In bull markets, like what we’re seeing today, a lot of people feel wealthier. They look at their portfolios and realize they are up say 20-30% and believe they are “way ahead’. Unfortunately, this may or may not be true in terms of their actual wealth. Why? Well wealth is relative to the people around you… it is not a dollar number. Dollar numbers are only useful for a snapshot, I.E a millionaire in 1960 was definitely wealthy and a millionaire today, is not in the same net worth bracket (not even close). In addition to that, wealth has absolutely nothing to do with your annual earnings. If you make $500K a year or $100K a year and both people save nothing… They are both poor. So we can take a look at this on a deeper level and help explain why we aren’t investing aggressively this year or in 2019.

Wealth is Relative: As stated above, wealth simply means “You own more than the average person”. Ownership of assets that generate cash flow or go up in value over the long-term. So a person with $1,000,000 in stocks is certainly doing well and that same person in 1960 would be elite due to inflation.

Understanding that wealth is relative is quite difficult for your average person. The average person doesn’t save much and their only view of wealth is based on what they see and feel. So if a person is spending $20,000 a month they are “rich” even if you find out that they only make $20,500 a month.

The only way to get wealthier is to increase your net worth at a faster rate than the average person. That is the easiest way to explain wealth creation. If there are 100 people in the room and your net worth goes up 10% while the other 99 saw an increase of 15% you’re actually poorer in terms of wealth. We’re not saying your life is getting worse (since the world generally gets better every single year for all socio-economic groups), we’re simply referring to your level of wealth.

Tough to Get Richer Without Becoming an Owner: Once we see that the above is true, the second rule you need to follow is that the only way to gain wealth is through investing. If inflation is 2% it means your relative wealth goes down every single year since you’re generating a 0% return. I.E. it doesn’t make any sense to hold cash unless you believe 1) valuations come down in the near future or 2) you need the money for some sort of payment (emergency money and to pay bills). A high cash position over the course of say 15 years, will result in a significant reduction in wealth.

Investing is just a fancy word for becoming an owner in something. If you’re not the owner of something it means you must consistently earn more than the average increase in net income of the S&P 500. We’re keeping it simple with that example. While this is not difficult when you’re young and earnings go up 20% in many cases, it gets significantly harder when you may have down years or flat compensation for several years in a row. Our best guess is that this is the main reason for low savings rates in the USA. The majority of people see incomes go up from age 20-40 and believe this will “always continue”. Which then results in disappointment as it’s certainly difficult to get a 20-30% raise when you’re making multiple six-figures for any particular company.

Even if you don’t want to become an entrepreneur and start your own business, you still need to put the vast majority of your money into ownership of assets (real estate or stocks for example) in order to maintain or gain relative to the population. It’s simply how wealth and money works.

Now that we’ve mathematically proven you can’t get ahead without being an owner unless you grow your net worth faster than the S&P 500… Why are we going into cash/crypto instead of equities… Well same old basic probabilities. Starting with the economic cycle.

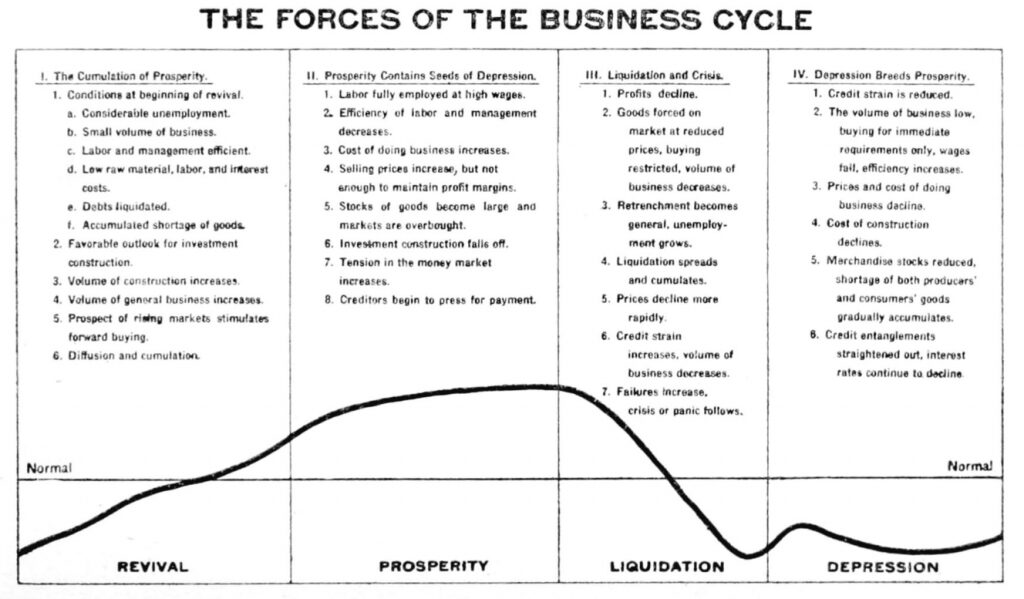

Basic Economic Cycles: The reason why we see consistent economic cycles is quite simple: 1) wage growth unlikely grows at the same rate as earnings for a Company, 2) as this occurs the value of the Company grows – say net income growth of 10% vs. expense growth of around 2-5%, 3) the Company hires more but eventually they cannot generate good returns with new employees – profits stop growing and may decline as they over hire and 4) as that happens, the cost of doing business usually goes up, creditors ask for payments.

The economic cycle is well known, but the concept of companies outgrowing wages seems to be lost on many people. No one asks the obvious question… Why would a Company hire someone if they are not going to generate an economic return? The answer is they wouldn’t. So unless the company is going to profit from a particular hire they are not going to pick them up which then makes it natural for net income to outgrow wages over the long term. Eventually, you can’t really squeeze additional productivity out of the low performing individuals.

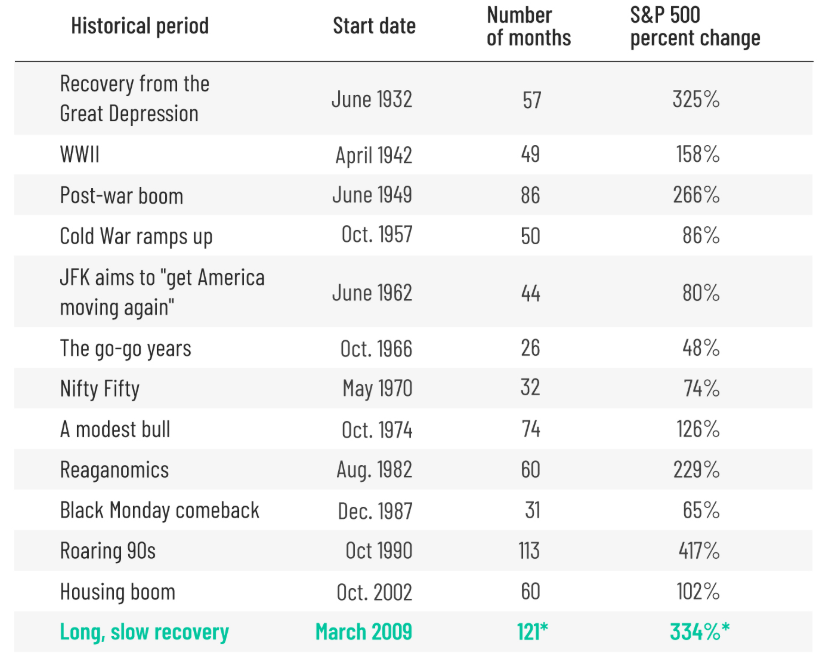

That brings us to today. Unless someone wants to make the argument that economic cycles are “done forever” and we’re going to experience forever growth, we have to acknowledge that S&P returns are not independent events. If you’ve seen an increase for 10 years in a row, the chances of the next year continuing to grow at the same rate is unlikely. Roughly speaking, if you invested starting in 2009 (after the draw down but not the exact bottom) and stopped investing at the end of 2018 the S&P 500 has compounded by about 11.5%.Think this through a bit, if we add the latest bull run (2019) the total would be around 12.3% compounding (remember you didn’t have to add, you simply had to hold).

Since we know that long-term stock price returns are around 7-8% it means you’re increasing at a rate that is 50% higher than the entire history of the stock market. This is absolutely fantastic if you already bought and not that great if you’re looking to add since over the course of 30-years the average compounding should be closer to 7-8% not 12%… Only way to go to 7-8% over 30 years is to have returns that are by definition lower than 12%.

A final item we’d add is the assumption that economic cycles are normal and we’re not experiencing independent events. The debt cycle is normal in our opinion, you increase loans, they result in bigger output than the rate, eventually no one can find a good source of returns, debt market tightens up, leads to recession… so on and so forth. Since we’re now in our 12th year of expansion (keep it simple and say 2008 to 2020), that would mean the chances of next year being up is around 28% (90% to the exponent of 12). Note: to all the real stats people out there we know this is definitely not the best way to explain it, the math is just used since its easy to confirm and helps explain the next point below.

Building off of this same assumption (economic cycles are normal) it means that the expected payoff of each year invested in the S&P 500 declines during a bull run. If the average bull run is around 10 years (it’s less but keep it simple) it means that each year should be up around 9-11% with a drawdown year, followed by another 10 years of upside. Since we know the chances of a bull market running for 20 years is significantly lower than a bull market running for 5 years, we should just take an expected value on the returns. If we use 28% it means that investing now is going to generate around 2.8% (assume 10% returns). Again this is simple but the point should be clear now.

What Does This Have to Do With Wealth: The high-level explanation above should trigger an understanding of why diversification is so powerful. If the stock market pulls down this means other assets may go up in value (gold, bitcoin etc.). So? You actually want to be wealthy in all investment categories! Surprise, surprise, if money is going away from one asset class it has to go somewhere else.

Take a look at your options: 1) stocks, 2) bonds, 3) real estate, 4) crypto and 5) forced appreciation by investing cash in your own products/business/life.

At this point, we feel that we’ve got enough money in the first three categories. If the stock market continues to boom and you have 7-figures in there already, you’re not really getting richer by adding another $50,000 for example. Similarly, if you have two rental properties worth $500,000, by adding a third one worth $300,000… Nothing really happens since the other two will step function up if the market booms. So you’re left with only two options… asymmetric bets (speculative crypto assets) and your own forced appreciation which can generate returns higher than 10% without the risk of drawdowns.

“House Rich”, “Paper Profits”, “Crypto Rich”, “Illiquid Stock”. You’ve seen all of these phrases before. The goal? You want to be rich in terms of all of these categories!

Being rich in just one category and poor in another creates “wealth transfer” risk. In the situation where stock funds flow into crypto, you’d be absolutely burned if you had $0 in crypto. Similarly, if you had all your money in crypto, the government clamps down and you can’t sell, you’re instantly broke. Both are ugly. You see them all the time (WeWork, crypto bust in 2017 and more).

If we can agree that the expected returns of traditional assets is actually lower now (given a 12 year bull market), it means the ownership you want to pick up should be in assets that don’t have clear winners yet. Crypto and your own ideas are very clear examples of this. Mathematically, using bitcoin as an example, there are only 10M real coins (large chunk sold and large chunk held by early investors for 5-10+ years). Assuming the long-term value is equal to gold (a few trillion or $150,000 per coin) or ~17x return, you’d have to believe the chances of this being unsuccessful is less than a fraction of a percent (around 0.15%). Since we think the chances of crypto being successful is a lot higher than 0.15% it makes it an investable asset from a risk reward perspective.

To wrap this all up, if stocks suddenly came down 40% and we hit a recession, it would likely make the crypto space less investable. Why? Well the implies return of the S&P would be near 10% again and we’d have to redo the risk reward profile across all of the asset classes.

As a final note, for those that really believe new classes like crypto are worth nothing… that’s going to be a painful experience. The chances of a new technology being worth nothing after a decade is practically zero since it is usually legacy technologies that suddenly go the way of the dinosaur (fax machines). Your probability of it going to zero may be higher than ours, but we really doubt anyone can put a number under 0.15% in many cases.

How This Keeps You Wealthy: By thinking in terms of probabilities and implied returns we can see what type of real risk you’re taking with every single investment. Also. This prevents you from ever becoming “poor” again. If you are a large owner in every asset class wealth shift doesn’t hurt you at all. This caused a ton of turmoil on our Twitter as we laughed at people who have a grand total of 1 Bitcoin being emotionally moved by the price. If one coin causes emotional volatility the chances they sell when it hits $15,000 or $20,000 is a lot higher and it also means they miss the point on what diversification and wealth really is. Wealth is about maintaining ownership of various assets on a relative basis to the group. It has nothing to do with the price. Price means nothing since it’s purchasing power that matters.

While the poor (or eventual poor) focus on trading around, you should be focused on constant accumulation. If you’re consistently accumulating assets/wealth, it isn’t possible to fall behind over the long term.