We recently wrote about some quick tricks to hacking your 401K and many emails came in about a Roth IRA and tax rates for the future. So we went ahead and pulled up the data. You’ll see some surprising numbers, namely that there was a 70% historical income tax rate back in the 1970’s.

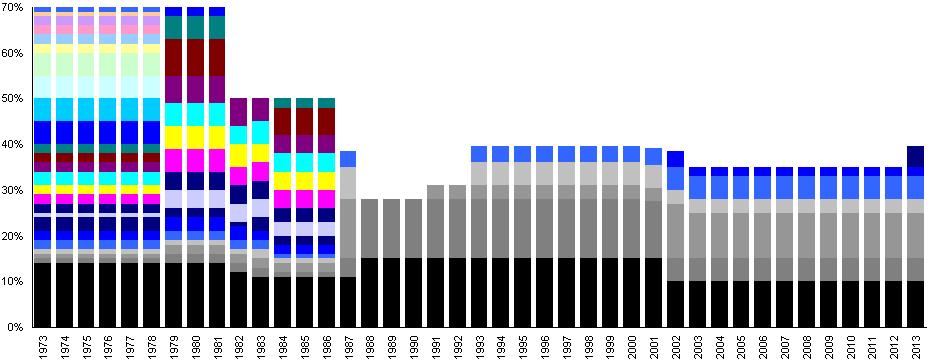

40 Year History of Personal Income Tax Rates for a Single Person:

1970’s: Back in the 70’s there used to be 26 different income tax brackets growing from a 0% tax rate to 70%. Luckily, this slowed down in the future as tax rates came down over time but you can see the tax rate is quite spread at this point in time.

1980’s: During this time frame you saw an enormous change in taxes, starting with a max tax rate of 70% moving all the way down to a simplistic two tax rate policy at 15% and 28%.

1990’s: At this point the tax rate climbs again and settles into five tax bracket system at 15%, 28%, 31%, 36% and 39.6%. This remains as the standard set up until the 2000’s.

2000 to Present: Finallylooking at the present day we have a relatively simple tax system where the max rate remained at 35% until recently bumping up to the 39.6% level in 2013.

Here is a graphical depiction of the historical income tax brackets. Each color represents a new income tax bracket. To confirm all of these numbers simply visit the tax foundation.

Impact On Your Life: This website is designed to encourage people to become part of the highest income bracket (avoiding the 99%) as soon as possible . With that in mind it makes even more sense for a person to do everything they can to avoid paying taxes in excess of 15%. So here’s the step by step assuming you will eventually make it into the highest tax bracket.

– Receive the company match in your 401K since this is free money or a 100% return

– Immediately roll over the net amount into your Roth IRA

– You will pay taxes on the roll over, however you will unlikely be in the highest tax bracket just yet

– Wait out the 5 year rule and pull out the principal

– Begin buying securities again

But What About When I Turn 65? Here are the major issues with the 65 year waiting period to withdraw your money from your retirement account. 1) They can increase the age of retirement at the drop of a hat, 2) You will likely be above the 15% income tax bracket when you begin withdrawing money so your tax rate will likely be above 25% relative to capital gains taxes at 15% and 3) you are illiquid.

Now if you disagree with the future of income tax rates (reiterate tax rate highs of 70%) and possible changes to retirement age, the main issue is that you are in fact illiquid. If changes to tax schemes occur over the next 5, 10 or even 20 years you want to be able to instantly move your money elsewhere. If anything the more liquid you are the safer you become as exhibited by the Cyprus debacle. Finally, the 5 year roll over provision could also be changed instantaneously.