One common recommendation from personal finance “experts” is to save 10% of your income. Unfortunately this advice is absolutely awful and will make sure that you’re extremely far behind over a 30-40 year time frame. Why? Well the numbers only work if you expect to make the same or less as you get older. We’ll use the power of compounding and factual math to prove this out. To avoid any sort of debate over investing returns, inflation etc. we will use 5% returns. This means the 5% gains encapsulate inflation already so it’s an aggressive number (5% returns guaranteed for 39 years straight).

Saving 10% Works If We Assume No Lifestyle Improvement

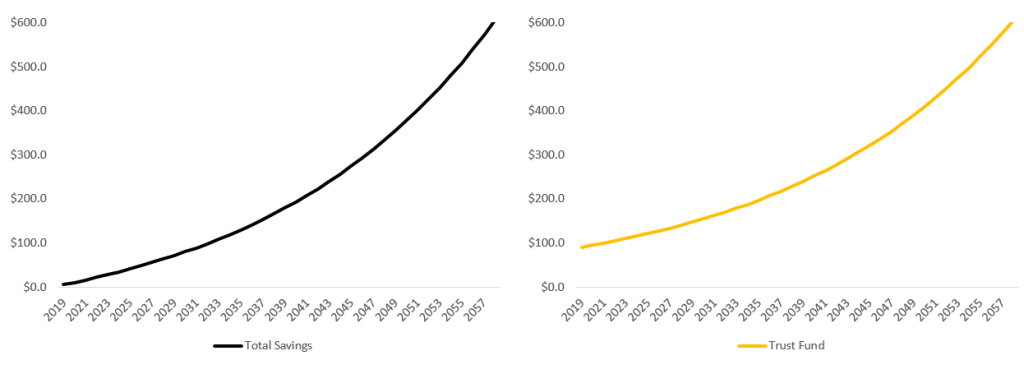

Save 10% – No Income Change: In this first example what we will do is assume that a person earns $50,000 per year. We will assume that they save 10% of their gross income ($5,000) per year for 39 years straight. At this point they should be at a nice retirement age of 60. The second assumption we make is 5% returns on that money for life. Anyone who has been through the last 20 years of stock market volatility knows this won’t be perfect. But. We want to make the picture as clear as possible. So we’re sticking with it.

What happens? In the first example, the math is extremely easy to run. What you see is that you save $5K a year, you spend $45K a year and your $5K annual contribution compounds at 5%. At the end of the 40 year run (39 years of compounding) you have $604,000. But… There is a problem here. The problem is that the spending number is actually $45,000 which means you have a multiple of just 13.4x. Since we know you need about 20x your living expenses to retire, you’re short $296,000. So despite saving 10% of your income from 21 years of age to 60… you’re not able to quit. You’d have to work until you’re 68 years old to pass the 20x number.

Wait what about social security and other inheritances… this could help fix the situation. While it is possible to make up the difference with social security and other one-time inheritances you *might* be able to pull it off. That said… Who wants to work for 40 years and live with a “might be fine” scenario. Not us and likely none of our readers.

The Power Of Compounding: If you wondered why Trust Fund babies don’t have anything to worry about… look no further than the power of compounding. If someone invested $90,085 in year 1 (2019 in this example) they would have exactly $604,000 as well. Instead of being shocked by this, it helps explain why having a career in sales or having a one-time *event* is so critical to becoming rich. The entire goal is to invest a lump sum as early as possible and forget about it so you don’t have to worry about saving money in the future (easier said than done of course!).

Saving 10% With Lifestyle Improvement is Actually Worse

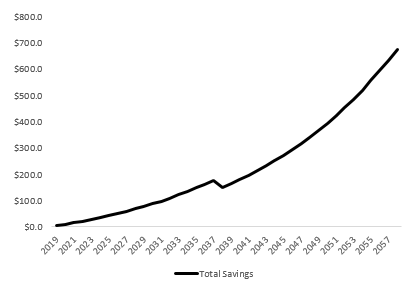

Save 10% – Grow Wage: In this example we’ll do the exact same math. But. We will assume that your wage actually increases over time. We have to keep the comparisons equal so remember our assumptions: 1) market returns of 7% which means an actual return of 5% after inflation eats 2%, 2) we assume you save 10% of your income and now 3) the new assumption is your wage grows at 4%, which is the average, or just 2% after inflation. In summary, your investment return in 5% (7% actual – 2% inflation) and your wage growth is 2% (4% actual – 2% inflation).

What happens? In this example the math is a bit more complicated but here are the numbers. By age 60 you’re making $108,000 per year and you have $805,325 to your name. Since you’re saving 10% it means your annual spending in the year 2058 is $97,413/year. When we apply that number through it means you have 8.3x your annual spending saved up. Wait a minute. This is a significantly lower number than the 13.4x you had when your wage was simply flat lined. The reason for this is that investment gains are outpacing your ability to earn. This has been the case for the average person for quite some time and also explains why the rich get richer while the poor get poorer over time.

The Problem: There are two common rebuttals with this math, first we assume the person cannot downgrade his lifestyle. This is entirely true and perhaps the person is slightly better off (meaning he could live on less). The problem? Well if we assume he can live on $60,000 instead of $97,000… this still leaves you with just 13.4x (essentially equal to the first example with a decrease in lifestyle). Nothing amazing.

The second rebuttal is that you’d save more as a percentage over time. This is true and is a legitimate debate point. The one wrinkle we’d throw in… we assume the person never had a set-back for a single year. Also. At age 40 earnings usually peak and it is unlikely to grow earnings from 40 to 60 at the exact same rate as from age 21-40. For fun… think about this insane stat… if this same person took a single year off (say at age 40) and actually lost money as he was unemployed (-$28,000) he would only have $675,000 at age 60 (***$130,000*** difference!!!!)

Too Much Math What is the Point

51% is Significant Acceleration: If you’re able to *invest* more than 50% of your income, even 51%, you’re seeing significant gains in your net worth of time. This is because you will not only put away a year of income, but more importantly, it means your standard of living is being forced upward without additional income. If long-term price appreciation (market return, real estate etc.) outpace your ability to earn… Eventually the switch will flip where your assets earn significantly more than your active income. This is an amazing cross over point and extremely difficult to achieve. But. If you put away over 50% it is a mathematical possibility.

Time Value of Money is *Serious*: If we assume you are happy with your lifestyle but you’re only saving 10% of your income… Now lets say one year you sell a business you were working on. It is sold for 10x your annual income. Boom an *event*. Assuming you do not spend the proceeds… you never have to worry about finances again. Why? Your savings just increased by a factor of 100x. Most people think their savings rate was only 92% versus 10% which doesn’t sound like much… This is not how you do the math. If you were saving $5K off of $50K a year, you incur an event at $500K, you just saved $500K/$5K = 100 years of savings in a single day. Make no mistake, most people who actually become rich have an *event* that makes their cash flow change for the rest of their lives. The reality is that you get rich in a windfall or by grinding out a large amount money over a *short* period of time.

We made this point in the first section. If the average person saves 10% for life (next to no one ever does), you’re better off receiving $100,000 at age 21 and leaving it invested for 40 years. You’ll have more money than they will by the time they retire. This is why money, like every other game in life, is rigged for the top. Actually… if you could earn an average income and somehow live for free (only 3-4 years) you’d be better off than saving 10% for 40 years. That’s how powerful compounding is.

Assets Have Been on a Tear: We have no real solution here. For some reason assets have continued to outpace wage growth for decades. This is unlikely going to change with automation, robots, artificial intelligence and more. The answer is to try and get as much money as you can up front and fast. Then you can build up that asset base faster than the general population and get well ahead of the eventual long-term climb in assets. To make sure we’re clear, we’re not positive on the macroeconomic climate over the next 2 years (so no change) but if you ask us about the next 30-40 years then we are certainly positive on future growth.

Increase Your Investment Rate Early: There was an overlooked comment from an anonymous person this week so we’ll share it below. Here is the link as well since we want to give credit where it is due.

“Want to share advice I wish I had to all the college students reading this. When you are earning income from a job, especially when it’s below 300k, comp numbers that seem very close on paper can be extremely different in terms of life impact.

In NYC most people spend about 100k pre-tax (60k post-tax) to live even as an analyst. This means that a 150k compensation will lead to 50k pre-tax in savings but a 200k compensation will lead to 100k savings. The amount saved in a year increased 100% despite income only going up 33%. This means a person working one year at 200k will save as much as a person working two years at 150k. It’s nuts. You even see this effect between 200k and 300k, it’s a 50% increase in comp but a 100% increase in savings (100k pre-tax vs 200k pre-tax).

This is why it’s so important to _maximize_ the income you are earning out of school. 100k is not enough as stated on this blog, you need to think of job income in two parts: (1) living and (2) savings. You also need to think of income in terms of _cash flow_ instead of just the dollar amount in the offer. If you have two offers: 1) Offer: 120k base + 50k annual bonus (~5k 6 mo stub bonus) + 0k signing; 2. Offer: 110k base + 45k/yr in equity vesting monthly over 4 years + 20k sign on.

#1 is a higher offer but #2 has much better cash flow. You can invest/use that 20k the day you start and will get investable equity every month. With #2 you will need to wait 18 months to cash in that 50k bonus and will be living off the base in the meantime. You can and need to _negotiate_ option 1 so that they offer a signing bonus. Even if it’s only 10k (half of #2) that up front cash will be incredibly useful out of college. Also, very few people negotiate for one-time aspects of comp (signing bonus, relo bonus), take advantage of that…. Much more can be said but those two points are key when picking offers.”

This is a fantastic summary. If you’re looking for one sentence it is this. When you’re in your 20s and even early 30s try to stack a ton of money up front as it will snowball you forward for the rest of your life. Most people try to play catch up and as you can see from our second example… one slip up and suddenly it’s a cliff not a hill that you must climb.

Don’t Waste Your Youth: The main point? If you waste your 20s you’re going to be climbing up a slippery mountain with jagged edges. If you waste time, you could be in an extremely deep hole for the rest of your life. Sounds daunting because it is. Look around and find the guys who tried to get it “together” at thirty and you’ll see they never quite get there. They are forced to scale back their living standards and options. You want your options to increase and your time to become more valuable, this is only possible if you don’t waste your youth.