect a blacked out person over the age of 23 anyway?, and 5) removing stressful relationships despite potential income stream – focus on lower maintenance higher quality clients.

#7 Personal Life Trap: It still doesn’t end! Then there is the personal life trap. If you want a perfect example of this just go into any major investment bank or law firm. “The boss is calling” typically refers to a significant other they are no longer in love with. This is why many *financially rich* but unsuccessful men live lives of quiet desperation.

This will be a shorter section since you’re reading this blog anyway. Anyone who can withstand more than a few short weeks of posts will likely understand the reality: never allow for governmental contracts in your personal life. Simply ignore all the hatred you get for living by this rule. You’ll be better off for it and we have 100% conviction that it won’t impact your life at all. In fact, it will make it better. You’ll filter out every single person who was only interested in a family if the dollars were there as well. Before moving on, as usual, we’re not again having a family as it’s a personal decision. We’re against getting the government involved (increases taxes and adds zero upside for you).

#8 The Argumentative Trap: This is another one we see (more common with people in their 40s for some reason). The need to “prove someone wrong”. Despite already being successful and rich, there are a few people who avoid all seven major traps but feel the need to “sell” their idea to someone else. We don’t understand it. We go with the smile, nod, agree and ignore route instead. This allows you to avoid conversations with people you strongly disagree with. Why? To an outsider you both look foolish and this doesn’t help you at all.

We’re not sure how to really fix this trap but it causes a lot of grey hairs from what we have seen. Arguing with people when you’re already set is quite comical. The worst of the lot are the people who throw passive aggressive comments towards other people who are set. We don’t even know what they get out of it but your best move is to agree and amplify the comment. The good news? Usually the people stick in this “need to prove they are right” camp have failed in #7 (typically have a bad personal life so they make up for it with condescending commentary). Instead, take the high road, have a good laugh. Agree with what they have to say. Delete their number and go back to meeting people you want to spend time with.

#9 The Attention Trap: We’ll write our most controversial comment here which won’t surprise anyone who has been reading for a while. The one thing you’ll learn after succeeding is 90% of people are essentially worthless. That is of course a harsh comment but doesn’t take way from reality. If you worked in a restaurant you know employees and customers steal food/items. If you make bets with people don’t’ expect them to pay up when they lose. If you hire someone, expect a sub-par job. If you incentivize someone to screw you for $100 when they would make $200 over the next year, expect them to screw you due to short term thinking. This is one of the realities of life. After all, these are the same people who think diet pills are going to make them skinny and buy well marketed caffeine pills with guarana.

With that paragraph out of the way, the last thing to be aware of is the trap of “needing” attention. If you find yourself trying to impress other people, the game has been lost. If you find that you’re only showing your cards when needed… The game has been won. Since this is confusing for people who are not rich (yet) we’ll provide an example. If you’re going out dressed extremely sharp and don’t talk about it, you’re in the clear. While you are displaying wealth in some sense, you’re not going out of your way to flash it. In another example, if people ask about money and you blurt out that XYZ is not enough or XYZ doesn’t matter, you’re going down the wrong road. All you’re doing in that case is showcasing that money is all you have. It’s a clear line to us at this point in time but is likely unclear to people who don’t have much money. Putting it another way, if you have to make it obvious you’re well off, you’re doing it wrong. If people can figure it out without big signs (like a lambo) you’re doing it right. Another good example would be being well known at a high-end restaurant. Any bright person would realize you’re doing pretty good if you’re eating an expensive place every week.

#10 Risking it All: The final trap is risking it all. When you make it, you get a rush of “immortality” and believe everything will go your way. Don’t worry, lady luck will happily strike that idea down. Instead of trying to risk it all you should only take more risk up to a point where it is not relevant. We can’t even count the number of people who have failed risking it all when they already beat the game.

To keep it simple, if you need $10,000 a month to survive forever, you’d never take that income out of boring assets: dividend stocks, bonds, CDs. This level of cash flow would essentially be set in stone and never moved. Never. No exceptions. The remaining money can then be used to blow on anything you’d like. It can be risky investments, parting, traveling, buying a boat/island in extreme cases etc. None of our business to be honest. The key is never risking it all because you don’t want to replay the game.

Concluding Remarks: Putting it all together you see there are really about 10 major traps, they become less and less life changing as you get older but they are always there. A simple way to think about it is “Financial, Health, Personal, Mental”. These are how the traps are laid out. First the system is set up for you to fail financially, then they target your health and personal life followed by mental traps to keep you grinding up the totem pole (for money you don’t even need!). There is nothing wrong with the money making part just don’t become those insecure guys with nothing else to live for but a few extra digits in a bank account that will go to charity.