As many of you may have noticed we have left the personal finance section of this site untouched as of late and that is for an important reason.

With that said lets go over the basics and the lies you’re being told by the media.

1. Buy and hold value only. Bad move for riches great move for protection.

2. Trading for quick profits. Bad move period.

Here is the problem with both of these ideas, if you’re looking to make real gains 100%+ over the course of a twelve month holding period, you’re not going to do it with either of the two methods above. It just doesn’t work that way. If instead you are looking to make small gains of 4-7% we have covered the buy/hold idea in a previous post and it works. But that is not the point of this post as the buy/hold position is a tool to protect assets. The point of the post is to explain how a person can make real money buying securities. Before we delve into that here’s the break down of why you are not going to make money “trading” securities so we can move onto the more important stuff.

1) Algorithms from major banks will eat your gains and losses (they can move in and out with shares in nanoseconds); 2) Trading fees will destroy your portfolio as those small tiny basis point charges add up – assuming you’re not rich yet; 3) The emotional breakdown of your own mind will work against you as it is significantly harder to be short a position (which you may need to do) or be down significantly in a single day, the human brain is not wired well for huge one time losses; 4) If you do make a profit trading, you will become addicted to the trades and over the long haul, even if you see 10% gains, you’re still losing out on large sums of money by not becoming a smart investor instead.

With the basics out of the way lets take a look at the arguments against having heavy positions.

1. Warren Buffet. People view Warren Buffet now as the “value-only” oracle of sorts. Fallacy. Lets take a look at his writings and realize what is really going on. The most important and often overlooked quote from Warren Buffet himself is below.

“I could improve your ultimate financial welfare by giving you a ticket with only twenty slots in it so that you had twenty punches – representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all. Under those rules, you’d really think carefully about what you did, and you’d be forced to load up on what you’d really thought about. So you’d do so much better.“

This does not sound like the Warren Buffet we know as a value investor today. The reason why he is seen as a deep value investor is due to his current position managing billions of dollars. If you have tens of billions of dollars you are now forced into a position of diversified long-term holdings. At heart Warren is in fact an intelligent investor.

2. Value Only. This method will generate gains. 5-10% long-term gains. The issue is this is not an attacking portfolio and is best used for those interested in protecting total assets that you are unwilling to lose.The final three words in the previous sentence must be taken to heart, when you are investing and “load up” as even Warren Buffet himself is suggesting, you cannot bet an amount you are unwilling to lose because your fear of losses will be too high and if it is volatile (cutting down 40%+ at times) you want to be iron clad strong in your long-term belief. Again we are not suggesting that value investing does not work, it does, but this method will not generate large returns. This is a downside of diversification.

3. Hedge Funds. The hedge fund argument is simply believing that average hedge funds will under perform value investors over the long-haul. Historically true. What is the problem with this analysis? It does not pick up the intelligent investors with a more liquid portfolio. Again, a fund with tens of billions of dollars may as well be a mutual fund at that point in time, instead we would need to look at more nimble portfolios. Again size can become a detriment to high exposure investments. With that lets take a look at Bloomberg’s list of the top 100 performing hedge funds and you quickly see… The highest returns come from relatively small hedge funds with $1-4 billion in assets under management.

1) Metacapital ($1.5B), 2) Pine River Fixed Income ($3.6B), 3) CQS ($1.5B), 4)Pine River Liquid ($1.1B), 5) Omega ($1.4B), 6) Odey ($1.8B), 7) Marathon Securitized ($1.2B), 8) Palomino ($4.9B), 9) PTG Pactual ($3.6B) and 10) Third Point Ultra ($1.3B)

Why is this? This is because a large portfolio does not allow you to invest heavily in a few ideas, at that point you are stuck to making a few calls on large sectors that can sustain a $1B+ investment. You’re approaching buy and hold investing territory and you are in fact becoming the stock market if you have tens of billions under management. In general, the best performers will be smaller scale and this should continue to reoccur in the future.

4. Mutual Funds. This one is a no-brainer with technology today, simply do not give your portfolio to a high fee carrying mutual fund because you can simply pick up ETFs or run your account at a low cost retirement planning portfolio. Notice the word retirement has come up here because Mutual funds and ETFs are vehicles primarily created for protecting assets.

Now that we’ve gone over the basic arguments against taking a heavy position lets look at what an extreme example of a heavy position would be:

1. Start Ups: A start up job where you acquire a decent amount of equity is essentially this “A high beta or risky growth stock that pays a dividend”. The dividend is your current paycheck. If the start up flops your dividend goes to zero (you’re fired) and your equity is worthless.

2. Moving All-in: The media enjoys showing stories of men and women moving into 100% exposed positions. What this means is they put every penny they have into a single stock. It flops. They go broke. This is then usually blamed on someone who told them to go all in and the finger pointing begins.

Now you might ask, how is going all-in less risky than a start up? Well the basic premise is that you’re going all-in at a start up with both your salary + equity exposure. On the other hand, with an all-in savings investment you still keep your job if you are wrong. This also explains why you see many “serial entrepreneurs”, once they land one correct move in a start up, they can simply venture into multiple start ups at once while using all their earnings from the original start up to have a diversified portfolio (buy and hold strategy).

So what is the solution? The best way to paint the answer to the question is as follows:

A man gives you 100:1 odds on a coin flip. If it is heads you win 100x your bet. If it is tails you lose it all.

How much do you bet?

As much as you can afford to lose.

This is really what the point of the article is. You do your work, research into a single idea and take one big bet where if you lose it all you are not dead. This way you can survive the psychological tugs if the stock is down 40% and also prevent yourself from selling it all if your position is up 30% when you’re playing for a double or better. This is a strategy for those who truly believe conventional retirement is just a scam.

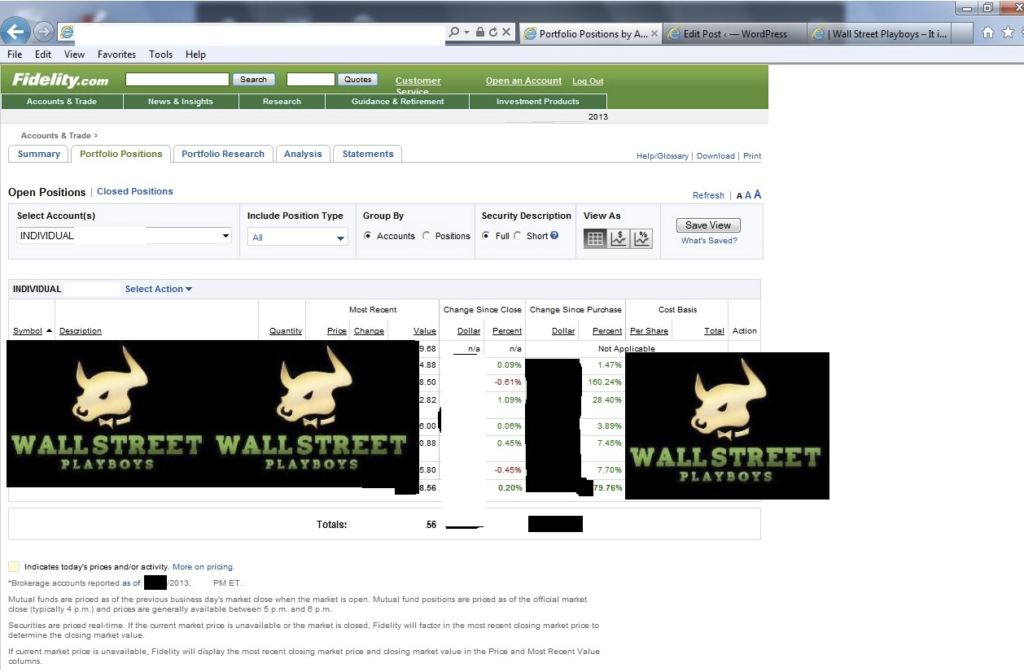

With that said, talk is cheap. Below is a screen cap of the 2013 year-to-date performance of one of our writers. Due to regulations we are not allowed to show any tickers nor pitch a security but without a screen cap we’re a bunch of liars on the internet (luckily we’ve found other ways to be vetted out as well).