One of the main items we attempt to portray here is that there is an actual decline in utility when it comes to money. We definitely don’t agree with mainstream advice that “utility” ends at $70,000 a year. But. There is definitely a line. We’ll walk through multiple ways to use money. Up front we’ll give you our two benchmarks for being “set” and emphasize that this assumes you are single (no family). It also assumes that you can be in a relationship or you can be a perpetual bachelor, in either case, the numbers are roughly the same.

Where Does Utility Drop Off? There is no hard answer here but in terms of 2018 dollars we’ll throw out two metrics: 1) $15,000 a month and 2) $7,000 a month in disposable income (excludes rent). Why is there a huge drop off in the second one? Well the second one assumes you are significantly younger and the first one assumes that you are in your mid 30s or later. You’d think that the numbers should be similar… Yet… they are not. This is because “utility” changes as you get older. While going and partying in college bars is great when you’re 21, doing the same thing at age 40 just isn’t going to cut it (walking around on sticky floors isn’t on the agenda). This also makes a lot of logical sense when you think about the transfer of status. Even if you’re able to spend $20,000+ a month and are under age 25… the return still doesn’t work out. The only place it would help is probably Las Vegas. Otherwise? You’re better off just going to the young/hyped places instead of the upscale bars/lounges.

The other alarming thing to notice is the amount of spending power you’ll need in a short decade. We all know the guys who spent their 20s doing nothing but partying… they end up struggling by mid-to-late 30s or so. This is because they were unable to evolve and social Darwinism catches up. It is ugly to watch. The last thing we’ll say on this topic is to remember that the numbers always reflect living in a high cost tier 1 city (New York, Miami, Los Angeles etc.). A common spending number for single guys living a great life in these cities is around $10,000, so if you’re at $15,000 you’re probably older and if you’re at $7,000 or less you’re generally younger.

Why the big change in a decade? There is no real answer but we’ll give a few explanations. From a dating perspective no half way intelligent attractive woman wants to date a guy trapped in the “good old college age”. From a health perspective you’re going to distain low quality beers, alcohol and food. From a living point of view you won’t enjoy noisy places and commuting. And. Traveling on 8 hour flights in economy is going to give you nightmares. These are some big items that change over the course of a decade since your body can take immense amounts of punishment from 18-25. Doing the same at age 35-40 is just not going to make a lot of sense.

Overview

Food Costs: We’ll start from the bottom and work our way up in terms of expenses. When you’re 20-25 you can eat practically anything with no real impact to your body. We can remember eating instant ramen noodles, low quality burgers and fries along with high amounts of pasta. This was due to a high metabolism and lower quality taste buds (yes your taste buds changes over time!). If we tried to do any of that today it would result in a painful day of feeling awful and sleeping horribly. Long-story short, you’re not going to be eating garbage past age 25 or so.

What does this cost? It costs at least a few hundred dollars a month extra. If you’re a busy person (you should be) you’ll be buying juices in airports, ordering the salmon instead of the burger and drinking tons of water. It also impacts the type of alcohol you will be drinking. The days of drinking “jungle juice” and vodka out of a plastic bottle are long-gone (okay no one drinks the plastic vodka we hope). This quickly turns into: Champagne, wine and high end vodka. There is a range here depending on your tastes (could be whiskey for example) but the point stands. The major difference is going to be the quality of food/drinks.

Venues and Dates: Another major change over the course of a decade. Going to grab drinks at a local bar just isn’t going to cut it anymore. When you’re young you can get away with stuff such as drinking wine on the beach, a basic Italian restaurant and bars in general. When you’re past 35 or so this is just not going to be congruent anymore. Nothing sadder than a guy who has to “think about” going to eat sushi for dinner when the total cost is only going to be $75 or so per person.

A more standard expectation (your own expectation as well!) should be ~$100 a person for any sort of date/going out to eat set up. This is pretty standard as you’d expect to spend around $50-60 for food and another $20 for a drink + the tip (rough math). Since eating low quality food would make you sick anyway, there is no reason to cut corners when going out on a date or with friends. Roughly speaking, this should result in an increase of about $100 a night. When you’re simply partying at college bars, the bill for food was coming in at around $50 a person since you didn’t really worry about the high quality food.

Travel: This is surprisingly bigger than venues and dates. Traveling on red-eye flights are essentially impossible. Going in economy for flights over 5 hours or so is “questionable” at best. Staying at “cheap” hotels is not on the list either. This is going to add up quickly. Before, it was possible to drink a ton, get on a red eye flight and still feel completely fine. Something happens along the way and suddenly this just isn’t going to work out. Luckily, when you sleep on a lay-flat bed, you feel rested so the additional cost is well worth gaining the extra day (it isn’t even close to be honest).

So how does this add up? It means your cost on long-distance flights goes up by around $800 at least. If you’re doing extremely long distance flights (9 hours or so) the cost of that ticket is going to be up at least $4,000. Naturally this won’t be a common occurrence but it still adds up anyway. For those that plan on travelling a lot we’ll go ahead and give the main items out: 1) if there is no direct flight always make the first leg as long as possible, meaning the second leg should be short. Shorter flights typically have more daily flights so if there is a delay you’ll still make it, 2) unless it is a lay flat bed there is no point in booking business/first class, the larger seat doesn’t do much for you in terms of rest unless you can go horizontal or extremely close to horizontal and 3) unless it is for a vacation, you want to stick with direct flights. Direct flights allow you to save time and is worth the pain. Only avoid them if it is a red-eye.

Services and Experiences: Generally speaking, we think there is a large movement towards experiences/services over materialism. Now if you’re in the $100M+ net worth territory all of these status goods come back in play. Either way. The point is the same. When you move up the socio-economic ladder you’re going to find yourself spending a lot more disposable income on services and experiences which will range from massages/high-end gyms to better tickets at the next Knicks game (alright they are awful still but you get the point).

Looking at the decade, “services” have no real meaning and then accelerate. Services in your early 20s consists of some ride sharing service, low end gym and maybe some laundry (that’s about it). Fast forward and suddenly you’re looking at some big changes: 1) blood work – anti aging protocol, 2) laundry consistently for dry cleaning, 3) some sort of cleaning/maid service, 4) massages – muscle protection protocol and 5) an upgraded gym. Adding the costs up, you’re going to see an increase of around $1,000 or so (rough math). The good news is that most of these items will either improve your health (much more important than money) and save you a lot of time which will be used to generate more money than the cost of the service. A strange inflection point should occur here where you’re making so much that your savings rate goes up without changing your life at all.

Housing: The final big item to be aware of, housing. You can get away with roommates until around age 25 (stretching it) and after that it becomes difficult. Must get your own place. We’re not sure how each individual will make their choice but they have two options: 1) smaller pad with more amenities, 2) much larger pad where you’re expected to host parties. We have a preference for option number one as it allow you to travel more. But. We also know several people who hate the airport and prefer throwing house parties more consistently (avoids the grind of going out consistently).

This is the largest expense change by a country mile. This is also why we left it *out* of the total disposable income piece. It’s going to determine how much you need since you don’t want to have an unaffordable mortgage. We were going to put our own view on how much you should spend but decided to leave it out. There are too many moving parts: 1) if you live in a nice condo does your apartment come with a gym/sauna etc, 2) are you living further away from nightlife and intend on having a house with a large yard, 3) are you willing to pay up for monthly cleaning services on a house even if it costs more than the apartment, 4) will you be traveling a lot requiring a place closer to an airport (30 minutes away) and 5) how much noise can you tolerate changing the apartment floor level needed. Too many items to cover (we didn’t even touch taxes) that will swing this number a lot.

Dollars

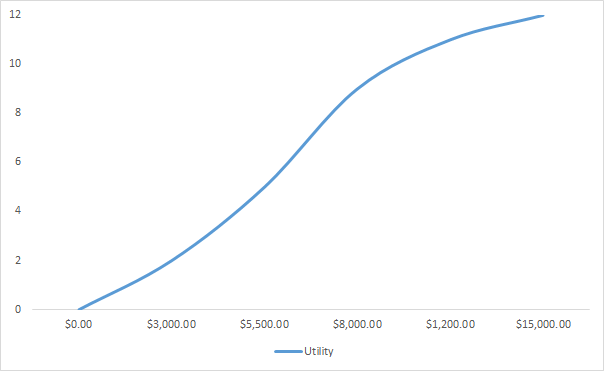

Mapping Out the Changes: Now that we’ve covered all the major items that will change in a decade we’re going to write out the dollar amount and utility level. This is entirely subjective. It’s fun though as you can see a rough change in the “slope” of the utility. At the end of the day, money does increase utility even past $15,000/month, it just tails off.

$3,000 a Month: At this point you’re simply getting by. We give this utility value a 2.0. It should not feel like a good life since you’re essentially paying the bills and doing your basic routine to essentially survive. A typical budget essentially has: 1) uber, 2) phone, 3) gym, 4) rare going out experiences and 5) one basic low level vacation a year. Sure beats living paycheck to paycheck, but it feels like treading water which isn’t exciting.

$5,500 a Month: There is a pretty big inflection here and we’d raise this all the way up to a 5.0. It means you can now plan for an international vacation easily, your gym can be upgraded and you’re not worried about the bill when you go to a decent restaurant here and there. You can’t close your eyes and buy everything but the feeling of “treading” water has left and you feel like you’re moving in a positive direction. Mentally a good place knowing you can spend this every month with little worries.

$8,000 a Month: The inflection continues and we’d raise this to 9.0. You’d think that the increase in utility would be weaker but there is a psychological benefit to being able to spend this much with no worries. We emphasize that this spending assumes your savings rate has not taken a hit, in fact, each time you jump up in utility the savings rate should go up if you’re operating appropriately. In this general ball park you have everything you need in terms of spending and you only scratch your head on the big items like first class flights and other one-time expenses that are large. Many people would be thrilled at this level and don’t feel a need to spend a penny more.

$12,000 a Month: There is utility to gain but it is no longer a big move, we’ll give this 11.0 points. The main thing that fades away is “one-time” charge concerns. This means those first class tickets are bought. The upgrades are not even a concern and you likely have a material possession that fits your personality (watch or car etc.)

$15,000+ a Month: This is the last significant move in utility and it only goes up a full point or under 10%! Here you essentially have everything you need. The additional increases are for chasing unnecessary items like a net-jets account or a Lamborghini. The odd thing about this spending range is that the only items out of reach are serious material items. Suits, watches, premium cars are all easily attainable but the “excess” or “super” version of each are out of reach. We’re not sure what the ultra rich would think about this level but we’re here to say that the move from ~$8,000 to $15,000 a month certainly sees lower increases in utility (unless you’ve got a drug problem). Essentially the curve looks a bit like an S as seen below.

Now with that out of the way, where does the decline in utility occur for you guys?