We haven’t done a major Wall Street post in a while for a reason: not much has changed. In fact, we went through all of our recruiting advice, interview advice, resume advice and posts that talk about each industry… nothing has changed except the valuation multiples since the stock market has continued to work higher. Is this good or bad news? It’s neither, but good news for us since we don’t have to change anything. The posts we put upin the past are as close to “evergreen” as it gets since the industry hasn’t changed at all. Also, people continue to waste their time buying modeling courses, debating online about $10K bonus differences and which bank is the “best”. In short, nothing meaningful has changed at all. For fun we’ll go ahead and highlight all the items to be aware of and unsurprisingly you’ll see why we’re glad we left.

Past: In the past we gave the following advice: 1) go to M&A, 2) worry more about getting promoted than getting the most prestigious bank – ie. better to be a VP at Citigroup than a career Associate at Morgan Stanley, 3) worry more about getting the right job experience when compared to a 4.0 GPA – this means a 3.5 GPA and legitimate experience kills a 4.0 GPA and no experience, 4) don’t go into secularly declining industries like retail, focus on good areas such as Technology and Bio-tech and 5) don’t waste your money on buying expensive courses since you’ll be trained on the job anyway.

Quite literally nothing has changed from this advice. It is still the same. If people want to know more about our career advice they can always pick up our book but at the end of the day the same highlights above still apply. We thought people would figure this industry out by now but we *Still* get the same questions. It’s honestly embarrassing at this point since it’s not even a “hot” industry anymore and more people are interested in product management and going into technology positions today. That is where the money is. We’ve reached a point where engineering is outpacing finance even at entry level. To conclude this section, we’re not going to link to every post but please use the search bar for all your questions. We can all but guarantee we’ve answered the major ones and nothing has changed.

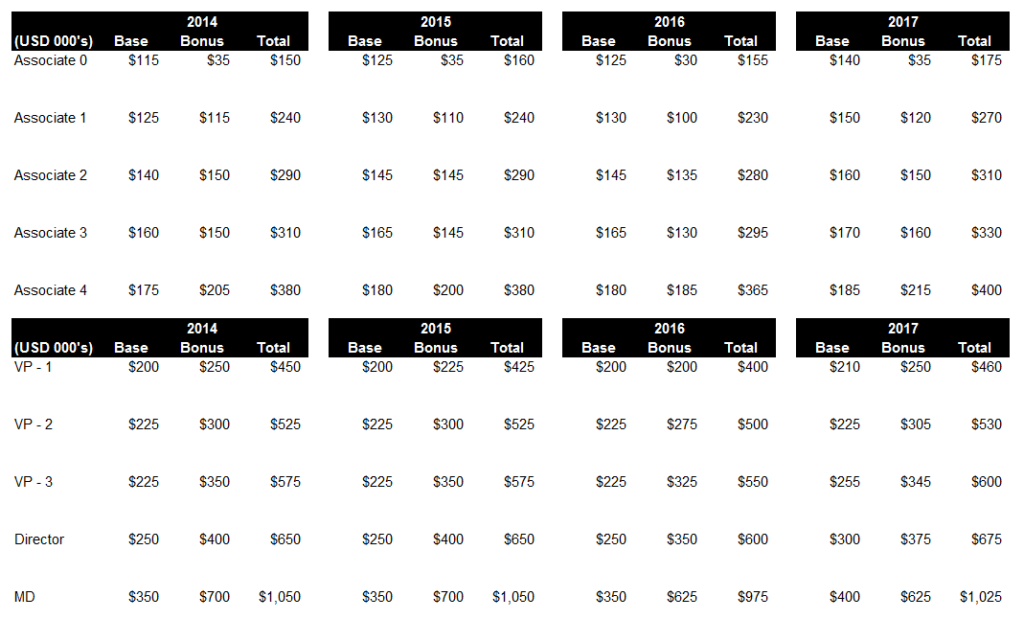

Present: This gets a little bit more fun. Why? We’ll we’ve correctly given out bonus expectations *before* they are officially paid out every single time in December. How is this possible consistently? We know the guys who have access to year end budgets. It’s never going to be 100% correct but it’s been accurate since budgets are set in December, we release them at that time and people are still “shocked” when they are accurate in February/March when those payments are made. Anyway. As it currently stands, the year is tracking to be up again. Probably to the tune of 5-7% but that is an initial guess and a lot can change in Q4 if the market tanks or a lot of IPOs are priced in Q4. So we won’t comment on the official number until December but you have our guess at this point in time. (2017 numbers below). As a small note, remember that your bonus is deferred when you get to the VP level with a good chunk of it (typically around 50% or so) deferred over multiple years 3-5 years on vesting of stock. Less is deferred at the VP level and more is deferred at the MD level since your bonus is higher.

Separation of the Groups: If you thought Wall Street was competitive before it appears to be getting worse. Why? Everyone is fighting to be part of the next big deal. Despite numbers being up 5-8%, the big banks with the best rain makers were up double digits compensation wise and took up the majority of the press. What was swept under the rug is how little the low performers were paid. We can’t confirm this since we don’t know each bank, but we can say we’d bet heavily on many guys being flat or down last year if they were in a group/industry that did terribly. Instead of worrying about who those people were lets focus on how to make you more money. In short, join the group with the most revenue. If you’re looking for money, focus on joining the group with the guys who bring in the most deals even if this means working 100 hours a week instead of 80 hours a week.

Pausing for a second again you can see why we’re concerned about the competitive nature now. Essentially, the top paying groups will work their people hard making it difficult to start a side business. This is a negative trend for anyone smart enough to realize they don’t want to spend 20 years on Wall Street. It is also bad for the internal work environment as everyone fights and claws to get on the next deal and work with the right people in the office. Luckily, our advice remains stable. Do the maximum to be a “top bucket” analyst/associate and that’s it. The one benefit of working in an office is that your reputation is difficult to change if you leave a solid first impression the first 9 months.

Avoid ECM/DCM: As always you want to avoid these group. Unless you’ve avoided the news for the last 2 years you’ll know that fund raising is slowly being disrupted by ICOs and other decentralized fund raising capabilities. This doesn’t matter for the next 5 years but it doesn’t help the industry in 10-15 years or so. The skills acquired in ECM/DCM are just not useful for anything. You’re better off in M&A where you widen the exit options. As the old saying goes, if you don’t know what direction to go in, choose the one that opens the most doors for you. M&A does that and is transferable into Private Equity, Hedge Funds (merger arb) and corporate development at any top tier company.

We’re sure people will still complain about the paragraph above. They know “so and so” who makes a lot of money doing ECM/DCM. That is great. There are also guys making a lot of money doing cash equities trading today… We all know that isn’t going to last very long. Unless there is an extremely big reason for you to go into ECM/DCM our point is that M&A is the best “risk reward” group to jump into. Two reasons to go into ECM would be as follows: 1) you already have a side biz running that just needs funding and 2) your parent/brother is the head of the group. As you can see both o these are extreme situations and the move to ECM has nothing to do with the actual job function.

Before signing off on this sub-segment we want to ask one more question. Have we been in a major bull run for 10 years? The answer is yes. Before anyone calls us perms-bears we would tell them to read out prior posts highlighting our recommendation to keep buying the market ever since 2012. In short, we have never been bearish. Our point here is that bull runs eventually do hit choppy points and it has been over 10 years so far. It’s much more likely we see a hiccup in the next 5 years and ECM is going to get cut a lot faster than M&A. In fact, when things hit the fan, M&A can heat up in some cases as companies are forced to sell assets. M&A is essentially more stable over 10-20 year cycles and ECM has secular headwinds (ICOs) along with heavy reliance on a positive equity market.

Consolidation of Banks: The industry seems to get smaller every year. While it may not seem like it, the logos we see on specific deals continue to favor the larger banks and top tier boutiques: Goldman, Morgan, Lazard, Evercore, Moelis etc. You can already guess what we have to say about this… try your best to join the winners. We’re not going to sit down and argue about joining XYZ bank or ZYX bank since that is something 20-22 year olds do with no experience. Instead we’ll simply say that competition for the top spots is continuing to climb. The good news? Mid-tier banks are actually getting easier to get into. This is great if you’re looking to do investment banking for a few years and quit as you’ll make similar money and don’t have to compete with the best and the brightest. The best and the brightest are fighting for technology jobs and the rare positions at the major aforementioned firms.

The turnover between the major banks has remained stable. Essentially, the industry still sees major turnover and people jump from bank to bank. The only thing we’ve noticed is that the jumps tend to be “closer to together”. Meaning it is harder to jump from a mid-tier bank like a Piper Jaffray to a Major bank like Morgan Stanley. We’re sure it still happens in special occasions, we’re simply noting that the ability to move up in big steps has slowed down since the industry has consolidated and there are less general seats at each respective bank. Beyond that not much has changed from ~10 years ago.

The Future: Well so far the picture isn’t great unless you’re at a bulge bracket, within M&A or already pretty well off. Luckily we do have *some* good news for those that are still in the industry. There are a few things that should help: 1) hedge funds that consistently outperform will pay a lot of money and the fund flows will continue to go up, 2) if you’re in investment banking, people get promoted within a lot easier when things go bad since no one wants to leave revenue on the table and 3) the competition is getting weaker so even if the people are “fighting hard” for the same slots, the actual people you’re competing against are not as bright. Before moving on we should explain that last point further. While competition is fierce in terms of people desperately trying to get into the same groups and banks, the type of people applying are getting weaker. That’s a fine point that needs to be separated. 10-20 years ago it really was the “best and the brightest” fighting for all of the slots. Now it’s more like the B+ talent fighting to get into Wall Street. This is good since the guys you compete with are generally weaker across the board.

Markets are becoming more efficient. We will never believe that markets are efficient as highlighted by consistent booms/bubbles and busts. But. We will say the market becomes more rational over time. This is good if you’re a top performer since it increases transparency. An increase in transparency only benefits the top performers which are now well known (Tiger funds, Renaissance, etc.). This means the best performers are rewarded with even more of the pie and they will pay more (hopefully this is you in the future!).

To close it out on a positive item for Investment Banking, when times get tougher, you have a very good shot at getting promoted. If you are an associate and well liked… and the VP ahead of you hasn’t been doing amazing… this is your chance to jump into a revenue generating role adding over $150K+ to your annual income. The firm will typically fire the guys in the middle (the VP/low end director level) and try to close the gap by promoting one or two low end guys to make up the revenue gap. Naturally, if you’re underperforming and you’re in the middle layer (VP) you should be working hard to make sure you justify your value to the company. As many of you already know, the low level generator roles are the most dangerous positions (similar to middle management in any major company).