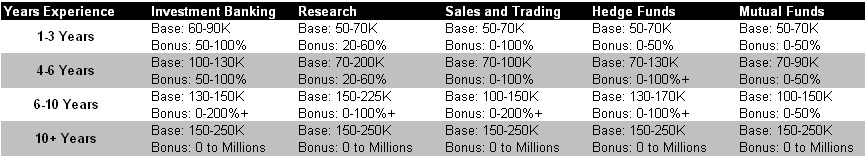

While everyone should ask themselves which Wall Street Profession they would be good at, usually starting at the sell side, its also important to look a the career progression below:

Investment Banking: Effectively the difference between investment banking and the rest of the sell-side is this, if you can sell garbage you’ll make a lot of money. In addition, at the low-end its one of the best decisions because you’ll get paid high even if you aren’t able to sell (Analysts/Associates practically never sell) and aren’t that great at your job. Your downside (excluding the 2008 disaster) is a $100K+ payout. Not a bad gig. Downside? You’ll be cracking 80 hrs no doubt.

Research: If you’re less social, this will be a good job for you at the lower end as the “Analyst” (eg: Managing Director) will be client facing so you can hide behind excel sheets and earnings recaps. There are two things to consider here 1) your base pay can reach the 200K mark and 2) the upside is limited as 200K base will likely come with smaller bonuses (25% range). Downside? It’s tough to move up unless your Managing Director retires, or suffers a stroke from his divorce settlement.

Sales and Trading: Welcome back to that Frat-tastic college environment. Again similar to research, the entry/middle level has lower pay relative to investment banking, however if you love being on the phone and sending out hundreds of emails quickly, this job is for you. Be honest with yourself. If you are not a likable person, you’ll get crushed in this biz. Downside? Sales and Trading competes aggressively for “attention” if research analysts and investment bankers are “beggars in suits” you’ll be competing for the attention of both clients and the good Managing Directors.

Hedge Funds: If you can get a low end job and maintain traction in a Hedge fund? Don’t leave. Notably, most hedge fund cats get started after racking up 2-3 years of experience. Unlike the sell-side, you can be an absolute asshole and still survive, why? How much green did you bring in, that’s it. Downside? You’re in a highly volatile environment and you’re a slave to the two and twenty. 2% of assets, and 20% on above market rate returns. Of course the 20 is also substantial upside if you’re the next Paulson, only need one great year.

Mutual Funds: Enter at a young age? It’s actually a rough gig as jumps are tough to make and you’re a slave to the slow progress up that corporate ladder. The huge plus side to Mutual Funds is at the top end. 100x better than even a Hedge fund from a stability standpoint as your pay is effectively tied to assets under management, best gig in the world has to be Fidelity long-only with billions under management. Downside? Good luck breaking into the top if you’re not connected, you’ll need God himself to help.

Conclusion: The descriptions and paths are relatively short for two huge reasons: 1) you can make large jumps in high competition environments (Investment banking, hedge funds etc.) so you can have just a few years under your belt but get paid like you have 7+ years of experience if you’re good and 2) do what you will be best at. This was mentioned previously but needs repeating, if you’re extremely good at any part of finance you’ll see so much green you won’t need to worry about money by your mid-thirties that’s for sure.

Note: Private equity was excluded from this analysis as was Venture Capital. The big reason why is more money is made when you have an actual stake in the LBO or the VC funding. If you have cash already or break into one of the MAJOR PE firms (TPG, KKR, etc.) then this is a great path for you. We may add a post for this route in the future.