Multiple questions continue to come in regarding debt. In this post we’re going to attempt to explain the vast majority of questions in a single article, from consumer to corporate debt. We do not believe in thinking about finances in linear dollar terms so instead we’ll create all of our examples using percentages. Starting with debt loads for an individual and working towards larger scale corporate debt.

Consumer

The most common question regarding debt starts with college. Overall, if you’re a high performer in high school and you are able to attend an elite university the numbers work in your favor if you choose a high paying profession so we’ll start with college debt.

College: If you are young this is the most important no non-sense piece of advice we will give you. College is a business investment. If you are going to college with the idea of partying your brains out, going on spring break and hooking up, you’re just like every other college student and you’ll graduate with minimal job opportunities and a dismal long-term outlook that will damage your value as a man. Instead run the numbers. We will make the formula simple since back of the envelope math is usually good enough so here’s the official formula for your quick look at a debt investment decision.

(Expected Return * Probability of Success) – Debt Rate = Net Return **must be greater than 20%**

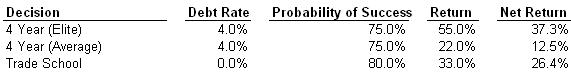

Let’s go ahead and plug some numbers in and see why this formula works relatively well. Here’s a quick example comparing Trade Schools to Universities and Elite Universities assuming that the average salary for a person with a degree is $45K per year.

Elite: Notice here your return is significant. A major elite university can land you a job in investment banking (70K+60K = 130K a year out of college) or in engineering/consulting which is at least $75K per year. This is 55% above the average salary of 45K per year. Running the math you see your net return is roughly 37%.

Average College: Here we’re giving a generous $10K salary bump as we assume you’ll attend college and choose a high paying career out of the University. Likely career choices include accounting and computer science. You can look to make roughly $55K or a good $10K above the national average… the catch? Your return profile on a net basis is well below 20%, a measly 12.5%.

Trade School: Overlooked as a career choice. Not everyone is going to get a perfect SAT score and go straight into Wall Street/Big Law so the answer could be taking up a trade. Don’t believe us? Then simply go to www.acinet.org

Here you’ll find high paying jobs that only require a two year associates degree, not all of them are glamorous but we’re about maximizing you’re money making potential as early as possible. Who knew that Air Traffic Controllers could make $120K+ per year. This is a significantly better return profile than a $55K a year career with $100K+ in student debt.

If you want to increase the complexity of your calculations you can look at a 5-10 year time horizon and be sure to calculate your debt payments as well as increases in salary. Let’s move on to credit card debt.

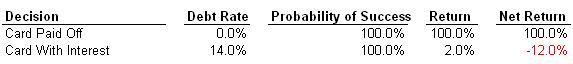

Credit Cards: We have already covered this topic in the past and believe that everyone should own a zero fee rewards credit card. Why? It’s free money. If you are a responsible person you can make a significant amount of money by having a high credit score, even your $2 double espresso for late night work or study should be charged to a credit card. If you pay it off in full you’re again, getting free money for a purchase you were going to make in the first place. Let’s look at an example:

That got ugly in a hurry. There are only two choices for credit cards, treat it as cash which refers to option one and option two is financial suicide.

Paid Off in Full: If you read our post on credit cards, then you know that a 1-3% cash back card is available for most consumers. Why is this a 100% return profile? This is because you were going to make all of these purchases anyway. Everyone needs to eat food, go to the gym and party once and a while, there is no point in leaving cash on the table. This is equivalent to meeting the company match in a 401K it is a risk free 100% return profile. In fact every single time you make a purchase, assuming you’re financially responsible, you should smash your head on the table if you purchase with cash instead of credit. Again it is free money. Even for a minimalist, you will spend at least ~$30K a year to live an exciting life in a major city, this number over 10 years assuming a 2% return is $6000, that is a vacation.

Card With Interest: Here is where the banks get their bad reputation, when people do not pay on time they start to accrue interest and it gets ugly fast. You’re looking at 12% losses every single year which is equivalent to being long-term short the S&P 500. This will do three things to you 1) ruin your credit, 2) ruin your personal finances and 3) limit your investment options. Number 1 and two are obvious but how does three come into play? Your options are now limited because your ability to raise debt to take risks is now limited. For every 50-100 points lost on your credit score you’re looking at 100bps or more added to the loan rate on your home. Which leads us to using the same formula for a home.

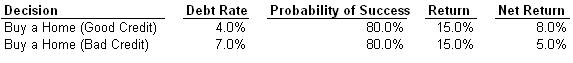

Homes: This will be quick as we already covered the three basic financing techniques for a home. You can see quickly that housing was a great investment during the housing boom and has since become more complex.

Notably, this number does not look appealing using our 20% return profile. The issue is that there are many moving parts as it can turn into an income producing asset (renting) or you may decide to settle down in a specific city (not something we recommend in your 20’s). The bigger takeaway is that good credit versus bad credit can practically cut your return profile in half. This is a major hit and is another reason why we recommend paying your cards off in full when maxing out your cash back points. With that lets turn to the corporate side.

Corporate

As you can imagine there are many reasons for a company to raise debt 1) bridge loans, 2) bankruptcy, 3) capital allocation, 4) working capital, 5) expansion of product and services. While there are hundreds of other examples we will stick with these five and walk through why a company should or should not issue debt.

1) Bridge Loans: As many of you know investment banks raise money for companies in order for them to expand their businesses. If a company only has $10M in revenue and a fantastic product they likely don’t have a large enough sales force to sell the invention so they look to raise money (IPO, FO, etc.). Prior to all of these major capital raises a company may require a bridge loan, simply put this is a short term corporate loan to cover operating expenses. We’re going to use the term bridge loan a bit more broadly (usually only refers to pre-IPO companies) and simply define a bridge loan as follows: “Money borrowed to wait out a lull period”.

This is a normal functioning loan for many businesses. As a quick example if you have recently won a major customer who is signing up to buy $20M of product X but only have $5M of product X and don’t have public equity… Debt may be the answer. You need to spend additional money to make the products for the firm and you can now borrow money against your future $20M in revenue to get past this ramp period. This is a great business model assuming the customer is locked in. The good news? You can use the same back of the envelope formula to decide if a bridge loan makes sense.

As you can see depending on the debt and how iron clad the agreements are a bridge loan or “debt raised for a lull period” can be extremely beneficial.

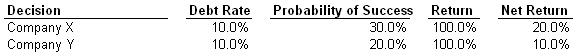

2) Bankruptcy: A major trend back in 2008 and 2009 was purchasing “going concern companies”. What does this mean? It means that many investors were making bets on what companies would be able to obtain loans given the dire financial market conditions. As an example Company X and Company Y are running at negative cash flows and are at risk of going bankrupt. Both companies trade at dismal valuations. Now it is time to invest in Company X or Y, essentially taking a bet on which one will raise the necessary capital to continue running at full operations. We can again highlight the issue with the same formula.

Notice here the issue becomes much less about the debt rate and instead focuses on the probability of success. Why? You’re essentially choosing to invest in one of two distressed companies and your payout will be large, however the downside will zero-out your entire investment.

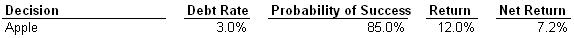

3) Capital Allocation: We havehistorically publisheda working model on Apple and one of the items noted was the change to capital allocation. Essentially the Company raised its dividend program and initiated a substantial buyback program. This was funded with debt, yet another way to raise money to deliver shareholder value. Cutting to the chase why would a buyback program increase a company’s stock? Well you can run the numbers using the same formula to find out.

Apple: While this doesn’t meet the 20% rule for consumer numbers, from a corporate basis you look at the net return and compare it to the alternatives. Previously, the company had all of its cash parked in marketable securities (1-2% returns) so a 7% return is positive.

To avoid additional questions on how to get a back of the envelope calculation for a buyback return use the following. 1) debt rate pulled from SEC filings, 2) Return for a buyback is equal to long-term EPS growth rate (EPS growth as a proxy for FCF growth), 3) run this through your financial model to see what probability you would give for the long-term EPS growth. Finally, we note the 12% numbers is simply pulled out of a hat for Apple.

4) Working Capital: Here we are getting into more complex large and cyclical corporations. Some industries require cash to run the business and due to cash flows being seasonal due to large and small deal wins companies may need to raise cash during the correct time frames in order to have the most efficient business model. As a mundane example if your cash flows are as follows: Q1: $150M, Q2: -$200M, Q3: $50M, Q4:$250M then you have a tricky financial situation. Overall the business model is strong with annual cash flow of $250M however the seasonality and wide range of cash flows can cause headaches for any CEO or CFO. Rather than run a calculation on the debt since acquiring debt may be necessary in Q2, the answer is timing and duration.

When you run a corporation that requires sporadic infusion of cash, you want these debt raises to be as short lived as possible. Remember how banks borrow short and lend long? Certainly easier to say than to execute. Fortunately a firm given in the example above would move directly to a revolving credit line.

A revolver is by and large the best form of debt as it does not have fixed payments and provides liquidity for general operating expenses. This is essentially a credit card. You want to draw down, and re-pay as swiftly as possible to establish two things 1) lower rates due to duration and 2) improve operating efficiencies. Not surprisingly a revolver is also one of the harder liens of debt to obtain particularly for smaller companies which may need to resort to sub-debt, mezzanine debt or otherwise.

5) Expansion of Products and Services: The final form of debt raise would be funding for a new product or service. This is vague and IPOs/FOs/Debt Raises/Venture Capital all fall into this final umbrella term. Essentially run the same equation through the debt raise 1) Rate on debt, 2) Probability of product/service success, 3) Return profile of product or service.

Concluding Remarks

The TL;DR version of this article is as follows:

Consumer: Financially responsible people should view college as an investment decision, purchase all items on a credit card and sit down and think honestly about home ownership as a long-term investment asset.

Corporate: Financially savvy corporations will use debt to 1) improve working capital, 2) expand products and services, 3) deliver value to share holders and 4) decrease risk to the business model by having access to credit.