It has been over a decade since the last bear market. Sure we’ve had some periods where over 52 weeks the S&P 500 is down. But. The trend has been up and to the right. Before anyone complains that we’re “bearish all the time” we have had a recommendation to simply buy the S&P 500 index since 2012 and never changed our stance. This is public and can be confirmed (no we did not edit it as proved by archives as well). As of today’s writing (December 13, 2018) we’re now changing our tune a bit. While we don’t think we go into full blown correction territory in the next 12 months, the upside of investing in to the S&P has started to wane. There is no such thing as “forever growth” and yields continue to increase (around 3% returns risk free are now available). So with that in mind we’ll jump through the main things to know about down-markets and how to navigate them.

What We’re Doing Today

Think About Timing: We’ll update the blog when we officially say we’re out of the market. The reason for this post is that we’re no longer investing in the market (okay 5%). If you read through all of our posts (takes time and not worth the effort) you’ll notice we slowly moved from 100% of total excess cash flow into the market, to 20% this year and now that number is officially 5%. As a reminder, the definition of excess cash is 1) all business expenses, 2) all business investments, 3) 1 year of living expenses in cash and then finally 4) the rest is considered “excess cash flow”. From today going forward, we’ll be investing 95% of all excess cash flow into boring old risk free investments that are returning around 3% today. If this number goes to 4-5% we’ll begin *selling* stocks and putting more and more money into risk free assets. As usual none of this is investment advice and we’re simply highlighting our own opinions on what to do. While the market might go up for another ~2 years (some geopolitical issues get solved) we doubt it goes up more than 5-6% each year. If this is the case we’re only missing out on a measly 2-3% of additional returns with the headache of potentially being down 20-25%. If you’ve been in the market this year, you’ve gotten a good preview of what it’s like to watch your account go down double digits (equities) from the peak.

Avoid Large Purchases Now: People didn’t like our comment of “don’t buy a home now”. There are always exceptions and we realize that. The point was pretty simple, if you believe assets are elevated right now… There is no reason to buy. Large purchases and bigger financial decisions should be made in recessions not bull markets. This is counter intuitive but makes a lot more sense when you think about it. If you’re watching the markets tank and people are losing their jobs, then you’re more likely to get a deal on any large item you buy. It has been over a decade and we really doubt a bull market lasts more than 15 years (already the longest bull market in history)… so a rich person can simply gather his chips and play the waiting game. Large purchases in this case would be homes, nice cars, moving to a nicer apartment etc. Anything that would be a large cash out flow should be avoided if markets appear to be elevated. As you can see the main issue with any of these purchases is that you’re missing out on pretty good returns by simply investing in risk free assets, an extra $30,000 a year *Risk Free* is a lot better than any investment that could lose 20% in the next 3-5 year frame.

No More Leverage: While there are always ways to scale your projects with leverage, the math begins to get fuzzy. Assuming you have some debt at around 4%, there might be an opportunity to match this number very soon. You should be salivating at the free money. Imagine having a 4% rate on a mortgage you had several years ago, all you would have to do is begin putting your own money into risk free assets if it gets to 4%. It’s a weird situation but is a likely scenario for you. Okay. More realistically you take on an extremely small amount of risk (return slightly better than risk free rate) and suddenly you’re making a return on the outstanding mortgage. At this point you’ve de-risked all of your debt through a potential downturn. Over time inflation eats away at your debt load and you’re sitting pretty.

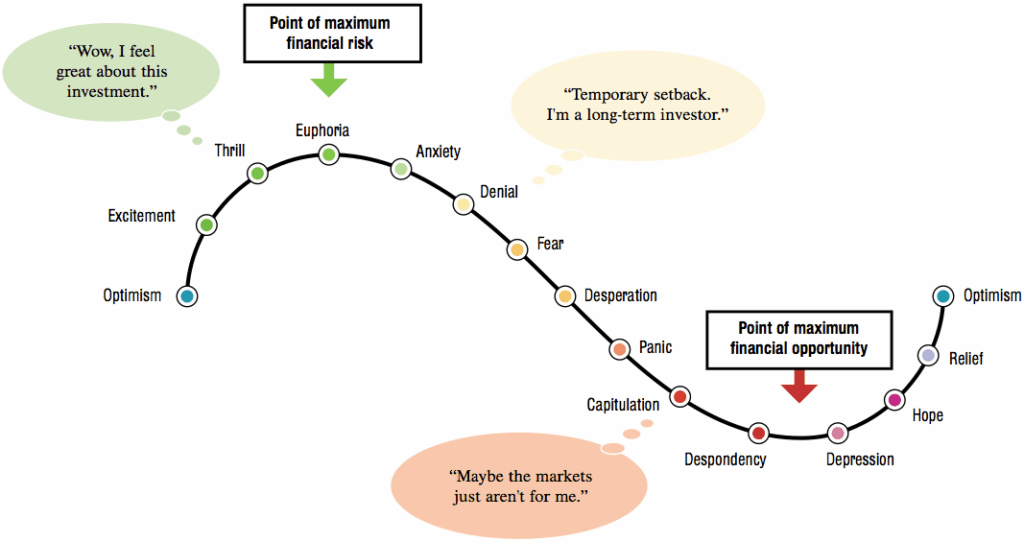

Now before the negative comments come in, there are a billion ways to play this. There is no “correct” way. In a change of stance from our usual “just do this” and cut to the chase… debt is far too complicated. We don’t know the return profile of your projects. We don’t know if there is a way to get “forced returns” on a specific asset. We don’t know your industry as well as you do. All we’re saying is that a rising rates environment and an opportunity to reduce downside is extremely attractive if you’re up well over 100% on all of your levered investments. One of the good signs of a near peak or post peak market is a feeling of anxiety/denial (photo below). Our own ideas are looking less and less attractive every single month and we have no doubt this is occurring for many other people .If you find something that you’re next to certain will generate 10%+ returns, then go for that 4-5% loan.

(We think we’re somewhere around Thrill, Euphoria and Anxiety. If you group those three that’s probably about right. Essentially people who didn’t believe markets would be fine have started to take on notable risk, this is usually a bad sign for things to come particularly as we see a lot of nervousness around the most recent pullback. Like we said, we still think there is about 2-3 years left but we’ll update our blog as we go along since it’s a fun topic)

Consumer Spending Freeze: We’ve seen an increase in status items. Rolex’s, Gucci shoes, high-end hand bags etc. While they are great and definitely have use as we’ve mentioned in the past… we’re skeptical of the people we see purchasing the items at this point. We took a look at what it takes to stand out from a crowd of well off people and you’re seeing a bad trend (takes a lot more than before to stand out). This could be a byproduct of changing environments. Yet. We have gone to places we no longer attend and see the same thing. Guys who can’t make more than $250K a year “flexing” with $25,000 watches. Sure. All of our reads on this could be wrong as it’s hard to predict who is really rich in a room with 100% accuracy. But… As usual, we trust our own intuition.

Consumer spending freeze for us means no more “upgrades” for a couple years. This isn’t a big deal as the last decade has been amazing and beyond comprehension. Being forced to hit the pause button on new toys/goodies is probably a good thing (flex the will power muscle a little bit). The entire point of these items isn’t to buy them to cover “insecurity” the point of material goods is that they work! Now that they don’t work as well… Time to hit the pause button. Just like the market, the same cycle will occur. When those nicer items start to become rare and everyone is using an “older version”, we can go back to buying a few nice items here and there.

Change in Spending: At this point, you’re probably imaging a guy shoveling cash into a barrel which is being delivered to a bank to collect 3% every single day. Shovel in, bag filled, deposit, sleep. This isn’t far from the truth. The part that is missing is a shift in spending. If the environment is changing, a lot of the normally nice places begin to fade (Las Vegas is ground zero for seeing the culture change, gets worse during economic booms). Well. This means it’s time to change spending venues. Good ideas include: yoga, meditation, spas, sports (playing not watching) and reading. Since everyone is spending to consume… in typical fashion… we reverse positions. Drinking a bit less and going through a nice detox phase is a good idea any year. Even more so in times like this. We’re ramping up our spending here and luckily its a lot less expensive allowing more time to shovel into the barrel.

How This Sets Up for the Next 2-3 Years

While we’ll update the blog if our views change, we’re pretty convinced that by around 2020 markets will have largely peaked out. Peaked out doesn’t necessarily mean they go down, it simply means the risk/return profile isn’t favorable (see the earlier chart again). We have to remember that as rates go up the market needs to offer much better returns than the risk free rate, otherwise it’s just not worth the time. Yes. We realize we said that twice in this post but its extremely important to remember particularly if someone reading this hasn’t even seen a bear market (a decade worth of people have not, more alarming… that’s around 25% of the work force if we assume a 20-60 year old age range).

Wait for Blood on the Streets – Cash Value: Assuming we’re right and there is a pull back sooner than later, if something half the size of 2008-2009 happens, we’ll be thrilled beyond belief. What you’re looking for is profitable companies with valuations below the cash on the balance sheet. This is a pretty standard approach and happens pretty frequently when there is a panic sale of an asset. Don’t get too greedy and be sure to check the fundamentals of any company. As long as you’re next to certain the Company will generate positive cash flows, you’re in a great position to scoop it up. For those in finance the basic term for this is “negative enterprise value”. We’re keeping it simple with that definition and if you see anything that looks like this, it’s time for us to swoop in. Being a vulture isn’t a bad thing.

A Slow Unwind: No one times the exact bottom. Okay. Someone technically has to by definition. That said, you’re going to get the bottom in some shape or form if you unwind your cash balance into equities, real estate and any other asset on a monthly basis. It’s psychologically difficult to do this as you’ll try to time the bottom only to see the investment go down another 5-10%. Painful. The good news is that consistency allows you to “average out” near the bottom which is good enough. If the bottom is minus 25% and you have an average entry with it down -18%, that’s solid and good enough for the next 10 years. That’s right. It is enough to set you up for the next decade because no one dumps large amounts of money in at the bottom, otherwise they wouldn’t complain about recessions so much. Crisis is another word for opportunity. (Side note: generally -20% is considered an official pull back.)

Search for Pain: This is the brutal part of the post. Your biggest returns are going to be searching for painful situations. Real estate professionals don’t like to talk about it but one of the best ways to get good deals is when a family member dies (not yours a different person) and they are forced to immediately sell the house for cash. There are going to be a lot of situations like this in the next recession. In fact if you search back in 2010 guys like Warren Buffet recommended this in a much nicer way “i’d love to buy a bunch of single family homes”. What that really meant is all of these loans blew up and people were desperate for cash and he’d take advantage of it. That’s really what the underlying message was in a more to the point way. People say that recessions and housing are not related (in some senses they are not) but we’ve found that there are a lot of cash strapped people in recessions which causes you to find some of these extremely undervalued opportunities.

Negotiate: You can tell how good the economy or sub-sector is doing based on your ability to negotiate for a change in price. If you find getting a good deal as a fun game, you’re going to love the environment in a few years. Back in 2008-2009 you could honestly negotiate anything. Even basic items like clothing had sales people who would give you their employee discounts or other backdoor discounts just to try and make the store appear more profitable. It’s quite interesting to watch how psychologies change from “we never do that” to “here are the 100 ways I can get you a lower price”. As of today we’re around the “we never do that stuff” phase and that’s usually a sign for the future.

Primary Items to Focus On

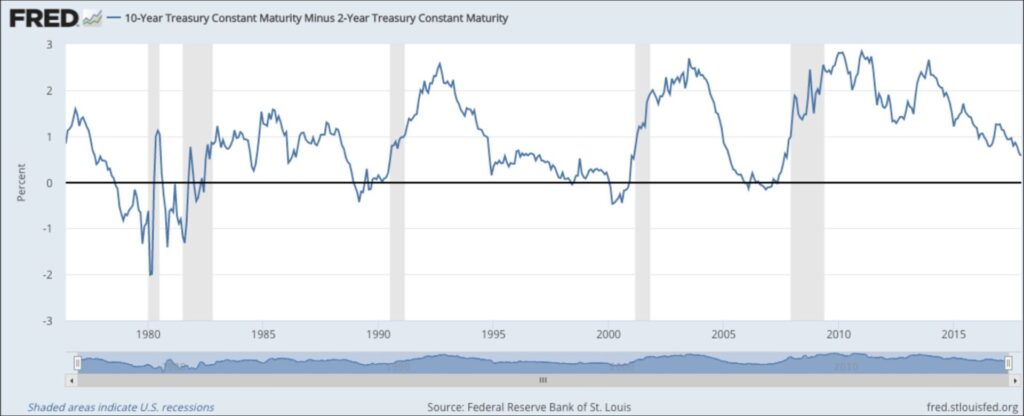

Interest Rates: You’ll notice that the primary item we care about is interest rates. That is because it determines your entire risk tolerance. If we could get 4-5% returns risk-free, there would be no reason to invest in other assets unless we were seeing hyper inflation. If we’re experiencing hyper inflation then you’ll want to own assets since they would also inflate. Putting the doomsday scenario aside, we just look at interest rates and it’s becoming interesting as yield curves are getting close to an inversion. (the 10-yr and 2-yr are what we prefer to look at)

The 30% Rule: This isn’t even a real one just one we use. You can find every single multiple on the planet for stock markets and you’ll see that there is a median/average for each one. If you ever see this multiple go north of 30%, you want to check your investments again. Why? Well we know that the average is say 15x and then there must be a time period where it goes well above this to average (can’t go to zero unless all equities die). So selling just because something is at the average doesn’t make logical sense (more upside left). For a good list of multiples just check out www.multpl.com (no affiliation it’s a common website that people use)

High Leverage: This is going to be a lot harder to figure out on your own and is even harder if you’ve never seen a recession. We’re not knocking on the people who haven’t been through one, it’s not their fault and we can’t confuse stupidity with ignorance (not even close to the same). That said…. an extremely good tell is high leverage. While some people may have higher risk tolerance than you do, take a good look at the type of people taking on leverage. As soon as you see people who are extremely low risk deciding to take on leverage that seems a bit high… that’s your cue. People who make bad financial decisions are always levered up so they don’t say much. When the low risk guys start taking on risk that makes you do a double take… it may be time to look at the portfolio allocation again.

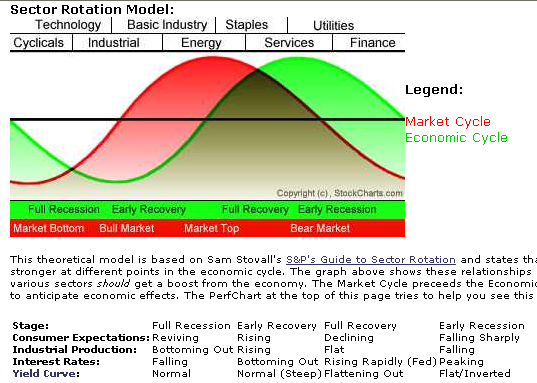

Bonus: Now that rates are no longer at zero (or practically zero). We’d recommend taking a look at this rough chart as a good proxy.

As usual good luck and make your own decisions (we hope you get rich if the market is up, down or flat). If you’re young this post probably doesn’t matter much since your own business + career will determine wealth not compounding of $20-40K. But. If you’re older and haven’t seen a recession in 10 years… At least take a look!