The most common question we receive nowadays is how to allocate cash if you’re going to live the bachelor lifestyle into eternity. This is going to be the first part in a series of posts where we will cover each step in more detail. However the three main steps are broken into two pieces: 1) The initial framework to financial independence, 2) Ways to obtain higher income and 3) Ways to swing for the fences when you’ve got extra money on the sideline.

1) The Framework

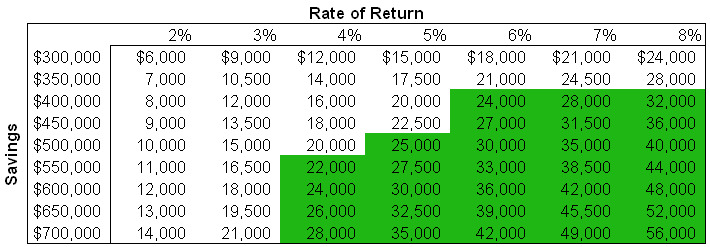

The name of the game is matching investment income to expenses. We’ll call this the relaxation point. If you’re correctly living your life as a minimalist we’ll earmark the number at $2,500 a month. Yes this is a low number but if you’re a perpetual bachelor it means that you can live quite a nice life in Thailand while you work on your other businesses and you will be free to work any job that you would like. We repeat, you are free to do as you please. How much is needed to generate $2,500 a month? Lets take a look and you can decide for yourself what amount of cash flow is necessary.

You’ve been tricked.

Look at the chart very carefully. Notice a major problem with a regular savings account? You have no chance at financial freedom with a savings account unless you have over $1.4 million in cold hard cash. If you’re trying to become rich and you are putting your money in a savings account you better be a risk taking entrepreneur because even a man of above average intelligence is going to have next to zero chance at amassing $1.4 million dollars in his thirties by having an investment return of 2%.

Lets make another assumption, lets say you understand that your body is going to slow down and you know you’re going to be half the man you were in your 30’s by the time you hit your late 50s. Not a PC comment and do not care. We are all going to get old so your goal is to maximize your happiness when you are able to enjoy it and at the same time set yourself up for a decent lifestyle in your 50s and 60s.

Assumptions are set. You’re in a race against time to obtain ~$450-550K in net worth, if you don’t have it by around thirty you better start grinding hard. For simplicity, we’ll use $500K as the watermark.

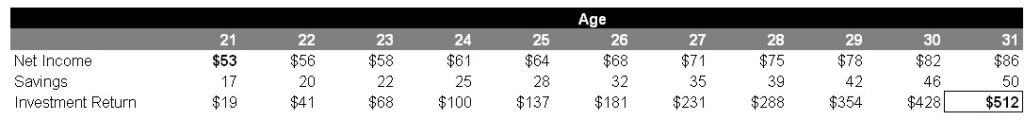

Obtaining $500K: Sounds like a lofty number doesn’t it? Not really. Long-term returns of 7% are not out of the question. The trick is that long-term means you’re ignoring your emotions by dollar cost averaging and you are not going to sell a single security or bond. Ride it out. Diversify, dollar cost average, diversify, dollar cost average. Play the game like a robot. Here’s how quickly you get to the five handle. We will assume that you are able to increase your income by ~5% on an annual basis, generate returns of 7% and you can live on $3K per month.

Boom. You’re already at $500K and you’re only 31 assuming that you choose your career wisely. Your first job out of college, out of trade school etc. will more likely than not determine your entire financial future. We already know the $53K net figure will be attacked however it shouldn’t. $53K a year net implies $80K per year gross.

You see the path and it takes 10 years of dedication to get there.

How to Earn $80K?

No doubt many people believe this number is too high. Lets flip it around. You know that a starting salary of $80K will give you an amazing shot at early financial freedom so lets start with how someone can obtain an $80K salary instead. No you won’t be working 40 hours a week and no there is no short cut to making a high income, you will pay a price: 1) mental effort, 2) endurance or 3) physical effort. If you do all three, well you’ll likely beat the 31 years of age mark by a country mile. Remember, you are young and you are in your twenties, the world is yours for the taking since you should be an energizer bunny at this stage in your life.

Mental Pain (require top tier schooling and grades)

High End Finance: Investment Banking, Private Equity, Sales and Trading, Equity Research, Hedge Funds.

High Consulting: Boston Consulting Group, Bain. McKinsey

Engineer: Google, Facebook, Twitter, Salesforce.com, lets go on and on and on with hundreds of tech companies. $80K out the gate

We know you’re saying “but what if I can’t get any of these jobs”, well how about this:

Endurance Pain (grinding out the hours)

Air Traffic Controller: Requires minimal education but is high stress

Accounting + Bartending: $50-55K a year + 2.5K a month on the side, you’re at 80K

Healthcare + Online Business: Trade schools are only 2 years long and can offer starting pay in the $50-60K range, you get a full 2 year head start and in addition… you can start a simply health website that will generate a few thousand dollars a month.

Now you’re saying these dual jobs are not practical or you cannot go into the top tier trades. Fair enough.

Physical Pain

Firefighters/Police Force: No risk no reward, will clear $80K. If you’re complaining about a few thousand dollars in difference we’ll simply respond that it won’t take you four years to get the job also… government pensions anyone?

Dockworkers: Manual work. Gruelling. Notice a trend in effort and income? $80K+ out the door

Now that your spirit is uplifted simply join one of these groups. There are hundreds of ways to make $80K a year. None of them are for the following people though 1) lazy, 2) uneducated or unwilling to do manual labor and 3) negative personality types. No matter what you do you’re going to have to put in that grind, it’s going to come from a mental standpoint (getting to a top tier college and top grades to go to Wall Street), physical standpoint (dock workers, firefighters) or from a longevity standpoint (working multiple occupations). Anyone reading this post can make $80K a year.

Final Note: Do not take a job for minimum wage no matter what. If you’re younger than 20 you can pick up a book and read how to fix iPhone screens and create a small time business fixing drunken mistakes in a major city. Do not work for minimum wage for anyone.

3) The Home Stretch

You’ve made it to $500K: Congratulations. If you run the rule of 72, when you hit 40 you will have $1M dollars in the bank. Welcome to the top 2% in the USA (there are roughly 5 million millionaires in the USA) and well into the 1% world wide. You’ve won the game and you’re just now hitting your stride as a man. Lets get cracking on some real wealth creation shall we?

That $5 handle is sitting on the sidelines and you won’t touch it. Close the book it is time to move on to bigger ideas. You’ve got 4-6 years left before you can really take the pedal off the gas if you feel like it. How do you capitalize? Well here are some interesting ideas to get you started.

Venture Capital/Private Investments: Now that you are saving ~$50K a year from your current job, no matter what track you took (we simplified it to 5% increases in salary), you can take some calculated risks. With the world becoming increasingly internet driven you can begin angel funding investments or purchasing shares in the private market. What does this mean? It means you’re swinging for the fences on a Mike Tyson level knock out punch. Generally speaking, most investment types will cause you to spend $25-100K to invest privately. That is fine because the goal is to take large equity swings with your annual savings since you don’t need more than $500K. You’re not searching for 5-7% returns anymore you’re trying to 10x or 20x your investment within the decade. No risk no reward it may go to zero.

Silent Investor: Use your additional cash to develop high level relationships. Similar to our post on politics how do you gain trust with wealthy investors? Well you invest with them and don’t pester them with questions over a long time horizon, once someone likes you the doors open a bit wider. With that said, Private Equity comes to mind as a decent idea, not to be confused with private investments (separate entirely). You create an investment consortium. You buy in as part of the takeout group and you sit and wait and wait. You’re looking for an annual rate of return in the high 20’s.

Lever Up and Fix it: Properties can be dangerous but he who takes on the headache will take on the profits. This is last on the three major ways to take a 5 figure investment and double or triple it in short order due to the level of stress involved. The premise is as follows: buy a high risk property, the risk can be associated with lower income tenants to major headaches due to a short sale or foreclosure… Put down a down payment heavy enough to move your rate as close to 3% as possible (generally a down payment at 25-33% of purchase price will do the trick)… take out a 3 year ARM you’re betting on appreciation…. Roll up your sleeves, or hire someone else to do it, and fix the underlying property (commercial or residential). Sell it, gunning for a flip of 50% of purchase price.

Concluding Remarks: Over the coming weeks we are going to take a deeper look into each step starting with investing your first pay check. We’ll walk through scenarios where things may go wrong and scenarios where you can adjust your portfolio for the future. One thing is for certain though, if you don’t get on the investment train early, it won’t be stopping to pick you up any time soon.