This is an appropriate time to write an article on the impending doom of the economy. The tone is likely going to be a bit harsh as talking about this subject is beyond annoying for us if you have been doing this for 60-80+ hours a week for multiple years…. but it needs to be done.

Back in 2007 the market was roaring due to a real estate bubble and everyone expected the bull market run to continue. Fast forward to March 2009 and everyone you knew was ready to buy guns and write off the entire equities market as a sustainable investment prospect. Fast forward again… and the S&P 500 is at all time highs of 1,700+. Needless to say the herd is always wrong.

What is everyone else doing? It’s probably a bad idea.

With that said lets go ahead and explain why you should always ignore the doomsday prophets, a handful of them are intelligent (Roubini for example) but the vast majority do not understand investing and are likely closet losers. This is going to be a rudimentary introduction to dollar cost averaging.

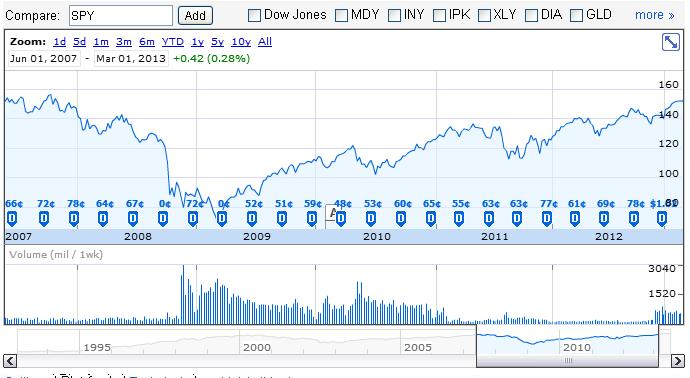

Buying the S&P 500 Monthly: For this example lets use the 2007 to 2013 time frame (roughly six years – 5.833 years to be exact). To make the example difficult, we are going to assume that you started purchasing shares at the peak of the last bull market. On June 1, 2007 the market was at 1,536, in addition we will assume that you survived until the market roughly broke even on March 1, 2013 at 1,518. This is terrible market timing, you began investing at the peak of the market.With that said here are all of the assumptions laid out, again this is assuming your timing was terrible and you bought at the peak and quit at break even.

- You buy $1,000 of S&P 500 (Simply use the ticker SPY) on June 1, 2007

- You buy $1,000 worth of S&P 500 the first trading day of each month after you receive your paycheck

- You never sell

- You never reinvest dividends

With that here is the chart of SPY.

Capital Appreciation: The chart doesn’t look that great. However this does not take into account dollar cost averaging. Over the next 70 months you are purchasing $1,000 in shares so lets go ahead and see how that works out.

- You spent $70,000

- You obtain 583.5 shares of SPY over the course of 7 months

- 583.5 Shares * $151.82 = $88,585

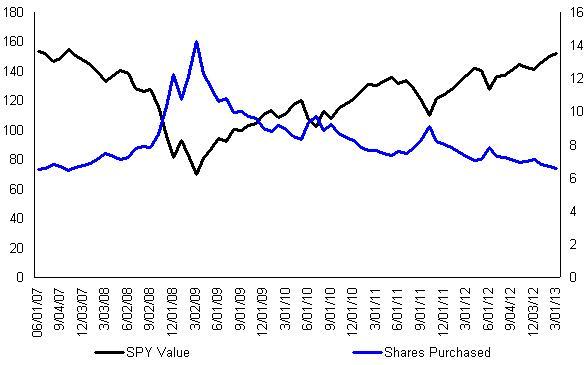

You made money. Below is a chart of exactly why this works, the answer is relatively simple: consistent buying patterns allow you to lower the average cost per share.

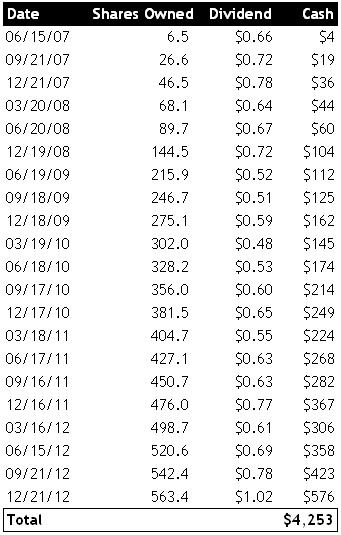

Dividends: We’re not done yet. We haven’t accounted for the dividends you’ve accumulated over the past 5.833 years. Lets go ahead and include them. We don’t want you to spend your time running these numbers so here is the table for you.

There you have it over the last five years you have accumulated ~$4,250 from dividend payments and we will go ahead and assume that you have not reinvested this money, it is sitting collecting dust in a savings account or under your mattress.

Final Calculation: Here is the final break down. You begin investing in the worst time possible, late 2007 and you purchased $1,000 worth of SPY for 70 months giving you a net investment of $70,000. In return if you decided to quit investing when the market was near break even you would have $92,837.

If we use a CAGR your total return was (($92,837/$70,000)^(1/5.8333))-1…. 5% annualized return. 7% returns should no longer seem impossible particularly given this example.

Concluding Thoughts: Now that the numbers are laid out, why exactly do people continue to lose money? They are unable to control their emotions. They attempt to out trade algorithms (will never be successful), they live in fear of a possible world collapse (check their bank accounts they are likely broke) and they have never run the numbers.

While this post is much more blunt you’ll be happy to know our next will be more upbeat. With that said, remember this, if someone believes the world is going to end, 9 times out of 10, their life has already ended. They chose to live in the moment and refused to put in the work.