For fun we did a quick Twitter poll to see how much people spent on their first down payment. This led to a series of various tweets and we noticed one common theme: many rich people bought a rental first. Before people jump in the comments and say “but I know so and so who bought and lived in his first place”, we already know this is true. It is one of the most common investment choices in America. Instead, we’re going to outline why doing the opposite could be good from a financial perspective. After all, if you see a trend or common theme, it is worth looking at. So we’ll run the numbers right here.

Purchase Assumptions: Before we begin here, we know that 20% down payments could be up to $200-300K in high cost areas (Bay Area, New York, Los Angeles etc.). Instead of complaining about this, we also know a 1 hour commute can give you access to properties that are much cheaper (50%+ cheaper) making them a lot more economical if you’re willing to do the dirty work. To keep this simple we’re going to use a $100K investment and a $500,000 purchase price. Why? Well if you live in a cheaper city this means you could probably pick up two homes ($250,000 each) or you could live in an expensive city where it would only buy you a home further away ($500,000). This also gives us easy numbers to work with since it’s easy to remember $100,000 and $500,000 for the home.

How the Concept Works: The one key item here is that many of the people who responded to our tweet with “purchased a rental” was this: living in a lower rent location for a longer period of time. Unsurprisingly, due to content targeted at future rich people, many of our readers live in expensive areas such as New York, the Bay Area and Los Angeles etc. The common strategy was to buy a place that was nicer than their current living standards and then rent out their purchase until they felt that upgrading would be easy. In short, they temporarily lived below the rent they could afford until their cash flows increased from their first rental property.

Scenario – Quick Math: Here is how the math would work if we focus entirely on the housing portion. If you live in an expensive city, you’re looking at total rent of around $2,000/month. This is a pretty standard number for high cost of living areas. In some cases you’re getting a studio and in other cases a one bedroom. Essentially, you can certainly live in a major city for around this number. Since “rent is going down the drain” this is another way of saying your negative cash flow is -$2,000. No equity is built.

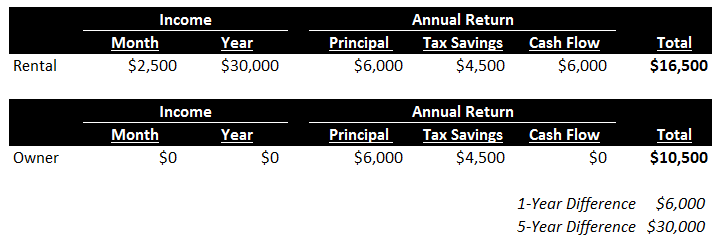

Buying: If you decided to buy using the same assumptions, you’re looking at a $400,000 mortgage with a 4.5% interest rate (yes it could be below 4.5% but the math is easier this way) and a monthly payment of $2,027. We’ll call this $2,000 to keep it simple and by the end of a single year, you’re looking at ~$6,000 in principal reduction and around $4,500 in tax deductions from the interest. After a year you’re looking at ~$10,500 in total return. Essentially it makes economic sense to buy, the question is… could you do better?

Rental: If you decided to buy a rental instead it gets a bit more complicated but we can run it through the same way. You are paying $2,000 a month for the rental property. That said, you should be generating ~$2,500 a month in rental income (6% cap rate). Your first $2,000 goes into paying down the mortgage which we calculated above is $10,500 in returns for the first year. The remaining $500/month then goes to your bank account, so the total return in theory should be $16,500… this is 57% better than buying.

It Gets Better: Some of you may be saying, well that’s only $6,500 and my standard of living gets better. But. It doesn’t end there. Remember that if your home is used as your personal residence you cannot deduct the cost of home improvements! This is *not* the case for a rental property. Any cost that goes into repairs/improvements can be deducted. The only benefit of improvements for a primary residence is that it can be used to increase the cost basis of the home. This is a significant difference over a multi-year time frame since you can only increase the cost basis on the sale. Referring back to that $6,500 in extra income, the chances that you’ll be paying any real tax on it is next to none. You’re incentivized to improve the place (increasing value of home) and get the deduction as well. For those that own a rental, we all know there are many other tweaks to make sure you show zero profit on the rental and this is where having a good accountant and receipt tracking pays off.

How This Snowballs: Taking a look at the math above it doesn’t look incredible. The important part is realizing that the returns snowball and improve over time. If it took the person above ~4 years to save for the place it means he was able to save $25,000 a year after taxes. If he owns a rental and lives in his current situation for just 4 years, he’ll have a second rental and still have money coming in from the first rental. The $6,500 after tax difference is approximately $25,000 after 4 years so you’ve captured an entire year of savings by purchasing a rental first. We don’t have to explain it further. Once you have the second rental property, you’re now saving about half as much as you do from your normal source of income! The incremental gains have now doubled and we have assumed your income hasn’t moved one bit to help accelerate the process.

The Nay Sayers: As mentioned in the beginning, we’re not saying that this is the “only” way to do it. We’re simply trying to outline why it may work better for you versus the standard “first home is for me” mentality. When we look at the situations where “first home is for me” succeeded, they are *typically* in areas where the price of the home goes up dramatically. Think high cost of living areas that see a sudden boom like New York, San Francisco and Los Angeles after the 2008-2009 recession washed out. In these situations we can come to one interesting conclusion, if you’re going to buy your first asset you should either 1) use the rental model outlined above or 2) do significant research and play the price appreciation game over an extremely short frame. The worst of both worlds is the classic middle that most people try to do. They buy in a safe neighborhood with minimal price appreciation qualities. This means you’re simply underperforming someone who bought the same home and rented it out (math above) and you’re not getting any traction from price appreciation (person who buys high demand real estate – think beach front property).

Two Other common Options: While the majority of the post highlights a common way that people made money on their first purchase, there are other ways to make money here. First one is extreme leverage. There are situations where you can put as little as 5% to buy a property which juices your upside (and downside) tremendously. Looking at these situations you’re much more likely to take a highly levered bet when you can “force appreciate” the asset. This means you are only taking on a high leverage ratio if you are sure that repairs and hard work could offset any potential devaluation scenario. Second one is higher cap risk. This is where you’re renting in lower income areas where there are more evictions and “headaches” associated with higher cap rates. As a rule of thumb cap rates are between 3-8% or so and if you see numbers in the double digits you’re moving into higher headache environments (or a fantastic steal you’ve been researching for a long time). The one cited in our Twitter feed was trailer parks, which certainly do work if you’re willing to accept additional work 9 times out of 10.

Concluding Remarks: Unsurprisingly, doing the opposite might be one of the better decisions. In the USA, the most common move is to buy a personal home first. Unless someone is in an area where price appreciation makes up more of the value (low cap rates), reversing the process could be a better way to build wealth. While a difference in the thousands of dollars after taxes might look “small” by re-levering the same amount of money into the next property, you are able to shave many years off of your working career at minimum.