For fun we decided to look into the Millennial generation which consists of people born between 1981 and 1996 (22-37 years of age). It’s an interesting age group as a chunk of them graduated only to see the Great recession and the ones that are even younger on the age bracket are racking up Student Loans at an alarming rate. We had no idea that 80% of the entire millennial generation had less than $9,999 saved. This is a startling number to say the least. In fact, all it does is prove that small amounts of entrepreneurship is the best way to go, asymmetric risk is the name of the game if someone’s net worth is that low. In this post, we’re going to outline our own strategy if we had to start over again and also outline benchmarks for multiples of annual spending that someone should have saved (by age).

Ignore the Macro Picture: At the end of the day, the macroeconomic picture doesn’t mean much for you. If you have no money, having your net worth go from $10K to $5K… is not going to change your life. That’s equivalent to about three months of unemployment checks. Don’t worry about things that are out of control since you’re essentially starting from zero. The only way to take control of your life is to have individual value that cannot be replicated by a machine. So instead, as usual with this blog, we’ll focus on the microeconomic picture and how to fix your own situation first. Fixing the world is something you can noodle on when you’re rich.

Microeconomic Environment: There is no nice way of putting this, unless you’re able to make the median wage which is around $50-60K a year… You don’t deserve to have any fun. Those invites to get drinks and travel are officially canceled. We’ve seen a lot of young people party hard in College only to end up with no job offers, debt and a belief that life is exciting and fun with no repercussions. As they say “life comes at you fast”. If you can live at home… Do it. If you can’t find the cheapest possible place and get your income up by working two jobs if needed.

Living With Nothing Sounds Terrible: Yes it does! It’s terrible because the situation is essentially a war zone. People have a hard time thinking about compounding and losing a single year in your 20s with no money means you typically have to work multiple years later on in life. Want to put this in perspective? If you saved one year of living expenses today… or you saved 10% of a year of living expenses for ~17-18 years straight… you’d get the same rough result. That is mind boggling when you think about it. It means you’re better off throwing money into investments all at once and early. Much better than the ridiculous strategy of saving “10% per year” forever.

For the people that love numbers out there, we’ll put some realistic money to work. If you were to save $50K in a single year or $5K per year for 17 years straight… the person who tossed in $50K would now have $157K and the “consistent” saver, would have $154K. If both people were age 23 when they started it means they are both 40 years old with the exact same net worth. Insanity. As you can see this is an obvious set up for our argument based on *event* income.

Starting Over, What to Do: The answer is always the same: asymmetric risk. You have to start numerous online companies, consulting companies… hell… even a blog generating a few thousand bucks would be fine because you have zero dollars to start with anyway. This is exactly what we would do. We would take a look at three types of work: sales, entrepreneur and services. The last one is a change of tune from our normal advice since the person is falling behind every single day. Services is an area where you can make well above minimum wage and is also an area where automation is unlikely in the next 10-years.

Services Jobs: What is a services job? It is a job you accept as an absolute dead last resort. You go to dead last resort positions when you’re falling behind. Falling behind is defined as your net-worth no longer tracking to the numbers at the end of this post (net worth relative to annual spending). Services positions that have good paying incomes include: nurse, air traffic controller, plumber, technicians, auto mechanics, electrician and more. If you get good at any of these things that also funds a low-income blog about said profession: You Tube videos on fixing stuff essentially.

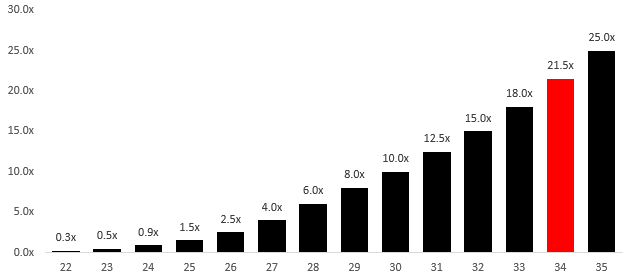

Getting Into The Numbers: Study this chart and take it seriously. Since you’re reading this blog we sure hope you’re not interested in saving 10% of your income and retiring at age 65. The goal is to get rich ASAP and leverage your time since money is always going to be there anyway. It is certainly a lot easier to sleep at night when you’re not worried about paying bills that’s for sure.

The chart is clear as day but we can assure there is no confusion. If you spend $50,000 per year, it means that you want to have ~$500,000 by the time you’re 30 and $1.25 million by the time you’re 34. Like everything else in life, if you’re making smart decisions your income actually grows exponentially and your net worth ends up generating large amounts of money for you ($70,000 is just 7% when compared to $1 million dollars). We use 21.5x total living expenses as a rough proxy for when you should feel “set”. To wrap this up, we use multiples since we have no idea where someone lives. Perhaps you can live on $30,000 a year and feel great… Others might need $120,000 per year. That’s not as relevant as the multiple since it adjusts for this naturally. In short, if you’re behind on this graph it’s time to delete everything: Facebook, Twitter, “beer nights with friends” so on and so forth. If you’re on track with this graph feel free to do whatever you like since the difference between being financially set and financially set times 1.5x or 2.0x isn’t really going to change your mental health much.

Just Get Over the Hump: The numbers look daunting since they accelerate. The reality? If you get over any of those bars earlier it means you’ll blow through the next several years. For instance if you had 10x your annual spending at age 28… you would hit your number at age 31 without contributions (simplistically, assume 7% returns which adds 0.7x incremental at 10.0x). Putting it another way, all you really need to do is “generate income to survive” if you’re able to get over the hump earlier in life. Just like physics, objects in motion stay in motion… applies to finances as well.

Front Load All of Your Work: One of the interesting conclusions from this math we’ve done is that you’re better off shoving all of your work into the beginning of the year instead of spreading it out through the full year. Why? Well you can hit your needed investment amount then forget about it. Lets say you’re behind and need to put away $40,000 (we made it up), well your best option is to live like a monk for the first half of the year working like a dog and then when you clear it you can forget about it like a bad dream. This creates a forced acceleration effect. If you’ve already hit your needed investment amount it is unlikely that you’ll go negative for the remainder of the years. If the prior statement is true then you’re going to be well ahead of all the bars listed in the graph above. Unsurprisingly this is exactly how we operated before becoming financially independent. Try to generate as much possible money in the first 6-8 months of the year and then move into relaxation/fun mode for the last 4-6 months.

Moving onto the Fun Stuff: Well if you’ve been following along for the past 5-6 years you already know that less than 1% of people will ever listen to the advice on this page. They are more interested in watching Sports, Netflix and debating politics. Since we know two things: 1) millennials are broke and won’t have many options and 2) the richer part of the population is getting older… this creates a pretty big business opportunity. The two options are essentially hedonism and healthcare.

Millennials are going to spend all of their money as they view their future as bleak and impossible to overcome. Even though math says it is possible, they are more likely to spend their money on life experiences. This means travel, alcohol, concerts etc. Similarly, their income will go up so you can imagine that more and more foodies will make a good living in the future. On the other side of the equation is the aging population. The people in their mid-60s will spend large amounts of money on healthcare, travel and potentially dining as well.

Massive Inequality: Think about it like this. The number of people willing to work hard is already around 10% maximum (hard work meaning solving problems not something worthless like working long hours). In addition, 80% of people are already behind and have to play catch up. This means you’re left with around 2% of the population to compete with (10% times 20%). We didn’t even adjust for people with low IQs, people with immense amounts of debt or people who have already hit age 30 with next to nothing to their names. Oh and by the way… many of the guys who are on track now will likely suffer a divorce or another major emotional mistake setting them back as well. This means you’re going to see a big big gap between the rich and the poor going forward as the rich people will be the only ones with an ability to produce. Attempt to have wealth redistribution, we wouldn’t even mind. Why? In 10-years the picture would be the same since the number of producers would be small at under a few percentage points versus the consumers with no tangible skills to earn money (only able to spend).

Positive Note: Since this has been a bit of a sadder post we’ll have our Q&A on Tuesday the 20th. Remember the only one you should look out for is yourself.