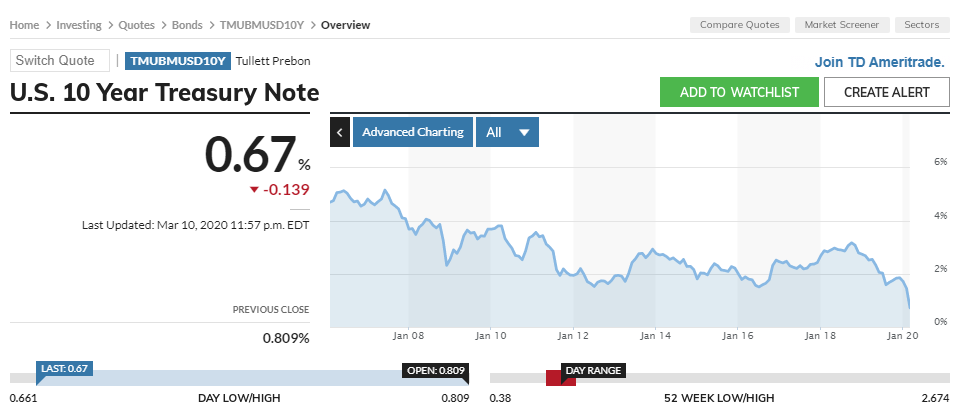

Can’t really think of a better name for the post than that. If we look at interest rates on the 10-year bond we’re now back under 0.75% (could move by the time you read this). Also. People are starting to miss paychecks due to the rapid spread of COVID-19. To the average person who doesn’t attend conferences or work at them, these major events can generate thousands of dollars for a single person which they need to pay rent, pay for food etc. To say that it’s a big deal would be an understatement. Hopefully it clears up but the bond market is giving us some worrying signs. Before jumping in, we’ll go ahead and use public data so you can see that we’re not “fudging data” to make it say something different.

How Do Banks Make Money: We won’t overcomplicate this topic. Banks make money by borrowing short and lending long. In theory, if you’re willing to let someone borrow money for 30 years before paying it back, they should be charged a higher interest rate than if you let someone borrow money for a month or a year. This makes logical sense. What banks do is they take the money, lend it in the form of a mortgage for example (3-4%) and pay 1% to customers who have their money in savings accounts. Yes we know these numbers do not reflect the current environment, but this example makes it easy to see the spread being made which is 2-3% on billions of dollars.

At this point, with bond yields coming down dramatically, it is saying that the customer will no longer earn any money by holding their deposits in a bank (closing in on basis points). If you only get a 0.65% return for 10 year bonds, even if you allow the customer (deposits) to gain 0.15% … This is a 0.5% spread… a huge difference compared to 1-2% (2x to 4x in terms of actual dollars, you have to put HUGE numbers in here to see why it is such a big deal). For those that are really unfamiliar with inversions, this is why the 2-year and 10-year bond inversion is a recession signal. It means that you earn more money by lending for 2-years versus 10-years which makes little sense long-term.

If interest rates go negative (like they have in parts of Europe), this means that banks would then *charge* the customer money just to deposit money in the bank. This creates a strange environment as you’re better off taking your money out and putting it under your mattress (factually). The only reason to keep your money in the bank (losing money on negative rates), is fear of being robbed for storing it somewhere else.

There you have it. The basic way that banks make money in a few simple paragraphs and we can now see why the craziness in the bond market is unprecedented. In Germany for example, the current 10-year rate is a whopping -0.79% (that’s correct they are negative) and unsurprisingly European banks are not in good shape (Deutsche Bank is now a $6.96 stock and Barclays is at $6.18 – both practically at or near all-time lows).

Bond Yield Drops: We usually don’t comment on anything market related. Feel free to use the search bar and you’ll see we’ve been dollar cost averaging into the S&P 500 since the start of the blog (and before we even started blogging) and then stopped adding in December of 2018 as we felt the probability of a recession was high. The reason we had to comment on the bond yield is that we have 5-6 alerts set up for “crazy” scenarios. This was one of them. Usually bonds move around by 3-5 basis points or so. Now if you look at what happened over the last few weeks it actually fell 100+ basis points! (choose the 2020 version)

The table is way too big so click the link and choose the 2020 period you’ll see that in the middle of February we saw a *huge* drop in yields. This means the market anticipates a massive drop in the federal funds rate. While the 10-year bond moving from 2.2% to start the year to 0.67% doesn’t seem like much, that’s a 69.5% reduction in borrowing costs.

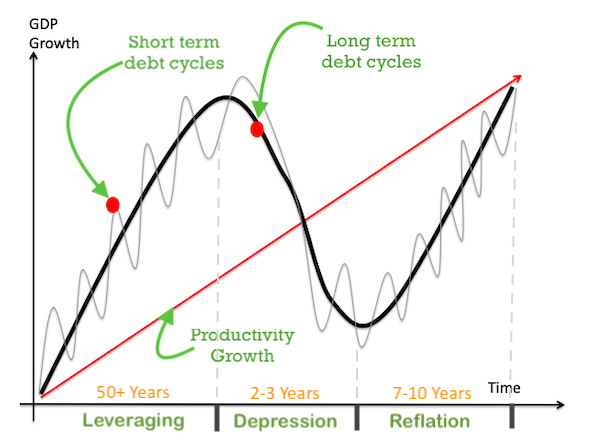

We’re swimming in extremely questionable territory at this point. If we keep cutting interest rates and prolonging the eventual default across multiple industries, it could very well lead into an actual depression.

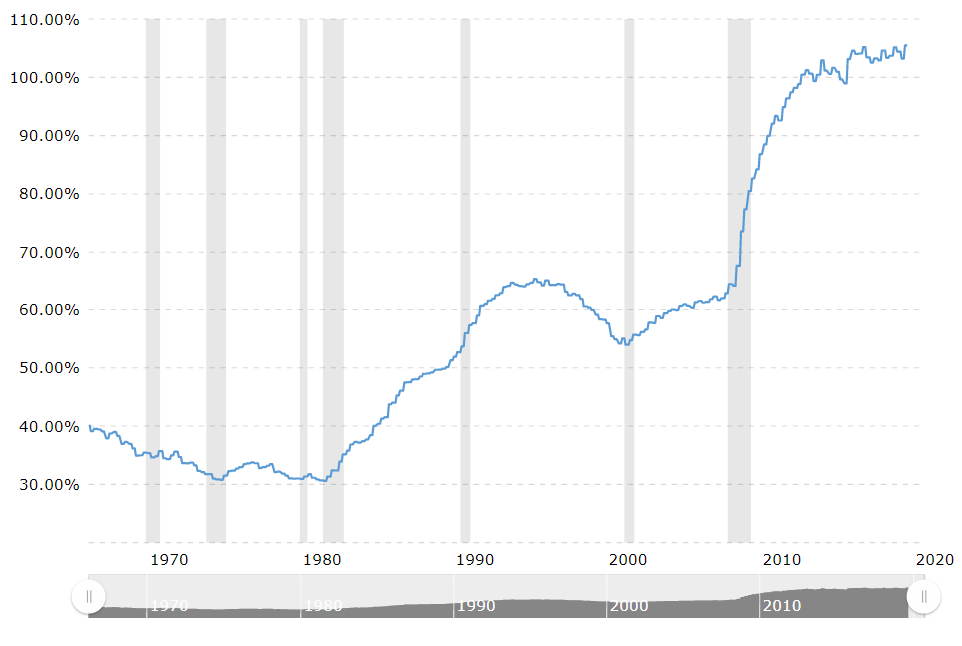

Debt to GDP… Continuing On: While it’s pretty clear that there will be yet another interest rate cut if the 10-year bond is already trading below 1% (fed funds at 1-1.25%), we can see that the latest bull market was essentially debt fueled. Over the past 12 years we’ve gone from a debt to GDP ratio of about 65% to 105%. Adding more debt is just going to increase this ratio unless GDP suddenly goes up (doesn’t seem like 2020 has a fighting chance of being up relative to 2019).

So? You’re now in a situation where debt exceeds GDP, GDP appears to be falling and on top of all this countries all over the world are devaluing their currency (some even negative). It’s absolutely warped and the last “shoe to drop” will be negative rates in the USA. Ideally we can hold above 0% and even work back to 1% but it seems unlikely in the near-term (remaining below 1%). For those unaware of the long-term debt cycle, a simple chart is pasted below.

Find Ways to Hold Value: If you get nothing from this post and are not interested in learning about economic cycles, yield curves and how banks make money… You should think about ways to own things that will either 1) hold their value or 2) be used by you over long periods of time. While many people laughed at our prior posts, you’re in great shape if you followed them. Some companies are already forcing people to work from home, paychecks are being delayed for events etc. You want to take a look at things you will use and see if they have long shelf lives.

Why? You’re automatically hedging yourself against inflation. We’re not jumping into the “next great recession camp” at this time… But… If you were overly confident the last 2-3 years it’s going to show up in your numbers at this point. Revenues will go down, services in particular get dismantled and as inflation picks up (in theory) the price of every day goods should begin to increase. While this is a small example, think back to bars, clubs and restaurants and you should notice that the price increases largely occurred over the past 3-4 years and were relatively stable in the 2010-2014 time frame.

Simple examples of things that hold value and don’t perish: 1) homes of course – even if the price goes down, if your mortgage equals the cost of rent… you have to live somewhere anyway, 2) some gold, crypto and liquid cash – a smart person has an emergency stash in their house/apartment and 3) lots of basic goods from toothpaste to paper towels to canned food, pasta etc. We mentioned this in past posts but we’re bringing it up again because it is something you should always have (seriously). There is no downside to the strategy and it protects you against big risks. If anyone thinks this is paranoia, they either don’t understand what big risks are or they are too lazy to create a basic parachute for themselves if SHTF.

The Good Old Sinking Feeling: It has been quite a while since we’ve seen a drop like this and the only other time this feeling was pronounced was back in November 2008 to March of 2009. Even in the 2018 sell off it wasn’t the same as bond yields didn’t collapse and we didn’t see a real slowdown across the entire economy. When you see visible real slowdown in the regular economy (hotels, travel etc.) that’s a much bigger issue than a random technology or biotechnology stock trading down 20% on bad earnings.

As usual there is always good news here, it means that if you take the basic precautions set out here you’ll be miles ahead of everyone else. 12 months of zero income is certainly painful but if you’re prepared for that you won’t need to panic sell and you can simply grind along as we work through a period of pain. In a wild and unlikely scenario, perhaps there is mass stimulus and your stocks go straight up! That’s another great upside scenario and why life rewards people who are prepared for the worst case scenario. Keeping it simple though, we don’t think it’s likely to see a 20% recovery soon and you’re better off doing “worst case scenario” preparation so you can sleep easy at night and practice some meditation.