One of our readers kindly asked us for a simple discounted cash flow model and of course we are going to deliver.

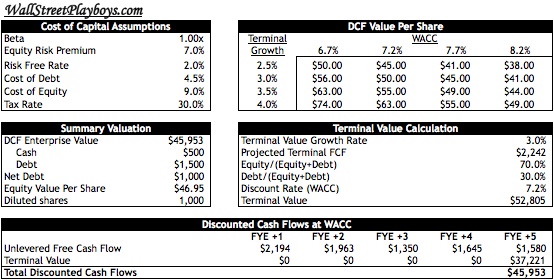

Below is the output of a basic DCF template lets take a look:

Cost of Capital:

- Enter in your BETA (not this kind of beta) by scurrying over to Bloomberg

- Add in your Risk premium, Risk Free, Cost of debt and Tax rates

Summary Valuation:

- Enter in your Cash on hand, debt numbers and diluted shares outstanding

Terminal Value:

- Calculate a long-term growth rate (usually linked to GDP)

- Enter in your percentage debt and equity

Free Cash Flow:

- Code in your EBIT or link this to your three statement working model

- Run your CAPEX,, working capital (off built balance sheet) and D&A numbers through

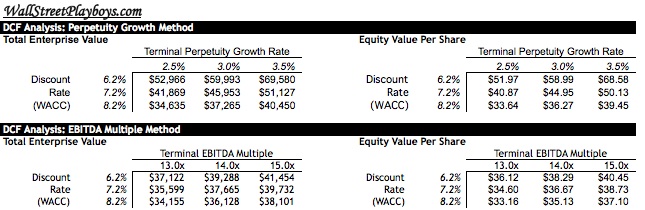

Results:

- The sensitivity table runs off of your WACC in your assumptions tab

- You run a multiple to spot check your analysis, notably these numbers are not real so they seem quit high

That’s really it guys. Remember to keep it simple.