Housing remains as a major topic on the blog so we’ll go ahead and do a short break down on how to think about housing. We are putting this post ahead of several much longer posts due to the continuous stream of questions. We caveat this with the premise that we believe young people should not bind themselves to a home as the ability to switch jobs or even cities at the drop of a hat is a major benefit to a young renter. Until you are ready to settle into a single city, your time and mobility should take precedence over a few thousand dollars saved from equity built in a home.

With that said, our readership seems to have quickly shifted to a much older crowd beyond college aged students so we’ll run through the basics on the math.

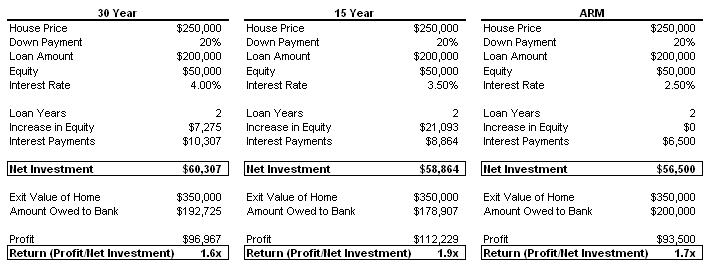

Price Appreciation: Assuming that you are searching for price appreciation as the main vehicle to increasing your net worth, flipping a house is the most viable option. Flipping a house involves renovation and adding value to the purchase price. Simply put this is a leveraged buyout transaction where you are accumulating debt, adding value to an entity and then selling the property within a few years at a premium to your original cash outlay. The problem here, is that many people do not run the math on the asset and instead simply stick to 30-year fixed mortgages which actually offer the lowest ROI.

As you can see, if you have the cash flow, a 15 year loan is typically much more lucrative. Always run the numbers. The difference between a ~90% return profile (1.9x multiple) and a ~60% return profile is drastic particularly as the number move higher.

Why? This does not even include the additional cost of home renovation so you quickly eat into the 60% number making the returns dismal.

When you really run the numbers you find that even an interest only ARM may be a much better opportunity for you relative to a regular 30 year fixed mortgage as you’re incentivized to quickly flip the home as your return on equity is higher.

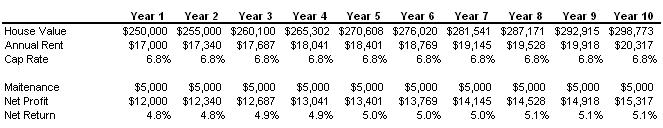

Rental Income: Ideally you will have both rental income and price appreciation within your financial model for a home but we’ll go ahead and speak to it separately. The quickest way to understand the numbers, without going in over your head, is to look at the cap rates (Net Income/Property Value) in the area you plan to target. As a rule of thumb major cities tend to have poor cap rates, this should make you lean towards being a renter, while large suburbs tend to have cap rates that are significantly higher.

Now for another practical example, a rental income property can certainly make positive long-haul returns as the inflation gains on the home will outsize the inflation impact on your net investment. With that said elongating your horizon can increase your return profile if you are covering your payments with direct rental income. If you take a look below making modest assumptions you see your net return slowly expand over time by a few bips.

Savings: Assuming that you are older and you plan on settling down in a specific location for a long period of time (using 10 years as a benchmark) ownership now becomes significantly more attractive as your payments are flat-lined while rental costs in your area, more likely than not, increase with inflation over time. In addition, if you can make your first net interest payment equal your current rental payment the decision becomes much easier as you save ~35% out of the gate on taxes alone. For an additional layer of safety you can add another 20% to the calculation to make up for any home maintenance costs.

(Initial Monthly Payment to Interest*1.20) < Current Monthly Rental Payment

At this point, you’re paying rent for no good reason and you are better off buying a home, again assuming you’re ready to settle down in a city.

While this breakdown is short in the future we will load up elongated posts on the topic, but before you begin thinking about such investments run the back of the envelope math. You cannot be afraid of leverage and become rich (ARM example) and you cannot simply look at a single financing option for all use cases (similar to an LBO model). Run the return on equity number across your return profile and you’ll likely be surprised at the results for various financing options.