It is going to take several years but the end of centralization or the top was likely 2020. We don’t even follow politics as many know but you can see the slow and steady move to control: 1) you can start a competing app, 2) removing apps they don’t agree with and now 3) coordinated de-platform and loss of servers. While the same old idiotic logic will show up “it’s a company they can do what they want”, this always misses the point: it means the firms have more control than the government at this point. Why? Well if you can remove the current president from being relevant you are the actual king of the jungle. As usual, this is not important. All that matters is what you should do and how to prepare.

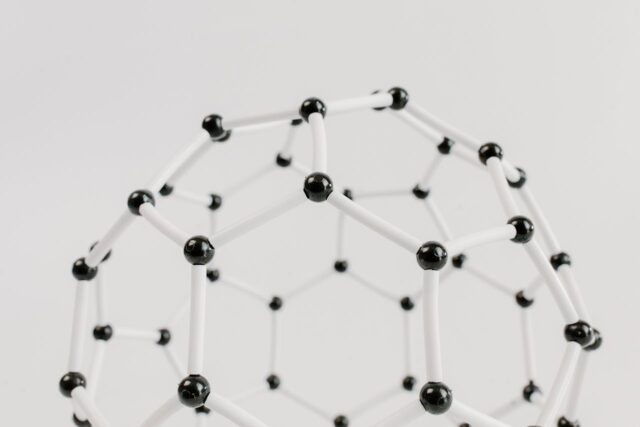

Crypto and Decentralization: If you haven’t figured it out by now, we’re sorry to say you’re behind the times. Crypto is going to balloon at this point and we will see innovation unlike any other industry (including the internet). The reason is simple: people can now create privacy and payment forms over the internet in small digital packets. This is simply the end of centralization as we know it.

Again. Feel free to laugh. Doesn’t matter to us, if you are laughing or think it won’t work then the comment is simple: “Have Fun Staying Poor”.

Right now the average individual operates his/her life at a loss. This means when you make $100 and put it into a bank account or in your mattress, that $100 no longer buys $100 worth of goods in a year. It can only buy $98. In addition, if you wanted to pay for college, a home, or stocks it would only buy $90 worth of goods. This means the system is designed to inflate away your hard work. Those days are now over and you’ll be able to hold your purchasing power flat through the use of crypto currencies. The $100 you save will likely be worth $100 in 10, 20, 50, 100 years in the future. A real savings account.

Decentralization doesn’t just impact money, it impacts every single industry with a middle man. Since the middle man can control the flow of content: facebook, twitter, etc. They will now have to face competition from decentralized servers that run with censorship resistant platforms. This is admittedly several years away, but the changes we saw over the past week have accelerated the move in this direction by a minimum of five years.

UBI and Wealth Tax: Even if you don’t believe the above apply to you because you’re rich, the wealth taxes and UBI are coming. Some believe that the US and other governments can simply print money forever. That is not the case. You can look at history and find that to be true. People in general believe in “American exceptionalism” where the USA always “finds a way”. This is also unlikely at the current printing levels.

Again. Even if you think the above is crazy conspiracy it doesn’t matter, you still have to hedge. So think through the consequences of massive printing. The answer is the same, you need a way to store your wealth so it cannot be confiscated and in addition to this, you do not want to be “illiquid rich”. Illiquid rich means large foot prints in expensive real estate or large sums of money in a single brokerage account. So on and so forth.

Our best guess is that a wealth tax (in some way shape or form) will come in the future as the rich have gotten insanely rich, while the middle class was thrown into poverty in less than 12 months. The only way to really fix that is by 1) taxing the rich aggressively based on income, 2) implementing a wealth tax or 3) implementing a bigger inheritance tax. Since we’ll get the question anyway, our best solution is likely an inheritance tax. To be clear, none of these solutions are great, but there is likely more room to fund deficits if you take a billionaire and say he can’t hand off more than $XM to his kids/family. Income tax changes kill off the potential for new entrepreneurs and a wealth tax ends up being a lot more complicated. Therefore? If you’re well off you do not want to have an obvious tax footprint. Make sure you appear to be “upper middle class” and hide in plain sight as these new rules come out in the future.

Which then leads us to UBI! Guess what, UBI is coming. Old boomers who are behind the times will say “this has been a theory for years”… unfortunately the same boomers just passed on insurmountable amounts of debt to the millennials and generation Z. UBI is one of the easiest ways to prevent people from slipping into poverty in droves. During this time frame, the decentralized internet will be built out and new economies will be built out in the virtual world (NFTs, Crypto assets, etc. see the book “Ready Player One” if you want a serious look at opportunities in the future even though it is meant to be fictional).

No Need for Concentrated Cities and Even Establishments: It has been over 12 months now of lock down. People have adjusted the way they live in a permanent manner. While some cities will boom (Miami for example), this is due to improved weather and tax treatment. It is unlikely that this trends slows down any time soon. The idea of sitting in a small apartment to go to an office is simply crazy. Front office workers will eventually go back to traveling but when you have “prestigious” companies such as Moelis going remote, you should be certain that this is structural (not temporary).

Lack of concentration has a lot of other implications beyond real estate. It also impacts the way that public goods need to be built out. If you used to have huge chunks of the population in certain cities and they are suddenly spread out across the state, the deployment of public goods will be different as well. The best example here is likely schools. If the USA wants to compete on a global scale in the future we have to move to a virtual environment which allows for both the rich and the poor to learn from the smartest people in the world. As we remove this massive barrier to entry (rich kids who were given massive head starts due to their parents), it should unlock value for millions of people who could have succeeded with the right resources. There is no reason to send kids to prisons where the teachers are unsuccessful with limited life skills to pass along.

Of course the other big one is banking. As we’ve been saying for quite some time… if you’re going into finance only go into M&A. The long-term outlook is bleak to say the least. With interest rates going to zero and the growth of financial technology (Square, PayPal, etc.) the usefulness of the legacy banking system is in secular decline. Money is nothing more than digits on a screen and the future is the digitization of all payments. The payment rails will be built out by new technology and eventually the dollar and other currencies made by countries will be digitized (just look at the talking points from the IMF for more information on this)

Acceleration of the Digital World: The one benefit here is that a smart individual can now scale a business into the millions and even billions of dollars without a single hire. Think we’re kidding? We’re not. In the future with software scaling at the rate it is today, you’re going to watch as all processes become automated. This leaves the following for work: creativity/becoming a producer. If you cannot produce or create, the world is going to speed past you.

Take an e-commerce business for example. All you really need in the future: 1) manufacturing and 2) distribution. That’s really it. Sales can be done by you (ads online), customer service can be outsourced and you are left with accounting which will of course be automated by software. What do you actually have to do? There is no need for a CFO anymore, there is no need for hoards of accountants, there is no need for massive teams or “headcount” which is a product of the industrial age where man power meant production. All of that is simply gone.

Long, Long, Long term, meaning 15 years or so, since digital items are now scarce the value will sky rocket. This is because people will be forced to earn all of their income online over the very long term. Sure there is is going to be some of the legacy stuff around (same reason why printers still exist despite DocuSign and PDFs) but the picture is the same… move to digitization. In the digital world you can then find scarce pieces of art/video that will likely go up in value, for a sports example (since this is what average joe understands), NBA Top Shot is a great example https://www.nbatopshot.com/

For fun we’ll do a sci-fi example, feel free to laugh. You put on your VR headset and enter virtual reality. Since all economic activity is now done via VR since everyone is connected and you can build anything you like, there are rare assets such as NFTs (non-fungible tokens) such as digital art. You can go up to the piece of art and walk around it and see it but it is not yours. Just like a physical museum, in fact you likely pay to view the rare exhibit. You also own digital coins/tokens for payments and digital homes/vehicles. Meanwhile in the “real world” you’re sitting in a small area with a simple bathroom and kitchen (think studio sized living). This means your quality of life is significantly higher at the expense of being in a bit of a smaller area. But hey, unlike the year 2000-2040, you get to keep what you make. There is no barrier to entry in terms of competition. While Ready Player One and Ready Player Two are incredible books for entertainment, they should be read with a bit of seriousness as a lot of the things are possible when VR takes off (next to no chance it evolves exactly like the books).

Side Note: We’ve been incredibly busy to start the year but we are seriously considering an explainer for decentralization. This is probably the only thing you need to understand to be rich in the future. If you don’t get it by now you’re at least 5 years behind the times now. People who believe it’s going to zero are simply morons. As our long-term readers know we rarely go out of our way to make a statement like that on the blog (we do it often on twitter to troll), but we’re saying it now. If you don’t get how important decentralization is going to be in the future, you will miss out on the biggest opportunity in your lifetime.