Lots of brain cells were lost over the past 72 hours. People who believe that you can just “bounce back” from margin liquidations to people who still believe you can access Bloomberg terminals with a twitter link (which would mean their entire business is worthless). Instead of getting infuriated we’re going to offer solutions as usual. For those that believe we’re frauds, luckily we have a track record dating back to 2012 in print and unedited (trump election, stock market crash, sports bets, compensation updates etc.). Do we get them right all the time? No. And… as several long-term readers have noticed 80-90% accuracy over 8 years is pretty high and at minimum we have been transparent. More than the vast majority of people can say. We would like to thank the people who have followed for years as they are both 1) the people we’re writing for and 2) the people who also hold us accountable when we’re wrong. We’re fine with this set up. See the comment from someone earlier this week.

Please don’t ever stop this blog.. I don’t know what I would do without it.”

On to Solutions: The money printer is on fire. Print, print, print, 0% interest rates, print, print, print. Massive amounts of damage has already been done. The only time over the past decade or so when GDP was negative? The 2008-2009 financial crisis and the Stock market was cut in half. According to that metric it means you could easily see the S&P 500 break 2,000 and stay there for a while. The way you see the market recovery in the idiotic “V-shape” recovery that everyone is praying for is through massive printing, inflation and more 0-1% interest rate debt.

One thing we’ve learned in life is that people will always do what they are going to do. As soon as someone is committed to buying stocks they will buy. Period. They will not go back to our old posts suggesting to stay liquid in cash and crypto for over 2 years now. They just won’t. So here is some advice if you are going to buy. (no we are not adding to stocks). We repeat, we are not buying a single share. If and only if you’re going to buy. We suggest a put protection strategy. If you are wrong you’re not going to be wrong by “10%”, you’re going to be wrong by 25% in one of the most liquid investments in the world (if attempting to time the bottom on the S&P 500).

What does this mean, it means if you were going to buy $100 of S&P 500, for the love of god please buy $95 of the S&P 500 and buy $5 worth of put options that are way out of the money and a 18 month time horizon (maybe even less). Why? You need to find a way to make sure if you’re wrong that you’re not down 20-30%. That is absolutely critical and it is absolutely unacceptable to put your life or the well being of your family at jeopardy.

The other solution is unsurprisingly the same. Keep doing what we’ve suggested for 24 months now, stay in cash and crypto (maybe a bit of gold after the pull back). This is good enough. If you don’t like crypto that is also fine. The value of the dollar is going to spike temporarily (already is and likely will) as people sell everything to make ends meet. When you sell an asset you’re “trading it” for dollars so demand for dollars goes up. Cannot be simplified easier than that. Anything sold for dollars is demand for dollars by definition.

As you can see, despite all of the wild swings, nothing has changed quite yet. if you were long since 2012 (see our old posts – here from 2013 as an example), you have a cost basis in the S&P way below where it is trading today so there is no reason to add. That is what we would suggest at this time. Again. We realize it is a free market so if you’re going to play hero and try to buy the exact bottom, please purchase some puts to limit downside significantly.

What Exactly is Happening? No fun and games here. A cascading pile of garbage. People who are in the middle class are unable to pay rent. In 2008-2009 around 60-65% were home owners, today around 40% are which means 60% are living in rented apartments. Those rented apartments are also levered up by companies. They don’t own the building in cash. This means…. You have the renters unable to pay, then the building cannot pay, which then means a massive default is about to occur. Multiply this out for casinos, restaurants, bars, clubs, dry cleaners, shoe repair, clothing/apparel, gyms, dentists, etc.

Unless this problem is solved quickly, you’re going to see a cascading pile of garbage as debt upon debt is defaulted on. So at this point, we will make an assumption. As we think about it, we’re seeing a higher likelihood of stagflation/hyperinflation at this time. As many of you know we don’t like to edit posts so we have to emphasize “At this time” since a lot of parts are still moving every 24 hours. It seems like the world has agreed to simply print trillions upon trillions of dollars. This means prices eventually have to go up. Also… This is where it gets tricky, the government needs to find a way to force the companies to raise wages if they resort to massive inflation. If prices of all assets are going up rapidly, the middle class actually loses the most. Think about it. For all the guys “praying to buy the dip”, if there is a V-shape recovery the only winner is rich people (everyone else loses). We doubt the american population will be okay with that.

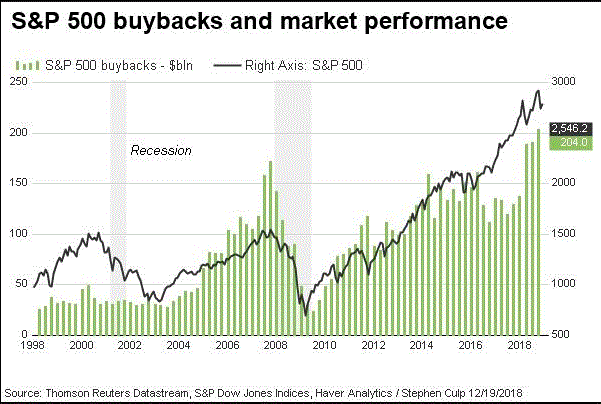

For the guys who look at the CPI and say “there is no inflation” we have nothing but laughter for you. You didn’t bother to read a single SEC filing. What is happening? For the last decade companies have borrowed money with low interest rate debt and bought back shares of their own stock. This is fine if you have a lot of cash as you’re returning value to shareholders. In fact we’re completely fine with share repurchases if a company can last 12-24 months without needing additional financing. In simple terms again… If you borrow $100,000 to buy a home worth $400,000 but you have 24 months of cash in a bank account in case you lose your job. You are being financially responsible. What are many of these companies doing? They are buying that $400,000 home but they have 3 months of cash in case the business goes down. This is not responsible. We’re not going to argue here with the exact number of months needed since that’s for you to decide. But. We think everyone can agree that we shouldn’t just give these companies free money for taking on debt to buy back stock. You wouldn’t consider yourself responsible if you didn’t have an emergency cash fund so why shouldn’t these companies be held to the same standard?

Since some of you are numbers people here is what we are trying to say visually. You run a company and have $2M in the bank. Nothing to do with it so you repurchase shares of your own stock and take out some outside investors money. You have $1M left and can survive 2 years on that if things hit the fan. That is totally fine in our opinion. You had nothing else to invest in. But. What companies did is they had $2M in the bank, enough to last 1 year. They said “well fuck it rates are low” lets borrow $4M and just buy our own stock. This then means they have a net debt position of $2M accruing 2% interest. It works fine if you’re profitable but then wham, recession and you could go bankrupt fast.

Short disclaimer: if you don’t know what a buyback is, it is when the Company say Apple, takes money from the Company to purchase shares of itself. Apple in particular is probably okay as they run a very large cash position, so they are being fiscally responsible. Companies like Boeing? Not so much, as they were levered up with thin margins, less excuses there (a topic for another day if people are interested).

How much have companies spent on buybacks? Sit down first. Take a deep breath. Take a second deep breath. Corporate buybacks have accounted for more share purchase activity than all household purchases, all mutual fund purchases and all ETF purchases… COMBINED. So where is the inflation? Very clearly in assets. So the companies are getting richer and richer and none of its workers get anything except for the ones at the top with large amounts of shares (and of course all investment “professionals”). The worst offenders don’t even offer their employees 401K matching to participate in the growth of the company.

Unmitigated Disaster: There is no reason to be coy about it. This is a complete mess. Now you have a halted economy and these companies are forced to stop buying back shares as they have to spend money to pay employees rent etc. Don’t even get us started on the fact that buybacks actually *help* with taxes. That is right, the government is set up to reward the company for repurchasing shares. To emphasize, there is nothing wrong with buybacks. There is something incredibly wrong with borrowing money you can’t pay back to purchase your own shares. That is beyond irresponsible. We won’t repeat ourselves to re-read the paragraph three levels up (it should probably be re-read a few times if you’re new to this). In simple terms once again, unless you were long assets for the last decade you fell incredibly far behind on the socioeconomic ladder. Partially by no fault of your own.

Want some numbers? Okay. You can look at the recent tweet by Marriott.

Since we know most people don’t like watching videos or reading in general, the punch line is that they are seeing 75% reductions. This is 3x worse than the great recession and dot com bubble which was 25%. Unfortunately most people do not understand leverage. How awful and painful it is. Go back to the basic business example we laid out earlier this week. You run a business with $100K a month in revenue, $80K in costs $20K in profits per month. If revenues are $0 you actually lose $80K which is four full months of income (per month you are closed). Now you run this number with real revenue. Marriott does $23B in revenue per year, that is more than $6B per quarter or around $2B per month. If its down 75%…. You can figure this one out… That is billions per month. Much more severe than 2008-2009. Even if they get a 0% interest rate loan, it has to be paid back over the course of time with future earnings (or default and bankruptcy).

More important Matters – Solutions: Assuming that you care about the future of the United States you really have a few clear solutions. On a microeconomic scale do your best to help your local sized businesses if you can. We won’t waste our time asking how much everyone is worth. If you can afford it, order catering, get your dry cleaning done, get haircuts etc all in your local area ASAP. They run on slim margins and when the doors open that’s where you want your dollars to go.

The second solution is also why we don’t think this is solved in a “v-shape” recovery. If it is a V-shape recovery 90% of people should not be happy. The second solution here is to actually cut all your airline and hotel stays to a bare minimum. Once borders re-open the virus is back out and could come back in massive form by Nov-Feb. This is a simple precaution you should take. We cannot stand it when people say we’re exaggerating about “over run hospitals”. We’re very clearly talking about hospital beds and ICUs. They already have people in them and the “20-30 ICUs per 100,000” does not mean they are “all empty”. People get lung cancer, they get into accidents etc. So You do not want to take that risk especially in the winter time.

The third solution is to have a SHTF liquid solution. Yes the situation is that severe that you should have some money (physical), some gold (physical) and a Trezor or Ledger with some crypto in it. There is just no exception to this if you can afford it, the world has gone mad with printing and you must make sure you’re exposed to these stores of value in the rare case that fiat collapses or we go into hyperinflation. Not a drill. To make sure we’re not pegged as idiots, it doesn’t need to be more than a few points of your net worth. The point remains the same, it is your job to be safe if everything hits the fan.

The fourth item is to learn sales. Now. Not tomorrow. Not next week. Now. The main skill that will take you out of a recession or even hyper inflation if you remain employed is sales. People will need to make up lost ground and you need to be good at selling. Online, in person, on the phone it doesn’t matter. As usual we prefer online as it is much more scalable.

The fifth item is for wealthier people. As mentioned at the start if people are going to try to time the bottom that is fine. Look at ALL of your assets. Find a way to buy protection with an option. Yes we realize you may “guarantee” a loss of a few points. But losing 2-3 percent when anything could collapse 25% any given day is a winning bet to make. Better to sleep easy at night focus on things that matter and lock in a 2% loss on items you’re not comfortable with.